The Best Salary Advance Platforms for Employees will be covered in this post, with an emphasis on digital lending apps that offer rapid access to money prior to payday.

Flexible EMIs, quick approvals, little paperwork, and clear interest rates are all provided by these platforms. Salaried professionals can select the best platform to effectively manage short-term cash flow, whether for crises, monthly expense bridging, or scheduled financial demands.

What Are Salary Advance Platforms?

Digital lending businesses known as salary advance platforms give workers credit advances or short-term loans secured by their impending pay. In contrast to conventional bank loans, these platforms prioritize speed, ease of use, and minimal documentation, enabling borrowers to obtain funds in a matter of hours.

These platforms are a contemporary and dependable substitute for payday loans or high-interest credit options because they assist salaried professionals in effectively managing emergencies, monthly expenses, or unforeseen charges with features like digital KYC, adjustable EMIs, and transparent interest rates.

Tips for Choosing the Right Platform

Interest Rates – Make sure the rates are competitive and transparent.

Loan Amounts – Make sure the goals provide loan amounts that fit your needs.

EMI Cycle Flexibility – Opt for platforms where EMIs are aligned to your salary cycle.

Platform Credibility – Evaluate the reviews, licensing, and data security.

Terms and Fees – Make sure you are aware of the fees, and read the terms and conditions.

Usability – Look for a platform that has an easy to use mobile app.

Speed of Approval – If you need access to cash, it should be quick.

Key Point & Best Salary Advance Platforms for Employees List

| Platform | Key Points |

|---|---|

| PaySense | Instant personal loans, flexible repayment, credit score check, easy app interface, EMI options. |

| mPokket | Short-term loans for students, fast disbursal, minimal documentation, app-based, instant approval. |

| Buddy Loan | Peer-to-peer lending, competitive interest rates, flexible repayment, quick application, digital KYC. |

| KreditBee | Personal & short-term loans, instant disbursal, flexible EMIs, online application, credit scoring. |

| MoneyTap | Credit line facility, pay-as-you-use loans, instant approval, flexible EMIs, app-based interface. |

| CashE | Quick personal loans, minimal documentation, flexible repayment options, online disbursal, low interest. |

| FlexSalary | Salary advance & personal loans, quick processing, no collateral, flexible EMIs, easy application. |

| LoanTap | Personal & business loans, flexible repayment, instant approval, multiple loan products, digital KYC. |

| RupeeRedee | Fast personal loans, minimal paperwork, short-term credit, instant disbursal, app-based service. |

| SmartCoin | Education & personal loans, flexible EMIs, instant disbursal, app-based, low-interest rates for students. |

1. PaySense

PaySense is a popular digital lending solution that facilitates personal loans to salaried employees. PaySense helps employees address their financial challenges by allowing them to set their payments to be deducted from their salary.

The approval process takes a matter of minutes, and the company policy is to conduct a soft pull for the credit score and to require a minimal document set.

Given the company policy, PaySense is frequently classified as one of the best salary advance platforms for employees. Many employees leverage their services to receive money for emergencies during the month and to secure credit.

PaySense Features, Advantages & Disadvantages

Features

- Personal loans through the app are instant.

- EMI options are flexible.

- Documentations are minimal.

- Assess credit score.

- KYC verification is digital.

Advantages

- Quick disbursement is seen in a few hours.

- Application is simple.

- Cash needs emergencies are better served.

- Fees and interest are transparent.

- Accepted and trusted widely.

Disadvantages

- Higher interest than other banks may apply.

- Large loans are not ideal.

- Income/salary is a strict qualifying factor.

- Late payment fees are possible.

- Customer service is limited.

2. mPokket

mPokket offers low-cost, short-term loans with quick disbursement, mostly to young professionals and students. Borrowing is quick and easy because to its app-based infrastructure, which guarantees immediate approval and little paperwork.

Borrowers can avoid long-term financial obligations by repaying within weeks thanks to the flexible repayment choices.

mPokket is one of the greatest salary advance platforms for workers, particularly for those who require urgent dollars prior to their next payment, because of its smooth mobile experience and emphasis on prompt credit.

Salaried customers now favor it for short-term personal finance management due to its clear conditions and affordable interest rates.

mPokket Features, Advantages & Disadvantages

Features

- Short‐term loans with small tickets.

- Quick approvals via app.

- Decisions on credits are instant.

- Repayment timelines are flexible.

- Documentation is minimal.

Advantages

- Access to money is incredibly quick.

- Good for covering gaps in salaries.

- User-friendly simple interface.

- Students/ young professionals can qualify easily.

- No need for collateral.

Disadvantages

- Loans for a limited amount are provided.

- Smaller loans can have a higher fee.

- Large emergencies are not serviced.

- Timeframes for repayment are short.

- Compounding interest can get tricky.

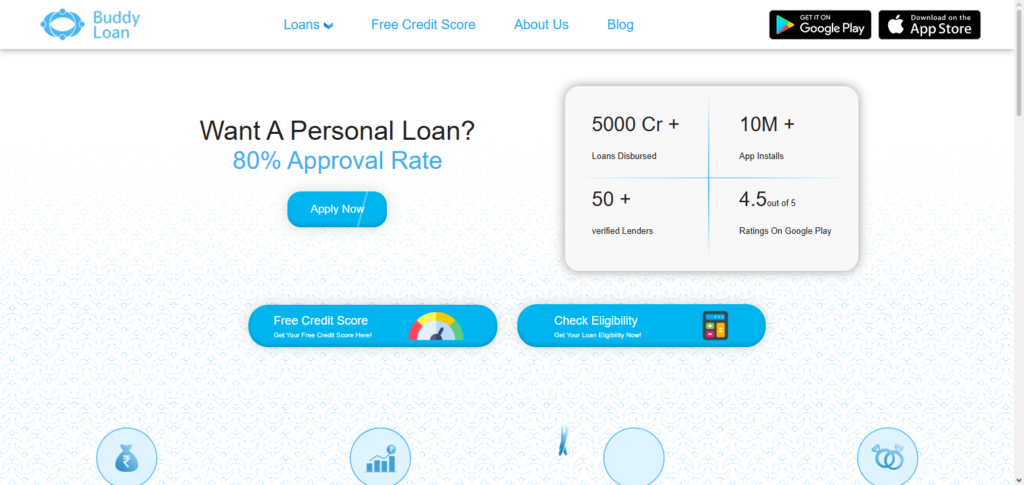

3. Buddy Loan

Buddy Loan is one of the first peer-to-peer lending platforms providing personal loans with low interest. With a fully digital KYC, employees can obtain money for emergencies or planned spendings quickly.

Flexible repayment terms, quick approvals and a simple application process allows for quick efficiency for borrowers. Buddy Loan is one of the best salary advance platforms for employees. They obtain their financial resources without the hassle of banks.

They gain financial transparency on the platform and know what the interest, tenure, and repayment is on the loan, which is especially important for salaried employees with short-term cash flow problems.

Buddy Loan Features, Advantages & Disadvantages

Features

- Lending models are peer-to-peer.

- Interest rates are competitive.

- KYC is digital.

- Repayment with EMI.

- Tracking is app-based.

Advantages

- Lower rates can be seen compared to payday lenders.

- EMIs flexibly are chosen.3. Ideal for salaried professionals

- Terms are clear

- Rapid approval

Disadvantages

- Variability in loan amounts

- Financing may depend on peer availability

- May take longer than fully digital lenders

- Not optimal for profiles with no credit

- A processing fee is charged

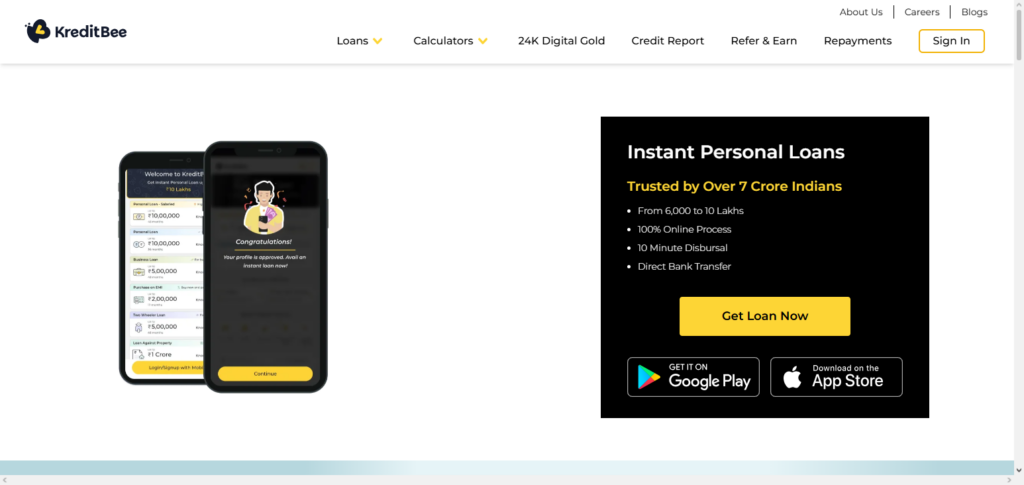

4. KreditBee

KreditBee is one of the best digital lending platforms that provides short-term loans and personal loans for salaried professionals. KreditBee allows for instant loan disbursal and requires a simple online application and a credit evaluation.

They are one of the best salary advance platforms because borrowers can access money without collateral. They also have a fully mobile experience. They have also provided salary advance service on KreditBee. There is a smooth mobile experience for borrowers.

The diverse variety of loan options, streamlined processing, and transparent repayment plans have made these services popular with those that need immediate liquidity before their subsequent paychecks.

KreditBee Features, Advantages & Disadvantages

Features

- Short-term and personal loans

- Rapid loan disbursal

- Various repayment period options

- KYC process is done online

- Credit line is available

Advantages

- Considerable loan amount

- Process is uncomplicated

- Usability of the app is satisfactory

- EMIs flexibility

- Charges are clear

Disadvantages

- Higher interest on riskier profiles

- Charges for being late can. be excessive

- For lower salaries, approval is not guaranteed

- Addtional fees ontop of interest

- There might be some document requirements

5. MoneyTap

MoneyTap offers an innovative, unique credit line that allows salaried users to pull, and pay, as they need. With instant approval and adjustable EMIs, it allows employees to customize their cash flow management.

The app’s overall simplicity, and ease of use, as well as the relaxed requirements, create a frictionless borrowing experience. MoneyTap ranks as one of the best salary advance platforms for employees.

MoneyTap is perfect for users who need access to emergency cash, a monthly cash flow gap, or financial flexibility to spend. The pay-as-you-use policy makes it a perfect fit for users who appreciate control over their personal finance management, as interest is only applied to the amount that is borrowed.

MoneyTap Features, Advantages & Disadvantages

Features

- Credit line for revolving

- A model whereby you pay as you use

- Approval is immediate

- EMIs are flexible

- Notifications via the app

Advantages

- Interest is charged only for the amount that you use

- Excellent for variable expenditures

- Disbursal is rapid

- Useful app for repeated use

- Fees are are clear

Disadvantages

- A higher credit score is necessary

- Fees may be charged on an annual basis

- Not very good for loans that ought to be held for long periods

- Interest is charged on a daily basis

- Would make some people want to spend more than they ought to

6. CashE

CashE was created to give salaried workers fast personal loans with no paperwork. Urgent financial needs are promptly satisfied thanks to its quick approval process and online disbursement.

Borrowers can tailor EMIs to their pay cycles with various repayment options. CashE, which is regarded as one of the top salary advance platforms for workers, provides clear interest rates and an easy-to-use digital method, making it practical for handling emergencies or monthly expenses. Professionals looking for short-term loans without complicated banking procedures favor it because of its emphasis on speed and use.

CashE Features, Advantages & Disadvantages

Features

- Focus on personal loans

- Streamlined online application

- Quick money transfers

- Easily adjustable EMI plans

- Streamlined digital paperwork

Advantages

- Streamlined process

- Great for urgent situations

- No collateral required

- Rapid repayment options

- Clear and straightforward conditions

Disadvantages

- Bank interest rates may be more favorable

- Lower limits on loan amounts

- Less available customer assistance

- Fees for late payments

- Firm salary requirements

7. FlexSalary

Employee short-term loans and salary advances are FlexSalary’s areas of expertise. It makes managing finances simple for salaried people by offering quick loan approval, no collateral requirements, and flexible EMIs. By ensuring prompt money transfers, the platform helps to close the gap between paychecks.

FlexSalary, which is regarded as one of the top pay advance platforms for workers, is ideal for emergency situations, regular bills, and urgent financial demands. It is a top alternative for professionals who require quick, short-term access to funds without the drawn-out procedures of traditional lending institutions because of its mobile-first strategy, transparent interest structure, and customized credit possibilities.

FlexSalary Features, Advantages & Disadvantages

Features

- Advances on salary and short-term borrowing

- Approval is instant

- No collateral required

- EMIs that are adjustable

- Applications are done digitally

Advantages

- Great for bridging salary gaps

- Rapid access to funds

- Clear and straightforward rates

- Interface is simple

- Predictable repayment plans

Disadvantages

- Processing fees may be charged

- Not suited for borrowing larger amounts

- Interest rates are on the higher side

- Income screen is applied

- Payment must be synced with the salary cycle

8. LoanTap

For salaried people, LoanTap provides a range of loan solutions, such as business, personal, and salary advance loans. Employees who require quick access to funds will find it useful due to its speedy approval, digital KYC, and flexible payback alternatives.

The program, which offers transparency in interest rates and EMI schedules, is regarded as one of the greatest salary advance platforms for employees.

Whether for emergencies, scheduled spending, or bridging monthly bills, LoanTap’s many solutions enable borrowers to select loans that meet their unique financial needs, guaranteeing a dependable solution for short-term liquidity management.

LoanTap Features, Advantages & Disadvantages

Features

- Different types of loans available

- EMI plans that are flexible

- Approval is done online and quickly

- KYC process is digital

- Fees are clear

Advantages

- Different uses available for loans

- Tenure is adjustable

- The app is easy to use

- Funds are transferred rapidly

- Fees are straightforward

Disadvantages

- Interest plus fees can accumulate

- Standards for eligibility are stringent

- Proof of salary may be required

- There are fees for being late on payments

- Not suited for those with no credit history

9. RupeeRedee

RupeeRedee concentrates on offering salaried professionals quick personal loans with no documentation. It guarantees prompt payment and adaptable payback plans based on the borrower’s work schedule.

Users who require quick access to funds might benefit from the digital application process because it is simple. RupeeRedee, one of the top platforms for pay advances for workers, effectively handles cash flow problems and urgent expenses.

For workers seeking short-term financial solutions without the inconvenience of typical banking processes, it offers a safe and practical platform with attractive interest rates and clear terms.

RupeeRedee Features, Advantages & Disadvantages

Features

- Personal loans offered instantly

- Speedy application process

- Loan documentation can be done online

- Adjust your EMIs

- Loan amount credited quickly

Advantages

- Ideal for unplanned expenses

- Approval process is straightforward

- No need for collateral

- Automatic reminders from the app

- Repayment period is shorter

Disadvantages

- Small amounts are offered

- Interest may be high

- Penalties for late payments

- Regular income proof is needed

- Not suitable for long term loans

10. SmartCoin

SmartCoin provides various repayment alternatives for personal and educational loans, catering to students and paid professionals. Access to funds is made easier by its mobile-first technology, which guarantees quick approval and disbursement.

It is well known as one of the greatest salary advance platforms for workers, with cheap interest rates and customisable EMIs that are perfect for handling unforeseen needs or filling paycheck gaps.

SmartCoin offers simplicity, speed, and financial flexibility in a single digital solution, making it a dependable option for salaried individuals looking for personal loans or emergency funds due to its transparent policies and user-friendly interface.

SmartCoin Features, Advantages & Disadvantages

Features

- Loans for individuals and students

- Application can be done through the app

- Eligibility can be checked simply

- Payouts are done quickly

- EMIs are adjustable for long repayment periods

Advantages

- Positive for students and those earning

- Fairly priced interest

- Disbursement is done fast

- Tracking is digital

- No need for collateral

Disadvantages

- Loan restrictions are determined by your profile

- Greater expenses incurred for high risk clients

- Users must have access to a smartphone

- Users may encounter late fees

- Not suited for large capital needs

Conclusion

In conclusion, effectively handling immediate financial needs can be greatly impacted by selecting the appropriate salary advance platform. For salaried workers, platforms like PaySense, mPokket, Buddy Loan, KreditBee, MoneyTap, CashE, FlexSalary, LoanTap, RupeeRedee, and SmartCoin are perfect since they provide quick approvals, flexible EMIs, little paperwork, and clear interest rates.

These systems offer dependable, practical, and digital-first options for managing anticipated financial obligations, resolving emergency expenses, or bridging a paycheck gap. Employees may guarantee prompt access to funds while preserving financial stability and control by choosing the platform that best suits their needs.

FAQ

What are salary advance platforms?

Salary advance platforms are digital lending services that provide employees with short‑term credit or loan amounts before their next paycheck. They offer quick approval, minimal documentation, and flexible repayment options aligned with salary cycles.

Who can use these platforms?

Primarily salaried individuals with regular income can use these platforms. Eligibility usually requires basic KYC documents, proof of income, and employment details. Some platforms also cater to students or self‑employed users.

Are salary advance platforms safe?

Yes, most reputable platforms are regulated and follow digital KYC and data protection standards. Always verify licensing, read reviews, and check terms before applying.

How quickly can I get funds?

Funds can be disbursed within minutes to a few hours after approval, depending on the platform and verification process.

What costs are involved?

Costs include interest rates, processing fees, and sometimes late payment fees. Rates vary by platform, credit history, and loan amount.