In this post, I will discuss the How to Find Profitable Deposits. Pick a good option and you can earn more interest while keeping your funds safe.

When you look at interest rates, how long the money is locked up, and the bank’s trust score, it becomes easier to find schemes that pay the most. So, let’s walk through a few quick steps that will help you find the most profitable deposits.

Understanding Profitable Deposits

Profitable deposits are basically special bank accounts or investment plans that promise better returns than your average savings option. They usually come with higher interest rates, so the money you tuck away grows a bit faster over time.

Common examples include fixed deposits, recurring deposits, or high-yield savings accounts offered by commercial banks and credit unions. How much profit you actually earn depends on the interest rate, how long you leave the money untouched, and how often the bank adds interest to your balance.

Pick these accounts carefully, and you can boost your savings while keeping your cash safe and, depending on the product, fairly easy to reach.

How to Find Profitable Deposits

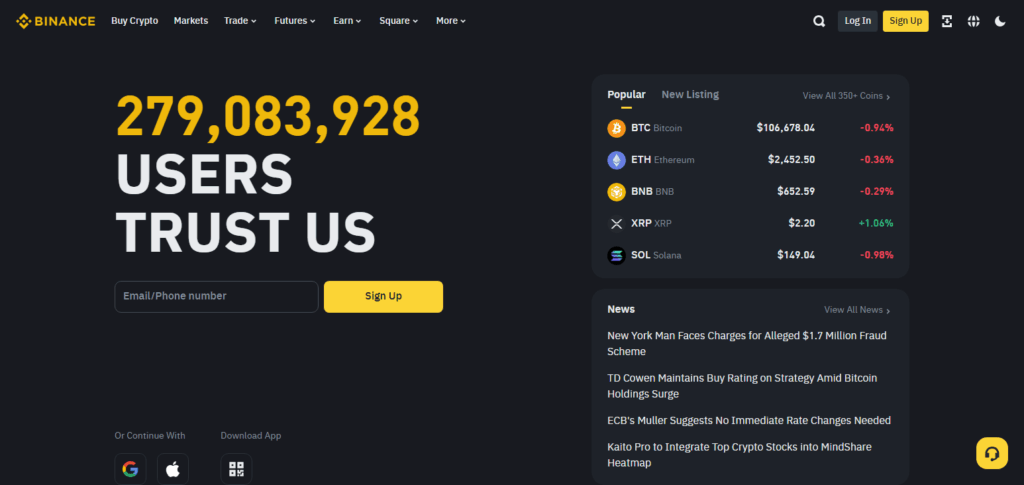

Example: Finding a Profitable Deposit on Binance Earn

Step 1: Choose a Trusted Platform

- First, head over to Binance and set up an account.

- Once inside, tap the Earn tab at the top of the page.

Step 2: Explore Deposit Options

- Scan the list for options like Simple Earn, Auto-Invest, or Liquidity Farming.

- For a safer pick, stick with stablecoins such as USDT, USDC, or FDUSD.

Step 3: Compare APYs (Annual Percentage Yields)

- Flexible Savings USDT ~3%

- Locked Savings USDT 30 Days ~6–7%

- Liquidity Farming USDT/ETH Variable ~10–15%

Step 4: Assess Risk and Terms

- Keep in mind that Binance Earn products are not insured by banks or government bodies.

- Always read the fine print: Can you pull your money out early? Are you locked in for the full term?

- To smooth out wild price swings, focus on stablecoins rather than volatile coins.

Step 5: Start Small and Scale

- Kick things off with a tiny deposit, say just $100.

- Keep an eye on how your money moves for a few weeks.

- Add more only when you feel comfortable and confident.

Factors That Affect Profitability

Interest Rate: Obviously, the bigger the rate, the more money you make over time.

Compounding Frequency: If interest is rolled into your balance every month instead of once a year, you earn on your earnings sooner.

Tenure: Agreeing to leave your money locked up longer can snag a fatter rate, but you trade that gain for less access.

Inflation: When prices soar, the real buying power of your interest can quietly evaporate.

Tax: Uncle Sam-or your local taxman-may take a slice of your earnings, shrinking the profit you actually pocket.

Bank Trustworthiness: Picking a solid, well-rated bank protects your principal and makes sure promised returns come.

Early Exit Fees: Pulling funds out before the maturity date often triggers harsh penalties that wipe out some of your gains.

Researching and Comparing Deposit Options

To spot the best money-earning deposit, begin by browsing different banks and credit unions. Online comparison sites show interest rates, terms, and special perks in one easy chart. While you’re there, check each banks star ratings, read real customer stories, and make sure they follow the rules.

Dont forget to note the fine print: how much you must deposit, what it costs if you take money out early, and how often the interest piles up. Looking at all these details together will help you pick a plan that grows your cash and feels safe and comfortable for you.

Tips to Maximize Deposit Profitability

Pick Longer Terms: Banks usually reward patients savers with higher rates on longer FDs.

Go for Cumulative Plans: With these, interest piles up and pays out at the end, boosting your total.

Spread Your FDs: Placing money in different banks lets you chase the best ongoing rates.

Watch Rate Shifts: Update yourself on market moves, then roll over funds when yields climb.

Stick to the Plan: Breaking an FD early can cost you dearly in penalties and lost interest.

Use Tax-Benefit FDs: Some accounts shield returns from tax, so your gains stay closer to a dollar.

Common Mistakes to Avoid

Ignoring Penalties: If you pull money out early, steep fees can eat up most of what you earned.

Falling for Unrealistic Rates: Deals that promise sky-high rates may hide fees or be too good to last.

Not Checking Bank Credibility: Trusting a shaky bank puts your cash at risk, so always look at reviews.

Overlooking Inflation Impact: Even a high rate can lose value if prices rise faster than your interest.

Neglecting Tax Implications: Taxes on earned interest shrink your final gain, so plan for that cut.

Skipping Terms and Conditions: Blindly agreeing lets surprise fees, limits, or extra hoops catch you off guard.

Risk & considerations

Liquidity Risk

The longer your money is locked in, the harder it is to access.

Premature Withdrawal Penalties

Taking the money out early could wipe out interest or cost you extra fees.

Inflation Risk

If the return doesn’t beat inflation, your buying power shrinks over time.

Credit Risk

Storing funds at shaky or little-known banks could put your deposit in danger.

Tax Implications

Interest is usually taxable, so what you really keep is less than advertised.

Interest Rate Fluctuations

A fixed rate looks bad later if new accounts start paying much more.

Hidden Fees or Charges

Maintenance costs, setup fees, or other surprises eat into your earnings.

Pros & Cons

| Pros | Cons |

|---|---|

| Higher interest rates increase earnings | Longer lock-in periods reduce liquidity |

| Safer investment compared to stocks | Penalties for premature withdrawal |

| Predictable and steady returns | Returns may be lower than inflation rate |

| Easy to understand and manage | Interest income may be taxable |

| Flexible options (fixed, recurring) | Possible hidden fees or charges |

| Helps in disciplined saving | Fixed rates may not keep up with market changes |

Conclusion

Picking a good bank deposit takes a little homework, but the payoff is worth the effort. First, line up interest rates, lock-in periods, and any special rules from several banks side by side so you see how they match up. Then look at how often interest is added, what inflation may eat away, whether tax will nibble at gains, and even how reliable the bank feels.

Online calculators, fresh market news, and dodging rookie slip-ups like skipping small print will steer you toward the sweetest offers. With some patience and clear thinking, a solid deposit keeps your savings growing safely over time.