In this article, I will discuss the best crypto AI tools in 2025. As the cryptocurrency market continues to evolve, AI-driven tools have become essential for traders seeking accurate insights, automation, and strategic advantages.

These tools offer real-time data analysis, portfolio management, and innovative trading strategies, making them invaluable for navigating the complex crypto landscape and maximizing investment returns.

Key Points & Best Crypto Ai Tools In 2025 List

| Tool Name | Key Features |

|---|---|

| CryptoHawk AI | Market predictions, automated trading signals, sentiment analysis. |

| AI CryptoBot | AI-powered trading bot with risk management and customizable strategies. |

| DeepTrade Analytics | Advanced market analysis with AI, pattern recognition, and predictive analytics. |

| SingularityDAO | Decentralized asset management with AI for managing tokenized baskets. |

| TokenMetrics AI | AI-driven crypto investment research, portfolio recommendations, and price analysis. |

| NapBots | Pre-programmed AI strategies for automated crypto trading. |

| CoinPredict AI | AI-based crypto price prediction and forecasting. |

| Kryll.io AI | User-friendly platform for creating AI-powered trading strategies. |

| 3Commas AI | AI-enhanced portfolio management, smart trading terminals, and bots. |

| Fetch.ai | Decentralized AI solutions for blockchain applications and data sharing. |

| Trality AI | Advanced coding platform for creating AI trading bots. |

| Coinrule AI | Automation of trading rules powered by AI for 24/7 market monitoring. |

| CryptoHero AI | Free AI-driven trading bot with multi-exchange compatibility. |

| AI-Predictor Pro | Comprehensive crypto market prediction models and sentiment analysis. |

| TradeSanta AI | Cloud-based AI trading bot for beginners and experienced traders. |

| Numerai Crypto AI | AI-driven hedge fund model integrating blockchain data for trading. |

| Stoic AI | Long-term investment automation with AI risk-balancing. |

| Bitsgap AI | AI-powered arbitrage tools and portfolio management. |

| CryptoMood AI | Market sentiment analysis using AI to track news and social trends. |

| Covesting AI | AI tools for social trading, copy-trading, and portfolio optimization. |

20 Best Crypto Ai Tools In 2025

1.CryptoHawk AI

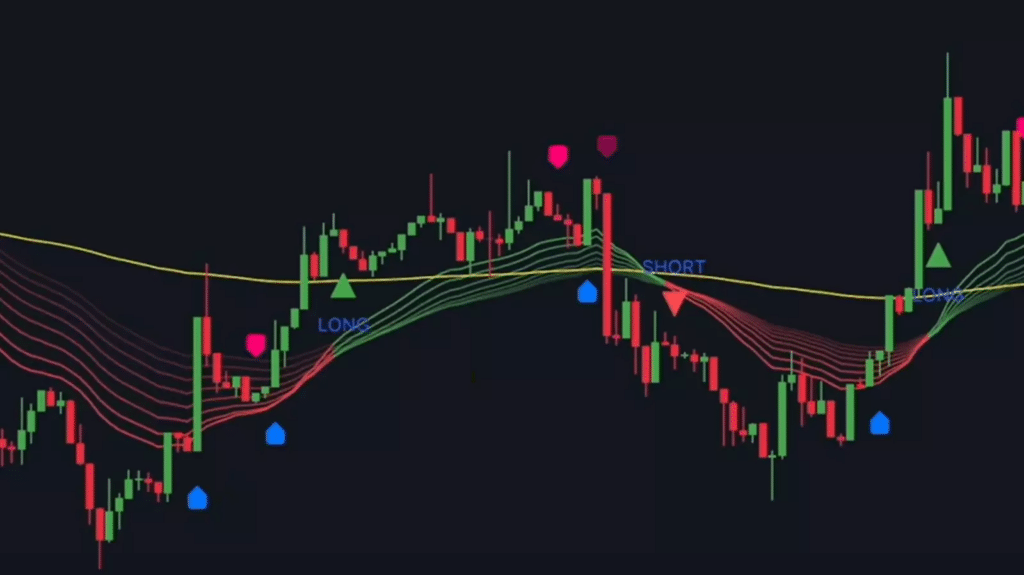

In the year 2025, one of the best AI tools for crypto traders is CryptoHawk AI. This AI offers traders with advanced market forecasts, predesigned trading signals and sentiment analysis.

All of this helps traders make optimal decisions. Due to its AI supported algorithms, CryptoHawk AI provides the accuracy and effectiveness making it an essential component for the increasingly volatile world of cryptocurrency.

Pros And Cons CryptoHawk AI

Pros:

- Includes timely and relevant market forecasts which help traders in their operations.

- Uses smart algorithms making it possible to generate signals with great precision.

- Very interesting user interfaces for both novice and expert traders are provided.

- It has detailed sentiment analysis in order to assess the prevailing mood in the market.

- For the users, automated trading functionalities reduce time and effort used.

Cons:

- There may be or are subscription costs to ‘unlock’ some advanced features.

- When algorithm dependence is high, losses might be encountered unexpectedly.

- Few degrees of freedom to tailor make one’s trading parameters to meet preferences.

- Owner of the account must stay logged in and connected at all times.

- Markets are very volatile which raises the question of how correct the predictions are.

2.AI CryptoBot

CryptoBot, at its peak in 2025, is regarded as one of the most advanced crypto AI trading bots in the market.

This AI trading bot uses advanced algorithms, automates operational strategies and performs trading in the most efficient manner considering the risks involved.

AI CryptoBot also provides tailor-made features, conducts a comprehensive analysis of the market in real-time and flawlessly trades

Which makes AI CryptoBot an excellent assistant for beginners and experienced traders alike.

Pros And Cons AI CryptoBot

Pros:

- Permite adoptar diferentes estrategias de trading adaptables a diferentes usuarios.

- Permite a los usuarios comerciar en múltiples intercambios de criptomonedas.

- Toma decisiones y analiza tendencias de manera más eficiente a través del uso de tecnología avanzada.

- Permits more than one task to be performed by one automated program that requires no human guesswork.

- People can maximize their risk management thanks to built-in features.

Cons:

- Initially set up involves setting high costs or premium subscription features.

- Effectiveness will vary depending on market conditions and the strategy that was chosen.

- Must have a technical understanding and ability to fully optimize and manage.

- Risk of excessive dependence which would result in poor manual trading performance.

- Created to function via the internet may be affected by network issues or technical errors.

3.DeepTrade Analytics

DeepTrade Analytics is expected to be one of the top crypto AI tools by 2025. It allows users to create AI-enhanced smart contract-based trading systems containing technical and fundamental market analysis as well as various forecasting models and patterns.

With the help of algorithmic strategies featuring DeepTrade Analytics, traders can grasp the ever-evolving world of crypto trading while spotting potential opportunities and efficiently controlling risk.

Pros And Cons DeepTrade Analytics

Pros:

- AI and Data generated predictions concerning the market and its possible changes are also provided.

- Advanced COT and TMS with unique DPA for automatic scanning of the market and identifying the most suitable time & price to enter or exit trades.

- Real-time data helps the traders make logical, less emotional decisions.

- Good dashboards & intuitive UI designed for easy navigation around the platform.

- Provides a variety of technical indicators for day trading as well as trend analyzing.

Cons:

- Users may not be able to access all the features without the need of paying or subscribing.

- There are no effective learning materials available for novices aiming to get familiar with advanced study tools.

- As with most systems of this type, its performance is highly reliant on the predictive algorithms that have been implemented into formulary/extractive content.

- Different data sources may generate different results because of rapid market fluctuations.

- Practice or Patience is necessary when researching the different strategies available to avoid becoming too dependent.

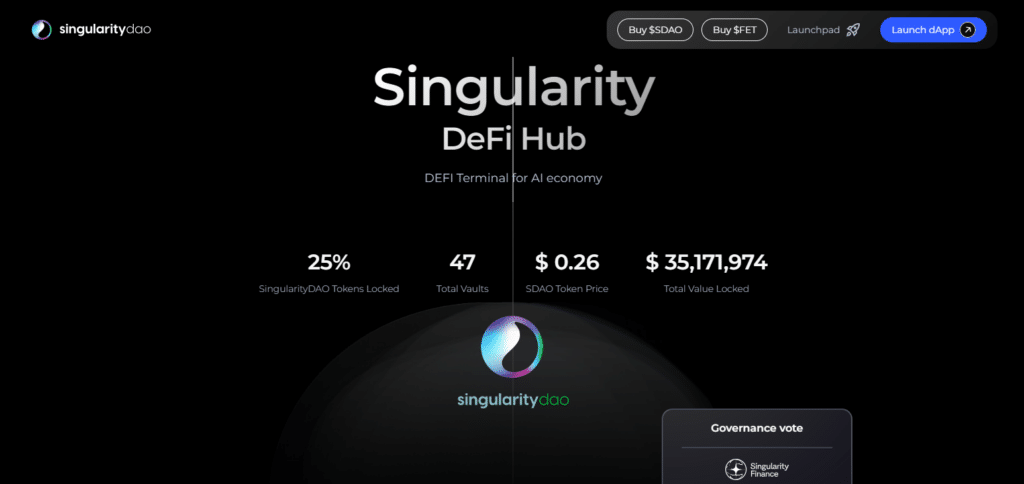

4.SingularityDAO

According to forecasts, SingularityDAO may be one of the most robust AI networks in the digital currency space.

This advanced system employs AI for the management of tokenized asset baskets, increasing the value while balancing security.

Thanks to its decentralized and AI-based solutions, users of SingularityDAO can easily maneuver

Through the increasing intricacies of the cryptoeconomics while aiming for more returns on their investments.

Pros And Cons SingularityDAO

Pros:

- Increases the possibilities of using AI for portfolio asset management and investment strategy development.

- Eliminates a centralized authority over the management activities.

- Souses new risk management systems to reduce probabilities of losses.

- Implements AI-based BDA to track market developments and support decision making.

- Provides automated tokenized baskets and effortless diversification.

Cons:

- Might be difficult for newcomers with no previous exposure to decentralized finance.

- Use of AI based algorithms may under certain circumstances not perform consistently.

- Awaits broader usage and application beyond blockchain knowledgeable individuals.

- May be subject to network bottleneck or blockchain technology growth constraints.

- Smart contract vulnerabilities are possible and form a security threat.

5.TokenMetrics AI

Crypto AI tools can come in handy as the market progresses, Many tools help to report investment research like predictions catered to your portfolio.

TokenMetrics AI is one of the tools out there and can be one of the best from 2025. Offering price prognostics

This platform analyses current market trends and assists in portfolio maximization. This allows traders and investors equipped

With AI-based technology and an array of support tools to navigate through the fast-changing world of cryptocurrency trade.

Pros And Cons TokenMetrics AI

Pros:

- Provides extensive investment research and analysis coupled with AI-driven insights.

- Delivers useful in-depth information relating to token metrics which promotes smart investment decisions.

- Employs machine learning algorithms to forecast the trends of the market and movement of prices.

Cons:

- Suscribers need to either get a subscription or a paid plan to access the entire features and functionalities.

- Predictive analytics may demonstrate different results in different times due to the influence of market and external conditions.

- Probably not ideal for the users who only look for automatic trading.

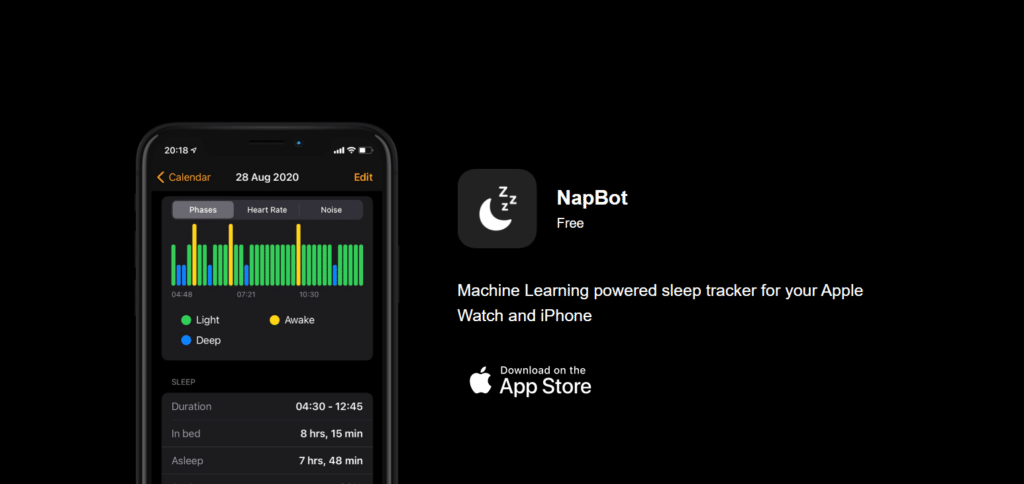

6.NapBots

NapBots is expected to be one of the finest AI tools for cryptocurrency in 2025. Cryptobots have automated AI crypto trading bots with several strategies.

Traders can use NapBots’s interface which contains risk management features and the company’s service operates 24/7

Which makes it easy for traders to effectively use their strategies and take advantage of the rapid changes in the cryptocurrency market.

Pros And Cons NapBots

Pros:

- It has pre-made automated trading strategies that anyone can set up and easily configure.

- It allows for trades on many different exchanges involving various cryptocurrency which improve liquidity.

- It’s easy to trade automated in the application as it has an intuitive design.

Cons:

- A freak turn of events and abnormal liquidity in the market can do a lot of harm to the performance.

- People cannot create the most optimal strategies because the options for personalization are sparse.

- The application is always working in the live mode and the internet connection is needed always.

- The over-dependence of trades on the automated strategies takes away most of the manual trading abilities.

7.CoinPredict AI

In 2025, CoinPredict AI has been regarded as one of the best platforms for providing crypto AI tools.

The platform has an AI module focused on price predictions that allow traders to have reasonably correct predictions and knowledge about the market trends.

With a variety of algorithms and real-time data, CoinPredict AI assists its customers in predicting patterns and trends which will expand their business performance in the volatile world of cryptocurrencies.

Pros And Cons CoinPredict AI

Pros:

- Predicts pricing using modern machine learning capabilities.

- Processes lots of historical and present data for more informed decisions.

- Has a user-friendly interface designed for both novice and professional trader levels.

- Delivers fresh updates regularly to market participants to reflect the latest developments.

Cons:

- Due to volatility in the market, predictions are speculative and can be inaccurate most times.

- Defined by user inputs, less feature for building precise prediction models.

- Some services including advanced ones may be behind a paywall.

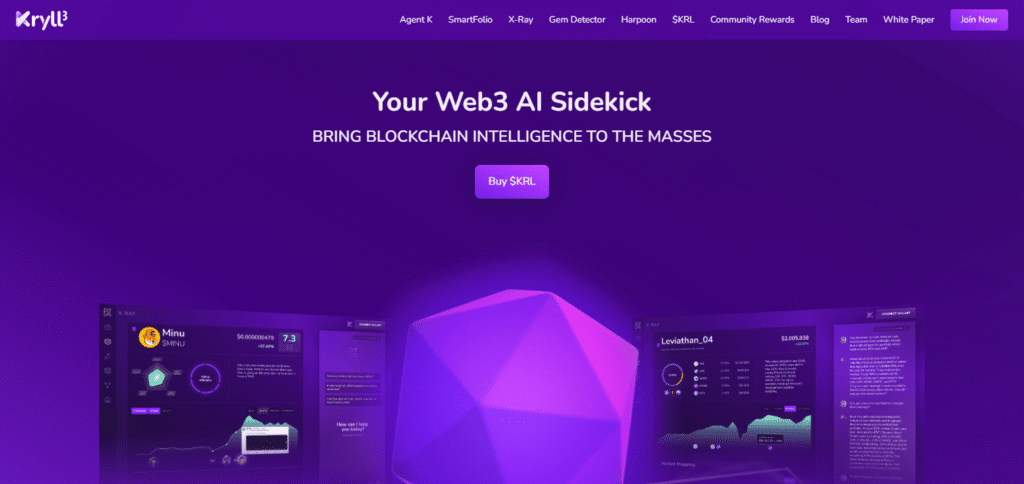

8.Kryll.io AI

Kryll.io AI, сreation as the world’s pioneering crypto AI tools in 2025. This platform provides users with the ability to build and implement AI-based trading strategies, which is very convenient.

Kryll.io AI provides for automation, market analysis, back testing and any other activities required by a trader interested in optimizing efficiency in cryptocurrency business engagements.

Pros And Cons Kryll.io AI

Pros:

- Provides users with a visual interface where they can drag and drop different components to build up their own custom trading strategies.

- Makes it possible to tackle backtesting for better measures before actual real-time deployment of the plans.

- Offers connectivity with leading exchanges without any hassle making it easier to trade flexibly.

- Has a platform in place for shares and accessing trading strategies developed by other community members.

- Comes with enhanced analytic tools to track strategy effectiveness and adjust them accordingly with the information gained.

Cons:

- To use the full features available, the user could either subscribe or buy credits.

- The application could be difficult for those who have never created and implemented strategies to use.

- Strategies can be expected to break or be inconsistent during periods of extreme volatility in the market.

- Very little automated help is available for the more advanced kind of trading or for really advanced algorithms.

- Since such a strategy will be internet dependent, disruption of internet access will affect the final working of the strategy.

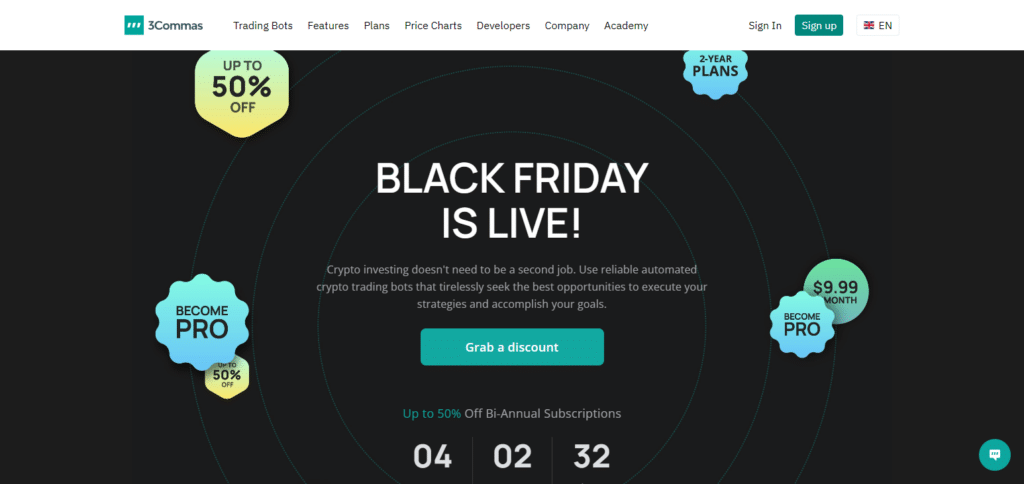

9.3Commas AI

As of 2025, the crypto AI tools space will be substantially enhanced with tools including the 3Commas AI.

As an all-in-one solution offering portfolio management, smart trading terminals and automated bots, the platform boosts efficiency whichever way it’s used.

Helping customers make the best of complex strategies, 3Commas AI helps traders maximize profits, reduces risks and places trades smoothly in a turbulent cryptocurrency environment.

Pros And Cons 3Commas AI

Pros:

- There is a variety of trading bots and tools for different automated trading strategies.

- Allows for portfolio management which lets users track and manage their assets efficiently.

- Available on different cryptocurrency exchanges for easy trading.

- Allows for smart trading such as stop-loss and take profit which helps reduce risks.

- Offers a clean interface which is easy to navigate for both beginners and expert traders.

Cons:

- Most of the time, to enjoy the full capabilities, a monthly fee is necessary to unlock premium features.

- A bit complicated for people who are not used to automated trading solutions.

- Pre-set trading strategies have limited customization options available.

- Technical issues or downtime may be faced during times of very high volatility.

- The performance may be affected by the volatility and reliability of third-party exchanges.

10.Fetch.ai

Fetch.ai is one of the best crypto AI tools as it contains unrivaled features in 2025. This is a decentralised system that uses AI technology for developing independent economic agents for blockchain application.

By incorporating Fetch.ai, users’ improved economic possibilities are optimized through efficient data exchange, automatic decision making, and cross-industry integration on decentralized networks.

Pros And Cons Fetch.ai

Pros:

- The project creates decentralized autonomous economic agents through blockchain and AI.

- Makes data exchange over decentralised networks quick and safe.

- Supports the automation of business processes via smart contract technologies.

- Provides unique efficiency improvements for supply chain and logistics.

- Builds highly scalable architecture for deploying AI-based DApps.

Cons:

- There might be a difficulty when attempting to leverage the full potential of the platform due to certain technical requirements.

- Integration to already existing systems might be complex hence the uptake might be slow.

- Consumption of high energy can be a challenge in the context of long-term sustainability.

- Overreliance on the dynamic token value can have adverse effects on the services cost and usage.

- There may be some competition from other blockchain/AI ii platforms that provide similar solutions.

11.Trality AI

Trality AI is one of the best crypto AI tools in 2025. Trality allows users to develop complex bots with the help of its advanced coding tools.

Backtesting, customizability of algorithms or easy to use exchange all allow Trality AI to be one of the most effective solutions for making any trading efforts in cryptocurrency more efficient and profitable.

Pros And Cons Trality AI

Pros:

- Provides a comprehensive code editor for custom algorithm trading.

- Has a backtesting feature where traders can test and modify their strategies before putting them in operation.

- Has a great marketplace for buying ranges of bots and bespoke community-based strategies.

- Allows easy trading by connecting to major crypto exchanges.

- Uses advanced risk management tools which assists in protecting users’ investments.

Cons:

- Some advanced functionalities are provided on a paid subscription which a number of users can find to be expensive.

- The coding part can be complicated for people who do not have programming skills.

- The systems may incur possible losses during the volatility of the market due to over dependence on algorithmic performance.

- Very few interactive customer service elements are available for clients who may encounter non-basic problems.

- Might necessitate periodic checks in order to guarantee that proper strategies are employed.

12.Coinrule AI

Coinrule AI, one of the fastest growing crypto AI tools in 2025. Coinrule provides automated and AI-assisted trading strategies uniquely tailored for other traders.

Thanks to its simple platform, users are able to set up and deploy rules without the prospect of writing code and thus can monitor the markets all day and night and take smart decisions whether they are novices or seasoned cryptocurrency users.

Pros And Cons Coinrule AI

Pros:

- The variety of strategies comes from settings designed for particular market conditions.

- Crypto different exchanges are supported by the system.

- Strategies can be backtested and adjustments can be made towards improving their efficiency.

Cons:

- One of the factors influencing how quickly a cluster is felt while the price is changing.

- The graphical illustration of how this approach works can be quite confusing for those who are more accustomed to in-depth analytics.

- Users have to devote several hours learning how to best take advantage of the various tools available.

13.CryptoHero AI

CryptoHero is an AI-Enhanced Crypto Tool that will take the stage in 2025. The platform presents a free AI-based trading bot and is intuitive with multiple exchange platforms.

It is efficient to trade on CryptoHero AI which includes an integrated automated strategy, analytics in the course of trading, and integrated tracking

To analyze the portfolio of the investor, thus proving to be a great tool, for day traders who are searching for efficiency and convenience in handling their crypto investments.

Pros And Cons CryptoHero AI

Pros:

- It has a fully automated trading robot that works round the clock hence allowing continuous trading in the market.

- Nice and easy configuration, accessible to novice and professional traders alike.

- Has quite an array of varieties of trading strategies to enable more than one of those investment goals to be achieved.

- Lets the user see the data in real time to make the necessary adjustments as needed and see how effective the trades made are also.

- Pearl of great price by integrating with other exchanges via API.

Cons:

- Due to complexity or lower liquidity trading strategies there are little customization options.

- The relevant payment plan could be needed for the high-level features and reports.

- In the course of extreme market situations, performance tends to fluctuate.

- Most users may be required to have some phase of orientation to be able to know how to make the optimal settings for the bot.

- It may be due to internet connectivity high chances of interruptions due to poor network conditions.

14.AI-Predictor Pro

Built as a step up from its predecessor and initial design, AI-Predictor Pro additionally helps with predicting various market movements.

However, this all-encompassing platform offers far more relevance as it specializes in such activities within the realm of crypto assets AI.

It features AI-Predictor Pro which is able to deliver accurate predictions of price, trends, and stock market sentiment, helping traders to stay on top of the game in this competitive market.

Pros And Cons AI-Predictor Pro

Pros:

- Leverages sophisticated machine learning technologies for credible market forecasts.

- Performs instantaneous analysis of data available for making trades.

- It is easy to navigate, thus appropriate for beginners, intermediates, and advanced traders.

Cons:

- All premium features may include some subscriptions such services.

- Given the volatile conditions in the market, the errors in predicting the movement cannot be ruled out.

- Some users may be expected to possess the necessary technical skills to get the most out of some advanced features.

15.TradeSanta AI

According to predictions, by the year 2025 TradeSanta AI will become one of the most reliable crypto AI tools. As a cloud-based platform, TradeSanta automatically trades cryptocurrency through AI algorithms.

This platform provides features like personalized trading bots, advanced technical analysis, and risk management

Which allows traders to implement strategies effectively and enhance their trading performance with minimal manual intervention in the rapid trading of cryptocurrencies.

Pros And Cons TradeSanta AI

Pros:

- Possesses trading bots which are able to auto-trade across multiple exchanges.

- Features allow users to pick pre-made strategies or customize them to fit their personalized needs.

- Seamless connecting with popular exchanges including Binance and Bitfinex is present.

Cons:

- These advanced trading options may be locked behind a paywall, requiring purchase of a subscription.

- Dealing with automated trading may require some learning on the part of the users.

- Returns on investment may not be constant, being affected by the fluctuations of the market.

16.Numerai Crypto AI

Numerai Crypto AI is ranked among the top crypto AI tools in the year 2025. Numerai integrates both artificial intelligence and blockchain technology in realizing its peculiar hedge funding strategy in which predictors build models and accordingly invest.

This method allows users to use an AI based approach for cryptocurrency trading with an aim of improving the approaches and optimizing the returns in the dynamically changing environment.

Pros And Cons Numerai Crypto AI

Pros:

- Has the potential for providing rewards to its users for coming up with successful trading models.

- Employed the use of encrypted data which helps sustain security and privacy of its users.

- Gives users a unique hedge fund model which encourages the use of intelligence of the group.

- Additionally, receives all kinds of market data which helps in forecasting.

Cons:

- Such a user is expected to have knowledge or understanding of data science and machine learning in order to be useful on this platform.

- Its first come first serve model tendency can be frustrating to new customers seeking considerable returns.

- Limited options of overseeing specific types of models or trading strategies.

- Model is performing poorly in live markets, which can generate a scenario of very low returns.

17.Stoic AI

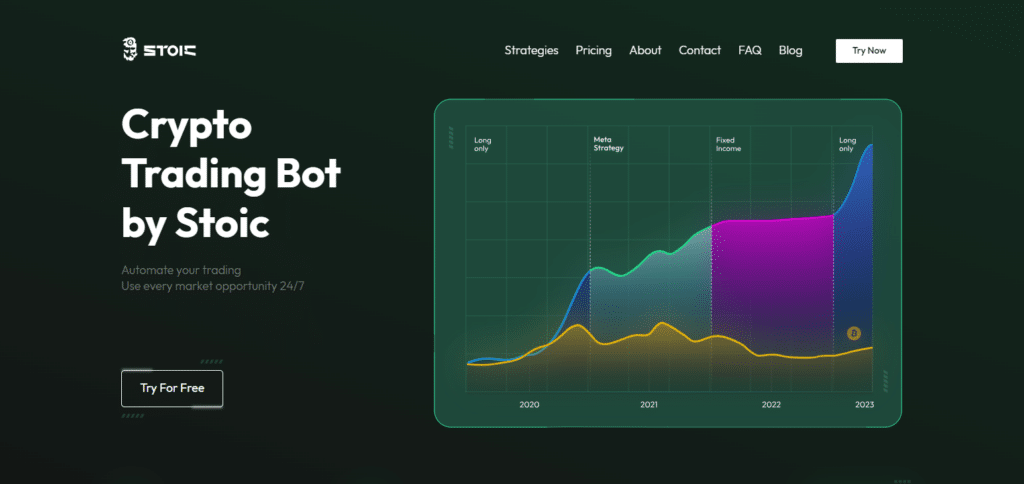

With such an analogy, it’s no surprise that Stoic AI is regarded as one of the best crypto AI tools in 2025.

Stoic AI is an automated service that focuses on long-term investment by managing portfolios through efficiently developed algorithms.

It was created to generate passive income by employing a risk-reward ratio, making it fit for investors looking for slow but consistent growth and easy investment management within the crypto market.

Pros And Cons Stoic AI

Pros:

- Advanced algorithms are employed to automate portfolio management and seek the best returns.

- It comes with basic requirements to set it up and require low efforts to maintain it.

- Spreads so as to minimize risk by investing across various coins.

- Ability to monitor portfolios as well as analyze their performance and returns in real time.

- Connects with the most popular crypto exchanges for efficient exchange of currencies.

Cons:

- Subscription or premium features are available for access members only.

- For those who wish, a partial control over the strategy is possible, but it is limited.

- Should prices drop too far, some consumers may lose all their money due to margin trading.

- Takes into account the volatility of the target MS and draws the appropriate conclusions.

- No control over decision making by “human”. Automation rules everything.

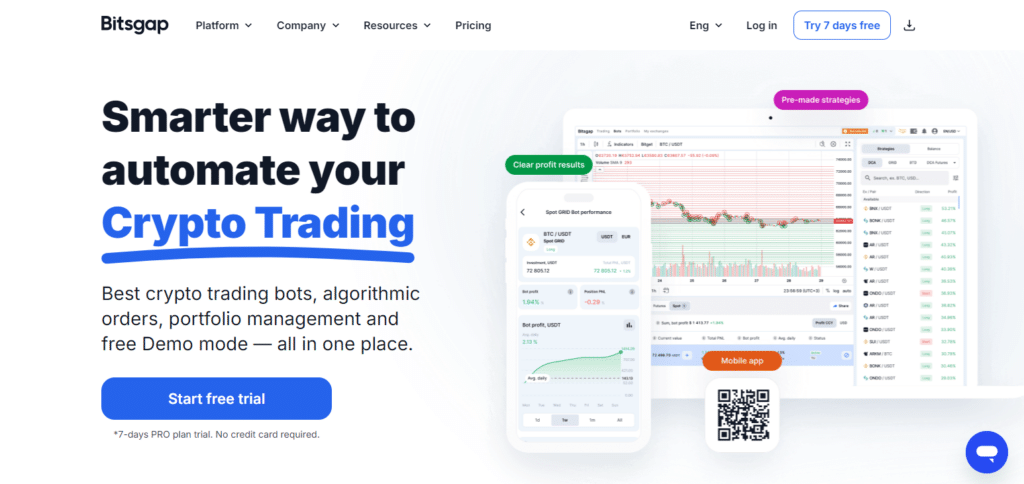

18.Bitsgap AI

As one of desirable features of crypto AI tools Bitsgap, Bitsgap AI is one of the most sought after tools in 2025 and beyond.

Bitsgap provides a wide range of AI-based tools tailored for crypto trading, encompassing bots for automated trading, arbitrage, and portfolio management solutions.

Combining with a number of other platforms, it allows the traders to implement tactics, increase returns and control the risks – to put it mildly, this is a must-have for any serious trader of cryptocurrency.

Pros And Cons Bitsgap AI

Pros:

- It comes with a range of features including trading bots, portfolio management, and more.

- Users can execute trades from any single interface and in as many exchanges as possible.

- Comes with advanced features including arbitrage opportunities and smart order routing.

- Provides demo mode for its users in order to practice before investing actual funds.

- Has comprehensive analytics to allow the users assess eastern trading and its patterns.

Cons:

- Some features have most including advanced tools requiring a paid fee under subscription.

- For the first time users it’s too much since it covers a broad spectrum of functions.

- There may be other platform levies regarding some services which will incur to the trader.

- Since the system depends on API integration, there can be problems if exchange wins downtime.

- Trouble tickets may take longer to get response due to the rare options in customer support.

19.CryptoMood AI

CryptoMood AI, quite flimsy AI we expect it to get better in 2025. Time for optimism! CryptoMood AI focuses on sentiment analysis and AI-based algorithms that study news activity, social networks, and trends.

As they deal with real-time information, CryptoMood AI assists traders in determining how the market views the current and future developments in cryptos, and how to take advantage of this knowledge in a volatile environment.

Pros And Cons CryptoMood AI

Pros:

- Effectively forecasts market tendencies through examining articles and social networks.

- Allows users to receive information timely and appropriately act on it.

- Graphically informative user interface with a visually appealing front end.

Cons:

- These tools may not perform too well when there’s very little activity and social media exposure.

- The premium subscription is required in order to fully utilize more advanced analytical functionalities.

- The experience may depend on how reliable the data that is available is at that time.

- No significant features to allow flexibility on the selected trading strategies.

20.Covesting AI

Covesting AI is the most powerful trading AI software out there and was recognized as such in 2025.

It enables users to follow and copy the actions of successful traders thanks to its fresh take on social trading and copy-trading.

Covesting AI has built in AI smart analytics and features to track trading performance which allows users both new to the field and advanced ones to make smarter choices regarding their investments in the assortment of cryptocurrencies.

Pros And Cons Covesting AI

Pros:

- Users can simply select good traders and copy their strategies.

- There is a systematic approach to gauging performance via a built-in analytic system.

- Broader trade volumes are available by enabling trade on many crypto exchanges.

- The platform safely encourages different interaction via social trading.

- Other strategies can be copied that enable further strategy diversification.

Cons:

- The follower’s success is solely determined by the trader and their performance may differ greatly.

- Fees for subscriptions, profit sharing may lead to lower profits.

- Creating custom strategies is not an option for most users who wish to have set targets.

- Those who are dependent on other traders may lose money if there is an under performing strategy.

- There is a lack of direct control on trades meaning fast execution can be hindered by quick market shifts.

Criteria For Selecting The Best Crypto AI Tools In 2025

Prediction Quality: Examining the level of forecasting abilities of the tool concerning market analysis and potential trading signals.

Accessibility: Allowing the traders, whether novices or seasoned ones, to use the tool without any difficulty.

Customization Options: The extent to which one would be able to customize trading strategies and edit their parameters in order to meet personal expectations.

Multiple Exchange Capability: Being able to link with the other commonly used cryptocurrency exchanges so as to be able to trade as many currencies as possible.

Performance Reports: Probing into the ability of the tool to facilitate portfolio performance measures and other related data at the same time.

User Data Controls: Making certain that users can meet compromise agreement on the data accesses granted, such as financial records, and information about the user.

Response Time: Client service provision in an effective manner where there is minimal wait time for all users to assist clients who have an issue.

Value for Money: Scrutinizing the price of the tool in relation to the features in order to ensure that the users do not incur unnecessary expense.

User Reviews: Analyze the perception of users towards the cryptocurrencies and other tools in concern to security issues and other provisions.

Complementary Features: Finding out whether the tool has new features like backtesting, portfolio management, and risk management tools.

Conclusion

When it comes to using crypto AI tools, it’s important to keep in mind the characteristics that set them apart: accuracy, ease of use and interesting functions.

By 2025 we will see tools designed for traders of every level. Such tools will offer everything from advanced market analysis to integration and security.

When it comes to selecting the right one it is important to pay attention to the degree of the tools offered since the ideal solution has to Basic, trade-bot, or strong customer support, among others. This way, one’s trade is guaranteed to be successful in the crypto market.