The Best AI Tools for Multi-Currency Financial Management that assist companies and individuals in effectively managing international finances will be covered in this post.

These solutions use AI to estimate cash flows, optimize currency conversions, automate cross-border payments, and lower operational risks. Organizations can reduce foreign exchange losses, expedite international transactions, and make more intelligent financial decisions globally by utilizing these platforms.

What is Multi-Currency Financial Management AI Tools?

Multicurrency Financial Administration AI Tools are sophisticated software programs that use artificial intelligence to assist individuals and companies in effectively managing their finances in a variety of currencies.

These tools minimize exchange rate losses and minimize manual labor by automatically tracking, converting, and optimizing transactions in several currencies. They frequently offer automated reporting, predictive analytics, and real-time insights, facilitating more intelligent decision-making for international businesses.

They can also be integrated with accounting software, payment platforms, and banking systems to handle multi-currency accounts, expedite cross-border transfers, and guarantee adherence to global financial regulations. In essence, these AI solutions make financial administration easier and more efficient for anyone handling international transactions.

Why Use AI Tools for Multi-Currency Financial Management

Currency RateVigilance – AI tools help consumers by monitoring specific currencies, reporting market changes in real time. They help people make educated choices as to whether to purchase, sell, or hold.

Currency Rate Converters – With a most currency converters, one enters a value in one currency and have to click on ‘calculate’ to get the answer in another currency. This can become monotonous as one enters multiple values. AI tools allow users to enter multiple values, in one click, and instantly convert them all.

Predictive Trend Optimizations – People like to complete expensive purchases when one or more currencies suddenly affordable. AI can help predict or identify when a currency is most affordable.

Predictive Trend Optimizations – People like to complete expensive purchases when one or more currencies suddenly affordable. AI can help predict or identify when a currency is most affordable.

Currency Risk Exposure – Every currency in the world, as a tangible or electronic commodity, comes with risk. AI can identify currencies that have risk, and poor monetary depth, and assist one in avoiding them.

Key Point & Best AI Tools for Multi-Currency Financial Management List

| Platform | Key Features / Highlights |

|---|---|

| Kyriba | AI-driven cash visibility, automated FX management, and predictive liquidity forecasting for global operations. |

| Tipalti | Automates mass global payments, currency conversion, tax compliance, and supplier onboarding with AI efficiency. |

| Trovata | AI-powered cash management, real-time bank data aggregation, and multi-currency forecasting for better decision-making. |

| Airwallex | Global payments platform with AI-based FX optimization, multi-currency accounts, and cross-border transaction automation. |

| Wise Business (TransferWise) | Real-time currency conversion, low-cost international transfers, and multi-currency account management using intelligent routing. |

| Payoneer AI Suite | AI-powered global payment processing, multi-currency wallet management, and transaction insights for businesses worldwide. |

| SAP Treasury & Risk AI | Comprehensive treasury management, automated risk analysis, and multi-currency exposure monitoring using AI analytics. |

| Corpay Cross‑Border AI | Automates cross-border payments, FX hedging, and multi-currency cash flow management with predictive AI insights. |

| WorldFirst AI Platform | Intelligent FX and payment optimization, multi-currency wallets, and global transaction automation for businesses. |

| Revolut Business AI | AI-enabled multi-currency accounts, instant transfers, and expense management with real-time currency analytics. |

1. Kyriba

Kyriba’s thorough and clever approach to international treasury operations makes it stand out as one of the top AI tools for multi-currency financial management. Businesses can effectively track and optimize liquidity because to its real-time cash insight across different currencies.

Its AI-driven predictive analytics foresee cash flow requirements and currency swings, assisting businesses in making strategic financial decisions and lowering FX risks.

Additionally, Kyriba reduces operational expenses and human mistake by automating FX transactions and payments. Its distinctive feature is the integration of multi-currency management, automated treasury procedures, and sophisticated AI forecasting into a single, integrated platform that simplifies and improves global finance.

Pros & Cons Kyriba

Pros:

- AI enabled cash forecasting. Smiths Advanced Treasury Management.

- Multi-currency support. Real feeds on liquidity.

- Offers solid ERP partnership for seamless financial management.

Cons:

- Expensive for small businesses.

- Onboarding and implementation are time cons.

- Level of some features is sufficiently advanced for non finance.

2. Tipalti

Designed to streamline and automate international payment procedures, Tipalti is a top AI tool for multi-currency financial management. Its special strength is its ability to intelligently handle large-scale payments in a variety of currencies, guaranteeing precise conversions, prompt transfers, and adherence to global tax and regulatory regulations.

By using AI to identify payment irregularities, optimize foreign exchange rates, and lower operational risks, the platform helps businesses save money and time.

Additionally, Tipalti offers real-time visibility into cash flows and multi-currency balances while streamlining supplier onboarding and payment reconciliation. It is the perfect option for companies handling foreign finances because of its automation, AI-driven optimization, and worldwide compliance.

Pros & Cons Tipalti

Pros:

- Automates cross border payments to suppliers. AI risk checks.

- Multiple currencies and tax compliance.

- Streamlined accounts payable. Less manual errors.

Cons:

- Unique payment workflows have limited payment flexibility.

- Older systems have integration challenges.

- Smaller payments tend to have higher transaction fees.

3. Trovata

Trovata is a superb AI solution for managing finances in several currencies, providing real-time visibility into global cash positions and sophisticated automation. Its most notable feature is AI-powered cash forecasting, which helps companies plan liquidity and effectively manage currency risk by accurately predicting multi-currency cash flows.

Additionally, Trovata automates the aggregation of bank data, combining accounts from several countries and currencies into a single, user-friendly dashboard. This improves decision-making and does away with manual reconciliation.

Trovata enables companies to optimize their international financial operations, lower FX exposure, and smoothly handle multi-currency treasury management by fusing predictive analytics, automated reporting, and intelligent cash management.

Pros & Cons Trovata

Pros:

- Cash and liquidity forecasting. AI enabled.

- Financial visibility is improved through multi bank aggregation.

- Finance teams have an easy to use interface.

Cons:

- More advanced ERPs have limited integrations.

- All global currencies might not be accepted.

- Smaller enterprises might not be a good fit.

4. Airwallex

A premier AI solution for managing several currencies, Airwallex is made to quickly and intelligently streamline international commercial transactions. Its distinct feature is AI-driven FX optimization, which minimizes expenses and delays by automatically choosing the optimal exchange rates and effectively routing payments across several currencies.

Additionally, Airwallex offers multi-currency accounts that let companies hold, send, and receive money anywhere in the world without having to convert it frequently.

Airwallex enables businesses to manage foreign finances with ease, reduce currency risk, and extend operations abroad with accuracy and transparency thanks to automated cross-border payment workflows, real-time tracking, and predictive insights into currency patterns.

Pros & Cons Airwallex

Pros:

- Multi-currency accounts and global payments.

- Competitive fees and exchange rates.

- Payment routing and compliance is AI optimized.

Cons:

- During busy times, client assistance may take longer than usual.

- Less complete selection of financial products.

- More sophisticated options may only be available in upper tier plans.

5. Wise Business (TransferWise)

An outstanding AI solution for multi-currency financial management, Wise Business (previously TransferWise) gives companies a clever, economical approach to manage foreign transactions. Its primary advantage is its real-time, AI-powered currency conversion, which minimizes hidden costs and guarantees the most favorable exchange rates.

Wise Business enables businesses to efficiently handle cross-border transactions, transmit and receive payments worldwide, and keep multi-currency accounts.

Currency risk is decreased and payment timing is optimized via the platform’s predictive features and intelligent routing. Wise Business helps companies to simplify foreign financial operations and make data-driven decisions for global expansion by fusing transparency, automation, and AI-powered currency insights.

Pros & Cons Wise Business (TransferWise)

Pros:

- Low-cost and quick payments across different countries.

- Uses up-to-date rates for currency exchange.

- Can be integrated with various accounting software.

Cons:

- Lacks some advanced finance management features.

- Not ideal for companies with many subsidiaries.

- No advanced analytics available.

6. Payoneer AI Suite

A top AI solution for managing several currencies, Payoneer AI Suite was created especially to streamline international payments and maximize foreign cash flow. Its distinctive edge is its AI-driven transaction insights, which assist companies in determining the most efficient payment methods, cutting expenses associated with currency translation, and reducing foreign exchange risks.

With the platform’s capability for multi-currency accounts, money may be received and sent globally with ease. Payoneer AI Suite enables companies to effectively handle complicated international finances with intelligent reconciliation, automated payment scheduling, and real-time analytics. It is the perfect solution for international financial management since it combines AI optimization, cross-border payment automation, and actionable analytics.

Pros & Cons Payoneer AI Suite

Pros:

- Detects fraud and optimizes payments with AI.

- Can make payments in different currencies.

- Global suppliers and freelancers can be onboarded with little effort.

Cons:

- Certain money exchange transactions can be costly.

- Less ideal for large and complex finance departments.

- May be overly complex in some cases.

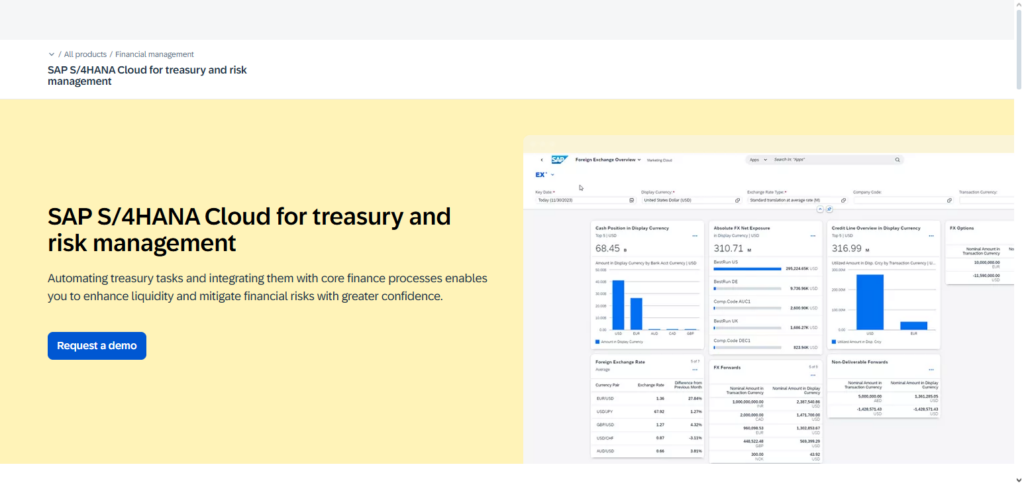

7. SAP Treasury & Risk AI

A leading AI tool for multi-currency financial management, SAP Treasury & Risk AI gives companies complete control over international treasury operations. Its special feature is that it combines real-time multi-currency cash and liquidity management with AI-driven risk analysis, allowing businesses to effectively maximize capital and predict currency exposure.

By automating FX transactions, hedging tactics, and compliance reporting, the platform lowers operating expenses and human error. SAP Treasury & Risk AI is a crucial tool for complex global treasury management because it enables businesses to make data-driven decisions, manage international cash flows intelligently, and reduce financial risks through predictive analytics, scenario planning, and integrated financial insights.

Pros & Cons SAP Treasury & Risk AI

Pros:

- Uses advanced AI systems to mitigate financial management risks.

- Forecasts and manages cash in real-time for multiple currencies.

- Works well with existing SAP business systems.

Cons:

- More costly for smaller companies.

- Implementation can be difficult without advanced competency.

- For smaller finance departments, this can be difficult to adopt.

8. Corpay Cross‑Border AI

A top AI tool for multi-currency financial management, Corpay Cross-Border AI was created especially to improve currency operations and expedite international payments. AI-powered FX and payment automation, which cleverly chooses the most economical methods and timing for cross-border transactions, is its special strength.

The technology helps businesses lower operational risk and conversion costs by offering real-time multi-currency tracking, automated reconciliation, and predictive analytics on currency swings.

Corpay Cross-Border AI makes it possible for businesses to effectively manage international cash flows, maximize foreign exchange risk, and streamline intricate global financial operations by fusing powerful analytics, smooth integration with international banking systems, and automated compliance management.

Pros & Cons Corpay Cross‑Border AI

Pros:

- Uses AI to process hybrid and variable-cost cross-border payments.

- Offers consistent records and management of various currencies.

- Helps to save on both customer transaction costs and processing time.

Cons:

- No or little support on small business sector.

- Learning and adapting to new features might take time and efforts.

- Integration with some enterprise resource planning (ERP) systems might be missing.

9. WorldFirst AI Platform

WorldFirst AI Platform is a cutting-edge AI multi-currency financial management solution designed to assist companies in managing international transactions effectively and economically.

AI-driven currency optimization, which finds the optimal exchange rates and forecasts market changes to lower foreign exchange expenses, is its most notable feature. The technology automates cross-border payments while guaranteeing compliance with international rules by enabling businesses to hold, transmit, and receive funds in numerous currencies.

With real-time reporting, predictive cash flow analytics, and intelligent risk management, WorldFirst AI Platform enables businesses to reduce currency risk, optimize international financial operations, and confidently and precisely make strategic decisions for global expansion.

Pros & Cons WorldFirst AI Platform

Pros:

- Transfers to other countries take short time to process and costs are low.

- Payment processing is optimized on the basis of AI predictions on currency price changes.

- Easy to use on small and medium businesses and sites which operate globally.

Cons:

- Not a lot of treasury management systems.

- Integrating with other digital systems is very limited for large businesses.

- Response time on customer support may be limited with high transaction amounts.

10. Revolut Business AI

Revolut Business AI is a potent multi-currency financial management tool that maximizes international cash flow and streamlines international transactions.

AI-driven currency analytics, which tracks current exchange rates, forecasts trends, and automatically suggests the optimal conversion times to cut expenses, is its special strength. The platform simplifies foreign financial operations for companies of all sizes by providing multi-currency accounts, instantaneous cross-border payments, and automatic expense tracking.

Revolut Business AI helps businesses manage international finances effectively, reduce foreign exchange risks, and quickly and accurately make data-driven choices by combining predictive insights, real-time reporting, and intelligent automation.

Pros & Cons Revolut Business AI

Pros:

- Accounts that are offered with different currercies and real-time AI predictions.

- Manage your expenses and automate payments.

- Transfers with low costs and are instant changing to a different currency.

Cons:

- Large businesses may have limited access to some features.

- Some features may be available on higher subscription plans.

- AI predictions on changing currency price is not as good as other systems that are specially designed to be treasury management systems.

Conclusion

In conclusion, companies’ handling of international finances is being revolutionized by the best AI tools for multi-currency financial management, including Kyriba, Tipalti, Trovata, Airwallex, Wise Business, Payoneer AI Suite, SAP Treasury & Risk AI, Corpay Cross-Border AI, WorldFirst AI Platform, and Revolut Business AI.

These technologies optimize foreign exchange rates, speed cross-border payments, and lower operational risks by fusing automation, predictive analytics, and real-time data.

Accurate cash flow forecasting, intelligent currency conversion, and effective multi-currency account administration are made possible by their special AI-driven capabilities. By using these technologies, businesses may reduce expenses, make strategic financial decisions, and confidently and precisely oversee global operations.

FAQ

What are AI tools for multi-currency financial management?

AI tools for multi-currency financial management are software solutions that leverage artificial intelligence to automate, optimize, and monitor global financial operations across different currencies, including payments, FX conversions, cash flow forecasting, and risk management.

Why should businesses use these AI tools?

They provide real-time insights, reduce manual errors, optimize exchange rates, automate cross-border payments, improve liquidity planning, and minimize currency risk, making global financial management faster and more cost-effective.

Which are the best AI tools for multi-currency financial management?

Some of the top platforms include Kyriba, Tipalti, Trovata, Airwallex, Wise Business, Payoneer AI Suite, SAP Treasury & Risk AI, Corpay Cross‑Border AI, WorldFirst AI Platform, and Revolut Business AI.