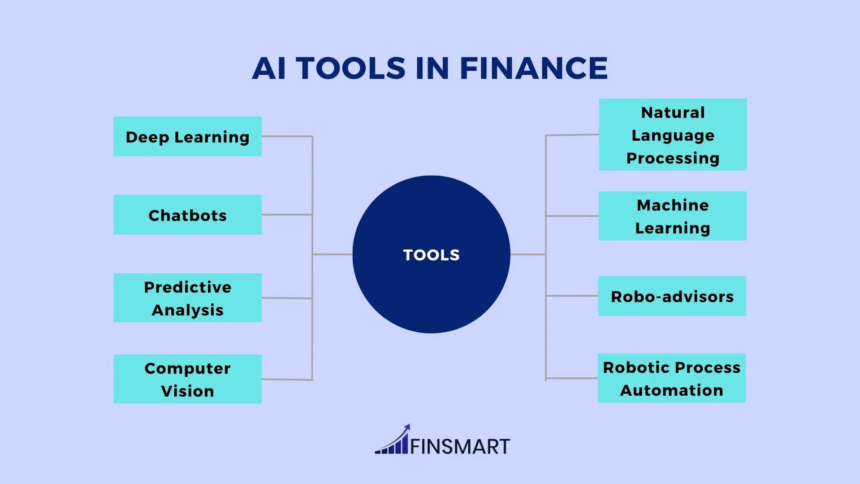

The platforms that revolutionize financial planning, analysis, and reporting will be highlighted in my post on the Best AI Automation Tools for Financial Analysts.

These AI-powered technologies assist analysts in reducing errors, saving time, and extracting useful insights from complicated data.

Financial professionals may make quicker, wiser, and more strategic decisions in the fast-paced business world of today by utilizing automation, predictive analytics, and real-time reporting.

Key Point & Best AI Automation Tools for Financial Analysts

| AI Tool | Key Features / Keypoints |

|---|---|

| AlphaSense | AI-powered search engine for financial documents, earnings calls, and market insights. Helps investors and analysts quickly find critical information. |

| Datarails FP&A Genius | AI-driven financial planning & analysis platform. Automates budgeting, forecasting, and reporting for faster decision-making. |

| Trovata AI | Treasury management AI platform. Enables cash flow forecasting, automated reporting, and real-time visibility into financial operations. |

| Kavout AI | AI-based investment analytics platform. Uses machine learning for stock ranking, predictive analytics, and quantitative research. |

| Zebra BI + AI | Business intelligence tool with AI-powered data visualization. Simplifies complex reports into intuitive dashboards for decision-makers. |

| Pigment AI | Collaborative financial planning platform. Offers AI-driven modeling, scenario planning, and real-time updates for teams. |

| Cube Software AI | AI-enabled FP&A software. Integrates with spreadsheets and ERPs to automate budgeting, forecasting, and data consolidation. |

| Trullion AI | AI-powered accounting automation. Extracts and verifies financial data from documents to speed up reconciliation and reporting. |

| Prevedere AI | Predictive analytics platform. Uses AI to forecast business outcomes and integrate external market data for smarter planning. |

| Planful AI | Cloud-based FP&A solution. Employs AI for scenario planning, predictive insights, and automated financial reporting. |

1. AlphaSense

AlphaSense was the first company within the financial services industry to develop an AI-driven search and AI data analysis tool. As a result, it is one of the most praised automations within the industry. Like other research tools, AlphaSense can help users pinpoint research, but the tools allows you to better utilize natural language processing to rapidly scan documents.

Within a matter of seconds, you can relieve data on financial documents, earnings calls, SEC filings, and various market reports. AI can provide even more data on specific trends, anomalies, and sentiment shifts to alert analysts on increasing market issues.

Analysts can lose hours of their lives sorting through documents. AlphaSense allows you to eliminate the manual labor and displace information formed on actionable data. Analysts can utilize AlphaSense to market their research and stay critical within on of the fasted markets dynamics.

| Feature | Details |

|---|---|

| Tool Name | AlphaSense |

| Purpose | AI-powered market intelligence and financial research tool |

| Key Functionality | Scans and analyzes financial documents, earnings calls, SEC filings, and market reports |

| AI Advantage | Highlights trends, anomalies, and sentiment shifts for faster decision-making |

| User Requirement / KYC | Minimal KYC needed; easy onboarding for financial professionals |

| Primary Users | Financial analysts, investment professionals, research teams |

| Output | Actionable insights, alerts, and searchable intelligence reports |

| Integration | Web-based platform with Excel and document export options |

2. Datarails FP&A Genius

One of the few fully automated financial planning analytical tools is Datarails FP&A Genius, and that is exactly why Datarails is earning recognition as one of the best automation tools for financial analysts.

Datarails is capable of taking financial information from various data sources, like ERPs, Excel spread sheets and cloud financial data sources, and pulling them into one consoidated view of the company’s financial position.

Datarails augments forecasting for financial analysts and provides scenario planning tools for budget optimizations and risk mitigation. Datarails is quickening reporting cycles and improving data accuracy by eliminating the need for manual entry of financial data. With dashboards that provide real-time data insights Datarails gives financial strategists the tools needed to drive their organizational objectives forward.

| Feature / Attribute | Details |

|---|---|

| Tool Name | Datarails FP&A Genius |

| Purpose | AI‑powered financial planning & analysis (FP&A) platform |

| Core Functionality | Consolidates data from Excel, ERP, CRM, HRIS and other systems into a single data model |

| Automation Capabilities | Automates data consolidation, reporting, budgeting & forecasting |

| AI Features | Provides AI‑generated insights, variance analysis, trend detection, anomaly spotting, and natural‑language “chat” access to company financial data |

| Interface / Compatibility | Excel‑native + web-based — lets you work in familiar Excel while leveraging automation and AI |

| Output | Real‑time dashboards, consolidated reports, forecasts, budgets, and presentations (reports or PPT) |

| Primary Users / Use Cases | Finance teams, CFOs, FP&A teams, businesses needing consolidated reporting and forecasting across multiple data sources |

| Setup & Adoption | No‑code / no heavy IT setup required — relatively easy to implement and scale |

3. Trovata AI

Trovata AI’s expertise in intelligent cash management and forecasting makes it one of the top AI automation solutions for financial analysts.

It provides real-time liquidity awareness by automatically gathering, organizing, and analyzing cash flow data from various banking sources using AI and machine learning. Its predictive analytics enable analysts to maximize working capital, foresee cash shortages, and make well-informed investment decisions. By eliminating manual reconciliation,

Trovata’s user-friendly dashboards and automatic reporting significantly reduce errors and save time. Trovata gives financial analysts the unique ability to preserve financial agility and confidently make strategic decisions by turning complex cash data into actionable insights.

| Feature / Attribute | Details |

|---|---|

| Tool Name | Trovata AI |

| Purpose | Automated cash management, forecasting, and treasury analytics |

| Core Functionality | Connects with bank APIs to aggregate bank balances & transactions in real time |

| AI/ML Capabilities | Uses AI/ML (and generative‑AI for chat queries) to deliver cash‑flow forecasts, scenario planning, anomaly detection, and natural‑language queries on cash data |

| Automation Benefits | Replaces spreadsheet‑based data consolidation; automates reporting, reconciliation, forecasting, and cash‑flow analysis |

| User Interaction | Allows finance or treasury analysts to “ask” questions (in plain language) about cash positions, flows, forecasts — no coding required |

| Real-time & Historical Data | Supports real‑time bank‑data feeds and stores historical transaction history for trend analysis and forecasting |

| Target Users / Use Cases | Treasury departments, FP&A teams, finance operations, companies needing efficient liquidity management across multiple bank accounts/subsidiaries |

| Outcome / Value | Faster cash visibility and forecasting, reduced manual work, fewer errors — enabling more strategic liquidity decisions |

4. Kavout AI

Because it uses quantitative finance and sophisticated machine learning to find high-potential investment possibilities, Kavout AI is regarded as one of the top AI automation tools for financial analysts.

In order to produce forecast stock rankings and useful insights, our AI-driven algorithms examine enormous volumes of market data, financial statements, and alternative datasets. By simplifying complicated market signals,

Kavout’s exclusive “K Score” enables analysts to promptly evaluate the viability of investments and control risk. It improves decision accuracy while cutting down on manual research time by automating data analysis and pattern identification.

Kavout enables analysts to make more intelligent, quicker, and profitable investment decisions by revealing hidden trends and offering suggestions supported by data.

| Feature / Attribute | Details |

|---|---|

| Tool Name | Kavout AI |

| Purpose | AI‑powered investment analysis and stock selection platform for financial analysts and investors |

| Core Functionality | Uses machine learning to analyze financial, technical, market‑sentiment and alternative data across thousands of equities, ETFs, and other assets. |

| Signature Metric / Score | K Score (Kai Score) — assigns a score (typically 1–9 scale) reflecting return potential and risk‑adjusted attractiveness of stocks. |

| AI Capabilities | Predictive analytics, real‑time signal generation, technical & fundamental analysis, sentiment & news analysis, automated screening and ranking. |

| User Interface / Usability | Web‑based and intuitive dashboard with tools like AI Stock Picker, InvestGPT (AI assistant), Watchlist & custom alerts — usable without coding. |

| Typical Users / Use Cases | Financial analysts, investors, traders, portfolio managers — especially those who need data‑driven stock selection, quick screening, and automated market intelligence. |

| Outcome / Value | Rapid identification of high‑potential investment opportunities, data‑backed decision support, risk‑adjusted portfolio planning, and reduction in manual research time. |

5. Zebra BI + AI

Zebra BI + AI assists financial analysts in providing so many financial services and assisting them in reporting complex financial data electronically in the form of digitized flexible reporting which is automatic and easily adaptable to their needs.

Analysts are able to measure and assess real-time data against any scrolling markers of their performance, whilst measuring a multitude of performance markers.

With the programs’ seamless interface with, Microsoft Excel and Power BI, teams can retain their workflows and in a financial analyst position, Zebra, BI + AI assists them in turning financial data into visualizations of automatic conjoined intelligence that help them drive financial data and turn it into action.

| Feature / Attribute | Details |

|---|---|

| Tool Name | Zebra BI + AI |

| Purpose | AI‑powered data visualization, financial reporting and analytics, enabling automated dashboards and insights |

| Core Functionality | Converts raw financial or business data into charts, tables and dashboards — automatically calculates variances, trends, and KPIs for clear reporting. |

| AI/ML Capabilities | Provides automated analysis: detects trends, anomalies, and performance drivers; allows natural‑language queries; produces forecasts and “what‑if” scenarios. |

| Usability / No-Code Setup | Works without coding — users can upload Excel/CSV or connect databases/Power BI, then get instant dashboards & AI-powered reports. |

| Visualization Strength | Offers finance-grade visuals: tables + charts, waterfall charts, variance visuals, drilldowns — suitable for financial statements, P&L, KPI dashboards. |

| Integration & Compatibility | Integrates with Excel, Power BI, SQL databases, Data warehouses (e.g. Databricks/Snowflake), enabling flexibility of data sources. |

| Primary Users / Use Cases | Financial analysts, FP&A teams, controllers, business analysts — especially for financial reporting, variance analysis, forecasting, and dashboarding |

| Outcome / Value | Rapid generation of clear, actionable reports; reduces manual reporting effort; helps analysts spot trends, drivers and risks quickly with minimal setup |

6. Pigment AI

Pigment AI simplifies intricate forecasting, scenario planning, and budgeting procedures, making it one of the top AI automation tools for financial analysts. Pigment uses AI to integrate and analyze data from various sources in real time, making it easy for analysts to predict various business scenarios.

Finance teams may operate concurrently thanks to its collaborative platform, which guarantees accuracy and uniformity across reports. Pigment reduces manual labor and decision-making time by highlighting trends, risks, and opportunities through user-friendly dashboards and predictive analytics.

Pigment enables financial analysts to make quicker, more intelligent, and more strategic financial decisions by fusing automation, real-time data, and scenario-driven planning.

| Feature / Attribute | Details |

|---|---|

| Tool Name | Pigment AI |

| Purpose | AI‑powered business planning, budgeting, forecasting and FP&A platform |

| Core Functionality | Creates a unified data model by consolidating data from multiple sources (ERP, CRM, spreadsheets, data warehouses) to support financial planning and analysis. |

| AI / Automation Capabilities | Includes built‑in “AI Agents” and Assistants that can: generate forecasts, detect anomalies, run scenario planning, automate variance & contribution analysis, and accept natural-language queries for charts/reports. |

| Modeling & Scenarios | Supports multi‑dimensional modeling, driver-based assumptions, “what‑if” / scenario simulations, and dynamic re‑forecasting. |

| Reporting & Collaboration | Enables real‑time dashboards, custom reports, collaboration with comments, version control, access permissions, and shared planning across teams. |

| Flexibility & Ease of Use | Spreadsheet-like interface but enterprise-grade structure: no coding required for modeling or forecasting, suitable for non‑technical finance users. |

| Outcome / Value for Analysts | Eliminates messy spreadsheets and data silos; speeds up budgeting, forecasting, and reporting; increases forecast accuracy; supports agile planning and strategic decision‑making. |

7. Cube Software AI

Because it bridges the gap between spreadsheets and sophisticated financial reporting, Cube Software AI is regarded as one of the top AI automation tools for financial analysts. Its AI-powered technology ensures accuracy and minimizes human mistake by automating data consolidation from various sources.

With little work, analysts can develop real-time dashboards, monitor performance data, and produce forecasts. Proactive decision-making is made possible by Cube’s predictive analytics, which show patterns, deviations, and possible hazards.

Cube uniquely enables financial analysts to save time, increase accuracy, and obtain actionable insights by supplementing traditional spreadsheet procedures with AI intelligence. This makes financial planning and analysis more effective and strategic.

| Feature / Attribute | Details |

|---|---|

| Tool Name | Cube Software (Cube AI) |

| Purpose | AI‑powered financial planning & analysis (FP&A), budgeting, forecasting, reporting and financial consolidation |

| Core Functionality | Consolidates financial and operational data from ERP/CRM/HRIS/spreadsheets into a unified data model; replaces fragmented spreadsheets with a central data hub |

| Spreadsheet Integration | Works seamlessly with Excel and Google Sheets — you can keep familiar spreadsheet workflows while using AI‑driven features |

| AI / Automation Capabilities | Provides “AI Analyst” and “Smart Forecasts/Variance Analysis” — AI flags anomalies or variances, generates narrative commentary, builds predictive forecasts and automates reporting workflows |

| Planning & Scenario Modeling | Supports budgeting, multi‑scenario planning / “what‑if” analysis, driver-based modeling, and dynamic model updates as data evolves |

| Reporting & Collaboration | Enables real-time dashboards, automated reports, version control, role-based permissions, and collaboration across teams without manual reconciliation |

| Outcome / Value for Analysts | Reduces manual spreadsheet work, avoids formula‑errors and data silos, speeds up forecasting/reporting cycles, and delivers accurate, audit‑ready financial data — enabling analysts to focus on strategic insights |

8. Trullion AI

Automating the extraction and validation of financial data from accounting-related documents such as contracts and invoices make Trullion automate some of the most repetitive tasks of financial analysts.

Trullion’s state of the art AI, conjures compliance with accounting standard, manual data entry, and errors disappear. Key financial metrics are now available from Trullion’s accounting platform instantaneously, and reports can be generated with greater accuracy.

Documents containing unstructured data can now be actioned, allowing financial analysts to make more strategic decisions and become unencumbered by technologically routine work.

There are few equally as accounting automation, accuracy, and efficiency, and as such, Trullion is one of the most important tools available to financial analysts. Trullion AI is unquestionably one the most advanced tools of its kind available.

| Feature / Attribute | Details |

|---|---|

| Tool Name | Trullion AI |

| Purpose | AI‑powered accounting automation: document processing, lease accounting, revenue recognition, audits & compliance ( |

| Core Functionality | Automatically extracts data from unstructured documents (contracts, leases, invoices, PDFs) using OCR + AI, converts into structured, accounting‑ready data. |

| Accounting & Compliance Modules | Automates lease accounting (e.g. under IFRS 16 / ASC 842), revenue recognition (e.g. IFRS 15 / ASC 606), journal entries, and audit‑ready disclosures. |

| AI Assistant / Smart Features | Includes agentic AI assistant (“Trulli”) that understands accounting terminology, interprets contracts/standards, answers technical questions, and provides traceable, source‑backed insights. |

| Audit & Reporting Automation | Offers audit automation: matching, vouching/tracing, data‑validation, generation of audit evidence packages — reducing manual audit workflows and improving accuracy. ( |

| User Types / Use Cases | Accountants, auditors, controllers, finance teams — especially useful for companies dealing with many contracts, leases, or complex accounting standards compliance. |

| Outcome / Value | Saves significant manual effort and time, reduces errors, ensures compliance/consistency, delivers transparent, audit‑ready financial data — freeing analysts for strategic financial work. |

9. Prevedere AI

Because it accurately forecasts business performance by combining predictive analytics with real-time external and internal data, Prevedere AI is regarded as one of the top AI automation tools for financial analysts.

To produce accurate revenue, cost, and cash flow forecasts, its AI algorithms examine market trends, economic factors, and company-specific data. Prevedere allows analysts to model various scenarios, foresee hazards, and find development prospects more quickly than with conventional techniques.

It improves decision-making efficiency by offering practical insights and lowering reliance on manual forecasting. Prevedere is a crucial instrument for strategic financial planning because of its exceptional capacity to combine internal financial data with external market signals.

| Feature / Attribute | Details |

|---|---|

| Tool Name | Prevedere AI |

| Purpose | Predictive analytics & external‑data‑driven financial forecasting and planning |

| Core Functionality | Combines internal business data with external economic, market, consumer and macro‑economic indicators to build econometric forecast models. |

| AI / Automation Capabilities | Uses AI / machine learning and a large external‑data repository (Global Intelligence Cloud) to identify relevant external drivers, correlate them with business performance, and generate demand, revenue, cost and market forecasts. |

| Modeling & Scenario Tools | Supports “what‑if” scenario simulations and econometric modeling to anticipate market shifts, demand changes, and risk events. |

| Generative‑AI Functionality | Offers a Generative‑AI “copilot” that helps business users explore external drivers, explains complex predictive models, and simplifies forecast modeling & interpretation. |

| Target Users / Use Cases | FP&A teams, financial analysts, demand planners, strategic planning groups — especially for firms needing market‑validated demand forecasting, revenue projections, and risk/market scenario planning. |

| Outcome / Value | Improves forecast accuracy, helps anticipate market shifts, reduces reliance on intuition, enables data‑driven decisions, and integrates external signals into financial planning — giving analysts a fuller, forward‑looking view. |

10. Planful AI

Because it automates and simplifies the entire financial planning and analysis process, Planful AI is regarded as one of the top AI automation solutions for financial analysts.

Real-time forecasting, scenario modeling, and budgeting are made possible by its AI-driven platform, giving analysts immediate insights into company performance. Planful speeds up reporting processes and removes human mistake by combining data from several sources.

Finance teams can make data-driven strategic decisions because to its predictive analytics, which reveal trends, risks, and opportunities. Planful’s collaborative capabilities and user-friendly interface enable analysts to maximize financial planning, increase accuracy, and make quicker, more intelligent business decisions.

| Feature / Attribute | Details |

|---|---|

| Tool Name | Planful AI |

| Purpose | AI‑powered financial planning & analysis (FP&A), budgeting, forecasting, consolidation, reporting and close |

| Core Functionality | Centralizes financial and operational data; handles budgeting, forecasting, financial close, consolidation, reporting and analytics. |

| AI / Automation Capabilities | Built‑in generative‑AI “Analyst Assistant” lets users query financial data in natural language, get instant tables/charts/narratives, detect anomalies, and build forecasts without needing manual formulas. |

| Reporting & Scenario Tools | Supports driver‑based planning, rolling/what-if forecasts, scenario modeling, variance analysis, dashboards, and customizable financial reports. |

| User Interaction & Ease | Offers cloud‑based, finance‑first interface with minimal IT overhead; non‑technical users can use natural-language queries for analysis. |

| Outcome / Value for Analysts | Reduces manual spreadsheet work, speeds up forecasting & reporting cycles, enhances accuracy and audit-readiness, and allows finance teams to focus on strategic insights rather than routine tasks. |

Conclusion

To sum up, the top AI automation solutions for financial analysts—including AlphaSense, Datarails FP&A Genius, Trovata AI, Kavout AI, Zebra BI + AI, Pigment AI, Cube Software AI, Trullion AI, Prevedere AI, and Planful AI—are revolutionizing the financial industry.

These technologies reduce errors, remove manual activities, and provide actionable insights by combining automation, predictive analytics, and real-time data integration.

Financial analysts may manage cash flow, forecast performance with accuracy, convey insights effectively, and make quicker, better, and more strategic decisions by utilizing AI. Using these technologies is crucial to being competitive in the fast-paced financial environment of today.

FAQ

What are AI automation tools for financial analysts?

AI automation tools are software platforms that leverage artificial intelligence and machine learning to streamline financial tasks such as data analysis, forecasting, reporting, and scenario modeling. They reduce manual work, enhance accuracy, and provide actionable insights for strategic decision-making.

Why are these tools important for financial analysts?

They save time by automating repetitive tasks, minimize human errors, and allow analysts to focus on high-value activities like financial planning, investment decisions, and risk assessment. AI tools also enable faster access to real-time data and predictive insights.

Which AI tools are considered the best for financial analysts?

Top tools include AlphaSense, Datarails FP&A Genius, Trovata AI, Kavout AI, Zebra BI + AI, Pigment AI, Cube Software AI, Trullion AI, Prevedere AI, and Planful AI. Each offers unique features like predictive analytics, cash flow optimization, and advanced visualization.