Best Payment Gateways is vary depending on the demands of the business, but a few stand out for being dependable, secure, and adaptable. Stripe is well known for its global reach and developer-friendly interface, which enables companies to take payments in multiple currencies. PayPal is still a major player, providing a user-friendly interface and being widely accepted, which makes it a great option for businesses of all sizes.

Square stands out for its smooth integration of online and in-person payments, supporting a variety of business models. PayPal subsidiary Braintree stands out for those who value flexibility due to its extensive feature set and support for multiple payment methods. The ideal payment gateway is ultimately the one that best suits the particular needs of a company, taking into account elements like transaction costs, security features, and the volume of international transactions.

What is Payment Gateways?

In the world of electronic transactions, a payment gateway is an essential element that acts as a middleman to enable safe and effective financial transactions between clients and companies online. In essence, it serves as a virtual link between the financial institution processing the payment and an online retailer or service provider.

The payment gateway ensures that sensitive data is encrypted, that money is transferred securely from the customer’s account to the merchant’s account, and processes transactions when a customer makes an online purchase. Payment gateways are essential to e-commerce because they provide a smooth and safe means of processing different types of electronic payments, such as debit and credit cards as well as digital wallets. They offer a safe and dependable way to finish online transactions, which greatly enhances the user experience overall.

Here is list of Best Payment Gateways

- PayPal

- Paytm

- Razorpay

- Stripe

- Cashfree

- CCAvenue

- PayKun

- PayU

- Instamojo

- Amazon Pay

- WePay

- Apple Pay

- BillDesk

- Braintree

- MobiKwik

- Payoneer

- Square

- Atom

- Easebuzz

- GoCardless

- Adyen

- BlueSnap

- Bolt

- PAYG

- Authorize.Net

- Stax

- Payment Depot

- Clover

- Helcim

- PayGlocal

- Nimbbl

- OPEN

- 2Checkout

- Payline

- PayJunction

- Phone Pe

- NMI

- HitPay

- TSYS

- Spreedly

- REPAY

- Moneris Gateway

- EBizCharge

- Payworks

- MyVirtualMerchant

- PayPay

- PaySimple

- PPRO

- Planet Payments

- NETELLER

- ANZ

- Checkout.com

- Worldpay

- Telr

- HyperPay

- senangPay

- QuickBooks Online

- AlliedWallet

- Dwolla

- Skrill

- Shift4

- Payeezy

- Google Pay

- Visa Acceptance Solutions (CyberSource)

- Thryv

- Fiserv (First Data) – ICICI Merchant Services

- Paddle

- Opayo by Elavon

- Alviere Hive

- CARDZ3N

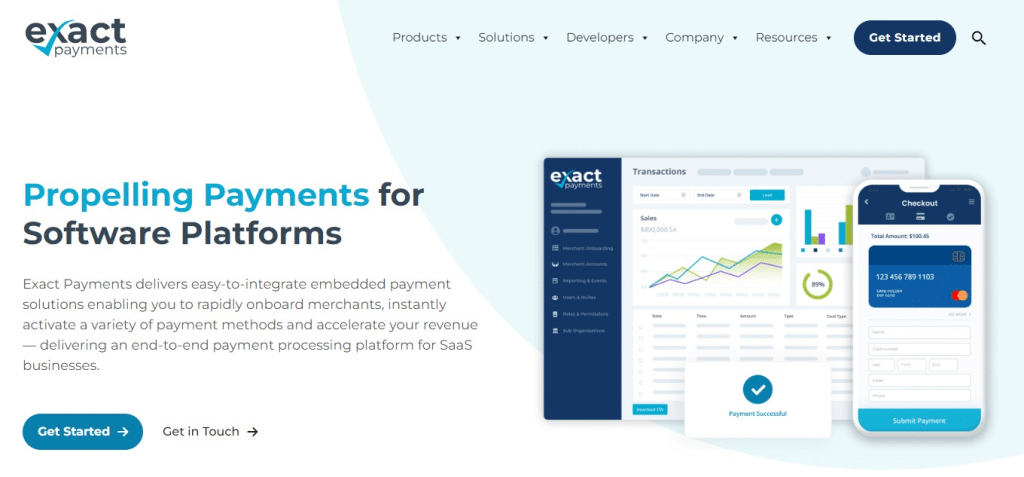

- Exact Payments

- Sila

- Autodeals

- Blockonomics

- Chargezoom

- Zoho Invoice

- Cloud9 Payment Gateway

- Wise

- Clearly Payments

- COINQVEST

- Zoho Checkout

- EBS

- U.S. Bank Merchant Services

- MONEI

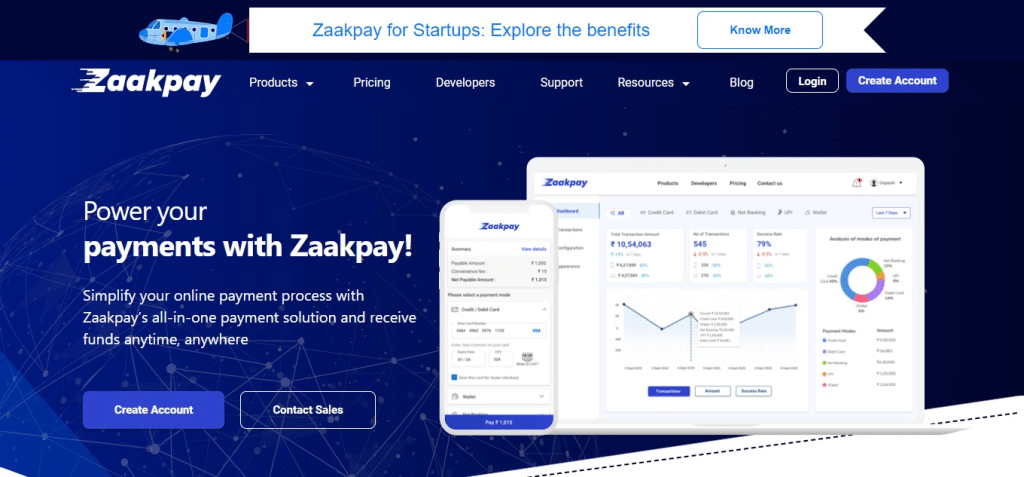

- Zaakpay

- Remitly

- Xero

- Western Union

- FreshBooks

- Shopify Payments

- Klarna

- Nochex

- Trust Payments

- Cardstream

- Mollie

- Escrow

- Wire Transfer

- Debit/Credit Cards

- Paysafe

- Clearpay

- PayUbiz

- Airpay Payment Gateway

- Citrus Payment Gateway

- DirecPay Payment Gateway

- ePaisa Payment

- Fondy

- Forte

- SecurePay

- Payflow

- Alipay

- iDEAL

- PagSeguro

- SamCart

- FastSpring

- Selz

- ClickBank

- Paylike

- PayKickstart

- PayWhirl

- MoonClerk

- Fortumo

- PayUmoney

- Fat Zebra

- GoCoin

- USAePay

- Borgun

- Bambora

- Bluefin

- Zapper

- ZipPay

- Fluid Pay

- MyGate

- Onebip

- Finbox

- FuturePay

- PayPlug

- Sisow

- Rapyd

- JVZoo

- Splitit

- Wallee

- Windcave

- Ogone

- JudoPay

- iATS Payments

- Geoswift

- Smart2Pay

- SnapScan

- Global Payments

- Peach Payments

150 Best Payment Gateways In 2024

1. PayPal (Best Payment Gateways )

One of the greatest payment gateways is PayPal, which provides a feature-rich and intuitive platform that has become widely associated with online transactions. Because of its broad acceptance, it’s a great option for companies of all kinds as it gives clients a dependable and comfortable way to make payments. PayPal’s integration process is easy to understand and quick to set up, making it suitable for both novice and experienced e-commerce users.

PayPal prioritizes security, using cutting-edge encryption and anti-fraud safeguards to protect private financial data. The platform’s versatility extends to cross-border payments, supporting numerous currencies and enabling smooth transactions. For companies looking for a dependable payment gateway for their online transactions, PayPal remains a top option due to its extensive feature set, clear pricing structure, and prompt customer service.

2. Paytm

Especially when considering the Indian market, Paytm has become one of the most popular payment gateways. Paytm, a company well-known for its creative approach to digital transactions, provides a flexible platform that serves both offline and online retailers. Features like a mobile wallet, QR code payments, and easy integrations with different merchants are what have made it so popular in India.

Strong authentication and encryption procedures demonstrate Paytm’s dedication to user security, giving businesses and customers alike confidence. A wide range of users, including those who are unfamiliar with digital payments, can easily utilize the platform thanks to its easy-to-use interface and straightforward setup. In the ever-changing world of digital finance, Paytm stands out as a comprehensive and adaptable payment gateway with a range of services that go beyond standard online transactions, such as booking tickets and paying utility bills.

3. Razorpay

Particularly for companies with operations in India, Razorpay has cemented its standing as one of the greatest payment gateways. Razorpay is a reputable platform that accepts a range of payment methods, including credit/debit cards, net banking, UPI, and well-liked digital wallets. It is well-known for its simplicity of use and smooth integration capabilities. For companies of all sizes, integration and customization are simple thanks to its developer-friendly interface.

Razorpay places a strong emphasis on security, protecting sensitive customer data by using industry-standard encryption and strict compliance guidelines. The platform is a desirable option for both established businesses and startups due to its competitive pricing and transparent fee structure. Razorpay’s features, which include subscription billing, support for international payments, and an intuitive dashboard, make it a popular payment gateway that helps customers and merchants alike have a positive payment experience.

4. Stripe

As a leading payment gateway, Stripe is recognized for its extensive feature set, developer-friendly layout, and international accessibility. Stripe provides a smooth integration process for developers to tailor payment solutions to specific requirements, catering to businesses of all sizes. Stripe is well-known for its adaptability; it accepts a wide range of payment methods, such as digital wallets, credit and debit cards, and other options, making it a complete option for a wide range of customer preferences.

Stripe prioritizes security, utilizing cutting-edge encryption and adhering to industry norms to safeguard confidential client information. Its attractiveness is increased by its clear pricing structure, which doesn’t include setup or other hidden costs, especially for small and startup enterprises. Businesses with a global presence choose Stripe because of its international capabilities, which include supporting multiple currencies and facilitating cross-border transactions. All things considered, Stripe is still at the forefront of the payment gateway market, offering a dependable and feature-rich option to companies looking for an excellent payment processing experience.

5. Cashfree (Best Payment Gateways )

In the world of payment gateways, Cashfree has become a significant player, especially in the Indian market. Recognized for its effectiveness and adaptability, Cashfree provides a selection of payment options to meet the various demands of commercial clients. It is accessible to both small and large businesses due to its easy-to-use interface and simple integration process. With support for multiple payment methods like credit/debit cards, net banking, UPI, and well-known digital wallets, Cashfree offers a complete solution for a range of customer preferences.

The platform prioritizes security, enforcing industry standards and putting strong encryption mechanisms in place to protect transaction data. Cashfree’s allure is bolstered by its transparent fee structure, competitive pricing, and features like seamless international transactions and subscription billing. Focusing on innovation and client satisfaction, Cashfree keeps making a name for itself in the payment gateway market by providing a dependable and feature-rich solution for companies doing business in India and other countries.

6. CCAvenue

In the field of payment gateways, CC Avenue is well-known, particularly in the Indian market. CC Avenue is well-known for providing a wide range of payment options and serving a variety of business needs in different sectors. The platform ensures flexibility for both merchants and customers by supporting a wide range of payment methods, such as credit/debit cards, net banking, digital wallets, and UPI.

The strength of CC Avenue is found in its dependable and safe transaction processing, which complies with industry standards and has strong encryption protections. Businesses of all sizes can use the platform because of its easy-to-use interface and seamless integration capabilities. CC Avenue’s allure is further amplified by its dedication to providing excellent customer service, competitive pricing, and clear fee structures. Being a reputable and well-established player, CC Avenue is a top option for companies involved in Indian e-commerce because it keeps a key role in enabling safe and effective digital transactions.

7. PayKun

PayKun has become well-known as a reliable and easy-to-use payment gateway, especially when considering the Indian market. With its smooth integration and easy setup procedure, PayKun can accommodate companies of all sizes, from start-ups to well-established multinationals. The platform offers flexibility to both customers and merchants by supporting a broad variety of payment methods, such as digital wallets, net banking, UPI, and credit/debit cards. PayKun prioritizes security and uses cutting-edge encryption technologies to protect sensitive transaction information.

For companies looking for affordable payment processing options, PayKun is a desirable option due to its clear pricing structure and reasonable fees. The platform’s responsive support system and dedication to ongoing innovation demonstrate its dedication to customer satisfaction. PayKun, a dependable and feature-rich payment gateway, keeps up a major contribution to the safe and effective execution of digital transactions for companies engaged in the ever-changing world of online commerce.

8. PayU

PayU is a prominent payment gateway that provides businesses worldwide with an extensive range of solutions. PayU, which is well-known for its adaptability and simplicity of integration, offers a smooth experience for both customers and merchants by supporting a large variety of payment methods, such as credit/debit cards, net banking, UPI, and different digital wallets. The platform’s strength is its dedication to security, which is demonstrated by the sophisticated encryption methods it uses and the industry standards it abides by to protect sensitive transaction data.

PayU’s dependable payment processing infrastructure and easy-to-use interface make it appropriate for companies of all sizes. Companies with a global presence find the platform appealing due to its multi-currency support and international presence. Because of its clear fee schedule, affordable prices, and extensive feature set—which includes fraud protection and subscription billing—PayU is a go-to payment gateway for companies looking for effectiveness, security, and a satisfying customer experience.

9. Instamojo

As a flexible and user-friendly payment gateway, Instamojo has made a name for itself, especially serving small and medium-sized enterprises in India. Well-known for its simplicity, Instamojo provides a platform that is simple to integrate and enables merchants to begin accepting payments right away. With its support for multiple payment methods, such as digital wallets, UPI, net banking, and credit/debit cards, Instamojo offers flexibility to both customers and businesses.

Features like the ability to create payment links without a website and instant onboarding demonstrate the platform’s focus on meeting the needs of micro-entrepreneurs and startups. Using encryption techniques to protect transaction data, Instamojo places a high priority on security. In the ever-changing world of Indian e-commerce, Instamojo has gained popularity among companies looking for a hassle-free and affordable payment gateway solution because of its clear pricing, reasonable fees, and extra services like online store creation.

10. Amazon Pay (Best Payment Gateways )

Because of the trust and large user base of the Amazon platform, Amazon Pay has become a powerful force in the payment gateway market. With the convenience of using their Amazon credentials for transactions, customers can make payments with ease using Amazon Pay, the payment arm of the massive online retailer. This integration provides a simple and safe payment process to a wide range of online retailers.

Amazon Pay is even more versatile because it works seamlessly with well-known digital wallets and accepts a wide range of payment methods, including credit and debit cards.Users are given confidence by the platform’s emphasis on security as well as the reliability of the Amazon brand. Businesses aiming to streamline their payment processes and leverage the trust associated with the Amazon ecosystem will find Amazon Pay to be an appealing option due to its user-friendly interface, competitive fees, and the added benefit of Amazon’s large customer base.

11. WePay

Due to its emphasis on offering streamlined and integrated payment solutions, WePay has established itself as a noteworthy payment gateway. WePay, which was acquired by JPMorgan Chase, is a desirable option for companies looking for effective payment processing because of its robust features and developer-friendly APIs. Online payments via credit/debit cards, bank transfers, and digital wallets are made possible by the platform.

WePay places a strong focus on user experience and provides simple integration for companies of all sizes, enabling them to seamlessly integrate payment features into their websites and applications. WePay places a high premium on security, and to protect sensitive data, we use cutting-edge encryption and compliance controls. For companies trying to improve their payment processing capabilities, WePay remains a dependable and developing choice because of its clear pricing, affordable fees, and dedication to innovation.

12. Apple Pay

As a prominent payment gateway, Apple Pay provides users with a safe and easy way to conduct transactions on a variety of Apple products. This payment solution, which is well-known for its smooth integration with the Apple ecosystem, improves the user experience by allowing users to make purchases with a simple touch or glance.

In addition to accepting a variety of payment methods, such as credit and debit cards, Apple Pay protects user data by using cutting-edge security features like Touch ID and Face ID for authentication. Due to the platform’s widespread acceptance as a payment method, it has been adopted by a large number of retailers and applications. Apple Pay has grown to be the go-to option for customers who appreciate ease and security in their digital transactions because of its dedication to privacy, simplicity, and contactless transactions.

13. BillDesk

More so than others, BillDesk is a well-known and trustworthy payment gateway, especially when it comes to India. Recognized for providing strong and safe payment processing options, BillDesk acts as a reliable middleman, enabling smooth transactions for both customers and companies. For the benefit of both customers and merchants, the platform accepts a wide range of payment methods, such as digital wallets, net banking, credit/debit cards, and UPI.

BillDesk is accessible to companies of all sizes thanks to its user-friendly interface and effective integration capabilities. The platform prioritizes security and uses cutting-edge encryption techniques to guarantee the integrity and confidentiality of transaction data. BillDesk has become a preferred payment gateway by demonstrating a dedication to innovation and customer satisfaction, along with a transparent fee structure. This has helped the digital payment ecosystem in India grow and function more efficiently.

14. Braintree

Due to its extensive feature set and adaptability, Braintree has established itself as a top payment gateway. PayPal owns Braintree, which offers companies a simple and safe way to take payments from all over the world. Because of its easy integration capabilities and developer-friendly interface, it is a great option for businesses of all sizes. To accommodate a wide range of consumer preferences, Braintree accepts a number of payment methods, including digital wallets like PayPal and Venmo, credit and debit cards, and other options.

Advanced encryption and fraud prevention measures are in place to protect sensitive data, and security is a top priority. The platform’s attractiveness is increased by its reasonable fees and clear pricing structure. Braintree’s dedication to innovation is evident in its backing of cutting-edge technologies and its facilitation of seamless payment processes. Braintree remains a top option for companies looking for a feature-rich and reliable payment gateway, whether they are conducting business online or through a mobile device.

15. MobiKwik (Best Payment Gateways )

Especially in India, MobiKwik has become a major force in the digital payment market. Well-known for its mobile wallet services, MobiKwik provides a wide range of features that go beyond conventional payment methods. The platform gives users a wide range of options by supporting credit/debit cards, net banking, UPI, and mobile wallets, among other payment methods. The widespread use of MobiKwik, particularly among consumers and small businesses, can be attributed to its user-friendly interface and effective integration capabilities.

The platform prioritizes security, utilizing strong encryption techniques to guarantee the safety of sensitive financial data. MobiKwik is a comprehensive financial services platform that offers services like digital loans and insurance, demonstrating its commitment to financial inclusion. With its cutting-edge features, dedication to security, and extensive range of financial services, MobiKwik keeps driving the digital payment ecosystem in India forward.

16. Payoneer

Payoneer is a well-known and trustworthy international payment gateway that serves companies and independent contractors worldwide. Payoneer, well-known for its cross-border payment options, makes it simple for customers to send and receive money internationally by allowing them to do so in a variety of currencies. Support for multiple payment methods, such as local e-wallets, credit/debit cards, and bank transfers, demonstrates the platform’s adaptability.

Payoneer is a desirable option for individuals involved in international trade due to its clear and affordable pricing structure. The platform prioritizes security, employing cutting-edge encryption and compliance controls to safeguard private financial data. Payoneer is a preferred payment gateway for companies and professionals doing cross-border transactions because of its user-friendly interface, simple onboarding procedure, and capacity to accept payments from marketplaces and clients worldwide.

17. Square

Square has made a name for itself as a cutting-edge and popular payment gateway, especially because of how well it can accommodate companies of all kinds. Square, well-known for its mobile payment options and point-of-sale systems, offers a smooth, integrated platform for both online and in-person transactions. Small businesses and entrepreneurs can use it because of its easy-to-use interface and simple setup. Square provides a comprehensive solution for a range of customer preferences by supporting multiple payment methods, such as digital wallets, contactless payments, and credit and debit cards.

Encryption and fraud prevention measures are in place to guarantee the security of transaction data, and security is a top priority. Square’s broad acceptance can be attributed to its clear pricing model, which offers affordable rates, no monthly obligations, and competitive fees. The platform’s dedication to innovation is evident in features like Square Online, which makes it simple for companies to create an online presence. Square remains a top option for companies looking to process payments quickly and easily because it is a reliable and all-inclusive payment solution.

18. Atom

In the field of payment gateways, Atom Technologies has made a name for itself, especially in the Indian market. Known for offering all-inclusive payment solutions, Atom meets the various demands of companies by offering a smooth online transaction platform. To ensure flexibility for both customers and merchants, the company accepts a wide range of payment methods, such as digital wallets, net banking, credit/debit cards, and UPI.

Atom Technologies prioritizes security, protecting sensitive transaction data by putting in place cutting-edge encryption techniques and abiding by industry standards. The platform is accessible to companies of all sizes due to its user-friendly interface and effective integration capabilities. In the ever-changing Indian e-commerce market, Atom Technologies remains a dependable and forward-thinking option for companies looking for a safe and effective payment gateway solution. This is due to its competitive pricing, clear fee structures, and dedication to ongoing innovation.

19. Easebuzz

With its extensive and user-friendly platform, Easebuzz has become a prominent player in the payment gateway market, particularly for businesses in India. Known for its adaptability, Easebuzz allows companies to accommodate a wide range of consumer preferences by supporting multiple payment methods, such as digital wallets, net banking, credit/debit cards, and UPI. The platform is available to companies of all sizes, including startups and SMEs, thanks to its simple integration process and intuitive interface.

Easebuzz prioritizes security, protecting sensitive transaction data with cutting-edge encryption technologies. With fees that are reasonable and transparent, along with extra features like event ticketing and subscription billing, Easebuzz has emerged as a top option for companies searching for an easy-to-use and affordable payment gateway solution in the rapidly changing Indian e-commerce market.

20. GoCardless (Best Payment Gateways )

As a top payment gateway, GoCardless stands out for specializing in Direct Debit bank-to-bank transactions and offering companies a dependable and effective means of collecting recurring payments. GoCardless, which is well-known for its smooth and intuitive platform, makes payments easier and is especially advantageous for subscription-based companies and service providers. Because of the platform’s focus on Direct Debit, businesses can efficiently manage their cash flow thanks to benefits like lower transaction fees and less friction for customers.

GoCardless places a high priority on security, putting strong safeguards in place to guard private financial data. Its competitive fees and open pricing structure add to its appeal, particularly for companies looking for an affordable way to handle recurring payments. GoCardless is still a top option for companies trying to streamline their recurring payment procedures because of its emphasis on dependability, simplicity, and the special benefits of Direct Debit transactions.

21. Adyen

One of the greatest payment gateways in the constantly changing world of online transactions is Adyen. Adyen is well-known for providing secure and easy-to-use payment processing solutions, and it has become a global leader in the fintech sector. Its extensive platform offers a unified solution that supports multiple payment methods, currencies, and channels, catering to a broad spectrum of businesses from small startups to multinational corporations.

Adyen guarantees a reliable and easy-to-use payment experience for both customers and merchants with its user-friendly interface and strong security measures. Because of the platform’s flexibility and scalability, companies trying to improve customer satisfaction and expedite payment procedures can’t go wrong. Adyen is a top option for merchants looking for a dependable and effective payment gateway solution because of its cutting-edge technology and extensive global reach, which enable it to facilitate payments online, in-app, or in-store.

22. BlueSnap

In the field of payment gateways, BlueSnap is a well-known participant, providing a flexible and all-inclusive platform that caters to the various requirements of companies worldwide. BlueSnap accepts a comprehensive range of payment options, including credit cards, digital wallets, and local bank transfers, with the goal of providing a seamless payment experience. BlueSnap stands out for its dedication to increasing conversion rates through streamlined checkout procedures and flawless user interface design.

Due to the platform’s global reach, businesses can accept payments in a variety of currencies, which promotes the expansion of their global operations. In addition, BlueSnap prioritizes security, putting sophisticated fraud prevention mechanisms in place to protect both customers and merchants. With its cutting-edge features and dedication to customer satisfaction, BlueSnap is a compelling option for anyone looking for a dependable and effective payment gateway solution, regardless of the size of their company.

23. Bolt

Bolt has become a prominent player in the payment gateway industry by providing a distinct and efficient method for conducting online transactions. Bolt is unique in that it focuses on giving customers and merchants an effortless and quick checkout process. The platform lowers cart abandonment rates and increases conversion rates for online businesses by fusing payment processing with a simple, one-click checkout procedure.

Strong security features complement Bolt’s dedication to simplicity, guaranteeing that transactions are safe and shielded from possible attacks. The platform also places a strong emphasis on analytics and insights derived from data, giving merchants the ability to optimize their payment procedures and make well-informed decisions. Bolt has established itself as an excellent option for companies wishing to improve their payment gateway capabilities thanks to its intuitive interface, cutting-edge technology, and commitment to improving the entire online shopping experience.

24. PAYG

PAYG, or Pay-As-You-Go, emerges as a standout choice among payment gateways, offering businesses a flexible and cost-effective solution for processing transactions. With a focus on simplicity and affordability, PAYG provides a straightforward pay-as-you-go pricing model, eliminating the need for businesses to commit to fixed monthly fees. This flexibility is particularly beneficial for smaller enterprises and startups looking to manage their budget effectively.

PAYG’s user-friendly interface streamlines the payment process, ensuring a seamless experience for both merchants and customers. Security is paramount, and PAYG implements robust encryption measures to safeguard sensitive payment data. The platform caters to diverse payment methods, including online, in-store, and mobile transactions, making it a versatile choice for businesses of all sizes. With its commitment to affordability, simplicity, and security, PAYG stands as a reliable partner for businesses seeking an efficient and economical payment gateway solution.

25. Authorize.Net (Best Payment Gateways )

In the world of payment gateways, Authorize.Net is a mainstay that is well-known for its dependability, security, and abundance of features. Serving companies of all kinds, Authorize.Net supports a number of payment options, such as digital wallets, eChecks, and credit cards, to enable easy online transactions. The platform is an appealing option for merchants wishing to simplify their payment procedures because of its easy-to-use interface and simple integration.

Additionally, Authorize.Net places a high priority on security by putting sophisticated fraud prevention tools into place and upholding industry-leading compliance standards. Businesses can obtain important insights into their transactions through its comprehensive reporting and analytics features, which support decision-making and optimization. Authorize.Net is one of the best payment gateways on the market because of its dedication to providing a safe and easy payment experience, regardless of whether the company is involved in e-commerce or other online endeavors.

26. Stax

Stax has quickly established itself as a top supplier of payment gateways, providing a transparent and all-inclusive solution for companies looking for dependable transaction processing. Known for its dedication to simplicity, Stax offers an all-in-one platform that includes merchant services, analytics, and payment processing, simplifying the frequently complicated world of payments. Businesses of all sizes are drawn to it because of its simple pricing structure and user-friendly interface.

Transparency is a key component of Stax’s pricing strategy, which removes any hidden costs and gives businesses a comprehensive picture of their transaction expenses. Customers and merchants can be sure of a secure environment thanks to the platform’s strong security measures and adherence to industry standards. For individuals looking for a cutting-edge, effective, and transparent payment gateway solution, Stax is a strong option due to its flexibility and commitment to meeting customer needs.

27. Payment Depot

By differentiating itself from conventional fee structures with its subscription-based pricing model, Payment Depot has made a name for itself in the payment gateway industry. Known for its openness, Payment Depot gives retailers a comprehensive picture of expenses by doing away with percentage-based transaction fees in favor of a simple monthly membership. Due to the potential for large cost savings, this strategy is especially appealing to companies handling high transaction volumes.

Payment Depot prioritizes strong security measures to safeguard sensitive data and offers a secure and dependable payment processing experience in addition to its creative pricing model. Payment Depot supports a variety of payment methods. For companies looking for an effective and affordable payment gateway solution, Payment Depot is a strong option because of its dedication to transparency, competitive pricing, and an easy-to-use platform.

28. Clover

Strong payment gateway Clover has received high praise for its adaptability and extensive features that are suitable for companies of all kinds. Fiserv-developed Clover is an integrated point-of-sale system that provides more than just standard payment processing. Because of its intuitive interface and adaptable hardware and software, businesses can design a customized payment environment. Clover ensures flexibility for merchants and customers by supporting multiple payment methods, such as credit cards, contactless payments, and mobile wallets.

The sophisticated analytics capabilities of the platform help businesses make wise decisions by offering insightful data on consumer behavior and sales trends. Additionally, Clover places a high priority on security by adhering to industry standards and using end-to-end encryption. Clover is a top option for companies looking for a cutting-edge and effective payment gateway, whether they are in the retail, hospitality, or service sectors. This is due to its comprehensive payment solutions.

29. Helcim

Helcim has established itself as a unique option for payment gateways, providing a transparent and all-inclusive service for companies of all kinds. Helcim, which is renowned for its dedication to reasonable and open pricing, does away with additional costs and gives companies an accurate cost breakdown. Credit cards and digital wallets are just a couple of the many payment options supported by the platform, giving customers and merchants alike flexibility and a flawless shopping experience.

Helcim is accessible to companies wishing to optimize their payment procedures due to its easy-to-use interface and simple integration. The platform places a strong emphasis on security as well, protecting sensitive transaction data by using cutting-edge encryption and abiding by industry standards. Focusing on ease of use, openness, and security, Helcim is a dependable option for companies looking for a dependable and effective payment gateway solution.

30. PayGlocal (Best Payment Gateways )

One of the greatest payment gateways available is PayGlocal, which provides both customers and businesses with a safe and easy transaction experience. PayGlocal guarantees that online payments are safe from potential threats and operate efficiently thanks to its user-friendly interface and strong security measures. The platform accommodates a broad variety of payment options to meet the varied preferences of its global clientele.

In the constantly shifting digital landscape, PayGlocal offers a comprehensive solution to meet the changing needs of businesses, whether they involve credit/debit cards, digital wallets, or alternative payment methods. Furthermore, businesses can obtain important insights into their financial transactions with the help of PayGlocal’s sophisticated analytics and reporting tools, which facilitate strategic decision-making. In the competitive field of online transactions, PayGlocal is a top option for a dependable and effective payment gateway that places an emphasis on security, ease of use, and flexibility.

31. Nimbbl

As one of the leading payment gateways, Nimbbl provides companies with an innovative and adaptable way to handle online transactions. Well-known for its intuitive UI, Nimbbl simplifies the payment process to give consumers and businesses a hassle-free experience. Nimbbl is committed to security and uses cutting edge encryption techniques to protect sensitive data during transactions.

Nimbbl stands out for its emphasis on financial inclusivity and support for a broad range of payment methods, such as digital wallets, credit/debit cards, and UPI, which accommodate a wide range of consumer preferences. Because of its easy integration features, Nimbbl is the preferred option for companies wishing to improve their online payment system. Furthermore, Nimbbl’s analytics tools give companies insightful knowledge about transaction patterns, which facilitates decision-making and improves financial strategy. In the ever-changing world of digital transactions, Nimbbl stands out as a leader for companies looking for a dependable and cutting-edge payment gateway.

32. OPEN

In the field of payment gateways, OPEN has become a major force, providing companies with a strong and all-inclusive solution for effectively managing online transactions. OPEN guarantees a flawless payment experience for both customers and merchants thanks to its user-friendly interface. The platform prioritizes security and uses cutting-edge encryption methods to protect sensitive information while transactions are being conducted. OPEN is unique in that it allows businesses to accommodate a wide variety of customer preferences by supporting a wide range of payment methods, such as digital wallets, net banking, and credit/debit cards.

OPEN is unique because of its dedication to innovation and constant integration of cutting-edge technologies to improve transaction speed and dependability. Businesses are given useful insights into their financial transactions by the platform’s analytics and reporting tools, which enable them to make well-informed decisions. In the constantly changing world of digital commerce, OPEN is a dependable option for companies looking for a dependable and innovative payment gateway solution.

33. 2Checkout

2Checkout has made a name for itself as a unique payment gateway by providing companies with an all-inclusive, worldwide solution for handling online transactions. Known for its flexibility, 2Checkout accepts a large number of payment methods, such as digital wallets, credit/debit cards, and several international payment choices. Because of the platform’s user-friendly interface, both customers and merchants can make payments with ease, which promotes satisfaction and trust.

2Checkout’s global reach allows businesses to grow their customer base and accept payments from customers all over the world. This is what makes it unique. 2Checkout is dedicated to security and uses strong fraud prevention techniques to protect sensitive data while transactions are being completed. The sophisticated analytics tools on the platform enable businesses to make well-informed decisions by providing them with insightful data on transaction trends and customer behavior. 2Checkout is a dependable and internationally-focused payment gateway that businesses can rely on to help them navigate the challenges of online commerce.

34. Payline

As a top payment gateway, Payline has made a name for itself by offering companies a dependable and effective way to handle online transactions. Payline provides a user-friendly interface that guarantees a smooth payment experience for both customers and merchants by emphasizing simplicity and functionality. To satisfy the wide range of customer preferences, the platform accepts a number of payment options, such as digital wallets, ACH payments, and credit/debit cards.

Payline sets itself apart with its open pricing structure, providing companies with competitive rates that are transparent and free of additional costs. Sensitive information protection is given top priority during transactions thanks to the platform’s strong security features, which include fraud prevention tools and encryption. Payline’s dedication to customer service amplifies its allure by offering businesses support and direction whenever required. Payline is a dependable partner for companies looking for an effective and trustworthy payment gateway solution to help them navigate the challenges of accepting payments online.

35. PayJunction (Best Payment Gateways )

One of the greatest payment gateways available is PayJunction, which offers companies an extensive and easy-to-use platform for accepting online payments. PayJunction is well-known for its dedication to moral business conduct. Its pricing model places a high priority on fairness and transparency, providing transparent rates without any extra costs. To accommodate a range of consumer preferences, the platform accepts a number of payment options, such as contactless payments, electronic checks, and credit/debit cards.

PayJunction prioritizes security, as seen by its cutting-edge features like tokenization and PCI compliance, which guarantee the security of sensitive payment data. The platform stands out as a socially conscious option thanks to its eco-friendly strategy, which emphasizes paperless transactions. Furthermore, PayJunction offers companies strong reporting capabilities that let them learn important things about transactional data and customer behavior. PayJunction is a dependable, transparent, and secure payment gateway that businesses can rely on to enable smooth online transactions.

36. Phone Pe

Particularly in the context of digital payments in India, PhonePe has become one of the leading payment gateways. PhonePe, well-known for its widespread acceptance and user-friendly interface, provides a simple and easy way for users to conduct online transactions. To accommodate the wide range of payment preferences of its users, the platform supports credit/debit cards, digital wallets, and the Unified Payments Interface (UPI).

PhonePe stands out due to its integration with multiple service providers and merchants, which enables users to pay for a variety of products and services directly from within the app. PhonePe contributes to a reliable payment experience by guaranteeing the security of sensitive data during transactions through a strong security infrastructure. In India’s quickly changing digital payments market, the platform’s dedication to innovation and ongoing development has cemented its standing as the preferred payment gateway.

37. NMI

Network Merchants Inc. (NMI) is a prominent payment gateway that offers companies an adaptable and dependable way to handle online transactions. Well-known for its adaptability, NMI takes into account the various preferences of both customers and merchants by supporting an extensive range of payment methods, such as digital wallets, ACH payments, and credit/debit cards. The platform’s intuitive user interface makes making payments easier and improves the user experience in general. NMI is renowned for its strong security measures, which include tokenization and encryption to protect sensitive payment data.

Because the platform is scalable and customizable, it can be used by companies of all sizes and can be adjusted to meet their changing needs. NMI’s unwavering updates and integrations with cutting-edge technologies demonstrate its dedication to innovation and guarantee that companies remain at the forefront of digital payment solutions. NMI is a dependable partner for companies looking for a flexible, safe, and cutting-edge payment gateway to enable smooth online transactions.

38. HitPay

With its sleek and contemporary approach to online transaction processing, HitPay has established itself as a rising star in the payment gateway space. HitPay, which is well-known for its effectiveness and simplicity, offers a user-friendly interface that makes payments easy and quick for both customers and merchants. The platform accommodates a range of user preferences by supporting multiple payment methods, such as digital wallets and credit/debit cards.

HitPay distinguishes itself by prioritizing the user experience and enhancing convenience through features like one-click payments. HitPay places a high premium on security, protecting sensitive data during transactions with strong encryption techniques. Businesses are provided with useful insights by the platform’s real-time analytics and reporting tools, which enable them to optimize their financial strategies. In the rapidly changing world of online commerce, HitPay shows promise as a payment gateway for companies looking for something new, safe, and user-friendly.

39. TSYS

Total System Services, or TSYS, has solidified its position as a top payment gateway by providing companies with an all-inclusive and dependable online transaction management solution. Renowned for its worldwide reach, TSYS gives businesses the flexibility to serve a wide range of customers by supporting a variety of payment methods, such as emerging digital wallets, ACH payments, and credit/debit cards. The payment process is made easier by the platform’s user-friendly interface, guaranteeing a smooth transaction for both customers and merchants.

TSYS prioritizes security, putting sophisticated fraud prevention techniques and encryption protocols in place to protect sensitive data. TSYS provides businesses with valuable insights into transaction data and customer behavior through its robust reporting and analytics tools, enabling well-informed decision-making. TSYS is a dependable partner for companies looking for a dependable, scalable, and global payment gateway to help them navigate the challenges of online commerce.

40. Spreedly (Best Payment Gateways )

Spreedly has established itself as a leading payment gateway provider, offering companies an inventive and adaptable online transaction management platform. With a focus on adaptability, Spreedly allows businesses to serve a wide range of clientele by supporting a vast array of payment methods, such as digital wallets, credit/debit cards, and alternative payment methods. The capacity of the platform to safely store and tokenize payment information, enabling smooth transactions across various channels and platforms, is what makes it so special.

Strong encryption measures on Spreedly show the company’s dedication to security and guarantee the privacy of sensitive information while conducting transactions. The platform is appropriate for companies of all sizes, from start-ups to large corporations, due to its scalability and flexibility. In the ever-changing world of digital commerce, Spreedly stands out as a dependable option for companies looking for a cutting-edge and flexible payment gateway solution because of its emphasis on customization and integration capabilities.

41. REPAY

In the payment gateway market, REPAY has become a major force, offering companies a complete and effective online transaction management solution. Renowned for its intuitive UI, REPAY guarantees a smooth payment process for both customers and merchants. In order to accommodate a wide range of customer preferences, the platform supports a number of payment methods, such as digital wallets, ACH payments, and credit/debit cards.

REPAY stands out for its emphasis on security and compliance, using cutting-edge fraud prevention techniques and encryption to protect sensitive data. With the help of the platform’s powerful reporting and analytics tools, businesses can make well-informed decisions by gaining insightful knowledge about transaction data and customer behavior. In the rapidly changing world of digital payments, REPAY remains a dependable, secure, and feature-rich payment gateway solution provider for companies that value innovation and client satisfaction.

42. Moneris Gateway

Moneris Gateway stands out as a prominent and trusted payment gateway, offering businesses a robust solution for managing online transactions. Renowned for its reliability, Moneris supports a variety of payment methods, including credit/debit cards, contactless payments, and e-checks, providing flexibility to both merchants and customers. The platform’s user-friendly interface ensures a smooth and intuitive payment experience, contributing to overall customer satisfaction.

Moneris is distinguished by its commitment to security, implementing advanced encryption and fraud prevention measures to safeguard sensitive payment information. With its seamless integration capabilities, Moneris adapts to various business environments and scales effectively to meet the needs of growing enterprises. The platform’s comprehensive reporting and analytics tools empower businesses with valuable insights into transaction trends and customer behavior. For businesses seeking a dependable, secure, and feature-rich payment gateway, Moneris Gateway stands as a reliable choice in navigating the complexities of online commerce.

43. EBizCharge

EBizCharge has established itself as a top payment gateway by providing companies with an all-inclusive and efficient online transaction management solution. Recognized for its intuitive user interface, EBizCharge guarantees a smooth and effective payment process for both consumers and businesses. In order to accommodate customers’ varied preferences, the platform accepts a number of payment methods, such as digital wallets, ACH payments, and credit/debit cards.

EBizCharge is distinguished by its dedication to affordability, offering transparent and unambiguous pricing structures devoid of additional costs. Prioritizing security, the platform encrypts sensitive payment data during transactions using strong encryption techniques. EBizCharge makes business reconciliation easier by integrating with popular accounting software and offering compatibility. The analytics and reporting features of the platform provide insightful analysis of transaction data, enabling businesses to take well-informed decisions. In the ever-changing world of online shopping, EBizCharge is a dependable, affordable, and feature-rich payment gateway provider for companies.

44. Payworks

In the payment gateway market, Payworks has become a dominant player by offering companies a cutting-edge and contemporary online transaction management solution. Payworks, a company recognized for its state-of-the-art technology, provides a smooth and easy-to-use interface for merchants and customers alike. The platform offers a wide variety of payment options, such as digital wallets and credit/debit cards, giving it the adaptability to satisfy changing customer demands.

Payworks distinguishes itself by emphasizing innovation and incorporating cutting-edge technologies to improve transaction speed and dependability. The platform prioritizes security, employing cutting-edge encryption techniques to safeguard private financial data. Payworks provides businesses with valuable insights into transaction data and customer behavior through its extensive analytics tools, facilitating strategic decision-making. Payworks is a reliable partner for companies looking for a progressive, safe, and effective payment gateway to help them manage the challenges of online sales.

45. MyVirtualMerchant (Best Payment Gateways )

MyVirtualMerchant has established itself as a dependable and effective payment gateway by providing companies with an all-inclusive online transaction management solution. Known for its easy-to-use interface, MyVirtualMerchant guarantees a smooth payment process for both customers and merchants. The platform allows for flexibility in accommodating a wide range of customer preferences by supporting multiple payment methods, such as digital wallets, electronic checks, and credit/debit cards.

MyVirtualMerchant places a high priority on security, protecting sensitive payment data with sophisticated encryption and fraud prevention techniques. Its adaptability to various business sizes and industries is what makes it unique. MyVirtualMerchant provides businesses with valuable insights into transaction data and customer behavior through its extensive reporting and analytics tools, enabling well-informed decision-making. In the ever-changing world of online commerce, MyVirtualMerchant continues to be a dependable option for companies looking for a reputable, secure, and feature-rich payment gateway.

46. PayPay

PayPay stands out as one of the best payment gateways, offering a comprehensive and user-friendly platform that caters to the diverse needs of businesses and individuals alike. With a commitment to seamless and secure transactions, PayPay ensures that users can effortlessly make and receive payments, fostering trust in online financial interactions. The platform supports various payment methods, including credit and debit cards, bank transfers, and digital wallets, providing flexibility to both merchants and consumers.

PayPay’s robust security measures, such as encryption and adherence to industry standards, prioritize the protection of sensitive information, assuring users of a safe payment environment. The integration process is streamlined, allowing businesses to easily incorporate PayPay into their online systems. With its commitment to innovation, reliability, and customer satisfaction, PayPay continues to be a leading choice in the ever-evolving landscape of digital payments.

47. PaySimple

Known for being one of the greatest payment gateways, PaySimple offers companies an all-inclusive and intuitive way to handle online transactions. PaySimple, which is well-known for its simplicity, provides a simplified interface that guarantees a seamless payment experience for both customers and merchants. To accommodate a wide range of consumer preferences, the platform accepts multiple payment methods, such as credit/debit cards, ACH transfers, and electronic invoicing.

PaySimple is distinguished by its comprehensive reporting and analytics capabilities, which offer businesses insightful knowledge into transactional data and customer behavior. PaySimple places a high premium on security, protecting sensitive payment data with advanced encryption and compliance controls. Because of the platform’s adaptability and scalability, businesses of all sizes can use it. Its features can be customized to meet unique requirements. PaySimple is a dependable option for companies looking for a feature-rich, safe, and dependable payment gateway to help them deal with the challenges of online sales.

48. PPRO

PPRO is a well-known player in the payment gateway market, providing companies with an advanced and adaptable way to handle international online transactions. PPRO, which is well-known for emphasizing international payments, offers a large selection of local payment options, allowing companies to accommodate a variety of client preferences in various geographic locations. Because of the platform’s strong technology, integration is seamless and merchants can offer their customers a seamless payment experience.

PPRO’s sophisticated encryption methods, which safeguard sensitive payment information during transactions, demonstrate the company’s dedication to security. With an emphasis on innovation, PPRO consistently adjusts to new payment trends and technologies, establishing itself as a progressive choice for companies functioning in the ever-changing world of international e-commerce. PPRO is a reliable partner for companies looking for a complete, safe, and internationally integrated payment gateway that helps with cross-border transactions.

49. Planet Payments

Planet Payments stands out as a premier choice in the realm of payment gateways, offering a robust and versatile platform that caters to the evolving needs of businesses globally. Renowned for its commitment to innovation and seamless transactions, Planet Payments provides users with a comprehensive suite of features designed to enhance the efficiency and security of online payments. The platform supports a diverse range of payment methods, including credit and debit cards, e-wallets, and other digital payment options, ensuring flexibility for both merchants and customers.

With a strong emphasis on security, Planet Payments employs advanced encryption technologies and adheres to industry standards, instilling confidence in users regarding the protection of their sensitive financial data. The user-friendly interface and efficient integration processes further contribute to the platform’s appeal, making it an ideal choice for businesses seeking a reliable, scalable, and globally accessible payment gateway solution. Planet Payments continues to be at the forefront of the digital payment landscape, providing businesses with the tools they need to facilitate secure and seamless transactions in today’s dynamic market.

50. NETELLER (Best Payment Gateways )

As a well-known and reliable payment gateway, NETELLER has made a name for itself by providing consumers with a quick and safe way to conduct online transactions. NETELLER, which is well-known for its adaptability, accepts many different payment options, such as digital wallets, bank transfers, and credit/debit cards. The platform is especially well-known for its extensive global reach, which enables cross-border payments and allows users to conduct transactions in multiple currencies.

NETELLER places a high priority on user security, protecting sensitive financial data with sophisticated authentication and encryption methods. In the ever-changing world of digital finance, NETELLER meets the varied needs of both businesses and individual users with its intuitive interface and extensive feature set. NETELLER is still a well-liked option for people looking for a dependable and secure payment gateway, whether they’re using it for trading, gaming, or online shopping.

51. ANZ

Australia and New Zealand Banking Group Limited, or ANZ, provides a dependable and all-inclusive payment gateway solution for companies. ANZ, a prominent financial institution in the Asia-Pacific area, offers a safe online transaction processing platform. The ANZ payment gateway accommodates the different preferences of businesses and customers by supporting a wide range of payment methods, such as credit/debit cards and electronic funds transfers.

ANZ’s emphasis on security is demonstrated by its sophisticated encryption protocols, which guarantee the security of private financial data while conducting business. The platform’s seamless integration with e-commerce websites streamlines the payment process for businesses and offers consumers a seamless shopping experience. In the constantly changing world of digital commerce, ANZ is a trusted partner for companies looking for a dependable and secure payment gateway because of its solid reputation and dedication to financial services.

52. Checkout.com

Checkout.com has maintained its status as a top payment gateway by providing companies with an innovative and adaptable online transaction management solution. Renowned for its ingenuity and global reach, Checkout.com enables businesses to serve a wide range of international clientele by supporting a variety of payment methods, such as major credit/debit cards, alternative payment options, and localized methods. Both customers and merchants benefit from a seamless payment experience thanks to the platform’s user-friendly interface and seamless integration capabilities.

Checkout.com prioritizes security, employing cutting-edge fraud prevention techniques and encryption protocols to protect private data while conducting transactions. Checkout.com is dedicated to giving businesses real-time data insights via all-inclusive analytics tools so they can make well-informed decisions and maximize their payment strategies. In the ever-changing landscape of online commerce, Checkout.com stands out as a dependable, scalable, and globally compatible payment gateway for businesses.

53. Worldpay

With a strong and all-inclusive online transaction management solution, Worldpay has long been acknowledged as a prominent player in the payment gateway market. Prominent for its worldwide presence, Worldpay facilitates a vast array of payment modalities, encompassing digital wallets, credit/debit cards, and multiple international payment choices. Both customers and merchants will have a smooth payment experience thanks to the platform’s user-friendly interface.

Worldpay prioritizes security, employing cutting-edge fraud prevention tools and encryption techniques to safeguard private data during transactions. Worldpay’s versatility and scalability enable it to serve companies of all sizes by providing features that can be tailored to meet particular requirements. Businesses can make well-informed decisions with the help of the platform’s analytics and reporting tools, which provide insightful information about customer behavior and transaction data. In the constantly changing world of digital commerce, Worldpay continues to be a dependable, secure, and feature-rich payment gateway option for companies.

54. Telr

Telr distinguishes itself as a dynamic and dependable payment gateway by providing companies with an all-inclusive online transaction management solution. Telr is well known for its adaptability; it can accept a wide range of payment methods, such as digital wallets, credit/debit cards, and other options, to accommodate a wide range of customer preferences. Overall satisfaction is increased by Telr’s user-friendly interface, which guarantees a smooth payment experience for both customers and merchants.

Telr prioritizes security, employing cutting-edge encryption techniques and compliance guidelines to safeguard private financial data. Due to its scalability, the platform can be used by companies of all sizes, accommodating their distinct requirements and growth paths. Telr’s dedication to innovation is evident in its constant updates and integrations, which enable it to stay up to date with new developments in the payment sector. Telr is a trusted partner for companies looking for a flexible, safe, and dependable payment gateway to help them manage the challenges of online sales.

55. HyperPay (Best Payment Gateways )

As a prominent payment gateway, HyperPay offers companies a reliable and cutting-edge way to handle online transactions. HyperPay is a highly versatile payment solution that accommodates a broad range of payment methods, such as digital wallets, credit/debit cards, and multiple regional payment options, thereby meeting the diverse needs and preferences of its customers. Because of the platform’s user-friendly interface, both customers and merchants can make payments with ease, which promotes satisfaction and trust.

HyperPay prioritizes security, employing sophisticated encryption techniques and fraud guards to protect private data while conducting business. HyperPay’s flexibility and scalability enable it to serve companies of all sizes by providing features that can be tailored to meet particular requirements. With the help of the platform’s real-time analytics and reporting features, businesses can make well-informed decisions by gaining insightful knowledge about transaction data and customer behavior. In the competitive world of online commerce, HyperPay stands out as a dependable, secure, and feature-rich payment gateway for businesses. It is a technologically advanced solution.

56. senangPay

SenangPay is a well-known payment gateway that provides Malaysian companies with a dependable and easy-to-use online transaction processing solution. SenangPay is well-known for its ease of use, enabling smooth transactions for both consumers and businesses. It accepts a number of payment options, including credit/debit cards, online banking, and payments using a mobile wallet. Because of the platform’s focus on user-friendliness, payments are processed smoothly, which makes it a desirable choice for companies of all sizes.

SenangPay places a high priority on security, using cutting-edge encryption techniques to safeguard private data while conducting transactions. Its compatibility with regional payment methods from Malaysia increases its attractiveness to companies doing business there. SenangPay continues to be a reliable partner for Malaysian companies looking for a safe and effective payment gateway in the ever-changing world of digital commerce thanks to its dedication to innovation and customer satisfaction.

57. QuickBooks Online

QuickBooks Online is a comprehensive and effective solution that helps businesses optimize their financial operations, including payment processing. Well-known for its accounting features, QuickBooks Online also includes a smooth payment gateway that lets companies take payments from credit/debit cards and bank transfers. Real-time updates on transactions and financial data are provided by the platform’s integration with payment processors, which streamlines the reconciliation procedure.

Businesses of all sizes can use QuickBooks Online because of its user-friendly interface, which enables them to manage payments, expenses, and invoices on a single, centralized platform. Users are reassured by its strong security features, which guarantee the safety of sensitive financial data. QuickBooks Online is a dependable and user-friendly option for companies looking for a full accounting solution with integrated payment processing. It is a powerful tool for financial management.

58. AlliedWallet

AlliedWallet has established itself as a top payment gateway by providing companies with an all-inclusive and safe online transaction management solution. Well-known for its extensive worldwide reach, AlliedWallet enables companies to serve a wide range of foreign clientele by supporting a variety of payment options, such as digital wallets, credit/debit cards, and other options. Both customers and merchants will have a smooth payment experience thanks to the platform’s user-friendly interface.

AlliedWallet prioritizes security, employing cutting-edge encryption techniques and fraud guards to protect private data while conducting transactions. AlliedWallet is scalable and flexible, making it appropriate for companies of all sizes. Its features can be customized to meet specific requirements. Businesses can make well-informed decisions with the help of the platform’s analytics and reporting tools, which provide insightful information about customer behavior and transaction data. In the ever-changing world of online commerce, AlliedWallet is a dependable, secure, feature-rich payment gateway with global capabilities for businesses.

59. Dwolla

Dwolla has cemented its standing as a trustworthy payment gateway by offering companies a dependable and cutting-edge way to handle online transactions. Dwolla’s platform, which is renowned for its efficiency and simplicity, makes it easy for users to send, receive, and handle payments. The platform is unique in that it focuses on ACH (Automated Clearing House) payments, which allows companies to facilitate bank transfers at a reduced cost per transaction.

Robust security measures implemented by Dwolla, such as encryption and adherence to industry standards, guarantee the safeguarding of confidential financial data throughout transactions. From start-ups to large corporations, Dwolla serves a diverse range of businesses with its user-friendly interface and developer-friendly API. In the constantly changing world of digital commerce, the platform is a desirable option for companies looking for a simple and affordable payment gateway solution because of its dedication to openness and affordability.

60. Skrill (Best Payment Gateways )

Skrill has become a well-known payment gateway by providing a dependable and effective online transaction platform to both individuals and businesses. Skrill, a well-known international payment provider, accepts numerous payment methods, such as bank transfers, credit/debit cards, and several local payment choices. The platform’s intuitive user interface guarantees a smooth payment process, making it easy for customers and merchants to navigate transactions.

Skrill prioritizes security, employing two-factor authentication and cutting-edge encryption techniques to safeguard private financial data while conducting transactions. Skrill’s cross-border functionalities enable businesses operating in various markets to conduct international transactions with ease. The platform’s dedication to innovation is demonstrated by its frequent updates and features, which address the changing demands of the world of digital commerce. Skrill is a dependable, secure, and easily scalable payment gateway that is ideal for businesses looking for such services.

61. Shift4

As a top payment gateway, Shift4 has established itself as a reliable and safe option for companies to handle online transactions. Shift4, a well-known company for its extensive payment processing platform, accepts a wide range of payment options, including digital wallets, credit/debit cards, and other alternatives. Both customers and merchants will have a smooth and effective payment experience thanks to the platform’s user-friendly interface.

Tokenization and point-to-point encryption are two of Shift4’s cutting-edge security features that protect sensitive payment data during transactions. Businesses of all sizes rely on Shift4 to handle transactions securely because of its emphasis on data security and adherence to industry standards. The platform provides businesses with valuable insights into transaction data and trends through its real-time reporting tools and integration capabilities. In the always changing world of online shopping, Shift4 is still a dependable, secure, and feature-rich payment gateway for customers.

62. Payeezy

Payeezy is a well-known and trustworthy payment gateway that provides companies with an all-inclusive online transaction processing solution. Payeezy, which is well-known for having an intuitive interface, guarantees that payments are processed quickly and easily for both customers and businesses. To accommodate a range of user preferences, the platform accepts a number of payment methods, such as digital wallets, credit/debit cards, and other options.

Payeezy stands out for having strong security protocols in place to protect sensitive data during transactions. These protocols include advanced encryption and fraud prevention tools. Payeezy is scalable and flexible, making it appropriate for companies of all sizes. Its features can be tailored to meet particular requirements. With the help of the platform’s real-time analytics and reporting features, businesses can make well-informed decisions by gaining insightful knowledge about transaction data and customer behavior. Payeezy is a dependable, secure, and feature-rich payment gateway that is highly adaptable for businesses operating in the ever-changing world of online commerce.

63. Google Pay

Google Pay has established itself as a leading payment gateway, providing users with a secure and convenient way to make online transactions. Renowned for its seamless integration across various platforms and devices, Google Pay enables users to make purchases with just a few taps. The platform supports a wide array of payment methods, including credit/debit cards and bank transfers, allowing for flexibility and ease of use.

Google Pay’s user-friendly interface and straightforward setup contribute to a smooth payment experience for both consumers and merchants. Security is a top priority, with advanced encryption and tokenization measures ensuring the protection of sensitive payment information. With its widespread acceptance and integration with numerous online retailers and services, Google Pay continues to be a popular and trusted choice for individuals and businesses seeking a reliable and efficient payment gateway in the digital age.

64. Visa Acceptance Solutions (CyberSource)

Visa Acceptance Solutions, powered by CyberSource, stands out as a premier payment gateway, providing businesses with a comprehensive and secure platform for managing online transactions. Renowned for its association with Visa, a globally recognized payment network, CyberSource offers a wide array of payment methods, including credit/debit cards, digital wallets, and alternative payment options. The platform’s user-friendly interface ensures a seamless payment experience for both merchants and customers.

What sets it apart is its robust fraud prevention tools and advanced security features, including tokenization and encryption, ensuring the highest standards of transaction security. Visa Acceptance Solutions is designed to accommodate businesses of all sizes, offering scalable and customizable features to meet specific needs. Its real-time reporting and analytics tools empower businesses with valuable insights into transaction data and customer behavior, facilitating informed decision-making. For businesses seeking a trusted, secure, and globally accessible payment gateway, Visa Acceptance Solutions (CyberSource) remains a top choice in the ever-evolving landscape of digital commerce.

65. Thryv (Best Payment Gateways )

Thryv distinguishes itself as a complete platform for business management with effective payment processing features. Thryv makes it easy for companies of all sizes to conduct online transactions with its user-friendly interface. The platform offers flexibility to both customers and merchants by supporting multiple payment methods, such as digital wallets and credit/debit cards. Businesses can handle payments, customer interactions, and other crucial operational aspects on a single, centralized platform thanks to Thryv’s integrated approach.

The platform’s focus on automation and user-friendliness expedites payment procedures, giving users a seamless and effective experience. Transactions involving sensitive payment information are protected thanks to Thryv’s dedication to security. Thryv is a dependable and versatile choice in the field of business management platforms for companies looking for a single solution that integrates payment processing with other crucial business operations.

66. Fiserv (First Data) – ICICI Merchant Services

Fiserv, in collaboration with ICICI Merchant Services, represents a formidable force in the realm of payment gateways, providing businesses with a robust and versatile solution for managing online transactions. Leveraging the expertise of Fiserv and the expansive reach of ICICI Merchant Services, this partnership delivers a comprehensive platform that supports various payment methods, including credit/debit cards, digital wallets, and net banking. The integration of Fiserv’s technology with ICICI’s banking capabilities ensures a seamless and secure payment experience for both merchants and customers.

The platform’s user-friendly interface and scalable features cater to businesses of different sizes, offering customization to meet specific needs. With a strong commitment to security, Fiserv – ICICI Merchant Services employs advanced encryption and fraud prevention measures, ensuring the confidentiality of sensitive payment information. For businesses seeking a reliable, secure, and well-established payment gateway, Fiserv (First Data) – ICICI Merchant Services stands out as a trusted and comprehensive solution in the competitive landscape of digital commerce.

67. Paddle

Paddle has become a major force in the payment gateway market, providing businesses involved in online sales with a cutting-edge and effective solution. Paddle is well-known for its intuitive platform, which makes online transactions easier for both consumers and businesses. The platform offers flexibility and convenience by supporting multiple payment methods, such as digital wallets and credit/debit cards.

Paddle’s distinctive value proposition is rooted in its comprehensive approach, which includes payment processing along with handling other essential aspects for digital product businesses such as subscription management and licensing. The platform’s advanced encryption measures and adherence to industry standards demonstrate its commitment to security. In the ever-changing world of online commerce, Paddle is a reliable and valuable payment gateway because it meets the needs of digital product sellers with an emphasis on innovation and extensive features.

68. Opayo by Elavon

Strong and dependable, Opayo by Elavon is a payment gateway that offers companies an all-inclusive online transaction management solution. Opayo, a well-known company with an intuitive UI, makes payments easier for both customers and businesses. To accommodate a range of user preferences, the platform accepts a number of payment methods, such as digital wallets, credit/debit cards, and other options. By integrating with Elavon, a reputable worldwide provider of payment solutions, Opayo expands its reach and credibility.

Opayo places a high premium on security, and to protect sensitive payment information during transactions, it employs cutting-edge encryption and fraud prevention techniques. Opayo’s versatility and scalability enable it to serve companies of all sizes by providing features that can be tailored to meet particular requirements. Businesses can make well-informed decisions with the help of the platform’s real-time reporting and analytics tools, which give them insightful knowledge about transaction data and customer behavior. In the highly competitive world of online commerce, Opayo by Elavon continues to be a top option for companies looking for a reliable, secure, and feature-rich payment gateway.

69. Alviere Hive

Among the top platforms, Alviere Hive provides a wide selection of the finest payment gateways to make financial transactions easier for companies of all kinds. Alviere Hive incorporates premium payment gateways with a dedication to efficiency and security, guaranteeing safe and easy transactions.

Alviere Hive supports a variety of payment methods, including credit card, online banking, and digital wallet transactions, ensuring a simple and convenient experience for both customers and businesses. The platform places a high priority on dependability, making sure that companies can rely on Alviere Hive’s strong infrastructure for their payment processing needs. Alviere Hive is at the forefront of a quickly changing digital landscape, giving businesses the resources they need to succeed in the cutthroat online market.

70. CARDZ3N (Best Payment Gateways )

When it comes to payment gateways, CARDZ3N stands out as a great option because it provides a full range of services that completely change the way businesses conduct financial transactions. Known for its creative thinking and dedication to user-friendly solutions, CARDZ3N combines the top payment gateways to provide a safe and easy payment process. Processing credit cards, making payments via smartphone, or using e-wallets,