In this article, I will discuss the How to Use Curve Finance one of the leading decentralized exchanges focused on the trading and liquidity provision of stablecoins.

I will explain how to connect your wallet, swap tokens, provide liquidity and earn CRV rewards. Whether you are new to DeFi or just exploring yield farming, this tutorial will help you safely and effectively use Curve Finance.

What is Curve Finance?

Curve Finance is a decentralized exchange (DEX) on Ethereum that focuses on stablecoin and wrapped token trading. Through an automated market maker (AMM), Curve executes swaps with lower slippage and lower fees than traditional DEXs, making it ideal for USDC, DAI, and USDT.

Curve differs from other DEXs in that it tries to optimize for comparable assets to reduce price impact. Through liquidity provision, users can earn CRV tokens which are used to vote in Curve governance.

How to Use Curve Finance

Example: Swapping USDC to DAI on Curve Finance

Step 1: Visit the Official Site

- Click here curve.fi to access the webpage.

- You might want to double check you went to the correct URL so that you don’t get phished.

Step 2: Connect Your Wallet

- On the upper right hand side click on “${Connect Wallet”}.

- Select a wallet interface like MetaMask, Coinbase Wallet, or WalletConnect.

- Confirm the connection in the wallet popup.

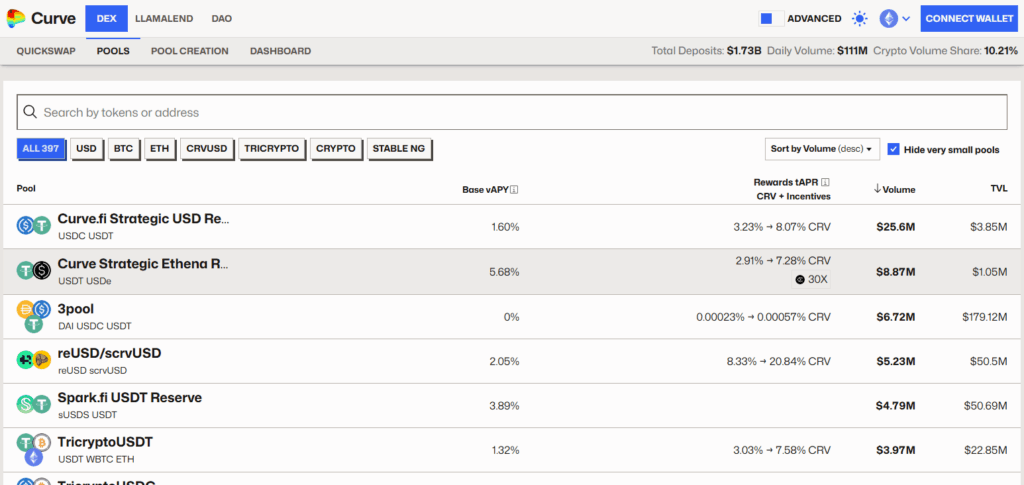

Step 3: Select the Swap Pool

- Hit “Swap” from the homepage.

- Find a pool that contains USDC and DAI (for instance the 3pool or Factory pool).

- Curve will automatically route the best path with minimal slippage and execute it.

Step 4: Enter Swap Details

- In the “From” field choose USDC and put in a quantity (for instance 100 USDC).

- In the “To” field choose DAI.

- Curve indicates an estimated value of DAI that can be received and also shows slippage and fees.

Step 5: Approve and Confirm

- Press “Approve USDC” and confirm.

- After that press either “Sell” or “Swap” button.

- Confirm the transaction in your wallet and wait for it to process.

Step 6: Check Your Wallet

- After confirmation, you should see the DAI in your wallet.

- If you want, you can confirm the transaction on Etherscan.

Why Use Curve Finance?

Trading with Low Slippage: Curve does curve swaps against stablecoins and near price aligned assets, which allows trades to occur with minimal slippage.

Lower Trading Fees: Stablecoin swapping on this DEX is more economical compared to other DEXs due to its lower fee structure.

High Yield Opportunities: Liquidity providers can earn CRV tokens and liquidity provider fees on Curve pools.

Decentralized Governance: Through Curve DAO, holders of CRV are able to take part in governance decisions.

Integration: Curve has relationships with top DeFi protocols which expands its scope and opportunities to earn even more.

Is Curve Swap Safe?

Just like most DeFi platforms, Curve Finance is still very much in the testing phases. This also means it has a lot of room for improvement and risk. When you utilize a service like Curve, you’re placing your trust in smart contracts that could possibly be buggy, hacked, or even deliberately poorly designed. For this reason, it’s important to do proper research and always approach investments with caution.

While most people believe that Curve Finance has been properly audited, it is clear that there are still gaps that need to be closed. Due to its focus on stablecoin pools—assets designed to maintain fixed-value pegs—any failure in those pegs can lead to losses. Should any of these stablecoins lose their value, liquidity providers could end up with significantly depreciated assets.

Curve works with several other DeFi platforms such as Yearn Finance in their efforts to maximize returns. These types of partnerships, referred to as composability, increase revenue, but they significantly increase risk as well. Any issues occurring with any of Curve’s connected partners could adversely impact Curve and its users as well.

Security and Risks

Smart Contract Risk: Funds could be lost due to exploitation or a bad code on Curve’s smart contracts. This system does undergo audits, however, there is not a single system that is 100% secure.

Impermanent Loss: Volatility of the tokens in the Curve pools may result in the price of providing liquidity being less than the actual loss suffered.

Protocol Exploits: Like any DeFi tool, Curve is at risk for flash loan attacks and other exploits.

Wallet Security: Users must safeguard their wallets and private keys—breaches of any kind add to compromised funds issues.

Governance Risk: Changes made to protocol parameters, emissions, or fee structure by Curve DAO introduces a degree of uncertainty.

Curve DAO and Governance

Curve DAO is the governing body of the Curve Finance protocol and manages it as a decentralized autonomous organization. It uses the CRV token as its governance token, granting holders the ability to participate in votes for critical decisions like new pool listings, fees, and upgrades to the protocol.

Users can only unlock the vote using CRV through a mechanism referred to as vote-escrowed CRV (veCRV), which also increases liquidity rewards. This mechanism helps to manage user retention while keeping incentivizing users good for the protocol’s health. Governance decisions are made on the basis of community votes, empowering users and liquidity providers.

Tips for Beginners

Start Small: Learn to swap and provide liquidity using a small amount at first.

Use Reputable Wallets: Only connect with trusted wallets like MetaMask or WalletConnect.

Check Gas Fees: Try to perform transactions while Ethereum gas fees are low.

Understand the Pools: Familiarize yourself with the different pools like 3Pool or stETH pool before adding liquidity.

Stay Updated: Follow official Curve channels for updates, changes in governance, and major security notifications.

Avoid Scams: Always use the official Curve site and check URLs to avoid phishing.

Pros & Cons

| Pros | Cons |

|---|---|

| Low slippage for stablecoin trading | Limited to stablecoins and similar assets |

| Low transaction and trading fees | Exposure to impermanent loss for LPs |

| High yield opportunities through CRV | Complex interface for beginners |

| Decentralized governance via Curve DAO | Smart contract risks and potential exploits |

| Integration with major DeFi platforms | Requires gas fees (especially on Ethereum) |

| Boosted rewards with veCRV | Long lock-up periods to earn max benefits |

Conclusion

To summarize, Curve Finance is a multi-faceted platform for stablecoin trading, yield farming, and participating in DeFi. Offering low slippage, competitive fees, and governance by users, it serves crypto enthusiasts at any experience level.

Understanding basic token swaps, liquidity provision, and governance participation equips newcomers to venture into and reap benefits from Curve’s ecosystem. As always, use trusted tools, stay informed, and begin with small amounts on your DeFi journey with Curve Finance.

FAQ

How do I start using Curve Finance?

To get started, connect a Web3 wallet like MetaMask to the Curve Finance website. Then, you can swap tokens or provide liquidity to pools.

How do I earn rewards on Curve?

You can earn CRV tokens and trading fees by depositing assets into liquidity pools. Staking CRV or veCRV can further boost your rewards.