What Is Reconcile?

Reconcile When linked and set correctly, an AI engine may manage different accounts in a variety of industries, including banking, bookkeeping, brokerage, and more. An AI engine may streamline and automate the management of these accounts by utilising sophisticated data processing techniques and algorithms, assuring accurate record-keeping, quick transaction processing, and thorough financial analysis.

It is capable of securely accessing and processing pertinent data, performing computations, generating reports, and even offering analysis and suggestions based on the information at hand. It’s important to remember that the precise implementation, security precautions, and user permissions put in place to protect sensitive information will determine the level of account integration and access.

Key Points Table

| Key | Points |

|---|---|

| Product Name | Reconcile |

| Starting Price | Free |

| Free Versions | Yes Free Versions Available |

| Product Type | Ai |

| Free Trial | Available |

| API Options | Available |

| Email Support | Yes |

| Website Url | Click Here To Visit |

| Device | Type of Courses | Support Channel |

|---|---|---|

| On-Premise | Human Expertise | 24/7 Support |

| Mac | Real-Time AI-Tax Assistance | Email Support |

| Linux | Maximize Your Tax Savings | |

| Chromebook | Flexibility and Customization | |

| Windows | ||

| SaaS |

Reconcile AI Features List

Here are some of the amazing features offered by the AI Reconcile tool;

- Reconcile Suggest™ for chat and helpdesk tickets retrieves relevant responses from a team

- quick start

- Aitubo assistant

- Customizable

Reconcile Price & Information

The software offers a free plan, but you don’t have access to all of its features. There are also pro and enterprise versions available.

How Does Reconcile Work?

Data Import: Reconcile gets started by importing financial data from different sources, such bank statements, credit card statements, or accounting software. Manual entry, file uploads, or direct linkages with financial institutions are all ways to get this information.

Data matching: After the data is imported, Reconcile compares the imported data with the records already in existence using algorithms and matching techniques. To find possible matches, it searches for transactions that have similar dates, quantities, and descriptions.

Reconciliation Procedure: Reconcile shows the user the matching transactions, usually in an intuitive manner. Users can check the matches and confirm that they are accurate. Any transactions that are not matched are marked as discrepancies for additional review.

Discrepancy Resolution: By looking over the unmatched transactions, users can look into and fix discrepancies. They can manually amend incomplete or inaccurate data, link transactions to the proper records, or classify transactions for precise reporting.

Reconciliation Reports: Reconcile provides reconciliation reports that list the transactions that match and don’t match, giving you a general idea of how the reconciliation procedure went. These reports can be used to ensure accurate financial reporting, for financial analysis, and for auditing purposes.

Ongoing Reconciliation:

Reconcile often provides the option to plan and automate recurring reconciliations, which eliminates the need for manual intervention. This enables ongoing oversight and guarantees that financial records are accurate and current.

Who Uses Reconcile ?

So who should be using Reconcile tool?

- Bloggers who are struggling to create new content regularly

- Small business owners who want to create original product reviews

- YouTubers who want crispy and unique titles and descriptions for their videos

- Social media managers who want to quickly create excellent social media posts

- SEOs, affiliate marketers, and anyone who wants to write blog articles

Apps and Integrations

Unfortunately, Reconcile doesn’t offer a native app for desktop or mobile devices.

You have the option to download an extension for:

- Chrome

- Firefox

- Microsoft Edge

- Opera

- Brave

You can also download add-ons for Google Docs, Word, Outlook, etc.

Some Outstanding Features Offer Reconcile

Unleash the Power of AI for Accurate Tax Insights

The AI model crunches your numbers, analyzes your financial information, and generates precise tax estimates tailored to your unique circumstances.

Maximize Your Tax Savings with Personalized Strategies

The platform looks into the intricate details of your finances, identifying deductions, credits, and strategies specifically tailored to your situation and goals.

Real-Time AI-Tax Assistance: Instant Answers at Your Fingertips

The real-time AI-tax assistance feature is available 24/7 to answer your queries, provide expert guidance, and demystify complex tax concepts. Empower yourself with instant access to accurate information, right when you need it.

Human Expertise for Unparalleled Assurance

The team of experienced tax professionals meticulously reviews your questions and executable actions before any action is executed. They understand that taxes require a human touch, and that’s why we take extra measures to ensure accuracy and peace of mind.

Account Aggregation

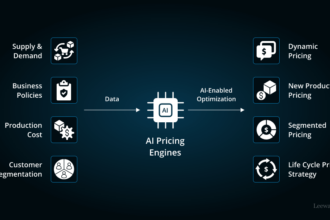

The AI engine can gather data from multiple accounts, consolidating information from various financial institutions into a centralized platform. This allows for a holistic view of your financial status and transactions.

Automated Data Entry

The AI engine can automatically extract and input relevant data from various account statements, invoices, receipts, and other financial documents. This saves time and reduces the chances of manual errors in data entry.

Transaction Categorization

The AI engine can categorize transactions based on predefined rules or machine learning algorithms. This categorization enables better tracking and analysis of income, expenses, investments, and other financial activities.

Reconciliation

The AI engine can compare and reconcile data across different accounts, identifying any discrepancies or missing transactions. It helps ensure accurate and up-to-date financial records.