In this article, i will discuss the PortfolioGPT AI, a sophisticated AI tool, streamlines the management of investment portfolios.

It employs machine learning along with real-time market data to offer tailored portfolio recommendations based on one’s unique financial objectives and risk appetite.

Regardless of one’s investing experience, PortfolioGPT AI assists all investors with actionable insights for better investment planning.

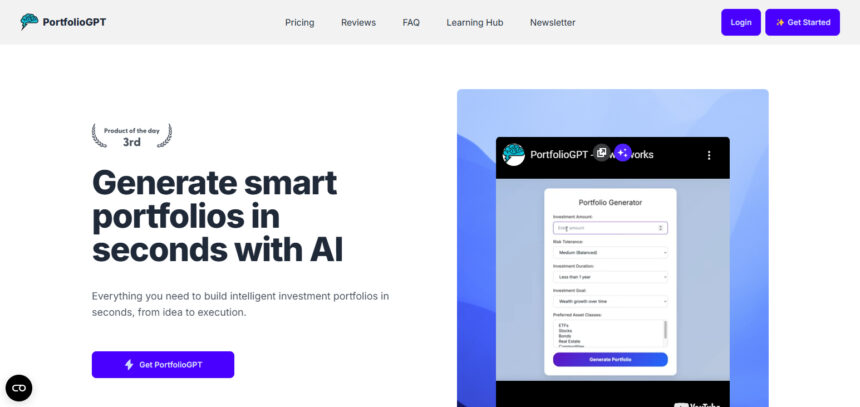

What Is PortfolioGPT AI ?

The PortfolioGPT AI automation tool is built to help users optimize their investment portfolios. Using machine learning and real-time market data, it offers tailored insights, recommends how assets should be allocated, and analyzes risk levels.

For novices and seasoned investors alike, PortfolioGPT AI streamlines financial decisions, enhancing their economic outcomes. Its intuitive design and smart automation strive to reduce risk and enhance returns, thus improving the efficiency of portfolio management.

Key Points Table

| Category | Details |

|---|---|

| Name | PortfolioGPT AI |

| Founded | 2024 |

| Founders | Not publicly disclosed |

| Category | AI-Powered Investment & Portfolio Management Tool |

| Technology Used | Artificial Intelligence, Machine Learning, Real-Time Data Analytics |

| Target Users | Individual Investors, Financial Advisors, Portfolio Managers |

| Key Features | Smart Asset Allocation, Risk Analysis, Real-Time Market Insights |

| Platform Availability | Web-based Platform |

| Business Model | Subscription-based Service |

| Official Website | Not officially listed yet |

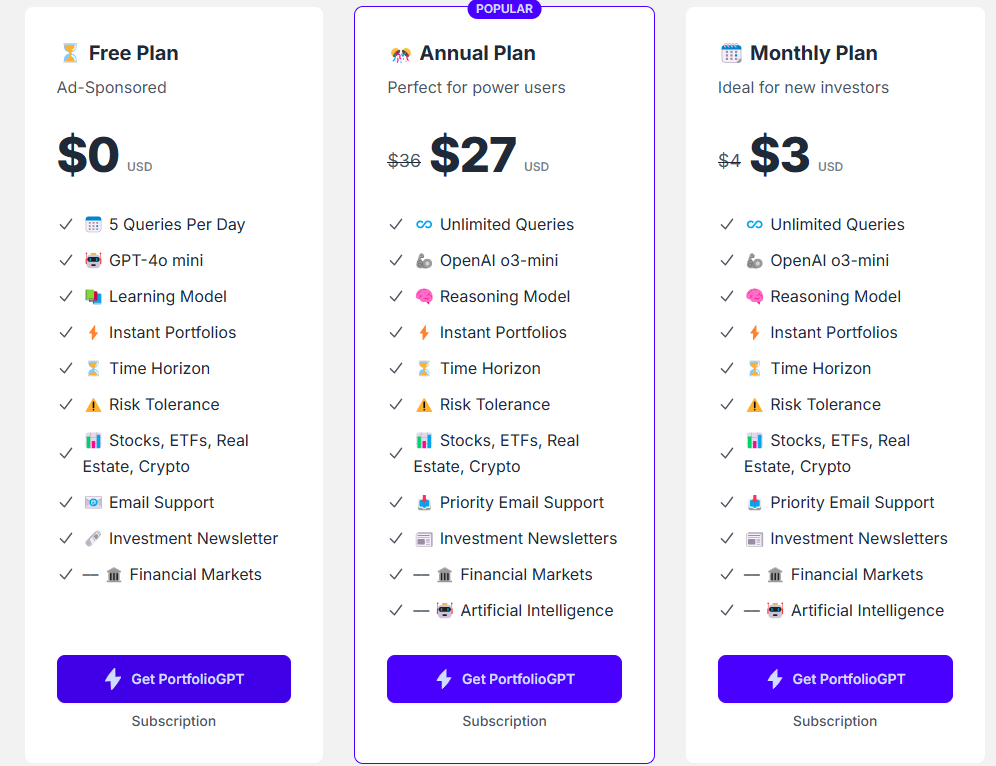

Pricing

How Can I Register On This PortfolioGPT AI Program?

Access The Site

Click on www.portfoliogpt.xyz.

Register As A New User

Start the registration process by clicking the sign-up button labeled “Get PortfolioGPT”.

Account Creation

You need to provide an email address and a name you wish to use which will allow you to create an account.

Investment Settings

To better tailor portfolio suggestions that align with your financial objectives, please provide your investment amount along with risk tolerance.

Portfolio Generation

The AI will, in a matter of seconds, generate a personalized investment portfolio based on the inputs made.

Is PortfolioGPT AI Worth it?

Artificial intelligence driven PortfolioGPT AI helps investors automated their portfolio management tasks with defined parameters.

By using machine learning algorithms, it designs customized investment portfolios for users depending on the given parameters of capital, risk description, and specific vuncher areas.

Its easy user interface and the ability to provide customers with customized portfolio recommendations in a nutshell is enjoyed by all clients.

Along with speed and personalization, clients are reminded that the service does not completely replace the intricate suggestions made from a live broker. Nonetheless, offering novive and seasoned investors an effecient method of making calculated decisions, PortfolioGPT AI aims to assist all users.

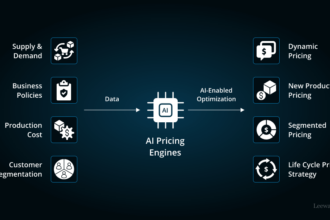

How Does PortfolioGPT AI Work?

Collection of User Input

First you add information such as the amount to invest, risk level, and other relevant factors like financial objectives.

AI Analysis

The AI assesses your inputs alongside current market data through machine learning in real-time.

Portfolio Generation

PortfolioGPT constructs an investment portfolio that considers all aspects of the profile the user provided.

Optimization & Suggestions

The program offers guidance on the level of risk and possible returns with the changes made to the asset distribution.

Ongoing Monitoring

The AI keeps track of changes in the market and is capable of suggesting alterations to your portfolio according to the changes.

Some Outstanding Features Offer By PortfolioGPT AI ?

AI To Automatically Generate Portfolios

Creates investment portfolios based on the user’s investment amount and associated risk through OpenAI’s sophisticated algorithms. .

Customized Risk Evaluation

Incorporates your particular risk preferences into the portfolio advice. Whether you are conservative or aggressive, it will tailor the recommend investment portfolio accordingly. .

Automatic Portfolio Recommendations

Tailors instantaneous portfolio suggestions to the user with optimally constructed portfolios depending on the given financial objectives and capital to be invested. .

Basic User Information Portals

Simple details like investment amount, risk profile or level, investment horizon, and goals are needed to generate comprehensive portfolios for users. .

Continuous Portfolio Enhancement

Monitors the prevailing market trends and suggests necessary changes to be incorporated so that the investment portfolio stays relevant and optimal at all times. .

Preferred Asset Class Investment with No Limit

Make selection from different asset classes best suited to the investors and guarantees diversification on investments. .

Candidate-centered Layout

The system is created to enable both advanced and novice investors at PortfolioGPT AI to optimally navigate the system without restrictions, thanks to the enhanced intuitive systems incorporated in the platform. .

PortfolioGPT AI Pros Or Cons

| Pros | Cons |

|---|---|

| AI-powered personalized portfolio creation | Limited transparency about team or company behind it |

| Fast and easy portfolio generation based on user inputs | May not offer the depth of advice a human financial advisor provides |

| Real-time market analysis and optimization | Requires stable internet connection to access platform |

| Beginner-friendly with a simple user interface | Still relatively new, with limited long-term performance data |

| Custom risk profiling and asset allocation options | Some features may be locked behind a subscription plan |

PortfolioGPT AI Alternative Brands

PortfolioPilot

Portfoliopilot is fueled by Portfoliogpt AI, which is an innovative tool for managing portfolios because it can design tailored investment plans.

The distinguishing feature of PortfolioPilot is that it considers user specific information which includes risk appetite and financial objectives in creating portfolios.

The system helps users make key decisions in real time and market shifts while helping to optimize portfolio with sustained insight tracking. This accurately tracks the user’s financial goals and provides a futuristic answer to evolving market challenges. It’s an effective answer for investors today.

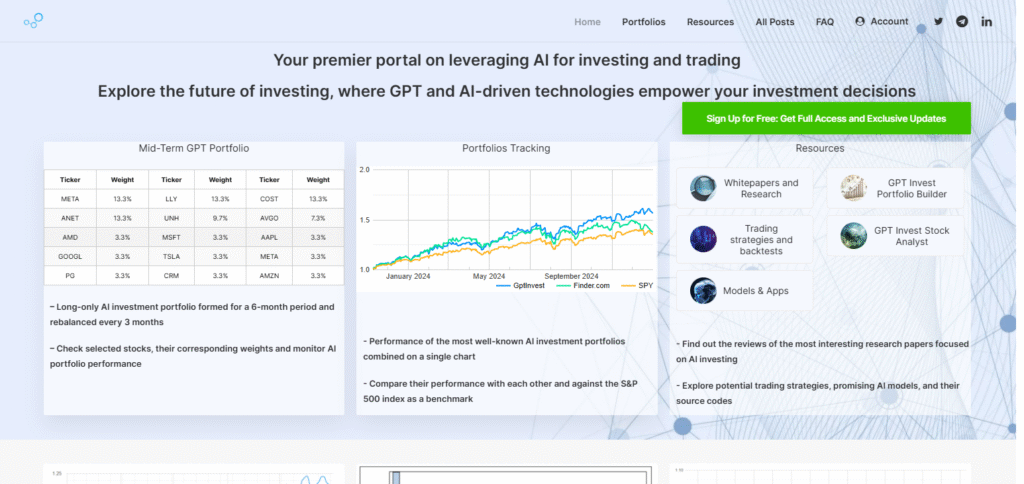

GptInvest

GptInvest is an autonomous investment platform that uses top-tier models like GPT-4, LLaMA, and Gemini for personalized portfolio creation and management.

Coupled with AI insights, mid-term portfolios are created and rebalanced quarterly because of its unmatched capability of real-time market data analytics integration.

Users of GptInvest are empowered by AI performance comparison tracking that features Shapre ratios, returns, and other self driven analysis enabling GptInvest AI strategics comparison against conventional standards. This precise portfolio monitored management is unparalleled for data obsessed driven investors making it highly optimization permerised.

Wealthfront

Wealthfront is a digital robo-advisor that creates customized investment plans based on the user’s provided data and preferences.

Using advanced machine learning strategies such as optimization through means and variance, and the Black-Litterman model, Wealthfront constructs and optimizes portfolios for clients based on their risk levels and financial aspirations.

Wealthfront offers differentiated portfolios encompassing as many as 17 global asset classes, and incorporates automated tax-loss harvesting and rebalancing, guaranteeing optimal and tailored investment management for clients.

Conclusion

To summarize, PortfolioGPT AI provides a remarkably effortless and individualized strategy concerning investment management by utilizing sophisticated AI technology which adjusts portfolios to fit one’s unique financial objectives and level of risk acceptance.

Its user-friendly interface and ongoing enhancements, combined with effortless market monitoring, make it a must-have resource for investors of all levels.

Although its recommendations are swift and rooted in empirical data, users ought to view them as supplementary to traditional advisory services for a holistic investment plan.