The Best Revenue-Based Financing Platforms that assist SaaS firms, e-commerce organizations, and startups in obtaining quick, flexible, and non-dilutive finance will be covered in this article.

These platforms enable business owners to scale operations, invest in expansion, and effectively manage cash flow by providing funds based on future income. You can locate the ideal platform to support business growth by looking at the best choices.

What is Revenue-Based Financing?

Revenue-Based Financing (RBF) is a flexible funding approach in which companies borrow money up front and pay it back using a portion of their future earnings. RBF repayments scale with business performance, which means they are higher in months with high revenue and lower in months with low revenue, in contrast to conventional loans or equity investments.

This strategy offers growth financing without sacrificing ownership or taking on strict debt, making it perfect for startups, SaaS firms, e-commerce companies, and SMEs with steady recurring revenue. RBF helps companies manage financial risk while promoting expansion and operational growth by matching repayment to cash flow.

Factors to Consider When Choosing an RBF Platform

Business Model and Industry Alignment – Make sure the platform accepts your particular form of business, whether it be a SaaS, e-commerce, or small to medium-sized enterprise.

How Fast Can You Get Funded – Make sure the platform gets approved and distributes the funds quickly so that you can meet the demands of your rapidly expanding business.

Structure of The Repayment – Determine whether there is a need to adjust your burden by making the payments at your pace dependent on your revenues.

Cost and Fees – Always consider the platform fee, the interest fee, and other hidden fees that might be applicable.

Terms and Transparency – Make sure that the provider communicates clearly the requirements to obtain the funds, the repayment period, and the penalties to be imposed on you if you will be late.

Funding Ceiling and Scalability – Check how much the provider can give you, and ensure that it is sufficient for your business growth activities and operating activities.

Acceptance Criteria – Look into your revenue metrics, the stage of your business, and the location of your business to determine if you will be able to meet the acceptance thresholds of the provider.

Funding Transparency and Support – Researching will take some time, but you will thank yourself if you take the time to find a platform with positive customer reviews and a strong reputation for supporting its users.

Other Features and Tools – There are other platforms that have enhanced features like analytics and inventory management, which are great for scaling purposes.

Versatility of Capital Application – Check whether the funds can be allocated toward marketing, operations, recruitment, or inventory, depending on your growth strategy.

Key Point & Best Revenue-Based Financing Platforms List

| Platform | Key Point / Focus Area |

|---|---|

| Capchase | Provides revenue-based financing for SaaS companies with fast growth. |

| Pipe | Enables trading of recurring revenue streams to get upfront cash. |

| Clearco | Offers equity-free funding for startups based on revenue performance. |

| Uncapped | Provides revenue-based financing and flexible repayment options for startups. |

| Wayflyer | Offers growth capital to e-commerce businesses based on future sales. |

| GetVantage | Revenue-based financing specifically for e-commerce and online businesses. |

| Velocity | Focuses on flexible funding solutions for growing SaaS and tech startups. |

| Recur Club | Helps SaaS businesses manage cash flow with subscription-based financing. |

| Efficient Capital Labs | Provides working capital solutions for high-growth businesses. |

| Indifi | Offers tailored loans and credit solutions for small and medium enterprises (SMEs). |

1. Capchase

Capchase is a frontrunner in revenue based financing for SaaS companies, providing non-dilutive financing depending on a startup’s Monthly Recurring Revenue (MRR). This allows for access to growth funding, without losing equity, which is necessary for scaling, hiring and product development.

Repayments are revenue based and it is flexible, which means there is less risk for Capchase and the startup for the most part of the slower months. It is, therefore, one of the Best Revenue-Based Financing Platforms for SaaS founders needing quick and simple financing, without any loss of equity. Integrating with a variety of payment processors also helps in capital deployment.

Capchase Features, Advantages & Disadvantages

Features:

- Offers revenue-based financing for SaaS businesses.

- Provides non-dilutive funding.

- Offers flexible repayment schedules based on revenue.

- Makes fast funding decisions.

- Connects with business payment processors.

Advantages:

- Provides rapid financing for business growth.

- Does not require dilution of equity.

- Offers cash flow-contingent payments.

- Makes financing processes clear.

- Provides good financing for business scaling.

Disadvantages:

- Does not cater to businesses outside of SaaS.

- Does not support businesses that are pre-revenue and do not have recurring revenue.

- Financing costs may be higher than other traditional lending options.

- Does not support businesses that have no online operations.

- Has a funding requirement of consistent monthly recurring revenue.

2. Pipe

Pipe goes one step further with revenue financing by allowing businesses to sell their recurring revenue streams to manage cash flow, almost like a revenue trading platform.

With Pipe, SaaS and subscription businesses can manage their liquidy issues without incurring debt or losing a stake in the business. Users simply connect accounts with recurring revenue to sell pending invoices on their accounts for working capital.

Pipe is also recognized as one of the Best Revenue-Based Financing Platforms for its marketplace innovation and flexible financing. Its transparency, speed, and predictability in cost makes Pipe optimal for early stage businesses that want to scale quickly and maintain control of their equity.

Pipe Features, Advantages & Disadvantages

Features:

- Provides a marketplace for the purchase and sale of recurring revenue.

- Offers non-dilutive, upfront financing.

- Provides revenue-contingent funding with a flexible repayment plan.

- Offers an analytics suite and dashboard in real time.

- Offers financing for SaaS businesses as well as subcription-based businesses.

Advantages:

- Provides instant monetization of prospective revenue.

- Retains equity and ownership.

- Offers rapid scalability in relation to revenue.

- Financing offers clear terms and an open market.

- Provides an optimal financing structure for businesses that operate on a subscription model.

Disadvantages:

- Does not support business models outside of recurring revenue.

- There may be financing costs that are associated with transactions.

- Does not work well for a single sale business.

- Does not support businesses that do not have SaaS metrics.

- There may be external factors which may determine the available financing.

3. Clearco

Clearco analyzes revenue, growth trends, and performance data to provide entrepreneurs equity-free capital. Repayment is based on a proportion of future revenue, which is in line with business performance, and funding decisions are made quickly—often in a matter of days. To maximize funding utilization, the platform also provides marketing insights and growth metrics.

Clearco is regarded as one of the Best Revenue-Based Financing Platforms in the middle paragraph, especially for tech and e-commerce firms looking for funding without giving up equity. Its data-driven strategy guarantees that companies obtain the right capital and that repayment plans are flexible, which lessens financial hardship during times of low revenue.

Clearco Features, Advantages & Disadvantages

Features:

- Startups receive funding and keep 100% of their equity.

- Payback model is based on revenue.

- Approval process based on algorithms.

- Support in marketing analytics.

- Funding geared towards technical and e-commerce startups.

Pros:

- Funding and approval is fast.

- No equity taken.

- Focused on the growth of the business.

- Funding comes with marketing analytics.

- Repayment model is flexible.

Cons:

- Limited to just technology and e-commerce startups.

- The performance fees may be considerable.

- Usually, traditional SMEs are unsupported.

- Financial records must be transparent.

- There is little support for merchants lacking an online presence.

4. Uncapped

Uncapped has carved a niche for itself with revenue-based financing, especially for high-growth startups. Funding does not involve equity, and financing is secured against revenue, which makes repayments flexible and adjusted to cash flows.

Uncapped has smoothed access to financing for a broad range of verticals, including SaaS, e-commerce, and technology. He provides funding, with a turnaround time of less than 48 hours.

In the mid paragraph, Uncapped is featured among the Best Revenue-Based Financing Platforms for its straightforward processes, adaptability, and time efficiency. E-commerce Financing Ease of financing without the involvement of investors and without predatory dilution is complemented with economically sustainable growth for the business.)

Uncapped Features, Advantages & Disadvantages

Features:

- Financing linked to revenue

- No equity needed

- Capital in no time

- Multiple industry support

- Repayment terms that are flexible

Advantages:

- Easy and fast application

- No dilution of ownership

- Payments based on revenue

- E-commerce and SaaS are ideal

- Growth that is sustainable is encouraged

Disadvantages:

- Startups of high growth are the focus

- Companies that are early stage are not suited

- Growth of tech industries is limited to funding

- Bottom line is higher than other loans

- Regular revenue reporting is needed

5. Wayflyer

Wayflyer provides revenue-based financing to e-commerce businesses and gives them capital to purchase inventory and fund marketing or growth initiatives. Because of the analytic tools Wayflyer supplies, businesses are able to optimize their ad spend to support inventory planning. One of the things Wayflyer is recognized for is their flexible pay-back plans.

With all of these elements, Wayflyer allows online businesses to maintain a healthy cash flow and grow without equity dilution, which is why they have received an accolade for being one of the Best Revenue-Based Financing Platforms.

Wayflyer Features, Advantages & Disadvantages

Features:

- E-commerce business financing

- Repayment based on revenue

- Marketing and inventory analytics for growth

- Capital in no time

- No dilution of equity

Advantages:

- Perfect for retailers on the web

- Stress during low seasons is eased by flexible repayment.

- Improved business operations thanks to better analytical insights.

- Funding is fast and transparent.

- Retains ownership.

Disadvantages:

- Only e-commerce businesses.

- Higher fees than conventional loans.

- Must have steady online sales.

- Offline companies are not suitable.

- Sale fluctuations are tied to repayment.

6. GetVantage

GetVantage specializes in revenue-based financing for online businesses, primarily for e-commerce and SaaS. By assessing the sales potential over the duration of the contract, businesses do not have to rely on their credit history. Funding is also fast and flexible for businesses with consistent sales.

Since the future payments are tied to revenue, the payments are temporary manageable during cycles of low revenue. In the mid paragraph, GetVantage ranks among the Best Revenue-Based Financing Platforms for startups needing capital without equity. Financing is best suited for startups wanting to scale their operations openly and marketing and not incurring any debt or equity.

GetVantage Features, Advantages & Disadvantages

Features:

- Online businesses only revenue-based financing

- Business performance-based funding decisions

- Revenue Flexible repayment

- Quick approval

- E-commerce and SaaS support

Advantages:

- Accessible capital in a short time.

- Scales with business revenue.

- No equity required.

- Predictable and transparent.

- Digital business tailored.

Disadvantages:

- Only online businesses are included.

- Early-stage startups may not be suitable.

- Higher fees than conventional loans are possible.

- Revenue consistency is required for repayment.

- Large offline businesses are not ideally suitable.

7. Velocity

Velocity offers revenue-based financing for SaaS and tech startups in a vertical, enabling fast-growing companies to un-collateralize working capital from recurring revenue. The platform is designed for rapid expansion without equity dilution and offers revenue-adjustable payments. Based on the dynamics of monthly revenue, cash flow management is optimized.

In the mid paragraph, he is ranked as one of the Best Revenue-Based Financing Platforms for tech entrepreneurs in search of scalable capital with no dilution. Rapid growth and the unique combination of industry financing have positioned him to finance growth for most companies.

Velocity Features, Advantages & Disadvantages

Features:

- Startups in tech and SaaS financing

- Revenue-based repayment

- Flexible funding that scales

- Rapid access to capital

- Financing that does not dilute equity

Advantages:

- Retains ownership.

- Payment adjusts with revenue.

- Quick approvals for growth capital.

- Ideal for high-growth startups

- Transparent and simple process

Disadvantages:

- Not enough funding.

- Focused on SaaS and tech

- Not suitable for traditional businesses

- Requires predictable revenue

- Fees may be higher than bank loans

- Limited support for offline operations

8. Recur Club

Recur Club focuses on finance with a subscription model, allowing SaaS companies to cash in on recurring revenue streams. Companies can convert invoices into immediate capital to fund potential growth in other areas like marketing, hiring, or broadening their scope, all without taking on new equity. Because the repayment structure is revenue-contingent, this provides flexible and affordable payment options.

In the mid paragraph, Recur Club features in the Best Revenue-Based Financing Platforms catalog for SaaS. Given its unique ability to monetize subscriptions and offering consistent repayment options, it stands out for founders with limited flexible capital and wanting to ease financial strain during low revenue seasons.

Recur Club Features, Advantages & Disadvantages

Features:

- Financing of revenue streams for already established businesses

- Converts recurring invoices into capital

- Flexible repayment term linked to revenue

- Financing available for SaaS businesses

- Business-in-a-box available

Advantages:

- Best for companies that operate with subscription revenue

- Repayments grow with revenue

- No equity financing

- Funding is quick and straightforward

- Funding is timely, especially for managing revenues

Disadvantages:

- Only available for SaaS and subscription businesses

- Startups that are still in the early stages may not qualify

- Might not be accessible for offline or instant revenue businesses

- Requires recurring revenue that is not seasonal

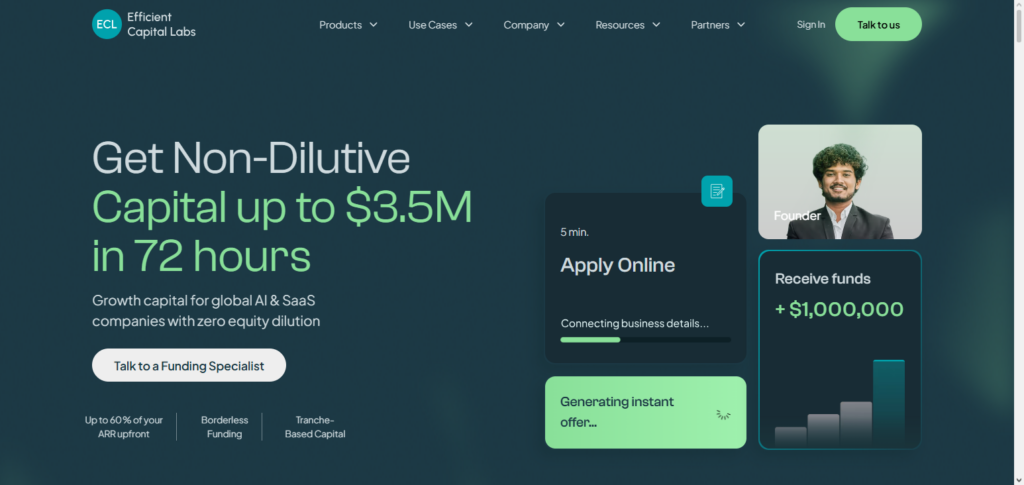

9. Efficient Capital Labs

Efficient Capital Labs provides revenue-based and working capital solutions for rapidly growing startups, including tech and e-commerce. Financing is available for revenue growth and business potential, beyond just credit risk. Businesses can avoid a cash flow crunch with adjustable repayment windows.

In the mid paragraph, Efficient Capital Labs is listed among the Best Revenue-Based Financing Platforms for not using equity and providing revenue-based financing for startups. The combination of quick financing, revenue-based repayment, and flexible working capital allows Efficient Capital Labs to bridge the gap for startups while preserving the benefits of traditional debt and equity avoidance.

Efficient Capital Labs Features, Advantages & Disadvantages

Features:

- Revenue-based and working capital financing

- Tailored solutions for startups

- Flexible repayment terms

- Quick and easy

- Works with multiple verticals

Advantages:

- Rapid growth funding that takes into account your current situation

- Revenue-based payments

- Ideal for accelerating growth

- Not equity financing

- Transparency in your financing and access to data

Disadvantages:

- Primarily focused on startups

- Funding may be expensive for non-payer businesses

- Companies that are just starting may have limitations

- Needs steady revenue info

- Small offline businesses not suitable

10. Indifi

For small and medium-sized businesses (SMEs) in a variety of industries, Indifi offers tailored credit and revenue-based financing options. Instead of relying solely on collateral, funding decisions are based on income, growth prospects, and business success. Financial flexibility is provided by repayments that correspond with cash flow.

Indifi is ranked as one of the Best Revenue-Based Financing Platforms for SMEs seeking flexible, easily available funding in the middle paragraph. Its emphasis on underrepresented companies, quick approvals, and flexible payback plans enable business owners to manage inventories, develop operations, and expand sustainably without sacrificing ownership or taking on onerous debt arrangements.

Indifi Features, Advantages & Disadvantages

Features:

- Financing for SMEs

- Repayment plans based on revenue

- Customized credit options

- Rapid approval

- Multiple industry support

Advantages:

- Large accessibility for small and medium enterprises

- Revenue flexible repayment plans

- Streamlined and efficient process

- Capital that doesn’t dilute owners’ equity

- Assists in scaling and growing the business

Disadvantages:

- Primarily caters to SMEs

- Could need adequate financial documentation

- Costs may differ based on financial performance

- Not ideal for new startups

- Insufficient support for large corporations

Tips for Choosing the Right Platform

Business Model Alignment – When looking to be funded try to ensure the platform matches your industry. Some examples include SaaS, e-commerce, or small to medium enterprises. If there’s no match you could be ineligible or not get even close to optimal funding terms.

Speed of Funding – Some platforms are able to fund within a predefined time-period. If you have an urgent growth requirement, try to select a platform that has rapid approvals as well as fast deployment of capital.

Repayment Terms – Not all platforms have the same terms and conditions on repayment that are of the same period and amount. If there are revenue attached scales to the repayment, you won’t have to worry about cashflow depletion when dollars are not flowing into the business.

Total Cost of Financing – Not all platforms are equal when it comes to the costs, rates, and miscellaneous fees. Some even have hidden costs that you will not discover until the financing is well on its way.

Reputation of the Platform – Being the first time using a platform, it is logical that you will want to have your finances with a platform that has all the necessary reviews, a solid track history, and you are able to be attended when you have issues.

Stage of Business – Platforms vary in terms of the amount of funding that they are willing to provide as well as the business eligibility they will require. Some will want even the most funded businesses financially secure. Others will provide almost no capital but will fund the very first start-ups.

Level of Funding and Growth Analytics – Certain platforms will provide beyond-dollars funding where they will offer tools of analytics, marketing, or even inventory. Such funding is more than just a dollar value, it might add to the business even more than what the dollars would make it. Some platforms also add tools that provide insights for growth, and marketing, or analytics in addition to how they fund.

Check Your Revenue History – If you are looking to have your business funded via some of the platforms, you will have to ascertain that your business’s revenue history, business model, and even where your business is located meets the platform’s criteria in order not to be rejected when you apply.

Check Flexibility of Capital Use – While some platforms place restrictions on how funds may be used, some platforms which are less restrictive and allow you to invest in marketing, operations, or even expansion should be preferred.

Compare the Platforms – You shouldn’t go for the first option you see. Evaluate multiple platforms to compare the features, the fees, and the repayment options.

Conclusion

In conclusion, for startups, SaaS firms, e-commerce companies, and SMEs looking for expansion capital, revenue-based financing has become a flexible, non-dilutive option.

In order to alleviate financial hardship during slow months, platforms such as Capchase, Pipe, Clearco, Uncapped, Wayflyer, GetVantage, Velocity, Recur Club, Efficient Capital Labs, and Indifi offer customized finance options that match payback with revenue performance.

As some of the Best Revenue-Based Financing Platforms, they give business owners quick, transparent, and scalable access to financing without sacrificing equity, enabling them to engage in operations, marketing, and expansion while keeping control over their growth trajectory.

FAQ

What is revenue-based financing?

Revenue-based financing (RBF) is a funding model where businesses receive capital in exchange for a fixed percentage of their future revenue. Repayments adjust based on performance, making it flexible and non-dilutive compared to traditional equity financing.

Who can benefit from revenue-based financing?

SaaS companies, e-commerce businesses, tech startups, and SMEs with predictable revenue streams can benefit most. It is ideal for founders seeking growth capital without giving up ownership or taking on rigid debt.

How do repayments work in revenue-based financing?

Repayments are tied to monthly or daily revenue, meaning payments rise and fall with business performance. This reduces financial stress during low-revenue periods while aligning funding costs with growth.

What are the advantages of using these platforms?

Key advantages include fast access to capital, no equity dilution, flexible repayment schedules, tailored funding based on business performance, and support for growth initiatives like marketing, hiring, or inventory.

Are there any risks involved?

Risks include higher total repayment if revenue grows significantly, dependency on predictable cash flow, and platform-specific fees. Choosing the right provider with transparent terms mitigates most risks.