The Best AI Tools for Fraud Prevention that assist businesses in real-time fraud detection, prevention, and response will be covered in this article.

In order to lower financial losses, increase accuracy, and safeguard consumer trust in banking, e-commerce, and digital transactions, these cutting-edge platforms employ artificial intelligence, machine learning, and behavioral analytics.

What Are AI Tools for Fraud Prevention?

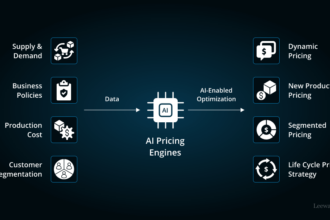

Artificial intelligence (AI) technologies for fraud protection are sophisticated software programs that employ machine learning, artificial intelligence, and behavioral analytics to detect, stop, and react to fraudulent activity instantly.

In order to find abnormalities and suspicious patterns that conventional rule-based systems frequently overlook, these tools examine vast amounts of transaction data, user activity, device signals, and identity information.

AI fraud prevention systems eliminate false positives, make quicker, more accurate risk choices across banking, e-commerce, payments, and digital platforms, and adapt to new fraud strategies by continuously learning from fresh data.

Key Features to Look for in AI Fraud Prevention Tools

Machine Learning and Behavioral Analytics – Recognition of fraud will strengthen as patterns and anomalies are detected from transactional history and real-time behavioral data.

Decisioning/Risk Scoring in Real-Time – Ability to approve, flag, or block risky activities in an instantaneous manner and to score transactions and engagements seamlessly.

Identity Verification and Device Intelligence – Authenticating users through the use of device fingerprinting, biometric data, and digital identity graphs.

Adaptable & Custom Policies – Ability to set individual risk parameters, alert thresholds, and actions according to particular fraud prevention strategies.

Implementation and Growth – Ability to interface i seamlessly with gateways, e-commerce applications, and infrastructures while changing to meet the needs of the client.

Explainable AI & Analytics – Outlining the Waze and Why of model decisions and providing detailed dashboards to support investigations and compliance reporting.

Omnichannel – Providing protection for all customer engagements, including web, mobile, API, in-store, and other unchannel arrangements.

Key Point & Best AI Tools for Fraud Prevention List

| Tool | Key Points |

|---|---|

| LexisNexis ThreatMetrix | Provides real-time digital identity intelligence using global data networks, device fingerprinting, and behavioral analytics to detect fraud while reducing false positives. |

| Fraud.net | Offers AI-driven fraud detection with unified risk management across payments, account abuse, and compliance, supported by customizable rules and machine learning models. |

| Horizon Identity | Focuses on identity verification and fraud prevention through behavioral biometrics, identity proofing, and continuous user authentication across digital channels. |

| Kount (Equifax) | Delivers omnichannel fraud protection using AI, device data, and identity trust scoring, enabling accurate fraud decisions with minimal customer friction. |

| Featurespace ARIC | Uses adaptive behavioral analytics and anomaly detection to identify real-time financial crime patterns, particularly effective for payments and transaction monitoring. |

| SAS Fraud Management | Combines advanced analytics, AI, and rules-based detection to manage fraud across payments, cards, and digital banking with strong regulatory reporting capabilities. |

| Actimize (NICE) | Specializes in enterprise-grade fraud and financial crime prevention, leveraging AI and scenario-based analytics for AML, fraud detection, and compliance monitoring. |

| Feedzai | Provides real-time risk assessment and payment fraud prevention using machine learning and behavioral biometrics, optimized for banks and digital payment platforms. |

| Signifyd | Focuses on eCommerce fraud protection with guaranteed fraud decisions, leveraging machine learning to approve legitimate transactions and reduce chargebacks. |

| Riskified | Offers AI-powered eCommerce fraud prevention and chargeback protection, using network intelligence to maximize approval rates and customer conversion. |

1. LexisNexis ThreatMetrix

Best AI Tools for Fraud Prevention LexisNexis ThreatMetrix customers use the digital identity fraud detection platform to understand and analyze a customer’s fraud risk at each stage of the customer lifecycle.

ThreatMetrix uses machine learning to analyze customer devices, identities, and behaviors to quickly identify fraud.

The company describes their unique digital identity solution, which draws from the LexisNexis Digital Identity Network that encompasses billions of transactions and daily updates to identify specific fraud risk scenarios, including account takeover, synthetic identities, and mule fraud.

LexisNexis combines fraud prevention with a positive customer experience, ensuring clients achieve their customer interaction goals.

LexisNexis ThreatMetrix Features, Pros & Cons

Features

- Network for Digital Identity Intelligence.

- Analytics based on Device Fingerprinting & Behavior.

- Scoring of Risk in Real-Time.

- Sharing of Global Fraud Signals.

- Models of Risk Using Machine Learning.

Pros

- Outstanding identity resolution.

- Decreased Rates on False Positives.

- Flexible Scaling for Enterprise Needs.

- Robust Compliance Support.

- Integration with Multiple Systems.

Cons

- On the Expensive Side.

- Lengthy Onboarding/Implementation Process.

- Expert Configuration Required.

- Complex for Small Enterprises.

- External Data Accuracy Dependent.

2. Fraud.net

Best AI Tools for Fraud Prevention Fraud.net provides its customers with a fully integrated, modular, enterprise-level AI fraud detection and prevention solution in the cloud.

The fully integrated SaaS solution uses Machine learning, neural networks, and the full spectrum of data science analytics and behavior modeling to identify and understand the most complex cases of fraud, including application fraud, account takeover fraud, business email compromise, and synthetic identity fraud.

Fraud.net integrates dark-web intelligence with case management and real-time risk scoring to assist companies in understanding evolving risks and threat patterns. It helps organizations to streamline operations, enhance incident response, and reduce fraud losses by automating investigations and learning from new trends in fraud.

Fraud.net Features, Pros & Cons

Features

- Fraud Detection Driven by AI.

- Engine with Custom Rules.

- Intelligence on the Dark Web.

- Tools for Managing Cases.

- Real-Time Scoring of Fraud.

Pros

- Exceptional for Enterprise Use.

- Customization of Rules is Extremely Flexible.

- Assists with Multiple Fraud Types.

- Insights on Dark Web Monitoring.

- Architecture that is Scalable.

Cons

- Total Features Higher Costs.

- Increased Learning Curve.

- Adjustments Needed to Reduce False Positives.

- Professional Services May Be Required.

- Complex UI.

3. Horizon Identity

Best AI Tools for Fraud Prevention Horizon Identity helps enhance fraud investigations and risk assessment by correlating different identifiers – emails, phone numbers, IP addresses, and usernames – into organized and centralized profiles.

The ability for deep identity enrichment and link analysis helps to detect complex and synthetic identity fraud by uncovering and connecting data sources and networks that traditional systems fail to do.

Horizon Identity allows fraud analysts and investigators to efficiently validate digital identities and uncover fraud rings, enhancing customer onboarding, Know Your Customer (KYC), and compliance with enriched contextual intelligence.

Horizon Identity Features, Pros & Cons

Features

- Platform for Identity Resolution.

- Analysis of Links and Mapping of Entities.

- Enrichment of Behavioral Profiles.

- Graph of Digital Identities.

- An Interface That is Friendly to Investigators.

Pros

- Excellent at spotting identity fraud

- Assists in revealing fraud rings

- Streamlines KYC processes

- Deep contextual insights

- Improves compliance and risk operations

Cons

- Not an entire fraud suite

- Greater emphasis on identity than transaction risk

- Real-time risk scoring is limited

- Involves some integration work

- Best suited for analysts, not quick and easy to use

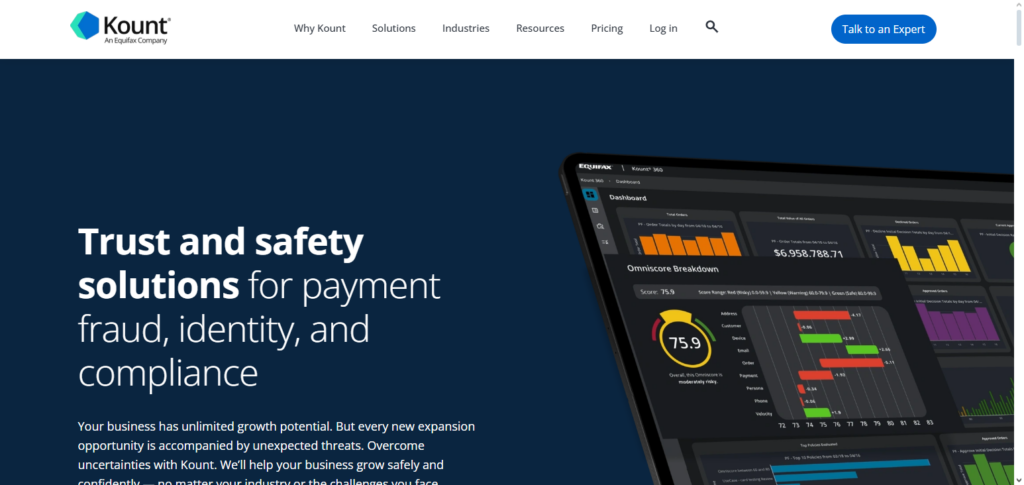

4. Kount (Equifax)

Best AI Tools for Fraud Prevention Kount (Equifax) offers adaptive, machine-learning-powered fraud detection, and risk management that focuses on identity trust and transaction security in digital spaces.

AI examines countless data points and identities in order sinkscore to answer risk questions so that companies may prompt, contest, or block adverse engagements.

kount, unmatched in paralleled real time fraud analytics combines with efficent chargeback reduction and loss manual review with kount shortened time to fraud with kount integrated eCommerce and managed marketplace. more effective fraud operations positively shifted behavior in customers.

Kount (Equifax) Features, Pros & Cons

Features

- Fraud detection across all channels

- OmniScore risk scoring powered by AI

- Device, identity & behavioral signals

- Rules and alerts that can be tailored

- Monitoring of chargebacks and transactions

Pros

- Excellent detection in real-time

- Ideal for online payment transactions

- Increases less manual assessment

- Wonderful analytics dashboard

- Enrichment of data from Equifax

Cons

- Charges can significantly differ

- Configuring can be difficult

- Integration of data is necessary

- Niche industries have false positives

- Advanced features can be difficult to understand

5. Featurespace ARIC

Best AI Tools for Fraud Prevention Featurespace ARIC (Adaptive Real-time Intelligence with Context) is an award-winning solution for the prevention of fraud and financial crime that employs adaptive behavioral analytics to understand transactions and customer interactions. ARIC differentiates between an overwhelming number of users and the activities that are overt or covert using machine learning.

ARIC has proven abilities to detect application, payment, check, and cross-channel fraud and scams, and it identifies and eliminates suspicious behavior that is overlooked by narrow, rigid rule systems. ARIC also self-adapts to evolving fraud patterns, which is critical in minimizing false positives, driving revenue, and reinforcing customer confidence while holistic risk detection.

Featurespace ARIC Features, Pros & Cons

Features

- Analytics with adaptive behavior

- Detection of anomalies in real-time

- Machine models that self-learn

- Support for multiple channels

- Scoring and alerting that is flexible

Pros

- Extremely low false positives

- Automatically learns and adapts

- Excellent at fraud in payments

- Visibility across channels is supported

- Good accuracy in detection

Cons

- Potentially expensive with an enterprise focus

- Complex to implement

- Needed historical data is required

- Suitable for processing lots of transactions.

- Requires some setup.

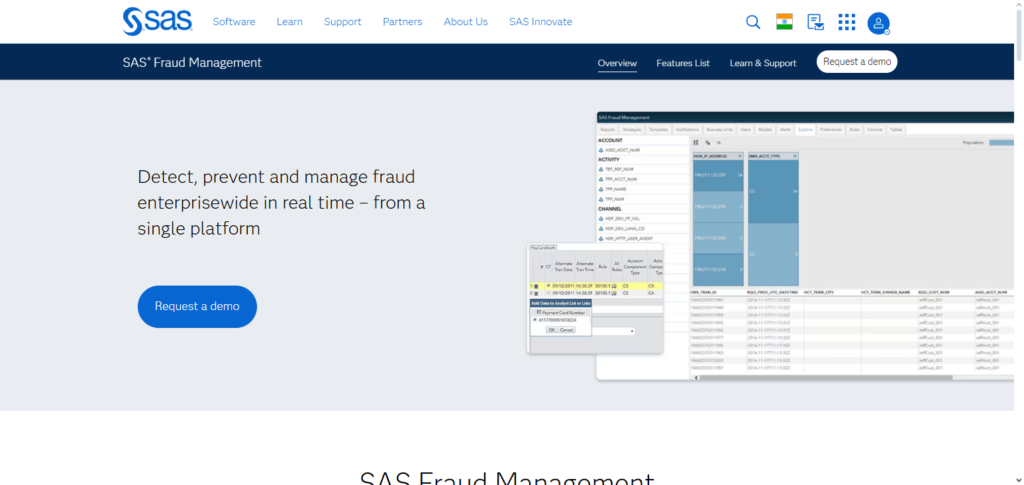

6. SAS Fraud Management

Best AI Tools for Fraud Prevention SAS Fraud Management is an enterprise-level platform for the detection of fraud, which combines high-powered analytics with real-time scoring, artificial intelligence, machine learning, and tools for data orchestration.

Being able to score all transactions in milliseconds means it can detect potential threats such as account takeovers, synthetic identity fraud, and ecommerce fraud all while minimizing false positives and maintaining a good customer experience.

Using a combination of predictive models, anomaly detection, and integrated alert workflows, SAS helps organizations identify and mitigate threats before catastrophic losses occur.

Its architecture, scalability, and ability to make real-time decisions allows it to be used by banks, insurers, and large corporations, all of which require processing large quantities of transactions.

SAS Fraud Management Features, Pros & Cons

Features

- AI models & predictive analytics.

- Transactions scored in real time.

- Workflows and anomaly detection.

- Integration for compliance & AML.

- Machine learning and rule-based hybrid.

Pros

- Robust compliance features.

- Big Analytics for huge enterprises.

- Scalable for larger enterprises.

- Case management, integrated.

- Dependable vendor management.

Cons

- Expensive.

- Lengthy time for setup.

- Requires seasoned personnel.

- Complicated implementations.

- Large enterprises only.

7. Actimize (NICE)

Best AI Tools for Fraud Prevention Actimize (NICE) is the most sophisticated since it has an Enterprise Fraud Management suite that applies ubiquitous AI and advanced analytics in detecting and preventing financial crime in payments, new accounts, authentication, and investigations.

The platform combines fraud prevention and AML (Anti Money Laundering) and other compliance use cases to provide real-time risk profiling and automated decisioning to block scams, mule accounts, and payment fraud across all channels.

Actimize’s extensive end-to-end workflow and case management capabilities enable organizations to optimize risk operations, comply with regulations, and minimize losses while enhancing their understanding of changing threat ecosystems through next-gen AI and behavioral modeling.

Actimize (NICE) Features, Pros & Cons

Features

- Suite for enterprise fraud management.

- Scenarios and pervasive AI detection.

- Analytics and alerts in real time.

- Integration for fraud and AML.

- Automation for workflows and cases.

Pros

- Outstanding for big banks.

- Extensive risk coverage.

- Outstanding compliance features.

- Scalable over different channels.

- Reporting features are great.

Cons

- Too high pricing.

- Implementation is very complicated.

- Requires specialist human resources.

- Training period is lengthy.

- Needs a lot of infrastructural resources.

8. Feedzai

Best AI Tools for Fraud Prevention Feedzai, is an AI-native platform that allows banks, payment processors, and even governments to detect real-time fraud and financial crime, regardless of the channel, payment type, or other criteria.

Machine learning models track user behavior and score transactions in real time to fraudulently control and prevent unauthorized access. This is how institutions automate risk decisions and fraud loss.

The Feedzai platform does handle AML use cases, compliance workflows, and risk management simultaneously to improve operational efficiency. It reduces genuine user friction and manages emerging threats through predictive analytics.

Feedzai Features, Pros & Cons

Features

- Machine learning models in real time.

- Scoring both behavior and transactions.

- Platform for risk orchestration.

- Features for compliance and AML.

- Dashboards for analytics.

Pros

- Excellent detection in real time.

- Real time detection for various payment types.

- Scalable

- Less fraud

- Banks and PSPs like it

Cons

- High pricing

- Takes integration

- Data engineering may be needed

- Takes time to configure

- Requires training on advanced features

9. Signifyd

Signifyd specializes in e-commerce fraud where fully automated, real-time chargeback fraud reimbursement, and order reviews fraud are guaranteed by protected commerce. With one of the largest networks of e-commerce merchants analyzing millions of data points, Signifyd is able to guarantee risk assessment in real time at the point of checkout.

This allows merchants to confidently allow transactions to go through, fully approving more legitimate orders and decreasing the number of orders that have to be reviewed manually. The platform also protects online retailers from return and refund abuse by scoring return risk and recommending actions, which improves revenue, customer experience, and operational efficiency online.

Signifyd Features, Pros & Cons

Features

- Fraud protection guaranteed

- Real time order scoring

- Chargeback reimbursement

- Scoring for returns and abuse

- Integrations for ecommerce

Pros

- Deployment for ecommerce is simple

- Chargebacks are reduced

- Decisions are automated

- Conversions are improved

- User interface is easy

Cons

- Costly for every transaction

- Only suited for ecommerce

- Limited beyond order fraud

- Relies on the integration of platforms

- Needs tuning

10. Riskified

Riskified is one of the most recognizable eCommerce fraud and risk intelligence platforms in the game. They combine behavioral analytics, machine learning, and a vast global merchant network to balance risk and protect revenue.

Chargeback guarantees and checkout adaptive features assist merchants in minimizing false declines, boosting conversions, and transferring fraud loss liability.

By enhancing consumer satisfaction, and merchant profitability, and dynamically preventing and controlling abuse of policies through big data and automated decisioning, analytics, and risk profiling, fraud abuse, and policy abuse at scale.

Riskified Features, Pros & Cons

Features

- Decisions powered by AI

- Options for chargeback guarantee

- Behavioral analytics

- Optimized adaptive checkout

- Risk dashboard for merchants

Pros

- Focuses on ecommerce

- Increases approvals

- Reduces false declines

- Liability shift on chargebacks

- Revenue growth

Cons

- Price per transaction

- Not good for financial institutions

- Online retail is all it focuses on

- Requires integration efforts

- Not the complete fraud suite

Comparison of Top AI Fraud Prevention Tools

| Tool | Key Strengths | Best For | Pros | Cons |

|---|---|---|---|---|

| LexisNexis ThreatMetrix | Global digital identity intelligence, device & behavioral analytics | Large enterprises, banks | Strong identity resolution, low false positives | Costly, complex setup |

| Fraud.net | AI risk scoring + dark web intelligence | Enterprise risk teams | Custom rules, broad fraud type coverage | Steep learning curve |

| Horizon Identity | Identity resolution & link analysis | Investigations & identity fraud | Deep identity graphs, reveals fraud rings | Not full fraud suite |

| Kount (Equifax) | OmniScore + adaptive AI | Ecommerce & payments | Real-time scoring, reduces manual reviews | Pricing varies by volume |

| Featurespace ARIC | Self-learning behavioral analytics | High-volume payment fraud | Very low false positives, adaptive models | Enterprise focus, high price |

| SAS Fraud Management | Predictive analytics + anomaly detection | Banks & insurers | Powerful analytics, compliance tools | Long deployment, needs experts |

| Actimize (NICE) | Enterprise fraud & AML integration | Large financial institutions | Broad coverage, strong case mgmt | Very expensive, complex |

| Feedzai | Real-time machine learning risk scoring | Banks & PSPs | Scalable, good payment coverage | Premium pricing, integration time |

| Signifyd | Guaranteed ecommerce fraud protection | Online retail | Chargeback guarantee, easy setup | Focused mainly on ecommerce |

| Riskified | AI decisioning + chargeback guarantee | Ecommerce & marketplaces | Boosts conversions, reduces declines | Transaction-based pricing |

Conclusion

In conclusion, the most effective AI fraud prevention systems are essential for shielding businesses from ever-evolving and more complex fraud threats. Advanced machine learning, behavioral analytics, and real-time risk scoring are used by programs like LexisNexis ThreatMetrix, Feedzai, Actimize, Featurespace ARIC, and Riskified to detect fraud with high accuracy and little customer friction.

These systems improve consumer satisfaction while assisting organizations in preventing financial losses, lowering false positives, and strengthening compliance. Organizations may create robust, scalable, and future-ready fraud defense strategies by selecting the appropriate AI-powered fraud protection tool based on industry requirements and transaction complexity.

FAQ

What are AI tools for fraud prevention?

AI tools for fraud prevention use artificial intelligence, machine learning, behavioral analytics, and risk scoring to detect suspicious patterns, anomalies, and fraudulent behavior in real time. These tools analyze large volumes of data to identify threats before they impact business operations, reduce false positives, and improve decision-making. They are widely used in banking, ecommerce, insurance, and digital platforms to protect against payment fraud, account takeover, identity fraud, chargebacks, and financial crime.

Why is AI important in fraud detection?

AI enhances fraud detection by learning from data patterns, evolving with emerging fraud tactics, and making real-time risk predictions that static rule-based systems cannot achieve. Machine learning models adapt continuously, recognize complex fraud schemes, and provide contextual insights that improve accuracy and reduce manual workload. This leads to faster decisions, fewer false alerts, and better protection for customers and businesses.

How do tools like LexisNexis ThreatMetrix and Kount differ?

LexisNexis ThreatMetrix focuses on digital identity intelligence by analyzing device, identity, and behavioral signals from a global network to assess risk. Kount (Equifax) centers on identity trust scoring and adaptive machine learning to detect fraud across digital payments and transactions. While both use AI, LexisNexis emphasizes identity resolution, and Kount emphasizes real-time risk scoring and omnichannel fraud management.

Can AI fraud tools reduce false positives?

Yes. AI fraud tools use advanced analytics, machine learning, and behavioral profiling to distinguish between legitimate and fraudulent behavior accurately. By learning from historical and real-time data, they significantly reduce false positives compared to traditional rule-based systems, improving customer experience while tightening security.