I will discuss the How to Use Mobile Banking Apps Securely. With the rise of digital banking, safeguarding your financial information becomes imperative.

Mobile users should manage their financial accounts as securely as possible by avoiding public networks and employing strong account passwords. To avoid stress, it is advisable to take note of all the relevant steps to enhance safety while banking through mobile devices.

What is Mobile Banking Apps?

Mobile banking apps are secure applications that enable users to carry out certain transactions using a smartphone or a tablet. These apps have numerous features including balance inquiry, fund transfer, bill payment, check deposit, and expenditure tracking.

With mobile banking apps, personal financial management is easier compared to traditional banking since they are available 24/7 from any location. With biometric authentication enabling login and real-time notifications, mobile banking offers convenience without sacrificing security.

How to Use Mobile Banking Apps Securely

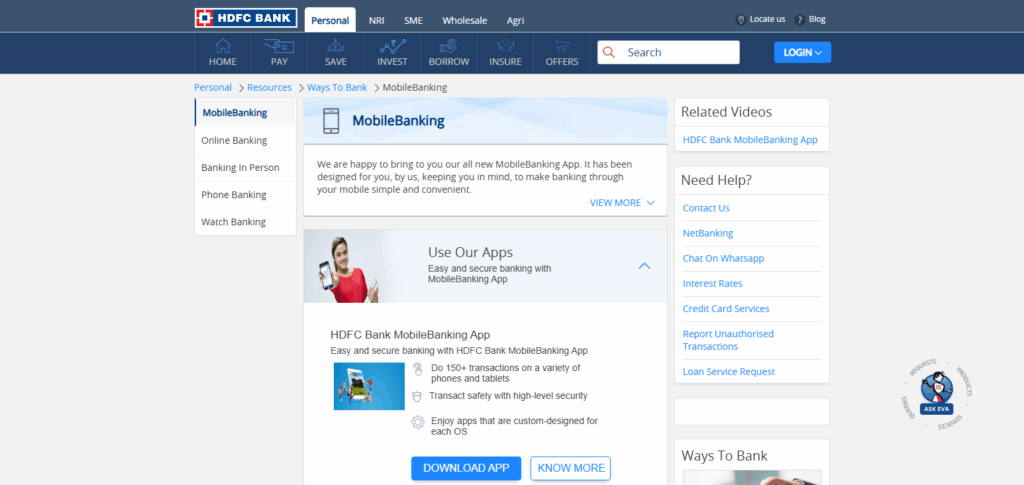

Example: Secure Use of HDFC Bank Mobile App on Android

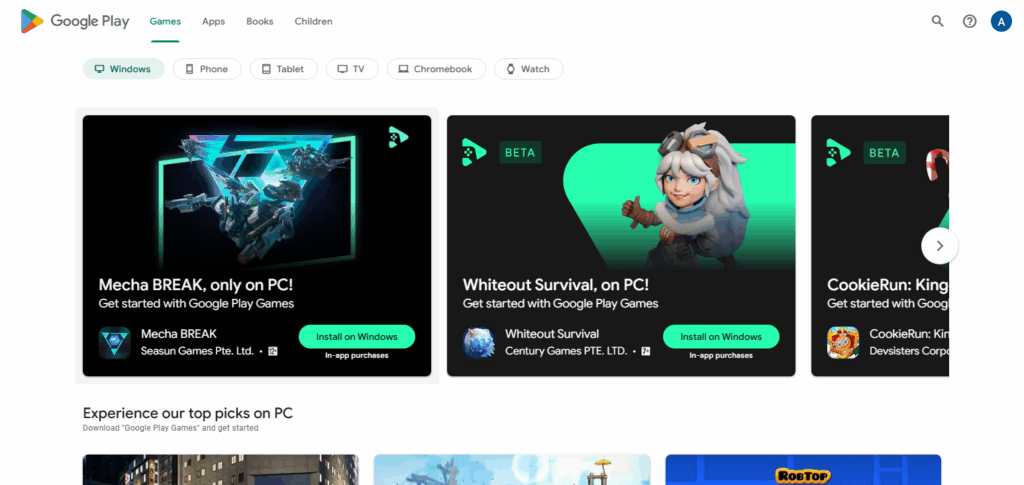

Step 1: Download Only from Trusted Sources

- Access the Google Play Store.

- Find “HDFC Bank MobileBanking.”

- Confirm the developer as HDFC Bank Ltd.

- Stay clear from third-party APKs or text/email links.

Step 2: Enable Biometric Login

- Access the app and navigate to Settings → Login Options

- Activate either Face ID or Fingerprint log in.

- These features provide additional protection over baseline passwords.

Step 3: Use Strong App Lock & Device Security

- Enforce a device PIN or pattern with minimum 6 characters.

- Activate App Lock on the device (through phone settings or a trusted security app).

- Avoid using easily guessable passwords like birthdays.

Step 4: Avoid Public Wi-Fi

- Avoid logging into banking apps using public Wi-Fi (airports, cafes).

- Opt for mobile data or a VPN for banking on the go.

Step 5: Monitor for Phishing

- Avoid clicking on bank related SMS/email links.

- It’s safest to access bank websites from their official apps or type the URL in manually.

Step 6: Always Log Out After Use

- Click on “Logout” to complete your session.

- Simply closing the app does not log you out and can lead to unauthorized access.

Step 7: SMS And Email Alerts

- Go to Settings → Notifications

- Make sure SMS and email alerts for transactions are turned on.

- Alerts help you catch fraudulent activities on your account instantly.

What to Do If You Suspect Fraud

In case of suspected fraudulent activities through a mobile banking application, avert potential risks by acting immediately. To mitigate losses, call the bank’s customer service or fraud department to report the suspected activity and place the account on hold.

Afterwards, change all login details, passwords, and PINs associated with the account. Scan the device for malware, spyware, or unauthorized apps and remove any identified threats. If there are losses, report to local law enforcement and, if necessary, to the national cybercrime agency. Remember to document all communications and transactions related to the case.

Limit App Permissions

Restricting mobile banking app permissions is critical as it boosts security. Only enable features such as internet access and notifications for the banking app to use. Do not allow access to your contacts, location, camera, or storage unless absolutely necessary.

Granting too many permissions can lead to the app exposing vulnerable data and increase the chances of spying or other harmful activities. To limit the chances of data being stolen or accessed without permission, check the settings on your device regularly to make sure only the basic permissions required are enabled.

Enable Notifications and Alerts

Turning on notifications, especially alerts for transactions through your phone banking application, help you track the activity on your mobile banking account without much hassle. You will receive instant notifications for transactions, logins, password changes, or any unusual activity.

Getting real-time notifications allows for the prompt detection of unauthorized usage or fraud, allowing for immediate counteraction. Set personalized alerts for any suspicious activities like huge withdrawals, unsuccessful login attempts or transactions from foreign countries to receive timely notifications while ensuring safety of your finances.

Security & Management

Use Strong Authentication: Ensure biometric login (fingerprint/face ID) is enabled and employ strong, unique passwords.

Keep Apps and OS Updated: Addressing existing and potential risks, regular updates improve security functionality and avert emerging threats.

Install Trusted Security Software: Antivirus and mobile security applications provide additional layers of protection.

Monitor Transactions Frequently: Capturing unauthorized actions becomes easier when account activity is reviewed regularly.

Log Out After Each Session: Critical for shared and public devices.

Avoid Sharing Sensitive Info: Sharing passwords, PINs, or OTPs is prohibited through calls, texts, or emails.

Secure Your Device: Device encryption, alongside screen locks (PINs and patterns), fortifies defenses further.

Limit App Permissions: Curbing the banking app exposure by granting only minimal required permissions.

Tips For Safe Mobile Banking Apps

Download Apps from Official Sources: Never download a banking application from any source other than Google Play Store or Apple App Store.

Use Strong Passwords & Biometrics: Set complex passwords and opt for bio-verification like fingerprints or face ID.

Enable Two-Factor Authentication (2FA): This adds an extra layer of security for your login.

Avoid Public Wi-Fi: Mobile banking is best done over mobile data or a secured connection.

Keep Your Phone & App Updated: Regular maintenance updates strengthen security and protection features.

Set Up Real-Time Alerts: Receive instant notifications for every transaction or login attempt for heightened security.

Log Out After Each Use: Helps to safeguard unauthorized access on shared or public devices with sensitive data.

Install Mobile Security Software: Antivirus and anti-malware tools provide further layers of safety.

Limit App Permissions: Set the permissions to the bare minimum.

Be Aware of Phishing Attempts: Do not click on odd messages claiming to be from your bank or respond to them.

Pros & Cons

| Pros | Cons |

|---|---|

| Convenient access to banking 24/7 | Risk of phishing and social engineering attacks |

| Real-time alerts for transactions and login attempts | May be vulnerable on unsecured or outdated devices |

| Enhanced security features (2FA, biometrics) | Public Wi-Fi use can expose sensitive information |

| Faster transactions and bill payments | Users may neglect app or OS updates, weakening security |

| Easier account monitoring and management | If phone is lost/stolen, data may be at risk without proper protections |

| Environmentally friendly (less paper use) | Some users struggle with tech or privacy settings |

Conclusion

To summarize the main points, mobile banking apps provide great flexibility, but utmost attention should be given to security. You can greatly minimize the chances of fraud or data theft by observing critical security measures such as using strong passwords, two-factor authentication, avoiding public Wi-Fi hotspots, and monitoring account activity.

Keeping the device and the app updated, limiting app permissions, and remaining vigilant against phishing scams are other necessary steps. When proper precautions are exercised, mobile banking can save one time and be secure.

FAQ

Is it safe to use mobile banking apps?

Yes, mobile banking apps are generally safe when used correctly. Ensure you download the app from official stores, use strong authentication, and keep your device secure.

How can I protect my mobile banking app from hackers?

Use a strong, unique password, enable two-factor authentication, avoid public Wi-Fi, and keep your phone’s software and apps updated.

Should I log out of my banking app after use?

Yes, always log out after each session, especially if you’re using a shared or public device, to prevent unauthorized access.