The Best Platforms for Digital Risk Quantification will be covered in this post. Measuring and controlling risk has become essential as companies deal with growing cyberthreats.

Businesses may measure risks, evaluate possible financial effects, and make well-informed decisions with the aid of appropriate platforms. We will examine the best options currently on the market, from sophisticated quantitative tools to all-inclusive GRC packages.

Why It Is Platforms for Digital Risk Quantification Matter?

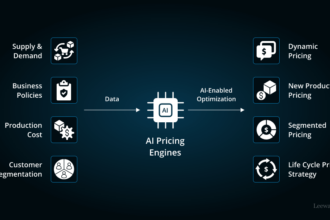

Measuring and Accurately Prioritizing Risk: Digital measurement of risk quantification allows organizations to measure, and, in a number of cases, quantify, risks that are more qualitative in nature such as damage (financial and qualitative), likelihood (numerical probability), and risk severance (threshold). Thus, organizations can better focus their attention on risks that matters most, rather than trying to address issues on an equal basis. This also saves valuable resources.

Facilitation of Data-Based Decisions: Digital risk quantification helps to reduce operational risk, IT risk, and risk from cyber attacks because it helps leaders make decisions based on the facts rather than emotion, because it provides the necessary components of actionable risk (operational, IT, cyber) through dashboards, analytics, and scenario modeling.

Compliance Better and More Easily: These quantification tools help to streamline risk associated to non-compliance of the global regulations (GDPR, SOC 2, ISO 31000, NIST) by automating the reporting and record keeping of the audit, thus reducing the risk and penalties of being non-compliant.

Mitigating Risk Before It Becomes An Issue: These tools are designed with features that identify risk such as smart analytics, real-time alerts, and others. These features identify risk before it occurs, thus reducing the likelihood of a security incident or loss to the business.

Enterprise Risk Management (ERM) Centralized: Tools such as this allow for the integration of disparate risk data across multiple departments, IT, operations, finance, and external vendors. This provides a more comprehensive picture of organizational risk and better transparency, accountability, and governance overall.

Key Point & Best Platforms for Digital Risk Quantification List

| Platform | Key Point |

|---|---|

| LogicGate Risk Cloud | Flexible, no-code platform for automating risk and compliance workflows. |

| RSA Archer | Comprehensive GRC solution with strong risk, compliance, and audit management. |

| RiskLens (FAIR Institute) | Quantitative cyber risk analytics using the FAIR framework for financial impact modeling. |

| Quantivate ERM | Enterprise risk management with integrated policy, audit, and compliance modules. |

| Protecht ERM | Cloud-based ERM software for risk, compliance, and incident management with real-time dashboards. |

| Hyperproof | Continuous compliance management platform with automation and collaboration features. |

| RiskWatch | Risk assessment software focused on cybersecurity, vendor, and operational risks. |

| Resolver Risk Management | Risk, incident, and compliance management with strong reporting and analytics tools. |

| Riskonnect | Integrated risk management suite covering operational, enterprise, and third-party risks. |

| OneTrust Risk Management | Combines privacy, third-party, and enterprise risk management with compliance automation. |

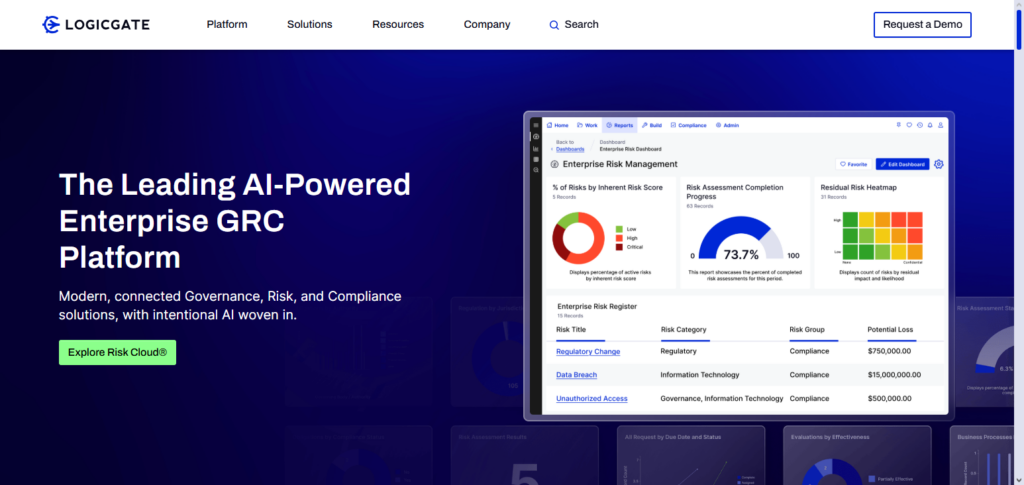

1. LogicGate Risk Cloud

LogicGate Risk Cloud is a risk and compliance platform that provides companies with the ability to automate intricate workflows in a no code manner to manage enterprise risk, third party risk, audit and compliance.

With the ability to manage and customize using a drag and drop interface, risk professionals have the flexibility to build, scale and adapt risk processes with little to no dependency on IT, which enhances agility and governance oversight.

Although LogicGate provides operational risk tracking and orchestration, it is more centered on the automation of workflows than on quant modeling of risks.

For digital risk quantification, platforms with advanced modules for analytics, such as RiskLens or OneTrust, are regarded as offering greater value in terms of actionable risk measurement, monetization, and financial quantification.

LogicGate Risk Cloud Features, Pros & Cons

Key Features

- Buildable risk workflows.

- Risk data cloud storage.

- Tailored dashboards and reports.

- Automatic alerts and task assignments.

- Enterprise tool integrations.

Pros

- No code flexibility.

- Manage and adjust risk workflows.

- Less manual effort from automation.

- Stakeholders see clear dashboards.

- Growing teams can scale more.

Cons

- Initially complicated.

- Power users may find reporting lacking.

- Requires a setup wizard’s brain.

- Analytics may require some customization.

- Requires techies to train the untrained.

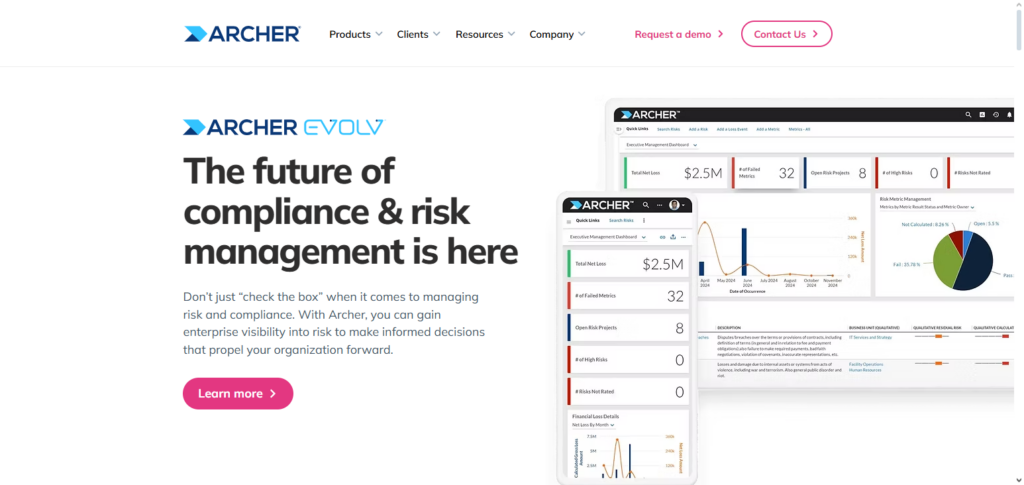

2. RSA Archer

RSA Archer has been recognized for being one of the strongest Governance, Risk, and Compliance (GRC) providers in the market. It is deeply embedded across the enterprise for centralizing the collection of risks, maintaining compliance, and managing audit activities.

The library that Archer has built around the numerous different types of risks, and the configuration of different types of risk documents is unique for maintaining oversight over operational, IT, third party, and strategic risks. Archer is one of the leading providers for consolidation of enterprise risks and the facilitation of enterprise risk reports.

Archer also provides and guides in the performance of evaluations and assessments. However, the greatest value truly lies in governance, rather than in algorithmic governance. In the case of digital risk quantification, Archer is likely to provide the most descriptive quantification, but that desciption is likely to be scored as qualitative.

RSA Archer Features, Pros & Cons

Key Features

- Integrated risk and compliance for the enterprise.

- Risk register.

- Integrated audit and policy management.

- Workflow automation.

- Built-in frameworks and templates.

Pros

- Risk coverage is comprehensive.

- Large regulated corporations trust this application.

- Risk and compliance standards credited.

- Integrated audit and control.

- Custom-configurable for sophisticated governance processes. Complexity.

Cons

- Learning can take time

- Timeline for implementation can be extensive

- Not as user friendly compared to new age tools

- Expenses may be high for complete suite integration

- Customizations may need special or additional admins

3. RiskLens (FAIR Institute)

RiskLens incorporates the principles of the FAIR (Factor Analysis of Information Risk) methodology. Thanks to this framework, it specializes in the qualitative cyber and enterprise risk analysis. It allows risk professionals to capture and assess risk scenarios in monetary values— generating statistically based outputs for possible loss exposure, frequency, and severity.

With a FAIR approach, organizations can understand the business impact of technical risks and improve the focus for better investment strategies. Within the field of digital risk quantification, RiskLens excels at transforming qualitative assessments into financial metrics, making it a leader in cyber risk quantification and executive-level strategic risk reporting.

RiskLens (FAIR Institute) Features, Pros & Cons

Key Features

- Integrated FAIR quantitative risk model.

- Analysis on the cost and the chances.

- Modeling risk scenarios.

- Prioritization heat maps.

- Risk Scenarios that are clearly articulated.

Pros

- Top risk assessment explains in detail the quantitative assessment.

- Risk explaining in financial terms is very easy.

- Especially excellent for leadership roles in cyber and operational risk.

- Data driven risk decision is excellent.

- Comparison of scenarios is easy.

Cons

- Less broad ERM (Enterprise risk management) as it mainly focuses on FAIR modeling.

- It requires the user to have knowledge in probability.

- Other systems integration often require additional effort.

- Customizations to reports are often needed.

- It doesn’t cater very well to cases that do not involve the measurement of risk.

4. Quantivate ERM

Quantivate ERM analyzes and integrates enterprise risk, making the simplification of risks and the data centralization of compliance, policies, audits, and incident management easier through the use of dashboards.

It helps support and plan strategies in the identification, assessment, and mitigation of risks via customizable templates.

While most of the risks and compliance workflows, as well as their trackable outcomes, are relatively easy to provide, Quantivate’s emphasis is mostly on the qualitative risk assessment and process standardization rather than financial risk quantification.

Advanced digital risk quantification is often lost in these scenarios. In organizations, platforms like RiskLens and OneTrust Risk Management are preferred, as they provide better analytics.

Quantivate ERM Features, Pros & Cons

Key Features

- Enterprise risk identification.

- Action and issue tracking.

- High-level reports and dashboards.

- Risk scoring matrices.

- Risk databases that are centralized.

Pros

- Good combination of quantitative and qualitative risk.

- Scoring and risk prioritization is simple.

- Good visualizations and summaries for executives.4. Strong integration with governance and audit functions.

- Easy retrieval of historical and trend data.

Cons

- Limited depth of data quantification versus specialized tools.

- The interface is more basic compared to newer SaaS options.

- Requires time to set up advanced dashboards.

- Less emphasis on automation.

- Some advanced analytics require external BI support.

5. Protecht ERM

Protecht ERM provides a modern cloud-based solution for enterprise risk management focused on risk registers, risk heatmaps, incident management, and compliance management. Its customizable dashboards provide real-time updates into changes within the risk profile and emerging risks, aiding risk teams in proactive management.

Protecht integrates with most governance tools and accommodates various organisational risk assessment methodologies. While Protecht provides detailed qualitative and semi-quantitative analyses, it lacks the level of quantification offered by specialist tools like RiskLens, which does digital risk quantification better than most due to its FAIR-centric financial modeling.

Protecht ERM Features, Pros & Cons

Key Features

- Risk and compliance platform integration.

- Dynamic dashboards with real-time data.

- Controls library and mapping.

- Automated workflows.

- Data linkage throughout the risk lifecycle.

Pros

- Excellent visual analytics.

- Easy risk-control linkage.

- Easy workflow creation without coding.

- Strong reporting at the executive level.

- Adaptable to changing organizational needs.

Cons

- Some initial onboarding may be time consuming.

- Some users may feel the compliance features are restrictive.

- There are few very advanced statistical tools.

- Advanced analytics may require the use of BI tools.

- A certain level of training is required to use the platform effectively.

6. Hyperproof

Hyperproof provides a continuous compliance management system that integrates audit, risk, and regulatory proof into one system, so that teams can automate and streamline evidence collection, task management, and control testing.

Hyperproof automation reduces the compliance tracking manual workload and cross-compliance activities for ISO, SOC, and GDPR. Hyperproof is highly functional for operationalizing compliance and facilitating the collaboration among multiple teams, though it is more focused on control verification and gap assessment than on providing deep risk assessment models.

Though Hyperproof supports risk assessment, it is true that RiskLens and OneTrust Risk Management are the best platforms for digital risk assessment and offer more comprehensive frameworks for assessing risk from a financial or probabilistic perspective.

Hyperproof Features, Pros & Cons

Key Features

- Continuous compliance tracking.

- Automated evidence collection.

- Support for multiple frameworks.

- Risk register with linkage.

- Control status change alerts.

Pros

- Rapid onboarding and deployment.

- Time savings from automated evidence reuse.

- Supports audits very well.

- Risk and compliance dashboards are clear.

- Greater work process automation limits manual work.

Cons

- Fewer tools for quantifying risk in depth.

- Less flexibility in custom dashboards.

- More appropriate for compliance than risk modeling.

- Sometimes manual integration setup.

- Increased pricing with increased module usage.

7. RiskWatch

RiskWatch provides risk management and assessment tools that specialize in operational, vendor, and cybersecurity risk. It offers risk reports, scoring algorithms, and automated questionnaires that assist teams in evaluating and understanding risk exposures in their ecosystems.

With that said, RiskWatch is most effective with organizations that need structured and repeatable assessment cycles for compliance or vendor programs. Still, its quantification approach is more qualitative or semi-quantitative.

For organizations needing sophisticated digital risk quantification, RiskLens is more extensive in converting risk into quantifiable loss and financial metrics, as it specializes in financial impact analysis.

RiskWatch Features, Pros & Cons

Key Features

- Risk assessment templates.

- Risk scoring engine.

- Dashboards.

- Incident tracking.

- Compliance mapping.

Pros

- Templates lead to rapid deployment.

- Risk can easily be assessed and scored.

- Excellent for security assessments.

- Cost effective for small to mid sized teams.

Cons

- Basic functionality for large enterprise risk management.

- Less integration partners than competitors.

- Weaker advanced analytics.

- Less robust scalability for large portfolios.

- Complex workflows may require manual effort.

8. Resolver Risk Management

With Resolver you get to manage risks from incidents, audits, and risks in one interface, along with reporting and analytics for operational oversight in managing risks. You get to analyze risk patterns, monitor remediation activities, and loss event data for better decision-making.

Resolver prioritizes actionable insights, especially in operational risk and incident response workflows.

However, in relation to digital risk quantification, Resolver falls short in risk scoring compared to the quantification tools available for specialized use, especially with RiskLens and OneTrust which provide quantification models with strong financial implications and underpin strategic investments in cyber risks.

Resolver Risk Management Features, Pros & Cons

Key Features

- Risk, incident, and compliance tracking.

- Dashboards and analytics.

- Workflows.

- Integrations.

- Risk scoring.

Pros

- Strong linkage between incidents and risk context.

- Good collaboration features.

- Reporting and audit trails.

- Useful for mid to large organizations.

- Integrations.

Cons

- UX is a little dated.

- Requires internal effort for setup.

- Separate modules for some advanced features.

- Licensing costs get higher as you scale.

- Significant learning curve for new users.

9. Riskonnect

Riskonnect has a risk management suite that is integrated with operational, compliance, enterprise, and third-party risk management, with good data visualization and aggregation features. The suite’s interconnected design provides each department a consolidated view of how their department’s activities impact the company’s overall risk posture.

This assists risk leaders in tailoring their risk decisions with real-time data. Riskonnect provides a solid integration and visibility framework, with reasonable support for statistical modeling from trend analysis and quantitative scoring.

For companies where digital risk quantification is of utmost importance, RiskLens is often suggested due to being tailored to provide quantifiable outputs in cyber and operational risk with specific frameworks, such as annualized loss expectancy and financial exposure.

Riskonnect Features, Pros & Cons

Key Features

- Risk visibility across the enterprise.

- Risk registers and heat maps.

- Automation for workflows.

- Linking incidents and compliance.

- Integration with enterprise applications.

Pros

- Comprehensive coverage across the risk spectrum.

- Sophisticated features for data visualization.

- Dashboards with advanced configurability.

- Support and training are quite good.

- Coverage for strategic, operational, and third-party risk.

Cons

- Configuration requires a lot of resources.

- Pricing is aimed at enterprise spending limits.

- Complexity is added with some advanced modules.

- Data migration and setup can take a lot of time.

- Not suitable for smaller teams.

10. OneTrust Risk Management

With OneTrust Risk Management, you can unify your workflows for privacy, third parties, and enterprise risk, and manage them alongside automation, assessments, and reporting focused on tracking compliance and risk.

It aids in developing and sustaining resilient risk programs through dynamic risk scoring, policy alignment, and data mapping. OneTrust’s strong risk platform contender status is due to increasing workflow automation and analytic incorporation for quantification.

Most reports mention RiskLens as being the best for digital risk quantification, and for good reason, as they provide focused, dedicated FAIR financial risk modeling. However, when OneTrust is integrated with its more comprehensive risk and privacy modules, it offers considerably complex digital risk landscapes analytics.

OneTrust Risk Management Features, Pros & Cons

Key Features

- Risk and GRC in a Single Platform.

- Risk and regulations, including privacy.

- Third-party and vendor risk modules.

- Assessments are automated.

- Control and risk repository central.

Pros

- Integration of risk and compliance is seamless.

- Impressive for privacy and regulation concerns.

- Templates and frameworks in abundant supply.

- Capabilities for monitoring are not static.

- A good ecosystem with audit and control modules.

Cons

- With many modules on, it can feel overwhelming.

- Full benefit can take some learning.

- Quantification tools more limited than specialized platforms.

- Pricing based on number of modules.

- Enterprise program setups are time-consuming.

Conclusion

Organizations face a growing number of complex risks in today’s digital environment, from operational and third-party exposures to cybersecurity threats.

Organizations may effectively measure, analyze, and prioritize risks with the help of the top digital risk quantification platforms, such as LogicGate Risk Cloud, RSA Archer, RiskLens, Quantivate ERM, Protecht ERM, Hyperproof, RiskWatch, Resolver, Riskonnect, and OneTrust Risk Management.

Businesses may improve compliance, optimize workflows, convert risks into measurable KPIs, and make data-driven decisions by utilizing these tools. By putting these strategies into practice, firms can improve overall risk governance, lower uncertainty, and minimize possible losses.

FAQ

What is digital risk quantification?

Digital risk quantification is the process of measuring and analyzing risks associated with digital operations, including cybersecurity, IT, operational, and third-party risks. It converts potential threats into measurable metrics, often in financial or impact terms, helping organizations make data-driven decisions.

Why is digital risk quantification important for enterprises?

It allows organizations to prioritize risks, allocate resources efficiently, and take proactive measures to mitigate potential losses. Quantifying risks helps in strategic decision-making, regulatory compliance, and maintaining business resilience in a rapidly evolving digital landscape.

Which platforms are best for digital risk quantification?

Some of the top platforms include LogicGate Risk Cloud, RSA Archer, RiskLens, Quantivate ERM, Protecht ERM, Hyperproof, RiskWatch, Resolver, Riskonnect, and OneTrust Risk Management. Each platform provides tools for risk scoring, scenario modeling, dashboards, reporting, and workflow automation.

Can these platforms integrate with existing enterprise systems?

Yes. Most modern risk quantification platforms integrate with ERP, IT management, cybersecurity tools, and compliance systems. Integration ensures consistent data, automated workflows, and a centralized view of enterprise risk.

How do these platforms help with regulatory compliance?

They provide automated tracking of risk mitigation actions, maintain audit-ready reports, and offer dashboards to monitor adherence to policies and regulations. This helps enterprises comply with standards like ISO 31000, NIST, GDPR, and SOC 2.