In this piece, I will cover how to invest in Mutual Funds, which is arguably one of the best ways to increase your wealth over time.

If you are looking for an investment opportunity or are new to investing, consider mutual funds, as they offer diversification, ease of investment, and professional management. A few tips and important factors will be shared to boost your confidence on the journey of investing in mutual funds.

What Are Mutual Funds?

Mutual funds serve as an investment option that collects funds from multiple investors to purchase a diversified portfolio of stocks, bonds, or other securities.

Fund managers oversee mutual funds, which enable individual investors to gain access to a variety of assets with minimal capital and alleviate the burden of asset selection.

Returns are earned on investment based on how well the fund performs, which also determines the investment value. The fund’s diversification features, combined with its ease of use and the fact that experts handle the decisions, make mutual funds an ideal choice for new investors.

How to Invest in Mutual Funds

Example: Monthly Investment of ₹1,000 in an ELSS Mutual Fund through SIP

Complete KYC (Know Your Customer)

- Submit your PAN card, Aadhaar, and address proof.

- These documents can be submitted through Groww, Zerodha Coin, or ET Money.

Choose an Investment Platform

- Recommended platforms include Groww and ET Money.

- Register and link your bank account.

Select a Mutual Fund Scheme

- Select ELSS funds such as Mirae Asset Tax Saver Fund or Axis Long Term Equity Fund.

- Evaluate fund performance, expense ratio, and lock-in period (3 years for ELSS).

Start a SIP

- Start with a SIP of ₹1,000/month.

- Set up auto-debit from your bank account.

Track and Rebalance Periodically

- Check your fund’s performance at least twice a year.

- Adjust your finances accordingly to meet your objectives.

Why It Works

- Low entry barrier: Minimum investment of ₹500–₹1,000.

- Tax benefit: ELSS funds provide tax benefits under Section 80C (deduction up to ₹1.5 lakh/year).

- Professional management: Investments are managed by experienced fund managers.

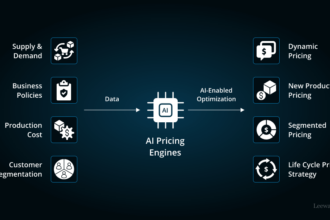

How to Choose the Right Mutual Fund

Define Your Financial Objectives: Choose a fund that aligns with your immediate or future goals such as retirement, education planning, or building wealth.

Evaluate Risk Appetite: Based on how much risk you’re willing to take, select equity, debt, or hybrid mutual funds.

Review Performance Metrics: Analyze the fund’s performance track record for 3, 5, and 10 years to establish a performance benchmark.

Analyze the Fund Manager: Fund performance varies significantly depending on the manager’s skill and experience.

Evaluate Expense Ratio: Invested capital grows more with lower expense ratio mutual funds.

Evaluate Peers Against Each Other: Assess competing funds on returns, risk, and ratings using provided benchmarks.

Assess AUM (Assets Under Management): A high AUM is a marker of trust, although very large AUM may limit growth opportunities.

Determine Investment Horizon: Ensure investment strategy is aligned with the time frame expected for remaining invested.

Benefits of Investing in Mutual Funds

Diversification: With mutual funds, you can invest in different assets, reducing the impact of any single investment that performs poorly.

Professional Management: Fund managers conduct all the necessary research and selection to ensure proper tracking of your investments.

Affordability: Through SIPs (Systematic Investment Plans), you can start investing with a small amount.

Liquidity: The majority of mutual funds can be easily cashed out, giving you access to your money within a short period of time.

Transparency: Performance, holdings, and costs are made available regularly which ensures investors are well informed.

Flexibility: Based on your goals and risk appetite, various types of funds, including equity, debt, and hybrid, are available.

Risks Involved in Mutual Funds

Market Risk: For mutual funds, especially equity funds, the overall market’s movements can cause significant gains or losses in value.

Interest Rate Risk: The returns from debt mutual funds could be impacted by alterations in interest rates.

Credit Risk: A debt fund can lose value if a bond issuer defaults on repayment of the debt.

Liquidity Risk: In extreme market scenarios, some funds may be unable to liquidate assets rapidly without incurring a substantial price impact.

Inflation Risk: Inflation can diminish the real purchasing power of returns, potentially outpacing them.

Management Risk: A fund’s performance may suffer due to inappropriate choices made by its managers.

Taxation on Mutual Fund Investments

Taxes associated with mutual funds are based on the category of the fund and the duration for which it has been held:

Equity Mutual Funds

- For Short-Term Capital Gains (STCG): 15% tax if held for less than 1 year.

- Long-Term Capital Gains (LTCG): If held for more than 1 year, the gain is subject to tax on surplus ₹1 lakh at 10%.

Debt Mutual Funds

- All gains (from April 1, 2023) are taxed according to the investor’s income tax slab, regardless of the period the investment is held.

ELSS mutual funds

- Provides a maximum tax benefit of ₹1.5 lakh under Section 80C with a mandatory lock-in period of 3years.

Common Mistakes to Avoid

Chasing Past Returns: Reliance on historical performance almost always yields adverse outcomes.

Ignoring Risk Profile: Market corrections can become panic-inducing events for those with low risk tolerance who unknowingly invest in high-risk funds.

Lack of Goal Planning: Most people invest in something valuable; therefore, not having an investment objective leads to irrational decisions.

Not Reviewing Portfolio: Long-term performance can be negatively impacted by a lack of consistent monitoring and rebalancing.

Over-Diversification: The ‘too many cooks in the kitchen’ principle is alive and well when it comes to investment funds: a single interplay of several funds does not ensure a risk-free solution and is often unnecessarily complicated.

Ignoring Fund Costs: On an everyday basis, high expense ratios and hidden charges are life robbers that slowly but surely chip away at your earnings.

Timing the Market: People often shoot themselves in the foot by trying to buy when they think prices are low, resulting in missed opportunities.

Conclusion

Investing in mutual funds offers a practical and beginner-friendly approach to wealth accumulation. Grasping your objectives, evaluating your risk appetite, and selecting the appropriate fund enables you to create a diversified and well-structured portfolio.

Steering clear of common pitfalls, practicing discipline, and tracking your portfolio performance lead to a positive outcome. Considering mutual funds within the scope of an enduring investment horizon, coupled with strategic choices, can unlock considerable value and help attain enhanced financial independence.

FAQs

What is the minimum amount needed to start investing in mutual funds?

You can start investing with as little as ₹100 per month through a Systematic Investment Plan (SIP), making it accessible to all.

What is the difference between SIP and lump sum investment?

SIP involves investing a fixed amount regularly, while lump sum means investing a large amount at once. SIP helps in rupee cost averaging.

Can I invest in mutual funds without a broker?

Yes, you can invest directly through AMC websites, online platforms, or mobile apps using a direct plan.