Hello Guys Today i come with new Wallet Ai Review. In this article i cover everything about Wallet new brand ai .Main area of my article focus on its features , prices , pros & cons and it support and product quality stay with me in this journey .

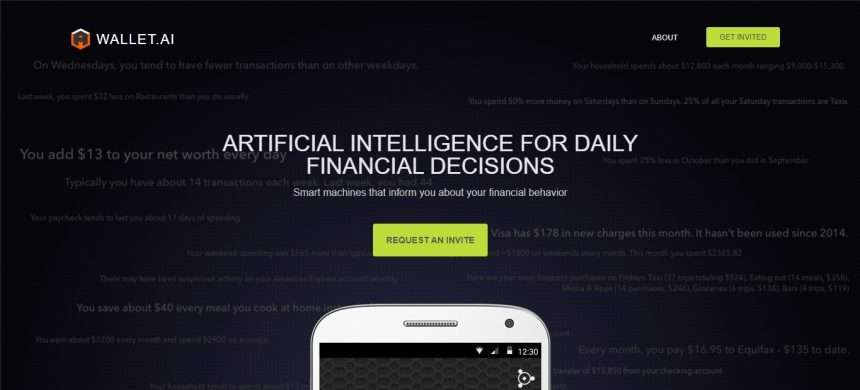

What Is Wallet Ai?

This is a state-of-the-art financial assistant that aims to transform personal finance management. With its sophisticated artificial intelligence algorithms at its disposal, Wallet AI effortlessly links with your bank accounts to deliver intelligent spending suggestions, tailored budgeting, and real-time insights.

This smart wallet monitors your transactions and examines your spending trends to provide personalized recommendations for improving your money management practices. Wallet AI makes sure you can easily keep updated about your financial health with an intuitive interface.

This AI-powered wallet attempts to give users the information and resources they need to make wise financial decisions, from classifying expenses to forecasting future spending patterns, eventually fostering improved financial well-being. Wallet AI is at the vanguard of financial technology, altering how we navigate and comprehend our monetary landscape by utilizing artificial intelligence.

Key Points Table

| Key | Points |

|---|---|

| Product Name | Wallet Ai |

| Starting Price | Free |

| Free Versions | Yes Free Versions Available |

| Product Type | Ai |

| Free Trial | Available |

| API Options | Available |

| Email Support | Yes |

| Website Url | Click Here To Visit |

| Device | Type of Courses | Support Channel |

|---|---|---|

| On-Premise | Personalized Budgeting | 24/7 Support |

| Mac | Expense Categorization | Email Support |

| Linux | Real-time Transaction Tracking | |

| Chromebook | ||

| Windows | ||

| SaaS |

Wallet Ai Features List

Here are some of the amazing features offered by the Wallet Ai tool;

- Wallet Ai Suggest™ for chat and helpdesk tickets retrieves relevant responses from a team

- User-Friendly Interface

- Quick & Easy

- Customizable

Wallet Ai Price & Information

At The Time Not Found Any Price

How Does Wallet Ai Work?

Wallet AI provides consumers with a full financial management experience through a multidimensional method that combines advanced algorithms and machine learning. The AI technology securely gathers transaction data after establishing a connection with users’ financial accounts, classifying expenses and revenue streams in real-time.

Subsequently, the sophisticated algorithms examine past expenditure trends, detecting patterns and deviations to produce tailored insights. With the use of this data, Wallet AI generates a dynamic budget that is customized for each user’s financial patterns and aids in setting sensible spending targets.

By continuously analyzing user behavior, the AI improves its recommendations over time to accommodate shifting financial conditions. Wallet AI gives people a clearer grasp of their financial situation by presenting notifications and visualizations in an easy-to-use interface.

Furthermore, the AI’s predictive powers help to foresee future spending patterns and provide proactive recommendations to maximize financial decisions. Thus, Wallet AI improves customers’ financial well-being by transforming traditional financial management into a simplified, intelligent, and personalized experience.

Who Uses Wallet Ai ?

Wallet Ai is an indispensable partner to anyone who wants to take control of their financial future, bringing state-of-the-art personal finance management solutions.

Wallet AI runs on advanced artificial intelligence algorithms and can be integrated seamlessly with bank accounts so that it offers very useful insights and directions based on sophisticated analysis of banking transactions.

The output of Wallet AI comes as intelligent spending suggestions, personalized budgeting tips, constant tracking of all your spending patterns as well as real-time feedback depending on the users’ unique financial lives.

Users are able therefore to gain access to an easy-to-read overview of their money matters through an intuitive interface empowering them with information to better handle their finances anytime.

When it comes to both day-to-day money management made simpler using AI technology and long-term financial wellbeing this is true; Wallet AI has revolutionized the manner in which individuals move along and make sense of their monetary terrain.

Apps and Integrations

Unfortunately, Wallet Ai doesn’t offer a native app for desktop or mobile devices.

You have the option to download an extension for:

- Chrome

- Firefox

- Microsoft Edge

- Opera

- Brave

You can also download add-ons for Google Docs, Word, Outloo

Some Outstanding Features Offer By Wallet Ai ?

Real-time Transaction Tracking

They gives users accurate and up-to-date information on their financial behavior by tracking transactions across many accounts in real time.

Cost Classification

By using sophisticated algorithms, the AI automatically classifies expenses and provides users with a comprehensive breakdown of their financial spending. This feature makes budgeting easier by giving a clear picture of spending trends.

Tailored Spending Plans

They uses machine learning to examine each user’s spending patterns and provide personalized budgets. These budgets are intended to be in line with users’ financial objectives and to change over time in response to new trends.

Wallet Ai Suggestions for Sensible Spending

They provides recommendations for wise spending that go beyond tracking and classification. The AI makes recommendations for optimal spending patterns to improve money management by comprehending user preferences and financial goals.

Predictive Analytics

To help consumers make wise selections, the AI uses predictive analytics to project future spending trends. This proactive strategy assists customers in planning for future spending and staying ahead of their financial obligations.

Privacy and Security

The security and privacy of user financial data are given top priority by Wallet AI. By using strong authentication and encryption protocols, the AI makes sure that private data stays private and is shielded from unwanted access.

Wallet Ai Interface That’s Easy to Use

With its visually intuitive presentation of financial insights, the interface is created with ease of use in mind. Users may easily understand their financial health with the help of uncomplicated reports, notifications, and clear visualizations.

Constant Learning and Adaptation

As financial behavior changes, the AI modifies its recommendations based on ongoing learning from user interactions. This flexibility guarantees that the financial guidance given will always be applicable and helpful.

Monitoring and Achieving Goals

Users can establish financial goals with Wallet AI, such as paying off a loan or saving for a trip. The system tracks users’ progress toward these objectives and offers advice and insights to support them.

Accessibility Across Platforms

Users can access their financial data and insights anywhere, at any time, with Wallet AI’s seamless integration across many platforms and devices. This guarantees a reliable and easy-to-use user experience.

Wallet Ai Pros Or Cons

| Pros | Cons |

|---|---|

| Efficient Financial Management: Wallet AI streamlines financial management by automating tasks such as transaction tracking, categorization, and budgeting, saving users valuable time and effort. | Dependency on Technology: Users relying on Wallet AI may become overly dependent on technology for financial decision-making, potentially reducing their hands-on understanding of personal finances. |

| Personalization: The AI’s ability to analyze individual spending habits enables highly personalized financial advice and budgeting recommendations, catering to the unique needs and goals of each user. | Learning Curve: Some users may experience a learning curve when initially using the AI, as they adapt to the platform’s features and understand how to leverage its capabilities effectively. |

| Predictive Insights: The predictive analytics feature empowers users with insights into future spending trends, enabling proactive decision-making and better preparation for upcoming financial obligations. | Potential Security Concerns: While Wallet AI prioritizes security, there is always a potential risk of data breaches or cyber threats, which could compromise the confidentiality of users’ financial information. |

| User-Friendly Interface: Wallet AI boasts a user-friendly interface with clear visualizations and notifications, making it easy for users to understand and navigate their financial data. | Limited Human Touch: For individuals who prefer a more personalized, human-centric approach to financial advice, the AI-driven nature of Wallet AI may feel impersonal, lacking the nuance and empathy that human advisors can provide. |

| Security Measures: The AI prioritizes the security and privacy of user data, implementing robust encryption and authentication measures to ensure the confidentiality and protection of sensitive financial information. | Internet Dependency: Wallet AI relies on an internet connection to function, and users may face limitations or disruptions in accessing their financial information if they encounter connectivity issues. |

Wallet Ai Alternative

Mint: Mint is a popular personal finance app that provides budgeting, expense tracking, and financial goal setting. It automatically categorizes transactions, offers credit score monitoring, and sends alerts for bill reminders.

YNAB (You Need A Budget): YNAB is a budgeting app that focuses on the philosophy of giving every dollar a job. It helps users allocate funds to specific categories, offers goal tracking, and encourages proactive financial planning.

Personal Capital: Personal Capital is a comprehensive financial management tool that combines budgeting with investment tracking. It provides insights into retirement planning, investment fees, and asset allocation.

PocketGuard: PocketGuard is a budgeting app that focuses on tracking spending and finding opportunities for savings. It categorizes transactions, sets spending limits, and offers a snapshot of available funds after bills and savings goals.

Goodbudget: Goodbudget is a digital envelope budgeting system, allowing users to allocate funds to specific spending categories. It promotes conscious spending by visually representing available funds in each category.

Wally: Wally is a simple and intuitive expense tracking app. It allows users to manually input expenses, set savings goals, and visualize spending patterns through easy-to-read charts.

Spendee: Spendee is a budgeting app that combines expense tracking with budget creation. It offers real-time sync between multiple devices, allowing users to manage their finances collaboratively.

Wallet Ai Conclusion

In conclusion, Wallet AI stands at the forefront of financial technology, offering users a powerful and intelligent tool for managing their finances.

With real-time transaction tracking, personalized budgeting, and predictive analytics, this AI-driven platform transforms traditional financial management into a seamless and insightful experience.

The user-friendly interface, coupled with continuous learning and adaptability, ensures that users receive personalized recommendations and insights tailored to their unique financial habits.

The emphasis on security and privacy safeguards user data, providing a trustworthy environment for handling sensitive financial information. While there are potential dependencies on technology and a learning curve for some users,

Wallet AI’s numerous advantages, including efficient financial management, personalization, and proactive insights, make it a compelling choice for those seeking a smart and automated approach to financial well-being. As with any financial tool, users should carefully assess their individual preferences and needs to determine if Wallet AI aligns with their goals and comfort level in managing their finances.

Wallet Ai FAQ

What is Wallet AI?

This is a cutting-edge financial management tool powered by artificial intelligence. It offers features such as real-time transaction tracking, personalized budgeting, intelligent spending recommendations, and predictive analytics to help users manage their finances more effectively.

How does Wallet AI categorize expenses?

They uses advanced algorithms to automatically categorize expenses based on transaction data. This categorization provides users with a detailed breakdown of their spending patterns, facilitating easier budgeting and financial analysis.

Can Wallet AI help me set and track financial goals?

Yes, They includes a feature that allows users to set and track financial goals. Whether it’s saving for a vacation or paying off a loan, the AI provides insights and progress updates to help users stay on track toward achieving their financial objectives.

Is Wallet AI secure?

Yes, Wallet AI prioritizes the security and privacy of user data. The platform employs robust encryption and authentication measures to ensure the confidentiality and protection of sensitive financial information.

How does Wallet AI offer personalized recommendations?

The analyzes individual spending habits using machine learning algorithms. By understanding users’ financial behavior, it provides personalized recommendations for budgeting, spending, and financial decision-making.