Hello Guys Today i come with new Dola Ai Review. In this article i cover everything about Dola new brand ai .Main area of my article focus on its features , prices , pros & cons and it support and product quality stay with me in this journey .

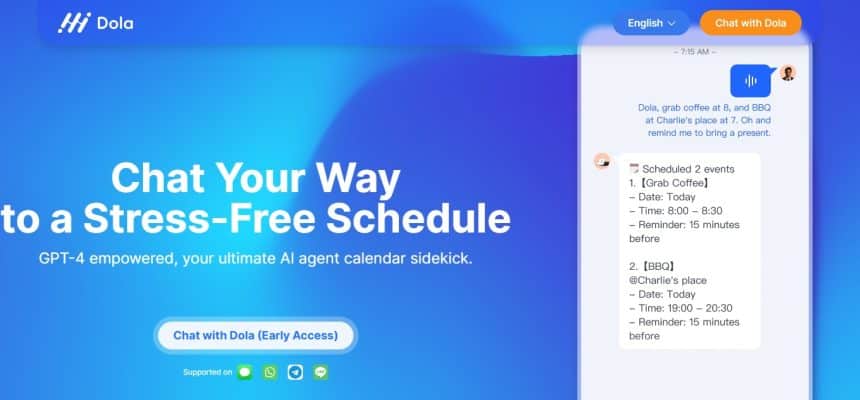

What Is Dola Ai?

This is an innovative artificial intelligence platform designed to streamline financial management and empower users with personalized insights and recommendations. Leveraging advanced machine learning algorithms and data analytics, Dola Ai enables users to effortlessly track expenses, create budgets, and set financial goals. By analyzing spending patterns and financial habits,

Dola Ai provides actionable insights and tailored recommendations to help users make informed decisions and improve their financial health. Whether it’s optimizing investments, reducing unnecessary expenses, or managing debt more effectively, Dola Ai serves as a trusted financial advisor, guiding users towards achieving their financial objectives. With its user-friendly interface and intuitive features, Dola Ai makes financial management more accessible, efficient, and rewarding for users of all backgrounds and skill levels.

Key Points Table

| Key | Points |

|---|---|

| Product Name | Dola Ai |

| Starting Price | Free |

| Free Versions | Yes Free Versions Available |

| Product Type | Ai |

| Free Trial | Available |

| API Options | Available |

| Email Support | Yes |

| Website Url | Click Here To Visit |

| Device | Type of Courses | Support Channel |

|---|---|---|

| On-Premise | Accuracy of Recommendations | 24/7 Support |

| Mac | Dependency on Internet Connection | Email Support |

| Linux | User-Friendly Interface | |

| Chromebook | ||

| Windows | ||

| SaaS |

Dola Ai Features List

Here are some of the amazing features offered by the Dola Ai tool;

- Dola Ai Suggest™ for chat and helpdesk tickets retrieves relevant responses from a team

- User-Friendly Interface

- Quick & Easy

- Customizable

Dola Ai Price & Information

At The Time Not Found Any Price

How Does Dola Ai Work?

Dola Ai operates through a sophisticated process that combines advanced machine learning algorithms with data analytics to streamline financial management. First, users input their financial data, including income, expenses, debts, and savings goals, into the platform. Dola Ai then analyzes this data to gain insights into the user’s financial habits, patterns, and goals.

Using this information, the platform identifies areas for improvement and generates personalized recommendations to help users achieve their financial objectives. These recommendations may include optimizing spending, creating budgets, reallocating investments, or reducing debt. Throughout this process, Dola Ai continuously learns and adapts to the user’s financial behavior, refining its recommendations over time to better suit their needs and preferences. By leveraging the power of artificial intelligence, Dola Ai simplifies financial management and empowers users to take control of their financial future.

Who Uses Dola Ai ?

So who should be using Dola Ai?

- Bloggers who are struggling to create new content regularly

- Small business owners who want to create original product reviews

- YouTubers who want crispy and unique titles and descriptions for their videos

- Social media managers who want to quickly create excellent social media posts

- SEOs, affiliate marketers, and anyone who wants to write blog articles

Apps and Integrations

Unfortunately, Dola Ai doesn’t offer a native app for desktop or mobile devices.

You have the option to download an extension for:

- Chrome

- Firefox

- Microsoft Edge

- Opera

- Brave

You can also download add-ons for Google Docs, Word, Outloo

Some Outstanding Features Offer By Dola Ai ?

Expense Tracking

The offers comprehensive expense tracking capabilities, allowing users to monitor their spending habits and identify areas for improvement.

Budget Creation

The platform enables users to create personalized budgets based on their financial goals and spending patterns, helping them to stay on track and manage their finances more effectively.

Goal Setting

The allows users to set financial goals, such as saving for a vacation, buying a house, or paying off debt, and provides actionable insights and recommendations to help them achieve these goals.

Dola Ai Personalized Insights

They provides personalized insights and recommendations based on the user’s financial data and goals, helping them make informed decisions and improve their financial health.

Investment Optimization

The platform offers investment optimization features, suggesting strategies to maximize returns and minimize risk based on the user’s financial profile and market conditions.

Debt Management

The helps users manage their debt more effectively by providing strategies to pay off debt faster and save money on interest payments.

Automated Transactions

Dola Ai can automate routine financial transactions, such as bill payments and savings contributions, to help users stay organized and on top of their finances.

Secure Data Handling

They prioritizes the security and privacy of user data, implementing robust measures to safeguard sensitive information and comply with data protection regulations.

Dola Ai User-Friendly Interface

The features a user-friendly interface that makes it easy for users to navigate and access its features, regardless of their level of financial expertise.

Dola Ai Pros Or Cons

| Pros | Cons |

|---|---|

| Expense Tracking: Dola Ai offers comprehensive expense tracking capabilities, allowing users to gain insight into their spending habits and identify areas for improvement. | Learning Curve: Users may encounter a learning curve when first using Dola Ai, particularly if they are unfamiliar with financial management concepts or the platform’s features. |

| Personalized Recommendations: The platform provides personalized recommendations based on the user’s financial goals and spending patterns, helping them make informed decisions to improve their financial health. | Dependency on Internet Connection: Dola Ai requires an internet connection to function, limiting its accessibility in offline environments. |

| Budget Creation: Dola Ai enables users to create personalized budgets tailored to their financial goals, helping them stay on track and manage their finances more effectively. | Privacy Concerns: Some users may have concerns about privacy when inputting sensitive financial information into the platform, although Dola Ai implements robust security measures to protect user data. |

| Goal Setting: Users can set financial goals within the platform, and Dola Ai provides actionable insights and strategies to help them achieve these goals. | Limited Investment Options: While Dola Ai offers investment optimization features, it may have limited options for users seeking to invest in specific assets or financial products. |

| Investment Optimization: Dola Ai offers investment optimization features, suggesting strategies to maximize returns and minimize risk based on the user’s financial profile and market conditions. | Platform Compatibility: Dola Ai’s compatibility with different devices and operating systems may vary, potentially limiting its accessibility for users on certain platforms. |

Dola Ai Alternative

Mint: Mint is a popular personal finance management app that helps users track expenses, create budgets, and set financial goals. It offers similar features to Dola Ai, including expense tracking, budgeting, and goal setting.

YNAB (You Need a Budget): YNAB is a budgeting app focused on helping users allocate their income towards their priorities and financial goals. It offers features such as goal tracking, debt management, and personalized budgeting strategies.

Personal Capital: Personal Capital is a comprehensive financial planning platform that offers tools for tracking investments, managing retirement accounts, and optimizing asset allocation. It provides features similar to Dola Ai for investment optimization and financial goal setting.

Quicken: Quicken is a personal finance software that helps users manage their finances, track expenses, and plan for the future. It offers a wide range of features, including budgeting, investment tracking, and bill management.

PocketGuard: PocketGuard is a budgeting app that helps users track expenses, manage bills, and optimize spending. It offers features such as expense tracking, budget creation, and personalized insights to help users stay on top of their finances.

Dola Ai Conclusion

In conclusion, Dola Ai offers a comprehensive and user-friendly solution for individuals looking to take control of their finances and achieve their financial goals. With its advanced features such as expense tracking, budget creation, goal setting, and personalized recommendations, Dola Ai empowers users to make informed decisions and improve their financial health.

While there are other alternatives available, Dola Ai stands out for its intuitive interface, continuous learning capabilities, and commitment to security and privacy. Whether users are looking to optimize investments, reduce debt, or simply manage their day-to-day expenses more effectively, Dola Ai serves as a trusted financial advisor, guiding users towards financial success. As technology continues to evolve, Dola Ai is poised to play a significant role in helping individuals manage their finances more efficiently and achieve their long-term financial goals.

Dola Ai FAQ

What is Dola Ai?

This is an artificial intelligence-powered platform designed to streamline financial management and help users achieve their financial goals.

What features does Dola Ai offer?

They offers a wide range of features, including expense tracking, budget creation, goal setting, investment optimization, debt management, personalized recommendations, and automated transactions.

How does Dola Ai work?

The utilizes advanced machine learning algorithms and data analytics to analyze user financial data and provide personalized insights and recommendations to help users manage their finances more effectively.

Is my financial data secure with Dola Ai?

Yes, They prioritizes the security and privacy of user data and implements robust measures to safeguard sensitive information. The platform complies with data protection regulations to ensure the confidentiality of user data.

Can I integrate Dola Ai with other financial services or platforms?

Yes, Dola Ai offers integration capabilities, allowing users to connect it with various financial services, platforms, and applications to access additional features and functionalities.