The Best AI Tools for Stock Market Analysis that assist traders and investors in making more informed, data-driven decisions in today’s volatile financial markets will be covered in this article.

These AI-powered tools, which range from sentiment analysis and automated trading platforms to real-time stock scanners and predictive analytics, are revolutionizing the identification of market trends, risk management, and profitable possibilities.

Key Features to Look for in the Best AI Tools for Stock Market Analysis

Ability to Process Market Data in Real Time

AI tools must be able to process, and subsequently act upon, information regarding changes in stock price, the volume of trades, and stock price volatility for thousands of different stocks at the same time. If a trader receives alerts of breakout stocks, trend reversals, and irregular trading activities, the tools are a in real time.

Good Predictive Analytics and Forecast Models

The best AI tools for stock market analysis should be able to recognize and learn patterns to predict price movements in the market. They should be able to work beyond the traditional indicators, and estimate price movement, associated risk, and investors anticipated reward.

Competitive News and Sentiment Analysis

The best AI tools should be able to analyze and evaluate the investors’ market sentiment and scan through stock market news, social media, and earnings to predict and explain the movements in the market. AI should be able to measure sentiment positivity to explain the stock movement in the market.

Backtesting of Automated Strategies

Before a trader can execute a strategy in a live trading session, the strategy requires some testing. A trader must be able to evaluate the strategy in a hypothetical trading environment using a trading platform and a data provider to analyze and evaluate the strategies.

Scanners and Alerts That Can be Customized

Some of the more advanced AI systems allow users to set alerts based on advanced filtering like price levels, volume spikes, certain technical indicators, or shifts in sentiment. This lessens the amount of information that is not relevant to one’s trading, and helps focus the attention on the opportunities that are more in line with the trader’s goals.

Risk Management Tools Scope of Portfolio Analytics

Good systems provide snapshots of the portfolio analytics of one’s balancing of assets, avoiding over concentration, and preserving capital during turbulent times in the market of the AI driven risk maintenance.

Automation and Access to the API

For more advanced clients and developers, API. It provides the ability to integrate automated trading systems and custom AI models. This allows fully automated execution of strategies as well as the setting up of high-frequency trading systems that are scalable.

Ease of Use in the Visualization and Interface

Powerful AI systems should be simple to use with smooth navigation. Dashboards that are user friendly, charts that are interactive, and signals that are visual allow for the ease of use in the interpretation of data. The systems allow for the user to avoid an advanced level of technical expertise to be able to make high level confident decisions.

Coverage of Multiple Assets

Great AI systems provide the ability to work with stocks, ETFs, forex and cryptocurrencies. This means that traders are able to diversify their strategies and monitor multiple systems across various markets.

Standards for Security and Data Privacy

We expect AI tools that offer customer investment strategies to use security measures like data encryption and two-factor authentication. These measures protect users, strategies, and account connections from malicious hacking.

Potential Risks and Limitations of AI Tools

Over-Dependence on Automated Predictions

Loss of critical thinking and personal assessment is the evitable result of becoming overly dependent on automated signals. AI models create predictions based on information which is subject to change. Uncharted geopolitical confrontations, policy changes, and irrational human behavior are just some factors the AI models may not consider, leading to predictions which are inaccurate or delayed.

Issues Related to Bias and Data Quality

AI insights and predictions lack value if the data they are based on is substantially flawed. AI tools can be dangerous to the decision to trade when data is incomplete, outdated, or biased, as the insights and predictions become flawed, especially in the areas of historical data, news, and bias sentiment feeds.

Unusual Market Conditions and Limited Performance

Market flash crashes, financial crises, and other extreme events are some of the scenarios AI models often struggle with. Scenarios which are outside the normal parameters, lead to an increase in the unreliability of predictions based on historical data machine learning.

AI Models’ Opacity

Frequently, AI tools lack clarity on the predictions they provide, as they often utilize “black box” models which predict results but lack an explanation as to how the results were reached, and providing a lack of transparency to the user on how the signal was reached.—

Technical Issues and Inactivity of the Systems

Systems and interfaces like the API can experience Technical problems. Because of these technical problems, they can delay and miss the trading opportunities, active trades, and market data.

Security and Privacy Issues

Cybersecurity can be an issue if someone connects their AI tools to brokerage accounts and APIs. Security flaws and breaches can expose trading techniques and sensitive data, like the financial information.

Expensive Advanced Features

Building small or beginner investors’ scopes can be constrained by the prohibitive cost of premium AI tools subscriptions, which can be very expensive. Real-time automation, data, and advanced analytics can only be accessed by paying substantial sums.

Regulatory and Compliance Issues

Every Automated trading system offers adherence to the financial regulations of the territory where it applies. If the user does not detect legal parameters and the limits of the automation platform, the user can incur compliance issues, such as restricted accounts.

Market Noise and False Signals

Scanning AI tools can be user-oversaturated by-and being bombarded with an abundance of alerts and signals that are of poor quality and irrelevant to the user’s focus, which can reflect detrimental to the user’s decision and can make it suffer from automation.

Learning Curve and Technical Complexity

Most advanced AI platforms take some time and expertise to install, tailor, and understand. New users may find it hard to explore the functions and features of the tools, and, without some training or support, they are likely to underutilize the tools.

Key Point & Best AI Tools for Stock Market Analysis List

| Platform | Key Point |

|---|---|

| Trade Ideas | AI-powered stock scanner that uses real-time market data and backtesting to generate high-probability trade alerts and automated trading strategies for active day traders. |

| TrendSpider | Advanced technical analysis platform that automates trendline detection, multi-timeframe analysis, and chart pattern recognition to improve trading accuracy and reduce manual work. |

| Tickeron | AI-driven market intelligence tool that provides predictive analytics, pattern recognition, and confidence levels for stocks, ETFs, and cryptocurrencies. |

| EquBot (IBM Watson) | Uses IBM Watson’s machine learning to analyze financial data, news sentiment, and market trends to generate AI-powered portfolio and stock recommendations. |

| Stock Rover | Comprehensive stock research and portfolio management platform offering in-depth fundamental analysis, screening tools, and performance tracking for long-term investors. |

| Sentifi | Financial sentiment analysis tool that scans social media, news, and online sources to measure market mood and identify trending stocks and investment themes. |

| FinBrain AI | AI-based news and sentiment analyzer that evaluates financial headlines and social data to predict short-term stock price movements. |

| Numerai Signals | Crowd-sourced AI prediction platform that aggregates machine learning models from global data scientists to generate stock market signals. |

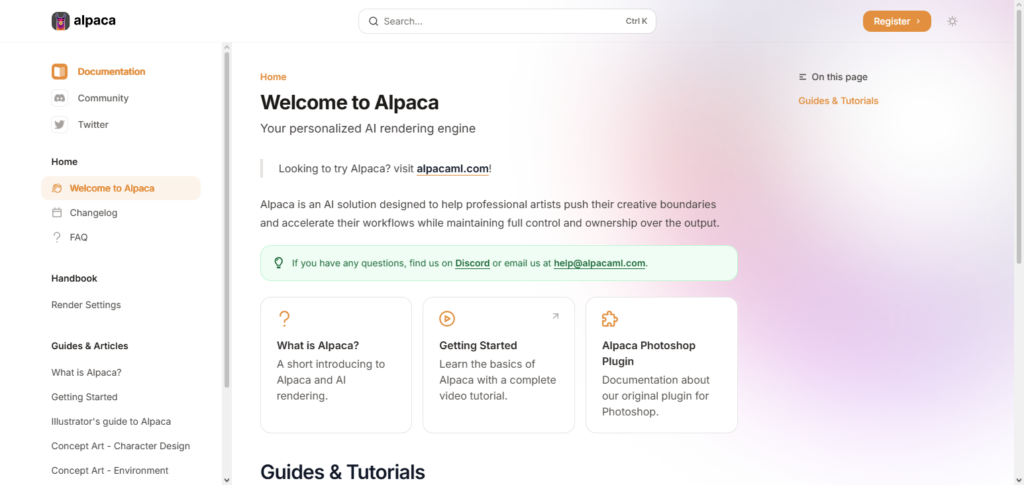

| Alpaca AI | Algorithmic trading and brokerage API platform that enables developers to build, test, and deploy AI-powered trading bots with commission-free trading access. |

| BlackBoxStocks | Real-time stock and options alert service that uses AI and unusual activity scanners to identify high-volume trades and potential market-moving opportunities. |

1. Trade Ideas

Trade Ideas is a platform with the most powerful stock scanning and trading AI that is designed for active traders with a preference for real-time trading data and alerts. It uses machine learning and data science to capture the changing state of the stock market to analyze and identify stock market patterns from different perspectives.

Trade Ideas offers a unique proprietary AI engine named Holly that backtests stock trading strategies to find the best trade ideas. Within its work flow, Best AI Tools for Stock Market Analysis is demonstrated in the automated strategy testing and simulated trading features.

Trade Ideas Features, Pros & Cons

Features

- Strategy generation AI “Holly“

- Sends real-time updates for thousands of monitored stocks

- Backtesting and practice trading

- Custom alert filters

- Simulated trading room integration

Pros

- Sophisticated AI powered and signal systems

- Support for active traders

- Real-time unfiltered alerts give a signal suite

- Backtesting features are robust

- Excellent resources for support and education

Cons

- Advanced features are expensive

- Beginners have a lot to learn

- Features of the UI are overwhelming

- Doesn’t support long-term investment strategies

- Requires a reliable internet connection to stream data

2. TrendSpider

TrendSpider is a sophisticated technical analysis tool that helps traders and investors identify market trends by automating charting. By automatically identifying trendlines, support and resistance levels, and candlestick patterns over a variety of timeframes, it removes the need for manual labor. Additionally, the platform provides backtesting tools and smart notifications that let users verify plans with past data.

TrendSpider incorporates AI-driven insights into its charting system as one of the Best AI Tools for Stock Market Analysis, assisting traders in identifying new opportunities more quickly. Both short-term traders and long-term market watchers can benefit from its user-friendly interface, cloud-based access, and extensive asset coverage.

TrendSpider Features, Pros & Cons

Features

- Automation of technical analysis

- Detection of trends across multiple time frames

- Raindrop charts and Smart Alerts

- Backtesting of strategies

- Cloud-based charting and workflows

Pros

- Automation of charting tasks

- Superior analysis for multiple time frames

- Customized analytics are robust

- Access to analytics is enhanced with alerts

- Access to workflows and charts on any device

Cons

- Limited data on fundamentals

- Tools are not the same for all pricing plans

- Some may find the layout to be overwhelming

- Lacks coverage of social sentiments

- Best fit for the technical traders

3. Tickeron

Tickeron is a market intelligence platform driven by artificial intelligence that offers predictive analytics for stocks, ETFs, currency, and cryptocurrencies.

It helps traders make data-driven decisions by using machine learning models to find trend directions, chart patterns, and probability-based projections. AI-generated trade ideas, customisable scanners, and performance confidence scores for various tactics are all available to users.

Tickeron, which is ranked among the Best AI Tools for Stock Market Analysis, is notable for fusing AI-driven pattern detection with technical indicators. It is useful for both novice and seasoned traders looking for more in-depth understanding of market movements because of its educational content, model transparency, and real-time notifications.

Tickeron Features, Pros & Cons

Features

- Recognition of AI patterns

- Forecasting with probabilities

- Scoring of confidence

- Support for multiple assets (stocks/crypto)

- Advanced screening capabilities

Pros

- Insight evaluations with probabilities

- Suitable for beginners & professionals

- Several classes of assets

- Adds contextual confidence evaluations

- Explanations for signals are intuitive

Cons

- Predictions are often not accurate

- Advanced functionality may be locked behind a paywall

- Compared to peers, less frequent updates

- Tools for sentiment analysis are inadequate

- Users with the interface being older may not like some of the designs

4. EquBot (IBM Watson)

EquBot, a platform driven by IBM Watson, is an artificial intelligence investment platform, which also integrations big data, natural language processing, and machine learning and focuses on dissecting global markets.

It analyzes financial reports, scans news articles, and focuses on social media sentiment and other variables to discover patterns and investment opportunities. The platform is recognized for its AI-driven ETFs and portfolio suggestions.

EquBot Provides investors with unique, actionable signals in the stock market that other analyses would not suggest. EquBot is recognized as one of the Best AI Tools for Stock Market Analysis. Users construct diversified portfolios, and pivot their strategies to respond to market shifts and sentiment fluctuations.

EquBot (IBM Watson) Features, Pros & Cons

Features

- The analytics of AI powered by Watson

- Processing of big-data

- Integration of news sentiments

- Model engines for ETFs

- Recommendations for portfolios

Pros

- Extremely high capacity as an analytics tool

- Sense of AI adds to the analytics

- Analytics of the institution level

- Supports varied portfolio

- Blends well with the long-term and smart beta ideas

Cons

- Limited retail market access

- Charting tools are not as advanced

- Not for active traders

- Pricing is premium for the upper levels

- No broker integration

5. Stock Rover

Stock Rover is a fully featured stock research and portfolio management tool for fundamental investors. Powerful screening functions, detailed company reports, and company financials help users assess potential long-term investments.

Portfolio management, performance benchmarking, and custom dashboards for key metrics are platform features.

Stock Rover remains part of the Best AI Tools for Stock Market Analysis as it uses smart analytics to spotlight potential growth and concern warrants. Stock Rover’s data coverage, seamless design, and connectivity to all major brokerages is a great tool for long-term investors and data driven decision makers.

Stock Rover Features, Pros & Cons

Features

- Engines of fundamental analysis

- Tailored tools for screening

- Benchmarking for performance

- Portfolio Analytics

- Integrated Tools for Brokers

Pros

- Best for long-term investing

- Deep data on fundamentals

- Nice dashboards and visualizations

- Good portfolio insights

- To some extent includes educational resources

Cons

- No focus on intraday signals

- Compared to others, AI tools are limited

- For beginners, may be overwhelming

- Some functionalities are behind premium plans

- Crypto/alternative assets are less focused on

6. Sentifi

Sentifi is a sentiment analysis and market intelligence tool that tracks financial conversations in internet forums, social media, and news sources using artificial intelligence.

In real time, it detects changes in investor sentiment, developing investment themes, and trending stocks. Sentifi assists customers in comprehending how market sentiment might impact price fluctuations by evaluating millions of data points.

It is regarded as one of the Best AI Tools for Stock Market Analysis and offers insightful information about public opinion and behavioral patterns. Sentifi is used by traders and analysts to add sentiment-driven signals to technical and fundamental analysis to create more comprehensive investing strategies.

Sentifi Features, Pros & Cons

Features

- Analysis and metrics on social sentiment

- News in real-time

- Alternative data streams

- Unusual sentiment on stocks and trending themes

- Value based on events

Pros

- Sentiment metrics are excellent

- Good for discovery on trends

- Alternative data is broad

- Good for understanding how the economy is doing

- dashboards that are visual and show sentiment metrics

Cons

- Trade setups are not provided

- No trading capability

- inflated sentiment is noisy, so may be less useful

- For people who trade only technically, this is less useful

- advanced data is priced at a premium

7. FinBrain AI

FinBrain AI attempts to understand financial news and online sentiment to forecast stock price fluctuations. It leverages machine learning and natural language processing to analyze the tone of reports, commentary in social media, and stock price affecting social media.

The platform provides the sentiment scores and directions of price shifts, allowing traders to define their buying and selling activities. FinBrain AI is recognized among the Best AI Tools for Stock Market Analysis for helping users protect themselves before the market reacts to news. It is designed for both day traders and swing traders, thanks to its user-friendly interface and real-time updates.

FinBrain AI Features, Pros & Cons

Features

- Analysis based on sentiment

- News with entity prediction

- Signals for price directions

- Sentiment on market and

- Forecasts for price in the short term

Pros

- Signals based on the news are fast

- Good for traders who are targeting the short term

- Helps to identify sentiment of the crowd

- Clean, simple interface

- Covers stock & crypto trading

Cons

- Inconsistent signal accuracy

- Basic charting

- Not ideal for thorough fundamental analysis

- Heavy dependence on news

- Best when used with other tools

8. Numerai Signals

Numerai Signals is one of the first AI driven services which combines the predictions of thousands of data scientists from around the world. Instead of one single model, it combines many machine learning models, and derives stock market signals from alternative data.

It also provides users with uncorrelated data driven predictions which outperform average benchmarks. For these reasons, Numerai Signals is featured amongst the Best AI Tools for Stock Market Analysis.

Founded on the principles of transparency and continuous improvement, it allows traders and investors access to sophisticated AI predictions sans the hassle of model creation, thereby enhancing the accessibility of advanced analytics.

Numerai Signals Features, Pros & Cons

Features

- Predictions using AI and crowdsourcing

- Modeling with alternative data

- Insights from the community

- Signals from machine learning

- Ranking and performance scoring

Pros

- Community models

- Unique prediction

- Contributes from data scientists

- Unique alpha signals

- Performance of models is visible

Cons

- Primarily designed for quantitative traders

- High learning curve for newcomers

- External execution platform is necessary

- No built-in charting

- Signals may be difficult to understand

9. Alpaca AI

Alpaca AI is a commission-less trading platform with an API that is built for developers to create, evaluate and implement algorithmic trading strategies. It offers real time analytics, a paper trading system and automated execution.

Alpaca is used by numerous developers and quantitative traders to integrate their AI models with trading instruments.

Alpaca AI is featured in the Best AI Tools for Stock Market Analysis because of its unique capability to provide scalable and flexible solutions. It is also custom built to support complex AI trading system, thanks to its cloud facilities, detailed and thorough guides, and multi language support.

Alpaca AI Features, Pros & Cons

Features

- Commission-less trading via API

- Algo trading automated rollouts

- Simulation trading mode

- Data on the market in real-time

- AI integrated strategies

Pros

- Best suited for automated trading

- APIs are friendly to developers

- Key features are free

- Easy to test strategies

- Good community backing

Cons

- Needs coding skills

- No traditional user interface for novices

- Built-in AI signals are few

- No sentiment analysis built in

10. BlackBoxStocks

BlackBoxStocks builds itself as a real-time stock and options analytics platform that detects unusual market activity. Using AI-driven scanners, the platform tracks significant activity across the following: trades, dark pools, and options that may suggest institutional movement.

The platform provides alerts and visual aids to assist traders in identifying breakouts. BlackBoxStocks has been recognized as one of the Best AI Tools for Stock Market Analysis given their combination of advanced analytics and real-time data. Active traders and options specialists appreciate their community options, educational materials, and customizable alerts.

BlackBoxStocks Features, Pros & Cons

Features

- Scanning in real-time

- Notifications of unusual options flow

- Alerts on high-volume trades

- Community chat and alerts

- Tools for visualizing market activity

Pros

- Wonderful for traders who are constantly active

- Major moves are highlighted in alerts

- Combination of stock and options insights

- Integration of strong community

- Focus on real-time data

Cons

- Fundamental tools are lacking

- Alerts may contain some false positive

- Complete access requires premium plans

- Not the best for investors of the long term

- Minimal focus on the engines of AI prediction

Conclusion

Artificial intelligence’s quick development has completely changed how traders and investors interact with the financial markets. Real-time data scanning, sentiment analysis, predictive analytics, automated charting, and algorithmic trading are just a few of the potent features that The Best AI Tools for Stock Market Analysis currently provide, making market insights more accurate and accessible than ever.

These systems assist in lowering emotional decision-making and enhancing strategy performance, regardless of whether you are an active trader looking for short-term opportunities or a long-term investor focusing on fundamentals.

In an increasingly competitive market, traders may keep ahead of market trends, manage risk more skillfully, and make more informed, data-driven investment decisions by fusing technology and human judgment.

FAQ

What are AI tools for stock market analysis?

AI tools for stock market analysis are software platforms that use machine learning, natural language processing, and data analytics to evaluate market data, price trends, financial statements, and news sentiment. These tools help traders and investors identify patterns, predict potential market movements, and make more informed, data-driven trading and investment decisions.

Are AI stock market tools suitable for beginners?

Yes, many AI stock market tools are beginner-friendly and offer intuitive dashboards, guided insights, and educational resources. Platforms like Stock Rover and Tickeron provide simplified analytics, pre-built scanners, and tutorials that help new investors understand market trends while gradually learning advanced strategies.

Can AI tools predict stock prices accurately?

AI tools do not guarantee accurate predictions, but they improve the probability of making better decisions by analyzing large volumes of historical and real-time data. They identify trends, patterns, and sentiment signals that humans may overlook, helping users assess risks and potential opportunities more effectively.

Do AI tools replace human traders and investors?

No, AI tools are designed to support, not replace, human decision-making. They provide insights, automation, and data analysis, but traders and investors still need to apply judgment, set risk management rules, and consider broader economic and personal financial factors.

Are these AI tools free to use?

Some AI stock market analysis tools offer free plans or trials with limited features, while advanced tools typically require a subscription. Platforms like Alpaca AI provide free access to trading APIs, whereas premium platforms like Trade Ideas and TrendSpider offer paid plans with full AI-powered functionality.