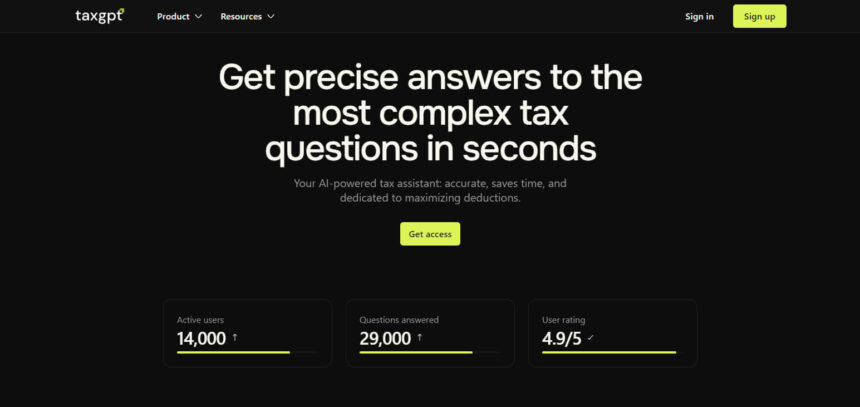

Hello guys, Today I am coming with the new Taxgpt AI Review. In this article, I cover everything about Taxgpt’s new brand, AI.

The main area of my article focuses on its features, prices, pros & cons, and support and product quality, which stay with me in this journey.

What Is Taxgpt Ai?

TaxGPT, a cutting-edge Silicon Valley-based firm, is revolutionizing the tax consultation space with AI-driven solutions.

With the backing of some of the world’s most prominent venture capitalists, it aims to redefine the tax industry.

At TaxGPT, it is revolutionizing how people file and understand their taxes, and it is looking for a talented and innovative Software Engineer to join our rapidly growing team.

This is an opportunity to dive deep into the world of cutting-edge technology and significantly impact our product.

You can work with a team of dynamic, like-minded professionals and push the boundaries of what’s possible in our field.

Key Points Table

| Key | Points |

|---|---|

| Product Name | Taxgpt Ai |

| Starting Price | $50 |

| Free Versions | Yes, Free Versions are Available |

| Product Type | Ai |

| Free Trial | Available |

| API Options | Available |

| Email Support | Yes |

| Website Url | Click Here To Visit |

How To Signup Taxgpt AI?

Visit the Website

Click on the link and visit their website, the tax AI service official website

Find where to sign up.

Look for either of these buttons on their home page- “sign up” or “register.”

Fill in your details

Your name, email address, and password will be required.

Confirm your Email

This involves checking your email inbox, where you can click on a verification link to activate it.

Finish filling out your profile.

You may need to provide further personal information to complete your registration.

How Much Does Taxgpt AI Cost?

Free Tier: Allows users to ask up to five monthly tax questions without charge.

The flat fee of $50

What Does Taxgpt AI Do?

Being in touch with the recent tax regulations and ensuring that everything is filed correctly are fundamental aspects of the tax preparation field.

As an AI-driven invention, TaxGPT is a system that changes how tax return completion works for people, firms, and tax practitioners.

The advanced capabilities of TaxGPT’s artificial intelligence imply that it provides immediate solutions to taxes, thereby ensuring accuracy, maximizing deductions, and making the filing of taxes much more accessible than ever before.

Who Uses TaxGPT?

It is for everyone, including tax professionals and many other people as well:

- Tax professionals: it makes it possible to increase efficiency in dealing with client tax returns.

- Businesspersons: they can streamline the whole taxation process, making it both effective and compliant.

- For private individuals, filing personal taxes becomes an easy task with the help of step-by-step guidance and automation tools.

Taxgpt AI Features

Personalized answers

TaxGPT’s AI assistant, tailor-made for your needs, transforms confusion into clarity. Harness this advanced AI to decipher even the most intricate tax situations effortlessly. It’s your round-the-clock personal accountant, ensuring simplicity and accuracy at every step.

Max refund guaranteed

It is not just about filing taxes but maximizing your refunds. In partnership with Column Tax, TaxGPT ensures you get every penny you deserve. Trust our combined expertise to provide you with a maximum refund.

100% accuracy

Precision is a promise. With the accuracy of Column Tax’s software, every detail of your tax filing is meticulously checked. No more second-guessing, just peace of mind.

Transparent pricing

With TaxGPT, transparency is critical. The flat fee of $50, clearly communicated upfront, covers your federal and state taxes. Collaborating with Column Tax, they provide top-notch service without hidden fees or gimmicks.

Audit assistance

Navigating audits can be daunting, but not with TaxGPT and Column Tax by your side. Benefit from Column Tax’s robust audit defense, ensuring you have expert support at every step.

TaxGPT AI Pros & Cons

Pros

Efficiency in Tax Filing: Tax filing is made faster using automated systems that handle complex procedures.

Cost-Effective: It is priced differently, providing free services for all classes of people.

High Accuracy Level: It has a lot of data and AI technology, ensuring that the answers and tax returns are as precise as possible.

User Empowerment: People can make decisions regarding their tax matters themselves, leading to a better understanding of the same.

Cons

Learning Curve: New users may need some time before they become familiar with all its features.

Limited Global Coverage: Although it has extensive coverage on tax laws in the US and Canada, other countries are still being added up on it.

Beta Phase Limitations: Expect occasional updates and adjustments for this tool in beta.

Is TaxGPT AI Safe?

TaxGPT AI has been designed with strong security measures put in place to protect the sensitive financial information of its users.

TaxGPT AI can do this by applying sophisticated encryption mechanisms, secure data repositories, and strict privacy policies, which aid in fending unauthorized access and data leakage instances.

Further, the platform always refreshes its security systems to avoid potential threats, thus offering a reliable and safe ambiance for tax preparation.

Users can, therefore, utilize TaxGPT AI without worrying about their safety regarding the accurate submission of tax returns.

TaxGPT Ai Team

TaxGPT AI Alternatives

TurboTax

Its user-friendly platform and extensive functions have made it so popular that TurboTax offers AI-guided tax preparation and deduction maximization.

H&R Block

It provides professional advice, audit support, and AI-assisted tax preparation to ensure accurate filings.

TaxAct

It is a cheap solution providing software enhanced by artificial intelligence to simplify filing processes and guarantee accuracy.

Credit Karma Tax

This program provided by Credit Karma helps its users file their income returns free of charge. It uses AI technology to guide users through the process and optimize their returns.

FreeTaxUSA

Another choice in this category is FreeTaxUSA, an affordable option that provides AI-powered help for different types of taxes.

Final Verdict

A revolutionary tool, TaxGPT AI takes the cake in taxation by offering advanced AI capabilities, making tax preparation seamless for individuals, businesses, and tax professionals.

This uniqueness of TaxGPT is enhanced through its focus on accuracy, real-time solutions, and maximizing deductions, thereby simplifying the complex journey that characterizes tax filing.

Besides, one needs to consider alternatives such as TurboTax, H&R Block, TaxAct, Credit Karma Tax, and FreeTaxUSA, which have different features and benefits.

Overall, it depends on your specific requirements and preferences, but TaxGPT AI remains a leading choice because of its innovation and secure systems.