I’ll talk about the Top New AI-Powered Crypto Exchanges in this post, which are revolutionizing the way traders purchase, sell, and handle digital assets.

These platforms optimize tactics, improve market insights, and assist users in making more informed investing decisions by combining sophisticated artificial intelligence technologies, predictive analytics, and automated trading bots. The future of cryptocurrency trading is being shaped by AI-driven exchanges, regardless of your level of experience.

Why Choose New AI-Powered Crypto Exchanges

Innovative AI trading instruments– These exchanges have automated trading bots, intelligent order execution, and predictive analytics which assist in increasing profits by reducing human error.

Rapid analysis of Market AI for crypto– AI can analyze enormous quantities of market data in real time. That last sentence of yours, AI can be used to analyze massive quantities of market data as well as automated trading, and can accelerate trading.

AI assists both beginners and advanced traders– AI can assist the trading professional in creating the optimum strategy and for the layman in creating the optimum strategy.

Minimizing losses and better portfolio management– This can be achieved by the application of predictive analytics.

AI for crypto makes life easier– AI assists in eliminating repetitive tasks, thus allowing the trader to complete more trades as well as allowing for rapid portfolio balance adjustments and decision making.

Benefits Of New AI-Powered Crypto Exchanges

Automated Trading- Artificial intelligence installs automated purchases, sales, and strategy executions, giving the user a large amount of time and effort savings.

Improved Accuracy- Enhanced portfolio management refers to artificial intelligence tools which assist in the monitoring, reallocation, and optimization of investments.

Accessibility for Beginners– Simplified tools of artificial intelligence make advanced trading strategies easy to practice for a beginner.

Data Driven Insights- Trading signals and market data predictions are formed through Artificial intelligence.

Cost Efficiency- Unnecessary trading losses and fees may be decreased by automated strategies.

Best New AI-Powered Crypto Exchanges & Key Points

- Binance AI Exchange Hub – Offers AI-driven trading signals and market insights for smarter decisions.

- Coinbase AI Advanced – Provides AI tools for portfolio optimization and predictive analytics.

- Kraken AI Insights – Uses AI to analyze trends and enhance trading strategies.

- Bybit AI Trade Engine – AI-powered engine for automated and efficient crypto trading.

- OKX AI Predictive Exchange – Predicts market movements using advanced AI algorithms.

- KuCoin AI Smart Trade – Integrates AI to execute trades and minimize risks.

- Bitstamp AI Hub – AI tools for real-time analytics and smarter trade execution.

- Gemini AI Exchange – Leverages AI for market forecasting and portfolio management.

- Huobi AI Global – Global AI insights to optimize trading across multiple markets.

- Gate.io AI Exchange – Uses AI to enhance trading efficiency and detect market patterns.

Best New AI-Powered Crypto Exchanges

1. Binance AI Exchange Hub

Founded by Changpeng Zhao in 2017, Binance is the biggest cryptocurrency exchange globally in terms of trading volume and a pioneer in incorporating AI-powered technologies such as analytics, smart bots, and predictive order execution.

With discounts using Binance Coin (BNB) and VIP tier reductions, Binance’s spot trading fees start at about 0.10 percent (maker/taker). On USD♈‑M contracts, futures fees can be as low as 0.02% (maker) and 0.04–0.05% (taker). Binance is a global center for sophisticated algorithmic cryptocurrency trading, thanks to AI-powered trading bots and analytics that automate user tactics and price forecasts.

Binance AI Exchange Hub Features

- AI‑Assisted Trading Bots ‑ Bots executed strategies based on the appropriate signals of the market.

- Smart Order Routing ‑ AI routing to optimal liquidity ponds enhances order execution.

- Advanced Analytics ‑ Provision of predictive indicators and potential trading trends.

- Low Fee Structure ‑ BNB discounts and maker/taker fees are some of the most competitive.

- Deep Liquidity Pools ‑ High volume of trading enables seamless execution and trading.

Binance AI Exchange Hub

| Benefits | Drawbacks |

|---|---|

| High‑performance AI analytics and bot tools for automated strategies. | Complex features may overwhelm beginners. |

| Very low trading fees, especially with BNB discounts. | Heavy platform with many options can be confusing. |

| Deep liquidity for quick execution and larger trades. | High demand periods can still cause volatility and slippage. |

| Large community and ecosystem for advice/support. | AI tools may require manual fine‑tuning for best results. |

| Continuous innovation and updates. | Regulatory challenges in some regions can restrict access. |

2. Coinbase AI Advanced

Founded in 2012 by Brian Armstrong and Fred Ehrsam in San Francisco, Coinbase has grown beyond simple exchange services to include AI-powered features like a robo-advisor and AI-driven market data. For makers/takers with additional spreads and service fees on ordinary tiers, Coinbase’s fees are typically greater than 0.5% because it is a publicly traded U.S. exchange.

With lower cost tiers and greater liquidity, the Coinbase Advanced platform caters to experienced traders. Instead of fully automated trading, AI integration concentrates on analytics and automated guidance. Coinbase is well-liked because of its solid institutional trust and regulatory compliance.

Coinbase AI Advanced Features

- AI Market Insights ‑ AI interpreted data trends.

- Automated Guidance ‑ AI suggestions for holding a stock or rebalancing.

- Professional Charting Interface ‑ High end visuals for advanced market analysis.

- Regulatory Safeguards ‑ U.S. compliance and security on custodians.

- Tiered Fees for Active Traders. Advanced platform tiers have reduced fees.

Coinbase AI Advanced

| Benefits | Drawbacks |

|---|---|

| Clean, regulated environment with strong security. | Higher fees compared to many global competitors. |

| AI insights help users understand market trends. | AI trading automation is less fully featured than some rivals. |

| Easy interface great for intermediate traders. | Limited advanced bot customization. |

| Strong compliance and institutional credibility. | AI features may feel basic for pros. |

| Integrated custody and insurance options. | Not ideal for high‑frequency trading. |

3. Kraken AI Insights

One of the oldest and safest exchanges, Kraken was established in 2011 and is renowned for its expert tools and strong risk management. Kraken offers advanced features like AI-assisted analytics to help predict market moves, and its regular trading fees for spot and futures are slightly higher (~0.16–0.26% maker/taker), though they can go down for high-volume traders.

For risk-averse traders who value dependability over the lowest cost, its AI insights are incorporated into Kraken Pro tools and portfolio suggestions, providing traders with improved decision support while preserving institutional-grade custody services.

Kraken AI Insights Features

- Market Prophecy – AI-generated algorithms can drive price movements.

- Risk Averse – Tools and analytics for cautious strategies and portfolio construction.

- Pro-Grage API – Custom software integration for algo traders.

- Impenetrable Security – Leading security protocol for cold storage, and proof-of-reserve systems to fortify security.

- Volume Based Tiered Fee Discounts – Fee discounts based on higher trading volume.

Kraken AI Insights

| Benefits | Drawbacks |

|---|---|

| Advanced predictive tools align with risk‑aware strategies. | Fees can be higher than low‑cost exchanges. |

| Stable, secure platform with long market history. | Less intuitive UI for beginners. |

| Good API for algorithmic traders. | AI tools are more analytical than fully automated. |

| Tiered fee discounts reward high volume. | Fewer bot templates compared to competitors. |

| Strong regulatory compliance in several regions. | Customer support can be slower under load. |

4. Bybit AI Trade Engine

Since its 2018 introduction, Bybit has quickly become one of the leading platforms for advanced trading and derivatives, providing AI-enhanced smart order routing, AI signal bots, and predictive analytics.

The exchange’s fees vary depending on the asset, although they typically range from ~0.1% for spot plus variable derivatives fees, with VIP volume traders receiving deeper discounts.

With a community focus on derivative innovation, Bybit’s AI Trade Engine helps traders optimize entries across spot, futures, and perpetual markets by balancing speed, liquidity, and execution precision through the use of machine-learning signals and automated bot techniques.

Bybit AI Trade Engine Features

- AI Trade Signals – for entry and exits.

- Intelligent Execution – AI enhances optimal trading and minimizes slippage.

- Cross Asset Capabilities – Bots for trading in spot, futures, and perpetual markets.

- Fee Discount – Higher trading volume and derivatives come with lesser costs.

- Bot Library – Ready to use bots for hands off trading.

Bybit AI Trade Engine

| Benefits | Drawbacks |

|---|---|

| Smart execution reduces slippage and improves entries. | Derivatives focus may increase risk for novices. |

| AI trade signals add guidance for decision‑making. | More complex interface than basic exchanges. |

| Cross‑market support (spot + futures). | Fees still significant for low‑volume traders. |

| Competitive promotions and VIP programs. | Rapid innovation can lead to feature churn. |

| Prebuilt bot library simplifies automation. | Bots still require supervision. |

5. OKX AI Predictive Exchange

Founded in 2017, OKX is a global exchange that integrates decentralized finance (DeFi), futures, and spot markets extensively. With discounts for large volume or native OKB token holders, the standard trading fees are roughly 0.14% for makers and 0.23% for takers.

Smart grid bots, DCA automation, and predictive analytics are examples of AI-connected technologies that improve order execution and market movement assessment. Both novice and expert traders can benefit from OKX’s prediction tools, which strike a balance between competitive fee structures, automated strategy features, and wide access to cryptocurrency assets.

OKX AI Predictive Exchange Features

- Grid & DCA Bots – AI enabled smart grids and DCA bots.

- Predictive Signals – Systems that anticipate movements in the immediate future.

- Access to Multiple Markets – Includes trading in spot, options, and futures.

- OKB Token Rewards – Fee rebates for trading with the native token.

- Sync on Mobile + Web – Full access to AI tools on all devices.

OKX AI Predictive Exchange

| Benefits | Drawbacks |

|---|---|

| Predictive indicators assist in timing trades. | Accuracy of predictions can vary with market regimes. |

| Strong suite of automated bots (grid, DCA). | More suited to experienced traders. |

| Multi‑market support including options and futures. | Can be overwhelming for newcomers. |

| Fee rewards for native token holders. | Native token exposure may add complexity. |

| Mobile + web tool consistency. | Heavy data visualization might confuse some users. |

6. KuCoin AI Smart Trade

Founded in 2017, KuCoin offers a large asset portfolio, one of the lowest average trading fees in the business, and services to over 40 million users. Its AI Smart Trade feature helps customers manage their portfolios and execute trades effectively by using automated strategies and algorithmic bots.

Additionally, KuCoin offers a variety of market scanners, analytical tools, and AI-assisted trading bots that are intended to streamline decision-making and enhance risk management. KuCoin is well-liked by both novice and expert users looking for intelligent automation because of its robust tokenomics, regulatory expansion, and bot-creation features.

KuCoin AI Smart Trade Features

- Intelligent Trade Orders – Orders with enhanced execution by AI.

- Bots – Automated strategies for trading that can be set by the user.

- Trading Costs – Low costs for spot trading and marginal trading in the industry.

- Portfolio Adivisor – Suggestions by AI to diversify the portfolio.

- 5. Wide Token Listings – A variety of assets for bot strategies.

KuCoin AI Smart Trade

| Benefits | Drawbacks |

|---|---|

| Low trading fees benefit frequent traders. | Security concerns in some regions. |

| Customizable bots for diversified strategies. | Some bots require manual oversight. |

| Strong portfolio planning tools. | Customer service experiences vary. |

| Wide asset listings – more opportunity sets. | Too many options can clutter interface. |

| User‑friendly automated targeting. | Advanced features require learning curve. |

7. Bitstamp AI Hub

One of the oldest exchanges, Bitstamp was established in 2013 and places a strong emphasis on dependability and legal compliance. Traditional fees are generally trusted for fiat on-ramps and institutional-grade services, but they can reach higher levels (often 0.25 to 0.50% or more on regular orders).

Bitstamp is appropriate for conservative investors who value legacy infrastructure and compliance, even though its AI-specific capabilities are more limited than those of more recent platforms. This is because Bitstamp’s API integrates with some third-party AI tools and predictive analytics for algorithmic strategies.

Bitstamp AI Hub Features

- API Integration – Works with external AI trading and analytics integrations.

- Reliable Order Book – Deep liquidity for key assets.

- Institutional Grade Custody – Storage with respect to security and compliance.

- Fiat Support – Multiple options for fiat to crypto on ramps.

- Simplified UI – A low complexity UI for users to utilize AI insights easily.

Bitstamp AI Hub

| Benefits | Drawbacks |

|---|---|

| Strong regulatory compliance and security. | Higher fees than low‑cost competitors. |

| Reliable order book and execution. | Less built‑in AI automation compared to others. |

| Suitable for fiat onboarding and basic trading. | Limited bot strategies native to platform. |

| Works well with third‑party AI tools via API. | Reliance on external tools can add complexity. |

| Simple experience for casual investors. | Not ideal for high‑frequency automated traders. |

8. Gemini AI Exchange

Targeting institutional and retail traders in regulated markets, Gemini was founded in 2014 by the Winklevoss twins and is renowned for its outstanding regulatory compliance and security. Depending on volume and service type, its fees range from modest to high, often at least 0.35%.

Instead than just automating trading, Gemini’s AI efforts aim to improve analytics, automated investment advice, and user insights. It appeals to risk-averse cryptocurrency investors because of its well-organized connections with insured custody and compliance frameworks.

Gemini AI Exchange Features

- AI‑Enhanced Insights – Recommendations for AI driven investment choices.

- Strong Compliance – Focus on market regulations and safety.

- Insured Custody – Asset coverage for loss and breach

- Structured Products – AI assistance for the modeling of complex products.

- Clear Fee Breakdown – User fee visibility.

Gemini AI Exchange

| Benefits | Drawbacks |

|---|---|

| High security with insured custody options. | Fees can be higher than many global players. |

| AI insights help with strategy and planning. | Limited advanced trading features relative to AI‑focused rivals. |

| Strong compliance footprint in regulated markets. | Slower innovation pace due to regulatory environment. |

| Trusted for institutional participation. | Less competitive on margin and derivative features. |

| Clear reporting and transparency. | AI tools are more analytical support than automation. |

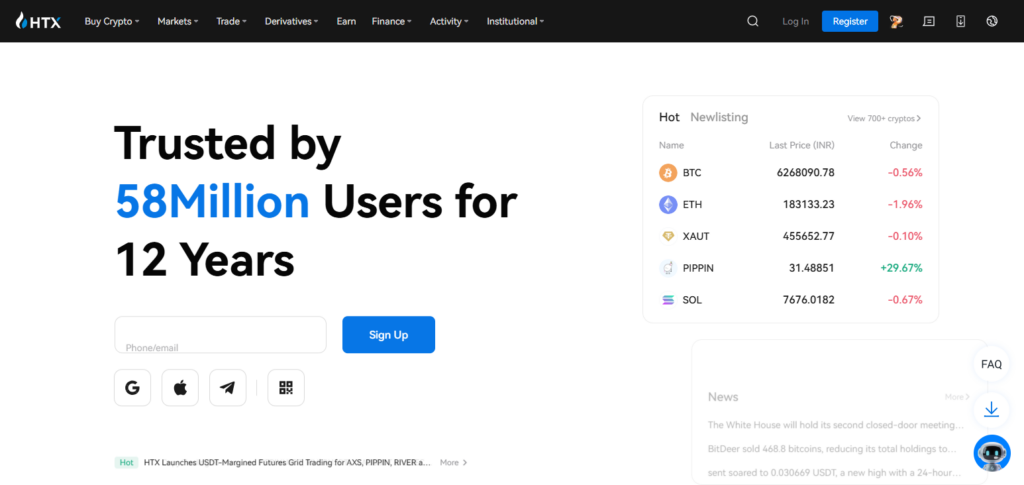

9. Huobi AI Global

Established in 2013, Huobi is still a significant international exchange that provides a wide range of assets along with AI-enhanced trading bots and market forecasting tools. Spot costs typically range from 0.2% to 2%, with futures and margin differing according to user tier.

Its AI solutions aid in automating price signals and tactics for more effective market execution. Although some regional services have been hindered by regulatory barriers, Huobi’s global reach and range of products make it a flexible option for traders wishing to combine automated insights with well-known trading tools.

Huobi AI Global Features

- AI-Ready Bot Systems – Systems for the execution of automated strategies.

- Global Asset Access – Extensive trading pairs.

- Multi-Layer Security – Robust security measures for accounts and APIs.

- Flexible Leverage Options – Tools for margin and futures trading.

- Forecast Models – AI pricing predictions.

Huobi AI Global

| Benefits | Drawbacks |

|---|---|

| Broad asset support with AI bot options. | Regulatory limitations in some countries. |

| Flexible leverage and margin strategies. | Fee structures can be confusing to new users. |

| Forecasting tools help evaluate trends. | Accuracy of predictions can vary widely. |

| Multi‑market trading features. | Complex interface for beginners. |

| Long‑established global presence. | Support quality varies by region. |

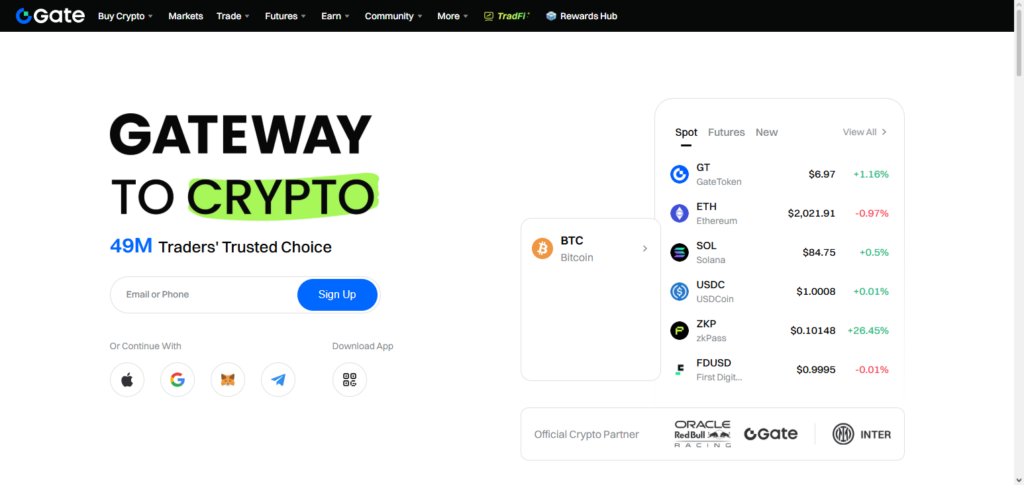

10. Gate.io AI Exchange

Founded in 2013, Gate.io is a full-featured exchange that offers spot, futures, margin, and blockchain services. The trading fees offered by Gate.io vary by market pair and volume level and are in line with industry norms. The platform provides automated tools and AI bots to help with portfolio management and order placing.

Despite its sometimes complicated interface, Gate.io’s combination of AI-assisted tactics and extensive token listings appeals to traders who are interested in specialized assets and automated strategy testing, providing flexibility across volatile cryptocurrency marketplaces.

Gate.io AI Exchange Features

- Automated Trading Bots – Bots for trend and grid strategies.

- Wide Token Accessibility – Substantial altcoin listings for AI resources.

- Backtesting Advanced Strategies – Past simulation for bot efficacy.

- AI Triggered Custom Alerts – Alerts for specified pricing/whipsaws.

- Fee Structure Flexibility – Incentives for wholescale and patronage.

Gate.io AI Exchange

| Benefits | Drawbacks |

|---|---|

| Extensive bot and automation options. | Interface is complex for new users. |

| Supports many token pairs and niche assets. | Risk of low liquidity in deep altcoin markets. |

| Backtesting capabilities help improve strategies. | Backtesting can give false confidence in volatile markets. |

| Custom alerts enhance monitoring. | Alerts may trigger too frequently in choppy markets. |

| Fee discounts for loyalty and volume. | Platform depth can be overwhelming. |

Conclusion

In conclusion, by fusing automation, predictive analytics, and intelligent tools to improve trading efficiency and decision-making, the Best New AI-Powered Crypto Exchanges are transforming the cryptocurrency trading scene.

They give traders of all skill levels the opportunity to implement strategies more quickly, lower risks, and obtain a greater understanding of the market. These exchanges shape the future of cryptocurrency investment and guarantee users can stay ahead in the extremely dynamic digital asset market by enabling AI-powered features like automated bots, real-time predictions, and portfolio optimization.

FAQ

What are AI-powered crypto exchanges?

AI-powered crypto exchanges integrate artificial intelligence tools, such as trading bots, predictive analytics, and automated strategies, to help traders make data-driven decisions, optimize trades, and manage portfolios efficiently.

Who can use AI-powered crypto exchanges?

Both beginners and professional traders can use them. Beginners benefit from automated tools and simplified trading, while professionals can leverage advanced AI insights and custom strategies.

Are AI-powered exchanges safe?

Reputable AI exchanges like Binance, Kraken, and Coinbase follow strict security and regulatory standards, including cold storage, two-factor authentication, and compliance measures.

Do AI-powered exchanges reduce trading risks?

Yes, AI can minimize risks by analyzing market trends, forecasting price movements, and automating trades to avoid emotional decision-making. However, market volatility can still affect outcomes.