Best Anti Money Laundering Software offers a thorough and advanced method of identifying and stopping financial crimes, going above and beyond simple compliance. It combines artificial intelligence, machine learning, and advanced analytics to evaluate enormous datasets and spot trends suggestive of money laundering activity.

High-quality AML software allows financial institutions to quickly respond to possible threats by providing real-time monitoring and alerts. Furthermore, these solutions frequently have strong reporting features to support audit trails and regulatory compliance.

The efficient implementation and management of AML software for organizations is facilitated by its user-friendly interfaces and seamless integration capabilities. All things considered, the most excellent AML software is proactive and adaptive, keeping up with new threats in the constantly changing world of financial crime.

Why Choose Best Anti Money Laundering Software

Financial institutions and businesses must select the best Anti-Money Laundering (AML) software in order to safeguard themselves against the dangers of money laundering and other financial crimes. Choosing the best AML software is imperative for the following main reasons:

Regulatory Compliance: To guarantee that businesses abide by anti-money laundering laws and regulations, the best AML software is made to both meet and exceed regulatory requirements. This is essential to prevent financial penalties and legal ramifications.

Advanced Detection Capabilities: Top AML software analyzes vast amounts of data and spots intricate patterns connected to money laundering activities by leveraging cutting-edge technologies like artificial intelligence and machine learning. This improves the system’s capacity to promptly and accurately identify suspicious transactions.

Real-Time Monitoring: Excellent AML solutions allow for real-time financial transaction monitoring, which helps businesses quickly spot and stop possible money laundering activity. This proactive strategy aids in avoiding monetary losses and harm to one’s reputation.

Scalability and Customization: The best AML software has features that can be adjusted to meet the unique requirements of various organizations. Additionally, it ought to be scalable, enabling companies to modify and enhance their AML capacities in response to evolving regulatory requirements or business expansion.

User-Friendly Interface: Compliance officers and staff find it simpler to navigate the AML software with intuitive and user-friendly interfaces, which facilitates effective monitoring and reporting procedures. This is essential for an organization’s AML policies to be implemented within it effectively.

Integration with Current Systems: When selecting AML software, a smooth integration with current systems and workflows is essential. This guarantees a seamless implementation process and makes it possible for risk management to take a more unified and thorough approach.

Audit Trails and Reporting: To prove compliance to internal stakeholders and regulators, robust reporting tools and thorough audit trails are crucial. The most effective AML software offers comprehensive reports that are simple to view and comprehend.

Adaptability to Changing Threats: Criminals are constantly coming up with new ways to launder money, and the financial landscape is changing as well. The most effective anti-money laundering software is made to adjust to new risks and keep up with changing patterns in financial crime.

Here is list of Best Anti Money Laundering Software

- Sumsub

- iDenfy

- Refinitiv World-Check Risk Intelligence

- Ondato

- Onfido

- Abrigo BAM+

- ComplyAdvantage

- ComplyCube

- IDMERIT

- Oracle Financial Crime and Compliance Management

- Persona

- NetReveal

- Sanction Scanner

- Trulioo

- Dow Jones Risk & Compliance

- Pirani

- PassFort Lifecycle

- 4Stop

- KYC-Chain

- ANTI-MONEY LAUNDERING

- Quantifind

- Verify 365

- Unit21

- Pliance

- Know Your Customer

- SAS Anti-Money Laundering

- Data Zoo

- Jade ThirdEye

- Digital iD

- AMLcheck

- iComplyKYC

- So Comply

- Fraud.net

- GeoComply

- IDfy

- Maltego

- Biz4x

- Focal

- Melissa Identity Suite

- Penneo KYC

- Sayari

- Vouched

- Workfusion Intelligent Automation Cloud

- Lucinity

- NameScan

- ThetaRay

- FileInvite

- DueDil

- Shufti Pro

- TigerGraph

50 Best Anti Money Laundering Software

1. Sumsub (Best Anti Money Laundering Software)

As a top supplier of Anti-Money Laundering (AML) software, Sumsub provides a thorough and creative solution to deal with the problems caused by financial crimes. Their platform combines cutting-edge technologies like biometric verification and artificial intelligence to provide a reliable and efficient AML solution. The software developed by Sumsub guarantees the continuous observation of monetary transactions by utilizing advanced algorithms to identify and avert instances of money laundering.

Sumsub offers compliance officers a streamlined experience by emphasizing user-friendly interfaces and seamless integration, which improves their capacity to navigate and manage AML processes effectively. Additionally, the platform performs excellently in customer due diligence by utilizing cutting-edge identity verification technologies to uphold strict security and compliance standards. Sumsub distinguishes itself by providing features that are adaptable to changing regulatory environments and new developments in financial crime, demonstrating its dedication to staying ahead of evolving threats.

2. iDenfy

Prominent in the field of Anti-Money Laundering (AML) software, iDenfy is renowned for its innovative approaches to thwarting financial crimes. Sophisticated identity verification technologies are employed by the iDenfy platform to guarantee stringent customer due diligence. iDenfy guarantees a safe and smooth user experience with features like liveness detection, document verification, and biometric authentication.

The software is made to make it easier to monitor financial transactions in real time. It uses clever algorithms to quickly identify any suspicious activity. With its comprehensive approach, robust audit trails, and regulatory reporting tools, iDenfy’s commitment to compliance is clear.

Compliance officers find the platform to be an indispensable tool due to its user-friendly interface and adaptable nature, which facilitates efficient navigation of AML processes. iDenfy is a dependable and progressive option in the AML software market because of its emphasis on staying ahead of new threats and changing regulatory requirements.

3. Refinitiv World-Check Risk Intelligence

One of the best Anti-Money Laundering (AML) software solutions available is Refinitiv World-Check Risk Intelligence, which is well-known for its extensive worldwide experience fighting financial crimes. With the aid of a large database and sophisticated screening tools, World-Check provides thorough watchlist screening and customer due diligence services.

Because the platform offers real-time alerts, financial institutions can quickly recognize and address possible money laundering risks. Its comprehensive risk intelligence features ensure a rigorous and meticulous screening process by covering a wide range, from sanctions lists to politically exposed persons (PEPs).

World-Check prioritizes regulatory compliance by enabling smooth integration into current systems and offering comprehensive reporting tools for regulatory and auditing needs. With the ever-changing landscape of financial regulations and security threats, Refinitiv World-Check is a top-tier option for organizations looking for a strong and dependable AML solution because of its reputation as a trustworthy source for risk intelligence.

4. Ondato

As a prominent supplier of Anti-Money Laundering (AML) software, Ondato has made a name for itself by providing a thorough and creative response to the ever-changing problems associated with financial crime. Ondato is renowned for emphasizing sophisticated identity verification and guarantees a thorough customer due diligence procedure.

The platform uses state-of-the-art technologies to improve the precision and security of its AML services, such as document verification and biometric authentication. Organizations can reduce the risks associated with money laundering by quickly identifying and responding to suspicious activities thanks to Ondato’s real-time monitoring capabilities.

The platform’s easy-to-use interface and seamless integration help compliance officers have a productive AML workflow. For companies looking for a complete AML solution that puts compliance and security first, Ondato is a dependable and progressive option because of its dedication to staying ahead of regulatory changes and new threats.

5. Onfido (Best Anti Money Laundering Software)

Leading supplier of Anti-Money Laundering (AML) software, Onfido stands out for its state-of-the-art identity verification offerings. Prominent for its inventive methodology, Onfido utilizes cutting-edge artificial intelligence and machine learning technologies to provide a safe and efficient AML encounter.

Utilizing biometric authentication, document verification, and facial recognition to ensure the highest levels of identity assurance, the platform excels in customer due diligence. Compliance officers receive timely alerts for additional investigation thanks to Onfido’s real-time monitoring capabilities, which facilitate prompt detection of possible money laundering activities.

With its easy-to-use interface and seamless integration with current systems, Onfido enables businesses to improve their AML procedures effectively. The platform is a reliable option for companies looking for an all-inclusive and cutting-edge AML solution because of its flexibility in responding to changing regulatory environments and dedication to ongoing innovation.

6. Abrigo BAM+

One of the best Anti-Money Laundering (AML) software solutions available is Abrigo BAM+, which is well-known for its extensive features that are intended to effectively combat financial crimes. BAM+ offers strong transaction monitoring and risk assessment tools by utilizing machine learning and advanced analytics.

When it comes to customer due diligence, the platform shines, providing thorough identity verification and watchlist screening. Compliance officers can act quickly and intelligently when suspicious activity is detected in real-time thanks to monitoring that keeps an eye out for irregularities.

The efficiency of AML processes within organizations is improved by BAM+ thanks to its user-friendly interface and seamless integration. Its dedication to remaining current with regulatory changes and new threats further emphasizes how dependable it is in assisting companies in navigating the challenging world of AML compliance. For enterprises looking for an all-inclusive and flexible AML solution that puts accuracy and compliance first, Abrigo BAM+ is a great option.

7. ComplyAdvantage

ComplyAdvantage is a leading Anti-Money Laundering (AML) software solution that is unique in that it takes a sophisticated and flexible approach to preventing financial crime. Utilizing state-of-the-art technologies, such as artificial intelligence and machine learning, ComplyAdvantage provides unmatched capacity for identifying and stopping money laundering activities.

The platform uses strong identity verification tools and thorough screening against international sanctions lists to excel at customer due diligence. Compliance officers can act immediately when suspicious transactions are quickly identified thanks to real-time monitoring.

ComplyAdvantage is a useful tool for businesses looking to improve their AML procedures because of its intuitive interface and smooth integration. ComplyAdvantage’s reputation for accuracy and dedication to staying ahead of regulatory changes and emerging threats make it a reliable and progressive option for companies navigating the intricate world of AML compliance.

8. ComplyCube

As a top Anti-Money Laundering (AML) program, ComplyCube stands out for taking a creative and all-encompassing approach to preventing financial crime. By utilizing state-of-the-art technologies, such as sophisticated document authentication and identity verification, ComplyCube guarantees a thorough customer due diligence procedure.

Organizations are enabled by the platform’s real-time monitoring capabilities to promptly identify and address potential money laundering risks. Compliance officers can streamline their AML workflow with ComplyCube’s user-friendly interface and seamless integration into current systems.

Businesses looking for a comprehensive AML tool that prioritizes security and compliance will find the software to be a dependable and forward-thinking option due to its ability to adapt to changing regulatory environments and dedication to staying ahead of emerging threats. ComplyCube is an important tool in the continuous fight against financial crimes because of its focus on efficiency and accuracy.

9. IDMERIT

IDMERIT is a well-known supplier of Anti-Money Laundering (AML) software, distinguished by its state-of-the-art identity verification offerings. By emphasizing cutting-edge technologies like document verification and biometric authentication, IDMERIT guarantees a solid and safe customer due diligence procedure.

Organizations can quickly identify and address possible money laundering activities thanks to the platform’s real-time monitoring features, which also provide compliance officers with timely information for wise decision-making. The intuitive interface and smooth integration of IDMERIT facilitate an efficient AML workflow, thereby improving overall productivity.

Furthermore, its dedication to keeping up with emerging risks and regulatory changes highlights how dependable it is in assisting companies with their compliance initiatives. Because IDMERIT places a strong focus on security and accuracy, it is a reliable option for businesses looking for an all-inclusive AML solution.

10. Oracle Financial Crime and Compliance Management (Best Anti Money Laundering Software)

With its advanced features and feature-rich functionality, Oracle Financial Crime and Compliance Management is a standout Anti-Money Laundering (AML) software solution in the market. With the use of artificial intelligence, machine learning, and advanced analytics, Oracle’s platform offers a thorough and proactive method of identifying and stopping financial crimes.

When it comes to providing sophisticated identity verification and screening against international watchlists, the software excels at customer due diligence. Compliance officers can act immediately when suspicious activity is quickly identified thanks to real-time transaction monitoring. Oracle’s scalable architecture, smooth integration capabilities, and user-friendly interface all support effective AML workflows in businesses of all sizes.

Oracle Financial Crime and Compliance Management is a reliable and progressive option for companies looking to uphold the highest standards of AML compliance and security because of its dedication to staying ahead of regulatory changes and emerging threats.

11. Persona

Persona is regarded as a top supplier of Anti-Money Laundering (AML) software and is renowned for its thorough and inventive approach to preventing financial crime. Persona guarantees a thorough customer due diligence procedure by emphasizing sophisticated identity verification and authentication. By utilizing state-of-the-art technologies like biometric identification and document authentication, the platform improves AML processes’ precision and security.

Organizations can quickly identify and address possible money laundering risks thanks to Persona’s real-time monitoring capabilities, which also give compliance officers important information for making decisions. An effective AML workflow is aided by the software’s intuitive interface and seamless integration with current systems.

Persona is a dependable and forward-thinking option for companies looking for a complete AML solution that puts compliance and security first. This is due to its dedication to staying ahead of emerging threats and regulatory changes, as well as its reputation for accuracy and dependability.

12. NetReveal

Being one of the most powerful Anti-Money Laundering (AML) software solutions available, NetReveal is renowned for its sophisticated ability to identify and stop financial crimes. Created by BAE Systems, NetReveal analyzes enormous datasets to find intricate patterns of money laundering by utilizing advanced analytics, AI, and machine learning.

Real-time monitoring is where the software really shines, offering a proactive method of spotting questionable transactions. In order to ensure compliance with regulatory requirements, NetReveal provides thorough customer due diligence, watchlist screening, and risk-based approaches. Compliance officers can navigate it more effectively thanks to its user-friendly interface, and overall operational effectiveness is increased by its smooth integration with current systems.

NetReveal continues to be a reliable option for businesses looking for a strong and innovative AML solution because of its dedication to staying ahead of new threats and changes in regulations. Because of its emphasis on precision and flexibility, it is positioned to play a significant role in the ongoing, effective fight against financial crimes.

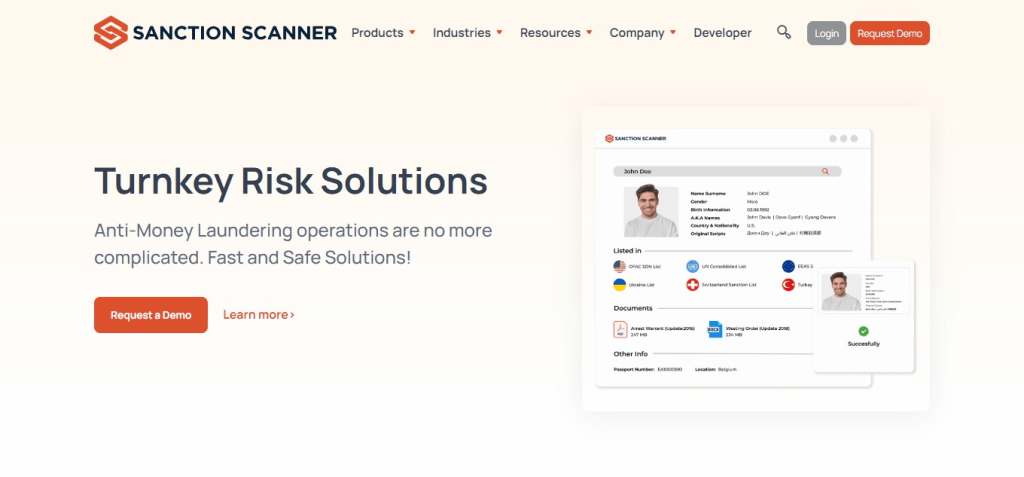

13. Sanction Scanner

Sanction Scanner, a top Anti-Money Laundering (AML) software program, has become well-known for its potent instruments for reducing the likelihood of financial crime. With the help of cutting-edge technologies like artificial intelligence and machine learning, Sanction Scanner provides comprehensive watchlist screening and capabilities for customer due diligence.

The program is excellent at monitoring in real-time, quickly identifying and notifying compliance officers of any possible money laundering activity. Sanction Scanner increases overall efficiency for organizations by streamlining AML processes through its user-friendly interface and seamless integration capabilities.

The platform’s dependability is highlighted by its dedication to remaining up to date with emerging threats and regulatory changes. Sanction Scanner is a reliable option for companies looking for an all-inclusive and flexible AML solution that puts security and compliance first in the constantly changing world of financial regulations and security threats.

14. Trulioo

Due to its creative and all-encompassing approach to identity verification and financial crime prevention, Trulioo has become a prominent player in the Anti-Money Laundering (AML) software market. Through the use of cutting-edge technology, such as global identity verification and document authentication, Trulioo guarantees a thorough due diligence procedure for customers.

The platform’s real-time monitoring features give compliance officers useful insights and enable organizations to quickly identify and address possible money laundering risks. The intuitive interface and smooth integration of Trulioo facilitate an effective AML workflow, thereby augmenting overall operational efficacy.

Trulioo’s reputation for accuracy and dependability, along with its dedication to staying ahead of regulatory changes, make it a reliable and progressive option for companies looking for an all-inclusive AML solution that puts security and compliance first in the ever-changing financial sector.

15. Dow Jones Risk & Compliance (Best Anti Money Laundering Software)

Being one of the top Anti-Money Laundering (AML) software solutions, Dow Jones Risk & Compliance is well-known for its powerful features that help combat financial crimes. By utilizing extensive risk intelligence and cutting-edge data analytics, Dow Jones offers a platform that is unmatched for watchlist screening and customer due diligence.

The software performs exceptionally well in real-time monitoring, guaranteeing prompt identification of questionable activity and proactive risk reduction. The meticulous screening Dow Jones Risk & Compliance conducts against international sanctions lists and politically exposed persons (PEPs) demonstrates its dedication to accuracy. Compliance officers can streamline their AML workflow with the platform’s easy-to-use interface and seamless integration features.

For businesses dedicated to upholding the highest standards of AML compliance and financial security, Dow Jones Risk & Compliance is a dependable and progressive option because of its flexibility in responding to shifting regulatory environments and proactive approach to combating new threats.

16. Pirani

Pirani has emerged as a notable player in the field of Anti-Money Laundering (AML) software, offering a comprehensive solution for financial crime prevention. Specializing in advanced analytics and real-time monitoring, Pirani provides robust tools for identifying and mitigating money laundering risks.

The platform excels in customer due diligence, employing advanced identity verification and risk assessment techniques. With a user-friendly interface and seamless integration capabilities, Pirani streamlines AML workflows, enhancing operational efficiency for compliance officers.

The software’s commitment to staying abreast of regulatory changes and its adaptability to emerging threats underscore Pirani as a trusted and forward-thinking choice for businesses seeking a reliable AML solution. Its emphasis on accuracy, compliance, and security positions Pirani as a valuable asset in the ongoing efforts to combat financial crimes effectively.

17. PassFort Lifecycle

As a premier Anti-Money Laundering (AML) software, PassFort Lifecycle provides a complete solution for companies and financial institutions. PassFort offers sophisticated tools for risk assessment and identity verification, with an emphasis on the full customer lifecycle.

The program excels at conducting due diligence on behalf of customers by using sophisticated algorithms to check against international watchlists and sanctions lists. Compliance officers can act quickly when suspicious activity is detected thanks to real-time monitoring. The intuitive interface and seamless integration capabilities of PassFort facilitate an effective AML workflow, thereby augmenting overall operational efficacy.

Because of the platform’s dedication to staying up to date with regulatory changes and its flexibility in responding to new threats, PassFort Lifecycle is seen as a reliable and progressive option for businesses looking for a strong AML solution that puts security and compliance first in the complicated financial environment of today.

18. 4Stop

Acknowledged as one of the top Anti-Money Laundering (AML) software programs, 4Stop is praised for its creative and all-encompassing approach to financial crime prevention. The platform uses state-of-the-art technology to offer a strong defense against money laundering activities, including sophisticated risk assessment tools, machine learning, and artificial intelligence.

With its advanced identity verification and global watchlist screening capabilities, 4Stop is a leader in customer due diligence. Monitoring in real-time guarantees the prompt detection of questionable transactions, providing compliance officers with timely information for wise decision-making.

An effective AML workflow is facilitated by the platform’s scalable architecture, seamless integration, and user-friendly interface. 4Stop’s dedication to staying ahead of emerging threats and regulatory changes makes it a dependable and progressive option for companies looking for an adaptable AML solution that puts compliance and security first in the ever-changing financial landscape of today.

19. KYC-Chain

Thanks to its state-of-the-art Know Your Customer (KYC) features, KYC-Chain has become a prominent Anti-Money Laundering (AML) software provider. Robust customer due diligence is given top priority on the platform, which provides sophisticated tools for risk assessment, document authentication, and identity verification.

Real-time monitoring is where KYC-Chain shines, offering a proactive method of spotting and stopping money laundering activity. The software facilitates an effective AML workflow for compliance officers with its user-friendly interface and seamless integration into current systems.

KYC-Chain is regarded as a reliable and progressive option for businesses looking for a complete AML solution because of its dedication to staying ahead of regulatory changes and its emphasis on adaptability to emerging threats. Its emphasis on security, accuracy, and compliance highlights its importance in the ongoing efforts to effectively combat financial crimes.

20. ANTI-MONEY LAUNDERING (Best Anti Money Laundering Software)

AML, or anti-money laundering, is a complete and effective software program that is a powerful weapon in the fight against financial crimes. By utilizing state-of-the-art technologies like artificial intelligence and machine learning, anti-money laundering (AML) effectively identifies and stops money laundering activities.

In order to ensure a proactive approach to compliance, the platform provides advanced features for watchlist screening, transaction monitoring, and customer due diligence. Organizations can minimize risks associated with illicit financial transactions by quickly identifying and responding to suspicious activities thanks to real-time monitoring capabilities.

Through its intuitive interface and smooth integration, AML simplifies the intricate procedures carried out by compliance officers. For companies looking for a complete AML solution, its dedication to staying ahead of changing regulations and evolving threats makes it a reliable and progressive option. The focus that AML places on precision, effectiveness, and flexibility is indicative of its critical function in preserving the integrity of financial systems and adhering to strict compliance guidelines.

21. Quantifind

Being a pioneer in the field of Anti-Money Laundering (AML) software, Quantifind is known for its cutting-edge and creative methods of thwarting financial crimes. Quantifind is an excellent tool for detecting and preventing money laundering activities because it makes use of advanced analytics, machine learning, and artificial intelligence.

The platform offers sophisticated identity verification and risk assessment tools, with a focus on thorough customer due diligence. Organizations can quickly detect and address possible money laundering threats with the help of real-time monitoring capabilities, which give compliance officers timely information to make wise decisions.

Quantifind improves overall operational efficiency by streamlining AML processes through a user-friendly interface and seamless integration capabilities. Because of the platform’s adaptability and dedication to staying ahead of regulatory changes, Quantifind is a dependable and forward-thinking option for companies looking for a strong and dependable AML solution that puts compliance and security first in the ever-changing financial world of today.

22. Verify 365

Verify 365 is regarded as a premier Anti-Money Laundering (AML) software solution because of its extensive feature set and state-of-the-art technology for preventing financial crime. By using cutting-edge identity verification technologies, Verify 365 guarantees a thorough due diligence procedure for customers.

The system performs exceptionally well at monitoring in real-time, quickly identifying and informing compliance officers of any possible money laundering activity. The efficiency of AML workflows within organizations is improved by Verify 365 thanks to its user-friendly interface and seamless integration into current systems.

Businesses looking for a comprehensive AML solution that prioritizes security and compliance in the ever-changing financial landscape will find Verify 365 to be a reliable and forward-thinking option due to its flexibility in responding to changing regulatory landscapes, dedication to staying ahead of emerging threats, and emphasis on accuracy.

23. Unit21

In the field of Anti-Money Laundering (AML) software, Unit21 is a notable player that provides a strong and creative solution for financial crime detection and prevention. Unit21 utilizes cutting-edge technologies like artificial intelligence and machine learning to analyze large datasets and spot suspicious patterns that may point to money laundering.

The platform, which includes sophisticated identity verification and risk assessment tools, places a high priority on thorough customer due diligence. Organizations can quickly identify and address possible financial crimes with the help of real-time monitoring capabilities, which also give compliance officers useful information. Unit21 increases overall operational efficiency by streamlining AML processes through its user-friendly interface and seamless integration capabilities.

Unit21’s dedication to staying up to date with regulatory changes and emerging threats establishes it as a reliable and progressive option for companies looking for a strong and flexible AML solution that puts compliance and security first in the ever-changing financial landscape of today.

24. Pliance

Pliance has made a name for itself as a top provider of Anti-Money Laundering (AML) software, thanks to its thorough and effective approach to preventing financial crime. Pliance excels at customer due diligence by utilizing cutting-edge technology and providing sophisticated identity verification and risk assessment tools.

The platform places a high priority on real-time monitoring in order to quickly detect and address any possible money laundering activity. Pliance integrates seamlessly and has an intuitive interface that helps compliance officers’ AML workflows run more smoothly overall.

The software’s dependability is highlighted by its dedication to remaining up to date with changes in regulations and its flexibility in responding to new threats. In the ever changing world of financial regulations and security threats, Pliance is a reliable option for companies looking for a strong and innovative AML solution that prioritizes security and compliance.

25. Know Your Customer (Best Anti Money Laundering Software)

A leading Anti-Money Laundering (AML) software solution, Know Your Customer (KYC) is recognized for its state-of-the-art technology and all-encompassing approach to financial crime prevention. With a focus on identity verification, KYC provides comprehensive features for customer due diligence, such as sophisticated biometric authentication and tools for document verification.

The platform performs exceptionally well at monitoring in real-time, quickly recognizing and addressing any possible risks of money laundering. KYC improves overall operational efficiency for compliance officers by streamlining AML processes with an intuitive interface and seamless integration capabilities.

Businesses looking for a dependable AML solution that prioritizes security and compliance in the ever-changing financial landscape of today will find KYC to be a forward-thinking and trustworthy option due to its software’s ability to adapt to emerging threats and its dedication to staying up to date with regulatory changes.

26. SAS Anti-Money Laundering

SAS Anti-Money Laundering has cemented its position as the industry’s leading software solution for preventing financial crime. SAS AML, which is renowned for its comprehensive features and advanced analytics, enables organizations to effectively detect and prevent money laundering activities. With the help of advanced algorithms and machine learning, the platform performs exceptionally well in real-time monitoring, making it possible to identify suspicious transactions quickly.

In order to ensure compliance with strict regulatory requirements, SAS AML offers comprehensive customer due diligence, including identity verification and risk assessment tools. Thanks to its intuitive interface and smooth integration features, the software helps compliance officers’ AML workflows run more smoothly.

Because of its reputation for accuracy and dedication to staying ahead of regulatory changes, SAS AML is a reliable and progressive option for companies looking for an all-inclusive and flexible AML solution that puts security and compliance first in the ever-changing world of financial regulations and security threats.

27. Data Zoo

As one of the top providers of Anti-Money Laundering (AML) software, Data Zoo is well-known for its creative and all-encompassing approach to preventing financial crime. With a focus on identity verification, Data Zoo provides sophisticated tools for client due diligence that make use of cutting-edge technologies like document verification and biometric authentication.

The platform is very good at monitoring in real-time and quickly detecting and reducing possible risks related to money laundering. Data Zoo improves overall operational efficiency for compliance officers by streamlining AML processes through its user-friendly interface and seamless integration capabilities.

For companies looking for a dependable AML solution that prioritizes security and compliance in the ever-changing world of financial regulations and security challenges, Data Zoo is a trusted and forward-thinking option because of the software’s dedication to staying up to date with regulatory changes and its flexibility in responding to new threats.

28. Jade ThirdEye

Jade ThirdEye, a renowned Anti-Money Laundering (AML) software program, has become well-known for its creative approaches to stopping financial crimes. With the use of cutting-edge technologies like machine learning and artificial intelligence, Jade ThirdEye provides a strong platform for the identification and stoppage of money laundering operations. With its sophisticated tools for risk assessment and identity verification, the software shines at customer due diligence.

Organizations can quickly detect and address possible financial crimes by utilizing real-time monitoring capabilities, which give compliance officers useful information. Jade ThirdEye improves overall operational efficiency by streamlining AML processes through a user-friendly interface and seamless integration capabilities.

For companies looking for a strong and dependable AML solution that puts compliance and security first in the ever-changing financial world of today, Jade ThirdEye is a dependable and forward-thinking option because of its dedication to staying ahead of regulatory changes and its adaptable nature.

29. Digital iD

A prominent provider of Anti-Money Laundering (AML) software, Digital iD has made a name for itself by taking a creative and all-encompassing approach to preventing financial crime. Digital iD, an identity verification specialist, provides sophisticated tools for thorough customer due diligence, including document verification and state-of-the-art biometric authentication.

The platform is very good at monitoring in real-time and quickly detecting and reducing possible risks related to money laundering. Digital iD improves overall operational efficiency for compliance officers by streamlining AML processes through a user-friendly interface and seamless integration capabilities.

For companies looking for a dependable AML solution that prioritizes security and compliance in the ever-changing world of financial regulations and security challenges, Digital iD is a trusted and forward-thinking option because of the software’s dedication to staying up to date with regulatory changes and its flexibility in responding to new threats.

30. AMLcheck (Best Anti Money Laundering Software)

AMLcheck has made a name for itself as a premier Anti-Money Laundering (AML) software program, set apart by its powerful features that effectively combat financial crimes. AMLcheck, which specializes in thorough identity verification and due diligence, uses cutting-edge technology to guarantee a strong barrier against money laundering operations. The platform is excellent at monitoring in real-time and quickly identifying and addressing possible threats.

Through its intuitive interface and smooth integration features, AMLcheck streamlines AML procedures, improving compliance officers’ overall operational effectiveness. The software’s dedication to remaining current with regulatory changes and its flexibility in responding to new threats highlight AMLcheck as a dependable and innovative option for companies looking for an AML solution. AMLcheck’s focus on security, compliance, and accuracy makes it an invaluable tool in the continuous endeavor to preserve the integrity of financial systems.

31. iComplyKYC

iComplyKYC has established itself as a top provider of Anti-Money Laundering (AML) software, known for its thorough and creative approach to preventing financial crime. With a focus on Know Your Customer (KYC) compliance, iComplyKYC provides sophisticated tools for risk assessment, identity verification, and customer due diligence.

The platform performs exceptionally well at monitoring in real-time, quickly recognizing and addressing any possible risks of money laundering. iComplyKYC improves overall operational efficiency for compliance officers by streamlining AML processes through an intuitive interface and smooth integration capabilities.

The software’s dedication to staying current with regulatory changes and its flexibility in responding to new threats highlight iComplyKYC as a dependable and progressive option for companies looking for an AML solution. Because of its focus on security, accuracy, and compliance, iComplyKYC is a useful tool in the continuous fight against financial crimes.

32. So Comply

Thus, Comply has become a well-known Anti-Money Laundering (AML) software program, renowned for its sophisticated functionalities and all-encompassing approach to financial crime prevention. So Comply, a compliance management specialist, provides strong tools for risk assessment, real-time transaction monitoring, and customer due diligence.

The platform is particularly good at quickly detecting and reducing possible money laundering risks. So Comply improves overall operational efficiency for compliance officers by streamlining AML processes through an intuitive interface and seamless integration capabilities.

The software’s dedication to staying current with regulatory changes and its flexibility in responding to new threats highlight So Comply as a dependable and progressive option for companies looking for an AML solution. So Comply is an invaluable resource in the continuous efforts to maintain the integrity of financial systems because of its emphasis on accuracy, compliance, and security.

33. Fraud.net

Fraud.net stands out as a premier Anti-Money Laundering (AML) software solution, renowned for its advanced capabilities in fraud detection and prevention. Leveraging cutting-edge technology such as artificial intelligence and machine learning, Fraud.net offers a comprehensive platform for identifying and mitigating money laundering risks.

The software excels in real-time monitoring, enabling swift detection of suspicious activities and proactive risk management. With a user-friendly interface and seamless integration capabilities, Fraud.net optimizes AML workflows for compliance officers. The platform’s commitment to staying ahead of evolving threats and regulatory changes underscores its reliability.

Fraud.net is a trusted and forward-thinking choice for businesses seeking a robust AML solution that prioritizes both compliance and security in the dynamic landscape of financial regulations and security challenges. Its emphasis on accuracy and efficiency makes Fraud.net an invaluable asset in the ongoing battle against financial crimes.

34. GeoComply

GeoComply is a leading Anti-Money Laundering (AML) software provider, recognized for its cutting-edge geolocation technology and robust features in financial crime prevention. Specializing in compliance solutions for the iGaming and financial industries, GeoComply ensures a secure and seamless user experience by verifying the geographic location of users in real-time.

The platform excels in mitigating money laundering risks through sophisticated geofencing and geolocation intelligence. With a user-friendly interface and seamless integration capabilities, GeoComply enhances AML workflows, providing compliance officers with accurate and timely insights.

The software’s commitment to staying ahead of regulatory changes, coupled with its adaptability to emerging threats, positions GeoComply as a trusted and forward-thinking choice for businesses seeking a reliable AML solution. Its emphasis on accuracy, compliance, and security makes GeoComply an essential component in the ongoing efforts to maintain the integrity of financial systems.

35. IDfy (Best Anti Money Laundering Software)

IDfy has cemented its standing as a leading supplier of Anti-Money Laundering (AML) software, set apart by its creative and all-encompassing strategy for preventing financial crime. IDfy, which specializes in cutting-edge identity verification solutions, provides strong instruments for risk assessment and customer due diligence.

The platform performs exceptionally well at monitoring in real-time, quickly recognizing and addressing any possible risks of money laundering. IDfy enhances overall operational efficiency for compliance officers by optimizing AML processes through its user-friendly interface and seamless integration capabilities.

The software highlights IDfy as a dependable and innovative option for companies looking for an AML solution because of its dedication to staying current with regulatory changes and its flexibility in responding to new threats. IDfy’s focus on accuracy, compliance, and security makes it a useful tool in the continuous endeavor to effectively combat financial crimes.

36. Maltego

Maltego, while primarily known as a powerful data analysis and visualization tool, is increasingly being utilized as an effective Anti-Money Laundering (AML) software solution. Its versatile capabilities in collecting, analyzing, and visualizing vast datasets make it a valuable asset in detecting and preventing financial crimes.

Maltego’s ability to aggregate information from diverse sources enables compliance officers to perform thorough customer due diligence and identify potential money laundering patterns. The platform’s graph-based approach provides a visual representation of complex relationships, aiding in the detection of suspicious activities.

With a user-friendly interface and integrative capabilities, Maltego streamlines AML workflows and enhances the efficiency of compliance processes. Its adaptability and customization options make it a versatile tool for organizations seeking a comprehensive and dynamic AML solution in the ever-evolving landscape of financial regulations and security challenges.

37. Biz4x

Positioning itself as a noteworthy Anti-Money Laundering (AML) software solution, Biz4x is known for its extensive feature set and creative approach to preventing financial crime. Biz4x is a compliance solutions specialist for currency exchange companies. It provides strong tools for risk assessment, transaction monitoring, and customer due diligence.

The platform is very good at monitoring in real time and reacting quickly to any potential money laundering risks in the currency exchange industry. Biz4x streamlines AML processes with an intuitive interface and smooth integration capabilities, giving compliance officers effective tools to manage intricate regulatory environments.

The software highlights Biz4x as a dependable and progressive option for currency exchange companies looking for an AML solution because of its dedication to staying up to date with regulatory changes and its flexibility in responding to new threats. Because of its focus on security, accuracy, and compliance, Biz4x is an invaluable tool for maintaining the integrity of financial systems in this niche market.

38. Focal

Focal has emerged as a prominent Anti-Money Laundering (AML) software solution, recognized for its innovative and comprehensive approach to financial crime prevention. Specializing in advanced analytics and artificial intelligence, Focal offers robust tools for customer due diligence, risk assessment, and real-time transaction monitoring.

The platform excels in swiftly detecting and responding to potential money laundering risks, providing compliance officers with actionable insights. With a user-friendly interface and seamless integration capabilities, Focal optimizes AML workflows, enhancing overall operational efficiency.

The software’s commitment to staying ahead of regulatory changes and its adaptability to emerging threats underscore Focal as a trusted and forward-thinking choice for businesses seeking a reliable AML solution. Its emphasis on accuracy, compliance, and security makes Focal an invaluable asset in the ongoing efforts to combat financial crimes effectively.

39. Melissa Identity Suite

Melissa Identity Suite has established itself as a leading Anti-Money Laundering (AML) software solution, renowned for its comprehensive identity verification and compliance capabilities. Leveraging advanced data quality and address verification tools, Melissa Identity Suite ensures robust customer due diligence processes.

The platform excels in real-time monitoring, promptly detecting and responding to potential money laundering risks. With a user-friendly interface and seamless integration capabilities, Melissa Identity Suite streamlines AML workflows, enhancing overall operational efficiency for compliance officers.

The software’s commitment to staying abreast of regulatory changes and its adaptability to emerging threats underscore Melissa Identity Suite as a trusted and forward-thinking choice for businesses seeking a reliable AML solution. Its emphasis on accuracy, compliance, and security makes Melissa Identity Suite a valuable asset in the ongoing efforts to combat financial crimes effectively.

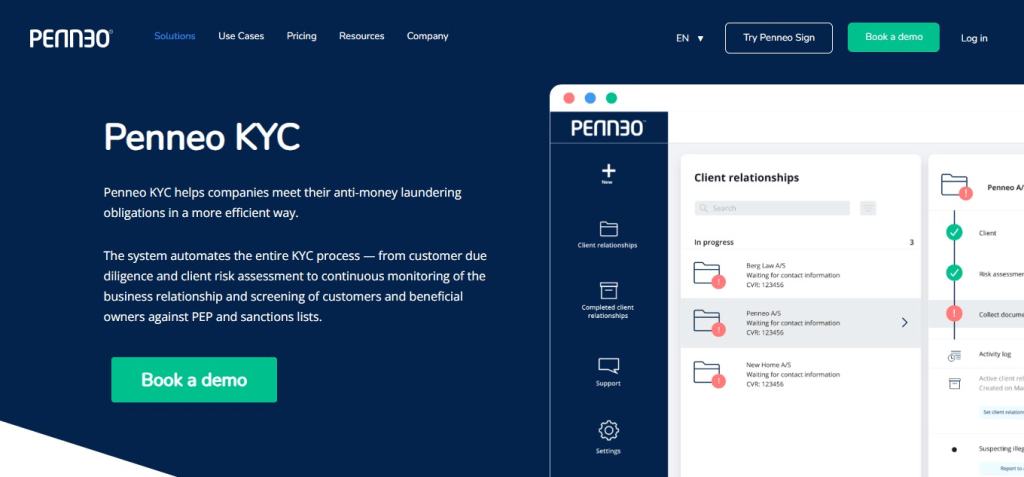

40. Penneo KYC (Best Anti Money Laundering Software)

Penneo KYC stands out as a leading Anti-Money Laundering (AML) software solution, known for its innovative approach to streamlining Know Your Customer (KYC) processes. Specializing in identity verification and compliance within a secure digital environment, Penneo KYC offers robust tools for customer due diligence and risk assessment.

The platform excels in real-time monitoring, swiftly identifying and responding to potential money laundering risks. With a user-friendly interface and seamless integration capabilities, Penneo KYC optimizes AML workflows, providing compliance officers with efficient tools to navigate complex regulatory landscapes.

The software’s commitment to staying ahead of regulatory changes and its adaptability to emerging threats underscore Penneo KYC as a trusted and forward-thinking choice for businesses seeking a reliable AML solution. Its emphasis on accuracy, compliance, and security makes Penneo KYC a valuable asset in the ongoing efforts to maintain the integrity of financial systems.

41. Sayari

Sayari, renowned for its creative approach to preventing financial crime, has become a prominent Anti-Money Laundering (AML) software solution. Sayari, a company that specializes in due diligence and corporate intelligence, provides strong tools for thorough risk assessment and real-time monitoring. The platform is excellent at quickly detecting and addressing possible money laundering threats, giving compliance officers useful information.

Sayari optimizes AML processes and boosts overall operational efficiency thanks to its user-friendly interface and seamless integration capabilities. Sayari’s software demonstrates a strong commitment to staying ahead of regulatory changes and adapts to emerging threats, making it a dependable and progressive option for businesses looking for an AML solution. Sayari is a useful tool in the ongoing fight against financial crimes because of its emphasis on accuracy, compliance, and security.

42. Vouched

Being a top provider of Anti-Money Laundering (AML) software, Vouched is well-known for its advanced identity verification and compliance features. With a focus on sophisticated biometric authentication and document verification, Vouched guarantees a thorough due diligence procedure for its clients. The platform performs exceptionally well at monitoring in real-time, quickly recognizing and addressing any possible risks of money laundering.

With its intuitive interface and smooth integration features, Vouched streamlines AML processes and gives compliance officers effective tools to handle challenging regulatory environments. The software’s dedication to staying current with regulatory changes and its flexibility in responding to new threats confirm Vouched’s reputation as a dependable and innovative option for companies looking for an AML solution. Because of its focus on security, compliance, and accuracy, Vouched is a useful tool in the continuous endeavor to preserve the integrity of financial systems.

43. Workfusion Intelligent Automation Cloud

Due to its creative approach to financial crime detection and prevention, WorkFusion Intelligent Automation Cloud is a powerful Anti-Money Laundering (AML) software solution. WorkFusion is able to provide strong tools for transaction analysis, real-time monitoring, and thorough risk assessment by utilizing intelligent automation and machine learning.

The platform is excellent at quickly detecting and addressing possible money laundering threats, giving compliance officers useful information to help them make decisions. The WorkFusion Intelligent Automation Cloud enhances overall operational efficiency by optimizing AML workflows through its user-friendly interface and seamless integration capabilities.

WorkFusion’s software demonstrates a strong commitment to staying ahead of regulatory changes and adapts to emerging threats, making it a dependable and progressive option for businesses looking for an AML solution. Because of its focus on security, accuracy, and compliance, WorkFusion Intelligent Automation Cloud is a priceless tool in the continuous battle against financial crimes.

44. Lucinity

Leading Anti-Money Laundering (AML) software provider Lucinity has established itself as a result of its creative approach to preventing financial crime. With a focus on artificial intelligence and advanced analytics, Lucinity provides powerful tools for thorough risk assessment and real-time transaction monitoring. The platform is excellent at quickly detecting and addressing possible money laundering threats, giving compliance officers useful information.

Lucinity enhances overall operational efficiency by optimizing AML workflows through its user-friendly interface and seamless integration capabilities. The program’s dedication to staying ahead of changes in regulations and its flexibility in the face of new threats highlight Lucinity as a dependable and progressive option for companies looking for an AML solution. Because of its focus on security, compliance, and accuracy, Lucinity is a useful tool in the continuous endeavor to preserve the integrity of financial systems.

45. NameScan (Best Anti Money Laundering Software)

Due to its creative approach to preventing financial crime, NameScan has become a well-known Anti-Money Laundering (AML) software solution. NameScan is a company that specializes in thorough customer due diligence and screening. It provides cutting-edge tools for risk assessment and identity verification. The platform performs exceptionally well at monitoring in real-time, quickly recognizing and addressing any possible risks of money laundering.

NameScan streamlines AML processes with its intuitive interface and smooth integration features, giving compliance officers effective tools to manage intricate regulatory environments. Because of the software’s dedication to staying up to date with regulatory changes and its flexibility in responding to new threats, NameScan is a dependable and innovative option for companies looking for an AML solution. Because of its focus on security, compliance, and accuracy, NameScan is a useful tool in the continuous fight against financial crimes.

46. ThetaRay

Because of its superior analytics and machine learning capabilities in preventing financial crime, ThetaRay has cemented its place as a top Anti-Money Laundering (AML) software solution. ThetaRay, which specializes in risk assessment and anomaly detection, provides powerful tools for spotting suspicious patterns suggestive of money laundering activity.

The platform is excellent at monitoring in real-time, quickly recognizing and addressing possible threats, and giving compliance officers useful information. ThetaRay optimizes AML workflows and boosts overall operational efficiency thanks to its user-friendly interface and seamless integration capabilities.

ThetaRay’s software demonstrates a strong commitment to staying ahead of regulatory changes and adapts to emerging threats, making it a dependable and progressive option for businesses looking for an AML solution. ThetaRay is an invaluable tool in the continuous efforts to preserve the integrity of financial systems because of its emphasis on accuracy, compliance, and security.

47. FileInvite

A notable Anti-Money Laundering (AML) software solution, FileInvite is renowned for its creative method of expediting compliance procedures. With a focus on safe document gathering and authentication, FileInvite provides strong instruments for effective client due diligence and risk analysis.

The platform performs exceptionally well in real-time monitoring, enabling organizations to quickly collect and examine the documentation required to recognize and address possible money laundering risks. FileInvite streamlines AML processes and gives compliance officers the tools they need to successfully negotiate complicated regulatory environments thanks to its intuitive interface and seamless integration capabilities.

The software’s dedication to staying current with regulatory changes and its flexibility in responding to new threats highlight FileInvite as a dependable and innovative option for companies looking for an AML solution. FileInvite is a useful tool in the continuous fight against financial crimes because of its emphasis on accuracy, compliance, and security.

48. DueDil

DueDil has established itself as a well-known Anti-Money Laundering (AML) software provider, renowned for its cutting-edge strategy for preventing financial crime. DueDil is a business intelligence specialist that provides strong tools for risk assessment and customer due diligence. The platform performs exceptionally well at monitoring in real-time, quickly recognizing and addressing any possible risks of money laundering.

DueDil streamlines AML processes with its intuitive interface and smooth integration capabilities, giving compliance officers effective tools to handle challenging regulatory environments. Because of the software’s dedication to staying current with regulatory changes and its flexibility in responding to new threats, DueDil is a dependable and innovative option for companies looking for an AML solution. Because of its focus on security, compliance, and accuracy, DueDil is a useful tool in the continuous efforts to preserve the integrity of financial systems.

49. Shufti Pro

Shufti Pro has made a name for itself as a top provider of Anti-Money Laundering (AML) software, thanks to its creative and all-encompassing approach to preventing financial crime. With a focus on sophisticated document authentication and identity verification, Shufti Pro provides strong tools for risk assessment and customer due diligence.

The platform performs exceptionally well at monitoring in real-time, quickly recognizing and addressing any possible risks of money laundering. Shufti Pro streamlines AML processes with its intuitive interface and smooth integration capabilities, giving compliance officers effective tools to manage intricate regulatory environments.

Shufti Pro’s dedication to staying up to date with regulatory changes and its flexibility in responding to new threats solidify its reputation as a dependable and innovative option for companies looking for an AML solution. Shufti Pro’s focus on accuracy, compliance, and security makes it an invaluable tool in the continuous fight against financial crimes.

50. TigerGraph (Best Anti Money Laundering Software)

With its cutting-edge and potent graph database technology, TigerGraph has established itself as a formidable Anti-Money Laundering (AML) software provider in the fight against financial crime. TigerGraph, which specializes in real-time transaction monitoring and advanced analytics, provides powerful tools for spotting intricate patterns suggestive of money laundering activity.

The platform is excellent at quickly identifying and addressing possible risks, giving compliance officers useful information. TigerGraph enhances operational efficiency by streamlining AML workflows and providing a smooth integration experience.

Because of the software’s dedication to staying ahead of regulatory changes and its flexibility in the face of new threats, TigerGraph is a dependable and progressive option for companies looking for an AML solution. TigerGraph is a valuable asset in the ongoing efforts to maintain the integrity of financial systems because of its emphasis on accuracy, compliance, and security.

Features Of Best Anti Money Laundering Software

Transaction Monitoring

One essential component is the ability to watch financial transactions in real time. In order to find odd trends, significant transactions, or other clues that point to possible money laundering, the software examines transaction data.

Customer Due Diligence (CDD)

Capabilities for thorough customer profiling and due diligence are critical. In order to ensure regulatory compliance, the software should allow businesses to authenticate customers and evaluate their risk profiles.

Risk-Based Approach

Organizations can allocate resources more effectively when they apply a risk-based approach to AML processes. Prioritizing higher-risk customers and transactions for closer examination should be made easier by the software.

Watchlist Screening

To identify people or organizations connected to money laundering, financing of terrorism, or other illegal activities, integration with watchlists and sanctions lists is essential.

Machine Learning and AI

The software’s capacity to identify intricate and dynamic money laundering patterns is improved by advanced analytics, machine learning, and artificial intelligence. These innovations lessen false positives and increase accuracy.

Alerts and Notifications

In order to facilitate timely investigation and action by compliance teams, the software should produce alerts and notifications in real-time for suspicious activities.

Case Management

Compliance officers can effectively monitor and oversee investigations with the help of an extensive case management system. Throughout the course of the investigation, it should facilitate reporting, communication, and documentation.

Regulatory Reporting

The creation of reports necessary for regulatory compliance ought to be made easier by AML software. This entails submitting SARs (suspicious activity reports) and other paperwork required to prove compliance with anti-money laundering regulations.

User-Friendly Interface

For ease of use, an interface must be simple to use and intuitive. This facilitates compliance officers’ efficient use of the software and improves the effectiveness of AML measures implemented inside an organization.

Integration with Other Systems

An effective risk management plan requires smooth integration with the banking and financial systems that are currently in place. For a complete solution, the AML software should integrate seamlessly with other tools and databases.

Audit Trails

For compliance and accountability reasons, comprehensive and tamper-evident audit trails are essential. This function makes sure that every action made within the AML program is recorded and traceable.

Scalability

An organization’s growth and variations in transaction volumes should be supported by the software. This guarantees that AML capabilities will grow with the company.

Training and Support

The successful implementation and utilization of the AML software is facilitated by extensive training resources and continuous support from the software provider.

Adaptive to Regulatory Changes

To guarantee that businesses stay in compliance with new laws and standards, AML software should be built to adjust to changes in regulatory requirements.

Pros & Cons Of Best Anti Money Laundering Software

Pros:

Improved Detection Capabilities: State-of-the-art AML software analyzes big datasets using cutting-edge technologies like artificial intelligence and machine learning to better identify intricate money laundering patterns.

Real-Time Monitoring: AML software provides real-time financial transaction monitoring, reducing the chance of financial losses by facilitating the prompt detection and reaction to suspicious activity.

Regulatory Compliance: Top AML software makes sure that anti-money laundering rules and regulations are followed, protecting businesses from fines and other negative outcomes.

Effective Case Management: From the point of initial detection to the point of resolution, compliance officers can track and manage investigations with efficiency thanks to the extensive case management tools provided by AML software.

User-Friendly Interface: By lowering the learning curve and improving overall usability, intuitive interfaces help compliance officers and staff navigate and use the AML software more successfully.

Scalability: The software is made to grow with the company, adapting to variations in transaction volume and guaranteeing long-term efficacy.

Integration with Current Systems: A more unified approach to risk management is made possible by smooth integration with other financial systems, which also simplifies procedures and boosts productivity.

Adaptability to Emerging Threats: In the constantly shifting world of financial crimes, the most effective anti-money laundering software is flexible and can change to meet new threats.

Cons :

Cost: Using and keeping up with sophisticated AML software can be expensive, particularly for smaller businesses with tighter resources. For certain businesses, the upfront costs and continuing expenditures could be a hindrance.

Difficult Implementation: It can be difficult and time-consuming to integrate AML software into current systems. It might take a lot of work to guarantee flawless functionality and compatibility.

False Positives: Although sophisticated analytics increase precision, AML software might nevertheless produce false positives that prompt the examination of lawful transactions. Compliance teams may have more work as a result of this.

Resource-Intensive: Large dataset analysis and continuous monitoring can be resource-intensive, requiring a substantial amount of storage and processing power. This might result in higher running expenses.

Dependency on Data Quality: The caliber of the data that AML software analyzes has a significant impact on how effective the program is. Data that is incomplete or inaccurate could make it more difficult for the software to identify and stop money laundering.

Training Requirements: In order to use the advanced features of AML software effectively, users—especially compliance officers—may need to undergo training. This can take a lot of time and might momentarily reduce output.

Over-reliance on Technology: Organizations run the risk of relying too much on AML software and undervaluing the value of human judgment and experience in spotting suspicious activity.

Regulations That Are Always Changing: AML laws are always changing. It can be difficult to keep software current and compliant with changing regulations, and the software provider may need to update the program on a regular basis.

Best Anti Money Laundering Software Conclusion

In summary, the Best Anti Money Laundering Software offers strong tools to identify, stop, and report on possible money laundering activities, which is crucial for the financial sector. These solutions, which come with cutting-edge features like machine learning, real-time monitoring, and thorough case management, enable businesses to stay ahead of changing financial risks and adhere to strict regulatory standards.

There are drawbacks to take into account as well, such as implementation complexity, potential false positives, and the requirement for continual training, even though the advantages include increased detection capabilities, increased efficiency, and a proactive approach against illicit financial activities.

The choice to purchase the best AML software should ultimately be based on an organization’s commitment to upholding the integrity of its financial operations, regulatory obligations, and risk profile. The best AML software is still essential for protecting against the constant threats of financial crime and money laundering as the financial landscape changes.

Best Anti Money Laundering Software FAQ

What is Anti-Money Laundering (AML) software, and why is it important?

AML software is a tool designed to detect and prevent money laundering activities within financial institutions. It employs advanced technologies, such as machine learning and artificial intelligence, to analyze financial transactions and identify patterns indicative of illicit activities. AML software is important for financial institutions to comply with regulatory requirements, mitigate the risk of financial crimes, and protect their reputation.

How does AML software work?

AML software works by continuously monitoring and analyzing financial transactions. It employs algorithms and models to identify unusual patterns, large transactions, or other indicators of potential money laundering. The software often integrates with watchlists and sanctions lists to screen customers and transactions against known entities involved in illegal activities. When suspicious activities are detected, the software generates alerts for further investigation.

What are the key features of the best AML software?

The best AML software typically includes features such as real-time monitoring, customer due diligence, risk-based approaches, watchlist screening, machine learning, alerts and notifications, case management, regulatory reporting, a user-friendly interface, integration with other systems, audit trails, scalability, training resources, and adaptability to regulatory changes.

How does AML software assist in regulatory compliance?

AML software assists in regulatory compliance by automating the monitoring and reporting of financial transactions. It helps organizations adhere to anti-money laundering laws and regulations by providing tools for customer due diligence, watchlist screening, and generating reports required for regulatory submissions, such as suspicious activity reports (SARs).

What are the potential challenges of implementing AML software?

Challenges in implementing AML software may include the cost of acquisition and maintenance, complexity of integration with existing systems, the potential for false positives leading to additional workload, resource-intensive data analysis, dependence on data quality, training requirements for users, overreliance on technology, and the need to keep the software updated to comply with constantly changing AML regulations.