In this article, I will discuss the best AI ETFs for 2025, focusing on top funds that provide exposure to artificial intelligence, robotics, and automation technologies.

As AI continues to revolutionize industries, selecting the right ETF can offer significant growth potential.

Let’s explore some of the leading AI-focused ETFs and their strategies for capturing the future of technology.

key Points & Best Ai ETF 2025

| Fund Name | Provider | Focus | Investment Strategy |

|---|---|---|---|

| Global X ETFs | Global X | Various, including AI & Robotics | Focus on thematic investments, including AI and tech |

| ARK Funds | ARK Invest | Innovation, AI, Robotics, and Tech | Actively managed, focusing on disruptive innovation |

| iShares | BlackRock | Broad range, including technology & AI | Diversified, with options in tech and AI sectors |

| SPDR S&P Kensho Intelligent Structures ETF (SIMS) | State Street Global | AI in infrastructure, intelligent systems | Invests in companies leveraging AI for infrastructure solutions |

| First Trust Nasdaq Artificial Intelligence and Robotics ETF (ROBT) | First Trust | AI, Robotics, and Automation | Invests in companies involved in AI and robotics innovation |

| WisdomTree Artificial Intelligence and Innovation Fund (WTAI) | WisdomTree | AI, Automation, and Technological Innovation | Focus on AI and automation-driven companies |

| Amplify ETFs | Amplify | Innovation, AI, and Future Tech | Invests in thematic sectors like AI, blockchain, and technology |

| Invesco QQQ ETF (QQQ) | Invesco | Technology and Innovation | Tracks the Nasdaq-100, with heavy tech and AI exposure |

| LGIM Fund Centre | Legal & General | Technology and Innovation | Focuses on global technology and AI companies |

| KraneShares CSI China Internet ETF (KWEB) | KraneShares | Chinese Internet and Technology Companies | Invests in Chinese tech, internet, and AI companies |

| Xtrackers MSCI All World ex US AI & Robotics ETF (AIER) | Xtrackers | Global AI and Robotics (excluding US) | Targets global companies in AI and robotics outside the U.S. |

| Vanguard Information Technology ETF (VGT) | Vanguard | Technology and AI | Invests in U.S. technology companies, including AI-focused firms |

| iShares U.S. Technology ETF (IYW) | BlackRock | U.S. Technology and AI | Focuses on U.S. technology sector, including AI companies |

| ARK Innovation ETF (ARKK) | ARK Invest | Disruptive Innovation, AI, and Emerging Tech | Actively managed, focused on AI, robotics, and other innovations |

| First Trust Cloud Computing ETF (SKYY) | First Trust | Cloud Computing and AI | Focuses on cloud computing companies, many leveraging AI |

20 Best Ai ETF 2025

1.Global X ETFs

Global X ETFs has many theme funds available such as artificial intelligence. As for 2025, it is most likely that the most promising AI ETF from Global X will be the Global X Artificial Intelligence & Technology ETF (AIQ).

This fund is targeting companies working actively in Robotics, Machine learning, and Automation and aims to take advantage of the increasing AI based economy.

Features Global X ETFs

- Global X ETFs launch themed funds that invest in new developments areas like robotics, artificial intelligence, and automation.

- The ETFs target companies that are at the forefront of technological innovation.

- They help achieve diversification across industries which increases growth opportunities.

- Global X ETF objectives include long term trends of growth in disruptive technology, architecture, bioengineering among others.

- These funds are targeted towards investors that want to invest into certain targeted future sectors.

2.ARK Funds

According to ARK Funds forecast, their ARK Autonomous Technology & Robotics ETF (ARKQ) will definitely be among the top AI ETFs by the year 2025. This is a managed fund which invests in companies that is engaged in the field of AI, robotics, or automation and autonomous technologies.

Fund ARKQ invests in companies with unique ideas which will in time develop. This makes it the perfect investment for those wanting exposure to new breakthroughs in AI technology.

Features ARK Funds

- The ARK Funds utilize an actively managed portfolio method to invest in companies which have the potential to disrupt existing technology.

- In this case, the funds allocation is made for AI and robotics, genomics and any similar high growth industries.

- The tech or some “disruptors” are not chosen arbitrarily but through a well thought out, research based process by the managers of ARK Funds.

- They allow the investor to gain direct interest in businesses which have stated themselves on the edge of developing a new technology.

- The funds of ARK Funds are conservative in the sense that they seek growth from very few companies, those which invest heavily in R&D.

3.iShares

Looking towards the future, the leader in robotics AI ETF is likely to be the iShares Robotics and Artificial Intelligence Multisector ETF (IRBO).

Unlike other funds, this fund invests in companies operating in AI, robotics and automation across different sectors.

Given its broad investment strategy, IRBO focuses on companies that are able to drive growth in AIs and their technologies which is ideal when considering long term growth of AI investment.

Features iShares

- iShares additionally provides a varied collection of ETFs that emphasize AI, technology and other sectors.

- The funds aim to give investors broad exposure to the world’s markets without incurring excessive costs.

- US iShare ETFs track the major US indices such as the S&P 500 making for accessible diversification.

- They offer mobility and adaptability which makes them available for a large spectrum of investors.

- iShares has broad research and management of funds and assets experience.

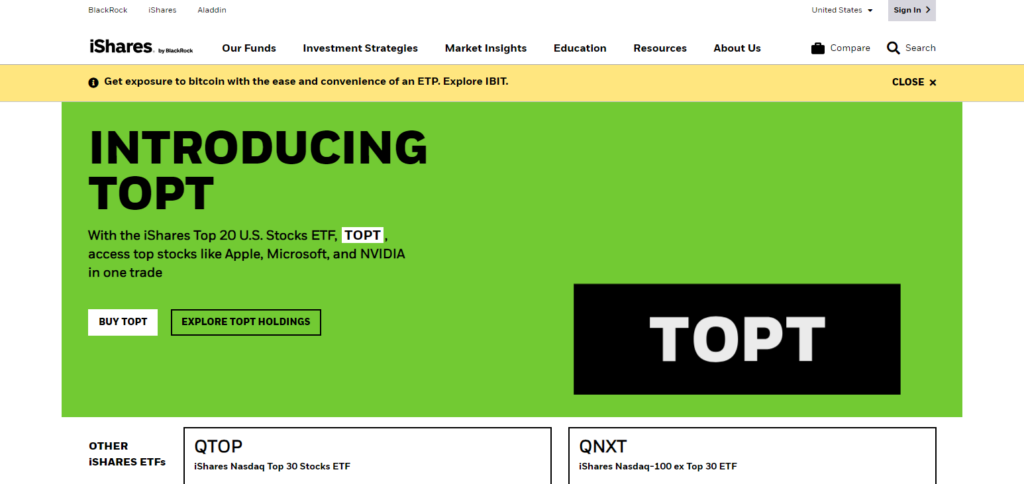

4.SPDR S&P Kensho Intelligent Structures ETF (SIMS)

For the year 2025, expect the SPDR S&P Kensho Intelligent Structures ETF (SIMS) be a leading AI ETF as it seems to have all the potential for growth.

The fund has allowed investments in companies that focus on the AI application for advanced infrastructure and intelligent systems such as smart building, energy, and smart transportation.

The SIMS fund invests in very advanced technologies which are AI powered and in essential industries, thereby making the fund a good option for many years to come.

Features SPDR S&P Kensho Intelligent Structures ETF (SIMS)

- SIMS Aims Companies which have Embedded AI in Infrastructure and Intelligent Systems.

- It addresses industries such as smart cities, energy, transportation.

- The fund wants to take advantage of the growth created by technological development in infrastructure.

- SIMS offers opportunities to invest in the companies which change the traditional sectors in innovative ways.

- AI-based Infrastructure Solutions are been looked into for long term value by the fund.

5.First Trust Nasdaq Artificial Intelligence and Robotics ETF (ROBT)

In 2025, the best AI ETF is likely to be the First Trust Nasdaq Artificial Intelligence and Robotics ETF (ROBT) .

This fund pools resources towards companies that lead the pack in AI, robotics and automation across manufacturing, healthcare, transport and any other relevant fields.

The emphasis on rapidly changing disruptive technologies makes ROBT a good long term bet for investors looking for the next leap in AI developments.

Features First Trust Nasdaq Artificial Intelligence and Robotics ETF (ROBT)

- ROBT focuses on various companies that are involved in artificial intelligence, robotics and automation technology.

- Fund aims at such areas as manufacturing, healthcare and transportation.

- This extends to companies that are leading advancements in AI and robotics.

- ROBT would look to partake in growth that would be attributed to the levels of automation in the system and other AI powered innovations.

- The designated ETF concentrates on businesses that are anticipated to revolutionize technology and robotics.

6.WisdomTree Artificial Intelligence and Innovation Fund (WTAI)

The WisdomTree Artificial Intelligence and Innovation Fund (WTAI) is among the best AI ETFs to look out for in 2025.

This ETF aims at investing in companies that specialize in innovations in AI, automation and technology.

Given its focus on disruptive industries, WTAI provides investors with a unique exposure to transformational

AI technologies and is a great fit for those who want to invest in growth opportunities in the fast-changing AI market.

Features WisdomTree Artificial Intelligence and Innovation Fund (WTAI)

- WTAI’s focus is on businesses involved in the further development of AI, automation, and technological innovations.

- The fund focuses on emergent technologies employing AI that improve the operations.

- It provides investment in the companies which are coming up with AI based new advancements.

- WTAI has an objective of obtaining AUM from the deployment of AI solutions in different sectors.

- This Fund seeks to deploy capital in disruptive companies which are changing the course of AI industries.

7.Amplify ETFs

The Amplify Transformational Data Sharing ETF (BLOK) could be termed as an AI ETF edifice from Amplify for the year 2025. This fund concentrates on businesses that use AI, blockchain and other disruptive technologies.

Provided with the opportunity to get involved with firms that are introducing innovations in data sharing and applications of AI, BLOK presents a hefty upside to growth potential and hence positions itself as an ideal option for investments on AI.

Features Amplify ETFs

- Undoubtedly one of the most rapid growth firms, Amplify considers disruptive technologies such as AI, Blokcc hain, and sharing data.

- layihenin mətni in a way that adds value or effect to the reader.

- Disruptive Technologies (96) Amplify’s funds employ thematic investment approaches towards emerging trends OR: Thematic funds able to adapt to changing circumstances.

- The goal of the ETFs is to perform well in technologically advanced companies.

- Financial services offer specialized ETFs targeting high-future potential industries.

8.Invesco QQQ ETF (QQQ)

By 2025, the Invesco QQQ ETF (QQQ) will be one of the top contenders for the best AI ETF, if not the best.

QQQ only tracks the large cap tech-focused Nasdaq-100 index, giving QQQ ETF holders ample exposure to quality technology beginning the likes of AI.

QQQ places significant weighting to AI behemoths like Microsoft, Apple, and Nvidia offering investors great potential in growth in AI innovation.

Features Invesco QQQ ETF (QQQ)

- QQQ’s strategy revolves around the top-performing technology firms from the Nasdaq-100 Index.

- In addition, the fund gains access to different growth-oriented segments, like Artificial Intelligence.

- Contains prominent players such as Apple and Microsoft, known for advancements in AI technology.

- On the other hand, QQQ is one of the most liquid ETFs, with active investors in the tech sector.

- This ETF, in particular, suits investors looking for diversified exposure to fast-growing technology stocks.

9.LGIM Fund Centre

The 2025 LGIM Fund Centre ranks this ETF among the industry-leading, AI-focused investment funds, referring to it as the LGIM Artificial Intelligence Fund.

This fund has a general aim at firms that are evolving in AI and technology innovation in most industries.

Such investment in companies leading AI deployment earns LGIM opportunities for growth hence making it suitable for investors who are prepared to have long-term investments that will heavily depend on AI in the future.

Features LGIM Fund Centre

- LGIM Fund Centre has developed numerous funds dedicated to AI, technology, and innovation.

- The platform provides investors with access to companies at the forefront of AI and automation.’

- LGIM seeks to invest for the long term in industries that drive transformation.

- The funds are intended to provide access to the latest technological advancements.

- LGIM believes in AI-based companies as well, but equally, they are a sustainable investing focus.

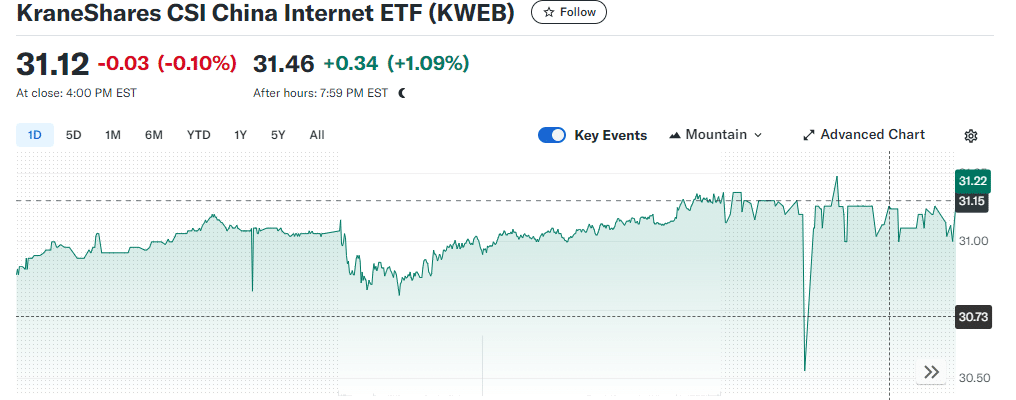

10.KraneShares CSI China Internet ETF (KWEB)

The KraneShares CSI China Internet ETF (KWEB) is the best investment in AI ETF, as it captures the major internet and technology companies in China which have a focus on AI and automation. KWEB is invested in innovative companies’

AI and tech markets in China and thus offers investors growth prospects from one of the most vibrant economies in the world.

Features KraneShares CSI China Internet ETF (KWEB)

- KWEB is directed towards the top internet and technology corporations in China which, with inspiration, are active in AI enhancement.

- The ETF was able to gain access to Chinese companies involved in e-commerce as well as social networking and AI technologies.

- KWEB buys high growing companies focusing on technology sector in particular regions of China which are rapidly growing.

- Investors can tap into an attractive emerging market with strong AI capabilities.

- KWEB enjoys the trend of China’s growing adoption of AI and digitalization.

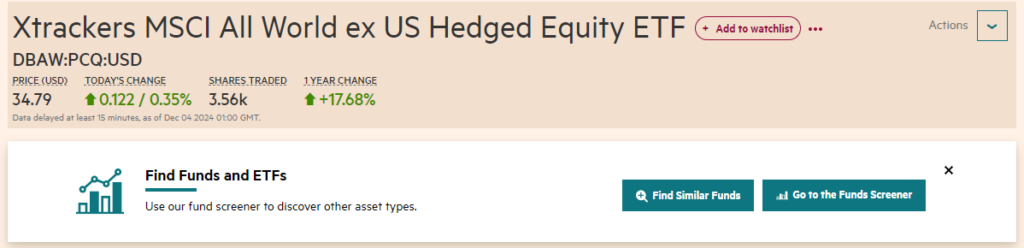

11.Xtrackers MSCI All World ex US AI & Robotics ETF (AIER)

The AIER is a unique fund as it potentially gives investors worldwide exposure to AI and Robotics Companies although it’s called the xtrackers MSCI All World Ex US AI & Robotics ETF

This Focuses on the inclusion of innovative companies that promote AI adoption and automation technologies developments, creating value for investors with a broad whose industries are focused in the field of AI and Robotics.

Features Xtrackers MSCI All World ex US AI & Robotics ETF (AIER)

- AIER allows investors to have an international perspective on AI and robotics companies which are not situated in the USA.

- The ETF seeks to invest in companies that are at the forefront of automation, robotics and Artificial Intelligence.

- AIER invests in foreign markets as well and increases the chances of growth.

- The investment strategy concentrates on high-growth companies in such sectors as manufacturing and logistics, among others.

- AIER grants exposure to the global markets of artificial intelligence and robotics industries which are on a fast pace.

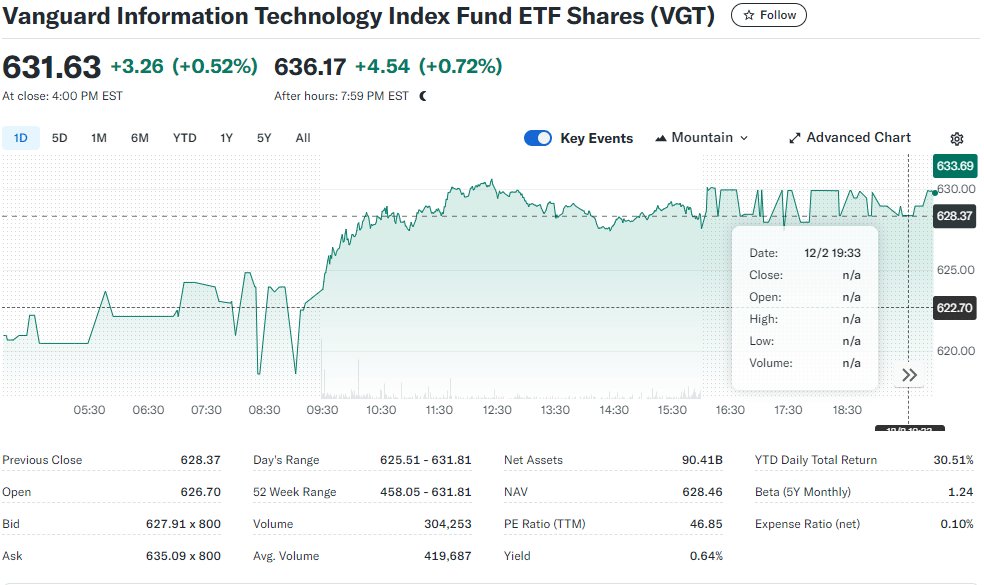

12.Vanguard Information Technology ETF (VGT)

Vanguard Information Technology ETF (VGT), an exchange-traded fund that departs a notch above its competition and is viewed as the AI ETF to have in 2025.

The fund gives exposure to a number of technology companies within the United States, a few of which are at the forefront of AI technology.

With significant investments in companies such as Nvidia and Apple, VGT presents clients with excellent prospects for growth from the technology and AI industries, making it suitable for investments over the long-term.

Features Vanguard Information Technology ETF (VGT)

- The basis of the fund seeks to achieve returns similar to the MSCI US IMI Information Technology 25/50 Index.

- VGT invests in software, hardware, artificial intelligence and other technology related industries that have high growth potential.

- It includes significant shares of companies such as Apple, Microsoft and Nvidia which are highly regarded in the AI field.

- VGT is ideal for those who are looking to invest their money with a focus on growth in the technology and AI industries.

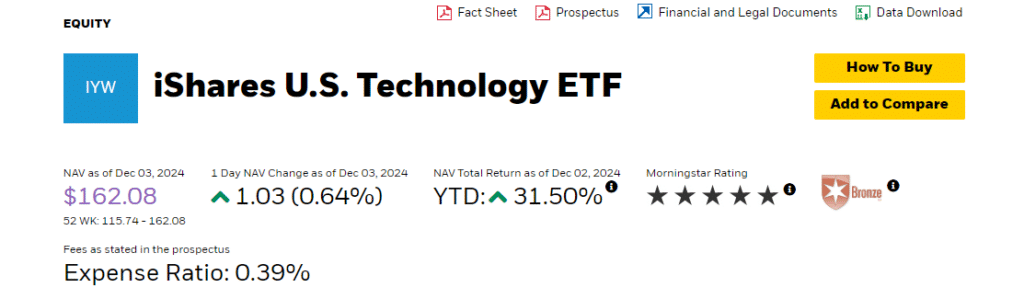

13.iShares U.S. Technology ETF (IYW)

In 2025, one of the best AI ETFs in the market is likely to be the iShares U.S. Technology ETF (IYW).

This fund gives exposure to powerful US technological companies as Apple, Microsoft and Nvidia, who are all leading in the sphere of AI development.

Investing in such industry leaders more than guarantees IYW a strong return in both AI and technology industries.

Features iShares U.S. Technology ETF (IYW)

- The fund IYW offers investors exposure to major US companies that contribute to the development of artificial intelligence technologies.

- The godl of the ETF is to replicate the performance of the Dow Jones US Technology Index.

- IYW supports investment across industries of software, hardware, and tech services.

- The ETF is invested in companies like Apple, Microsoft, and Nvidia who are significant to AI development.

- Investors wanting to get focused exposure into the US technology and AI sectors would find IYW suitable.

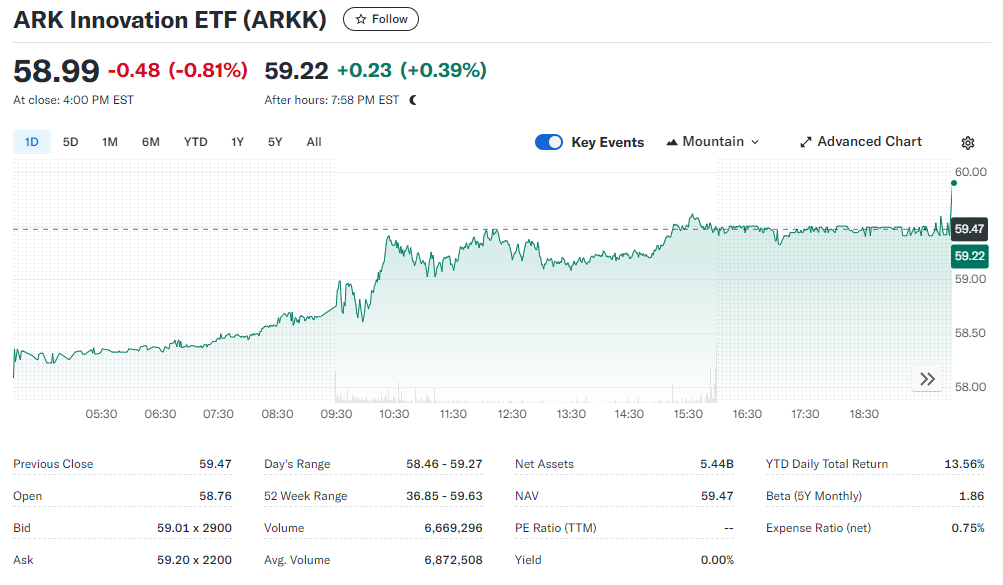

14.ARK Innovation ETF (ARKK)

Among the AI ETFs for 2025, the ARK Innovation ETF (ARKK) managed by ARK Invest is exceptional. It is an actively managed fund that emphasizes on disruptive technologies such as AI, robotics, and genomics.

ARKK has large positions in AI leaders like Tesla and Nvidia; it is a heavyweight actively managed fund that makes it easy for investors with a tech focus to invest into AI business outperformers.

Features ARK Innovation ETF (ARKK)

- ARKK concentrates its efforts to key technologies such as AI, robotics, and even biotech.

- This particular ETF engages in companies that enhance growth through new methods.

- ARKK attempts to gain exposure to emerging technologies able to disrupt entire sectors.

- It does include positions to such names like Tesla, Square or Roku which do utilize AI.

- Long-term growth objective is pursued by ARKK through investments in innovative companies with great potential.

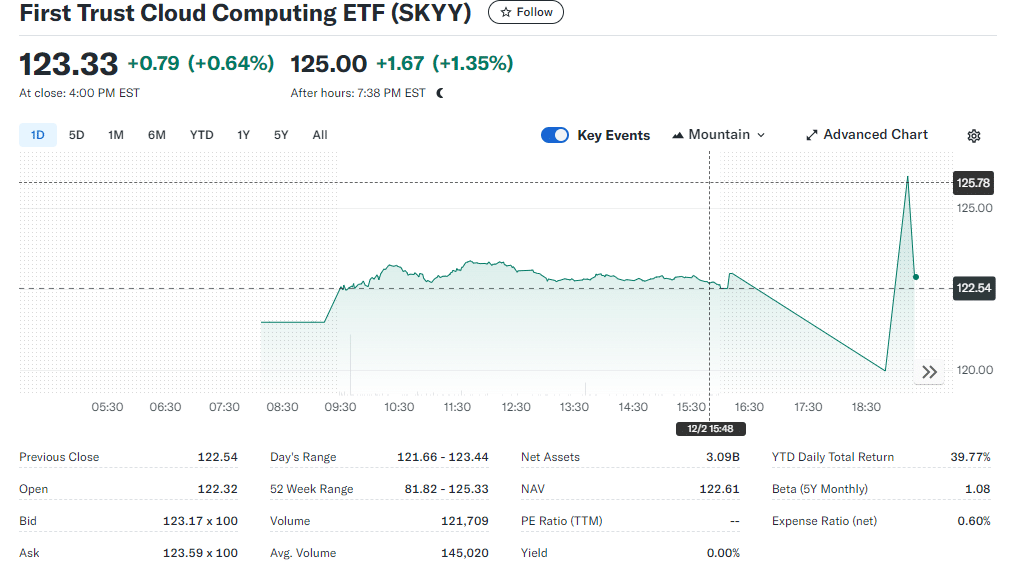

15.First Trust Cloud Computing ETF (SKYY)

Another good option for an AI ETF in 2025 is the First Trust Cloud Computing ETF (SKYY) which is centered around companies that are changing the cloud computing markets, many of which depend on AI and automation technologies.

SKYY has stakes in such cloud behemoths as Amazon and Microsoft, providing an investment in firms that are actively involved in the fusion of AI and cloud – a solid option for anyone looking for long-term investment in AI’s future growth.

Features First Trust Cloud Computing ETF (SKYY)

- SKYY specializes in companies that use cloud computing and many of them utilize AI and automation technologies.

- Through the ETF they invest in companies specializing in the development of cloud infrastructure or offer cloud services.

- SKYY provides exposure to large cloud firms such as Amazon, Microsoft and Google.

- The fund is focused on sectors which are benefitting from increasing use of cloud solutions.

- SKYY allows investors to gain exposure to the fast growing cloud and AI industries.

How To Choose Best Ai ETF 2025

Choose AI-Only Funds: Look for ETFs that are focused on AI, automation and robotics rather than tech-heavy or general ETFs.

Don’t Just Analyze What is Achievable: Look at the past performance of the fund, but do not expect future performance to be the same based on that.

Glancing at The Managing Cost Over Time: Aim for ETFs with lower expense ratios because it can help reduce cost over a period.

MultiRepeated Words In a Same Sentence Gif: Make sure in addition to the US stocks the ETF includes US segments and international market exposure to balance out risks with some growth opportunities.

Funds/KIT’s Management Strategy: In terms of investment selection, the ETF can be actively managed meaning more potential for growth or passively managed where certain strategies or constraints are followed.

Has the Fund Chosen an Appropriate Investment Strategy?: View the fund’s strategy so as to ensure that it goes in hand with AI trends as well as the expected growth opportunities.

How Easy It Is to Sell the Assets: Large and more liquid ETFs are relatively easy to buy and sell also tend to have lower spreads and more stability.

Conclusion

To sum up, the optimal AI ETF for 2025 will have to include high exposure to top AI firms, a diverse range of funds, and low expenses.

Robotics, AI-based grossing sectors like automation, machine learning and so forth will be best suited.

Do thoroughly evaluate performance, liquidity and your long term horizons so as to choose the ETF that you believe is best suited to your investment strategy in the developing AI market.