In this article, I will discuss the How to Use Uniswap is and how it can be used for trading with Ethereum-based coin since it is one of the most used decentralized exchanges.

You will learn how to connect your crypto wallet, make a token swap, add liquidity, and comply with key security measures. This guide is tailored to assist you in maneuvering through Uniswap whether you are a novice or an advanced user in DeFi.

What is Uniswap?

Uniswap is a decentralized exchange (DEX) located on the Ethereum blockchain, enabling users to exchange ERC-20 tokens straight from their wallets without involving any centralized entity. It employs an automated market maker (AMM) model; users trade against liquidity pools, instead of the conventional order books.

The pools are filled by users who earn a portion of the trading fees. Uniswap is open-source, easy to use, and an important part of the decentralized finance (DeFi) ecosystem.

How to Use Uniswap

Example: Swapping ETH for USDC on Uniswap

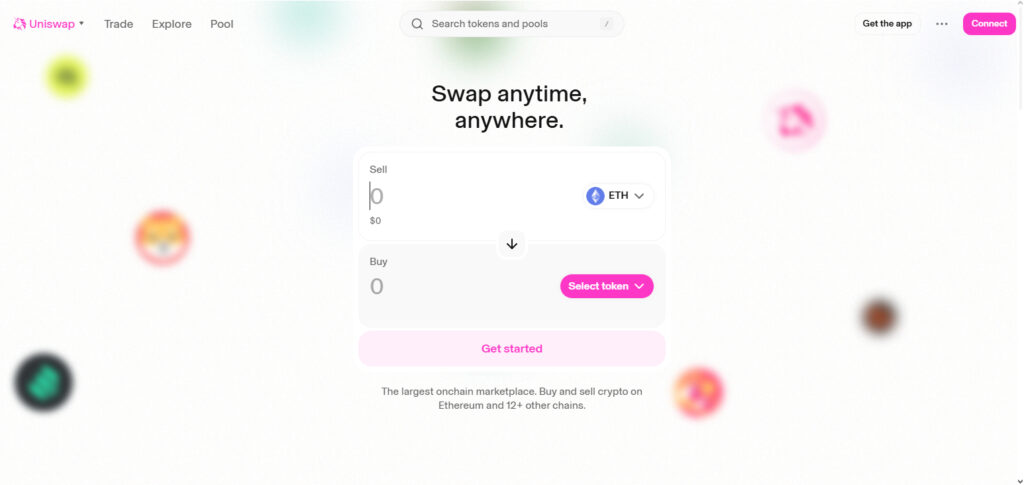

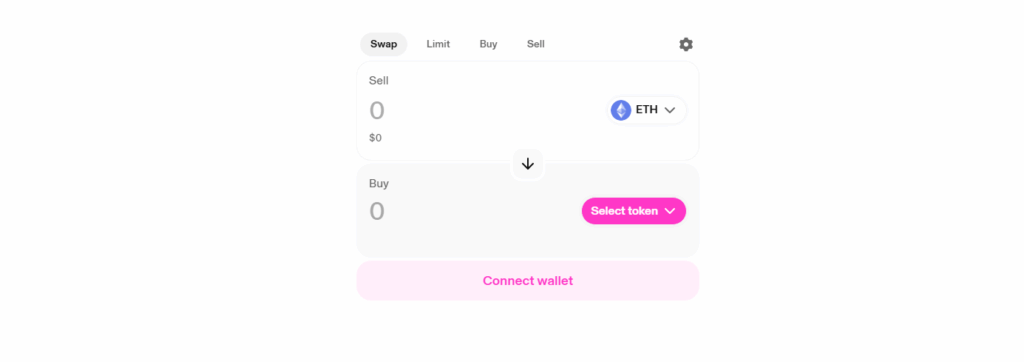

Step 1: Visit the Official Uniswap App

- Navigate to app.uniswap.org

- Always double check links for the right URL to prevent phishing attacks.

Step 2: Connect Your Wallet

- Press “Connect Wallet” button on the top right interface.

- Pick MetaMask, Coinbase Wallet, or WalletConnect.

- Confirm the connection on wallet popup.

Step 3: Choose Tokens to Swap

- On the Swap tab:

- From: Select ETH

- To: Select USDC

- Type in the amount of ETH you wish to convert (e.g. 0.1 ETH).

Step 4: Review the Quote

- From Uniswap, you can view:

- Estimated USDC Received

- Price impact

- Network (gas) fee

- You are able to change slippage tolerance through ⚙️ settings as required.

Step 5: Approve and Confirm

- Press “Swap” and afterwards “Confirm Swap”.

- Your wallet will ask for your approval on transaction and gas fee payments.

- After confirmation, the transaction will be sent to Ethereum network.

Step 6: Verify Your Wallet

- Within a few seconds or minutes, depending on gas, you will receive your USDC.

- You may confirm the transaction using the provided link on Etherscan.

Providing Liquidity on Uniswap

Participating in a pool of tokens on Uniswap lets users earn by receiving a share of trading fees. This type of DeFI technologies earn traders by providing a deep liquidity ecosystem. It Works as the following:

Wallet Connection: Make sure your wallet (example: Metamask or TrustWallet) is connected and go on Uniswap’s oficial web application.

Select a Liquidity Pool: Select an existing token pair or create a new one. Make sure the provided assets offer a 1:1 (example: ETH and USDC).

Deposit Tokens to the Liquidity Pool: Enter supply for both token fields. Uniswap incorporates an algorithm that guarantees you the desired pair value without altering pool user’s fairness.

Authorize through Wallet each Token’s Use: If you are a new user and wishes to join the pool, ensure you sign off both tokens on the liquidity restrictions approval.

Submission Confirmation: Check the pool share, fees estimate, and validate the transaction through the wallet.

Passive Income: While other users are swapping tokens for trade fee of 0.3%, you, as the liquidity provider are earning that fee proportionate to your share of the pool.

Liquidity Withdraw: Withdraw anytime to unlock your tokens with fees after the trade. Caution: Impermanent loss can be detrimental if token price shifts drastically below the supply price.

Security Tips and Best Practices

Official Links Only

Always access Uniswap to avoid phishing sites.

Wallet Security

Ensure to use verified wallets such as MetaMask and hardware wallets, like Ledger.

Do Not Share Seed Phrases

Seed phrases should be kept offline, private, and will never be shared.

Validate Token Contracts

Tokens may have fraudulent copies. Confirm the token contract addresses through CoinGecko and Etherscan.

Enable Your Wallet’s Security Features

Enable password login, biometrics, and transaction notifications if available.

Airdrops and Scams Warning

Do not interact with unsolicited airdrops or unknown tokens. These can empty your wallet.

Every Transaction Needs Double Checking

Confirm all swaps by checking token amounts, slippage settings, and recipient addresses.

Always Check for New Information

Stay tuned to Uniswap’s official announcements for new protocol updates, vulnerabilities, and other critical information.

Features Of Uniswap

Token Swap Feature

You can conduct swaps for ERC-20 tokens without going through an order book or a centralized intermediary.

Liquidity Pools

Users who provide token pairs into liquidity pools stand to earn a share of the transaction fees.

AMM Model

Price determination of tokens is done through smart contracts based on supply and demand using algorithmic methods.

Non-Custodial Trading

All users’ funds are fully secure as trades are conducted directly from their wallets.

Passive Income Generation

Liquidity providers share the 0.3% fee for every trade done in their respective pools.

Compatibility with Multiple Versions (V2, V3)

Capital efficiency is significantly enhanced with the implementation of concentrated liquidity and sophisticated fee tiers on Uniswap V3.

Support for Multiple Networks

As with other L2 Ethereum networks, Uniswap is accessible in the Ethereum mainnet, Arbitrum, Optimism and Base, which makes transactions speedier and cost-effective.

Open-source and Trustworthy

The protocol is entirely open-sourced and can be audited, and the underlying smart contracts are under active community governance.

Pros & Cons

| Pros | Cons |

|---|---|

| Decentralized and Non-Custodial | High Gas Fees on Ethereum Mainnet |

| Easy Token Swapping | Risk of Impermanent Loss for Liquidity Providers |

| No KYC or Account Required | Price Slippage on Large Trades |

| Earn Fees by Providing Liquidity | Complex Interface for Beginners |

| Supports Many ERC-20 Tokens | Vulnerable to Fake or Scam Tokens |

| Works with Multiple Wallets | Limited Customer Support |

| Layer 2 Support (e.g., Arbitrum, Optimism) | Requires Understanding of Ethereum Transactions |

| Open-Source and Community-Driven | Not Suitable for Fiat Transactions |

Conclusion

To summarize, Uniswap streamlined the process for decentralized trading, making it safe and open to everyone with a crypto wallet. Mastering the basics of token swaps, liquidity provision, and essential security measures allows you to engage freely in the DeFi world.

Uniswap operates on a trustless structure which allows users to trade or earn fees on a highly customizable platform without involving any third parties. Begin with small amounts, use your knowledge, and harness the benefits of decentralized finance through Uniswap.

FAQ

Do I need an account to use Uniswap?

No, Uniswap is non-custodial and doesn’t require account creation or KYC. All you need is a compatible crypto wallet like MetaMask.

What wallets are supported by Uniswap?

Uniswap supports MetaMask, Coinbase Wallet, WalletConnect, Trust Wallet, and hardware wallets via browser extensions.

Are there fees for using Uniswap?

Yes, each swap has a 0.3% fee, which goes to liquidity providers. You also need to pay Ethereum network gas fees.