In this article, I will discuss the Best AI Algorithms for Fraud Detection in Finance.

Financial crimes take new forms every day, and AI technologies are critical in detecting these cases with precision.

The application of machine learning models like Random Forest, SVM, and XGBoost enables financial institutions to advance their fraud detection systems and bolster defenses against emerging threats.

Key Point & Best AI Algorithms for Fraud Detection in Finance List

| Algorithm | Key Point |

|---|---|

| Random Forest | An ensemble method combining multiple decision trees to improve accuracy and reduce overfitting. |

| Support Vector Machines (SVM) | Finds the hyperplane that best separates classes in a high-dimensional space. |

| Gradient Boosting Machines (GBM) | Boosting technique that builds models sequentially to correct errors made by previous models. |

| XGBoost | Optimized version of GBM known for high performance, handling missing data, and regularization. |

| Logistic Regression | A regression model used for binary classification, predicting probabilities using a logistic function. |

| Neural Networks | Inspired by the human brain, these networks learn complex patterns through layers of interconnected nodes. |

| Autoencoders | Neural networks used for unsupervised learning, especially for data compression and noise reduction. |

| Isolation Forest | An algorithm focused on isolating anomalies in data, commonly used for anomaly detection. |

| Bayesian Networks | Probabilistic graphical models representing a set of variables and their conditional dependencies. |

| Decision Trees | A tree-like structure used for classification or regression by splitting data based on feature values. |

1.Random Forest

Random Forest is considered the best AI algorithms for detecting fraud in finance. Its strength lies in its ability to process large datasets and complex patterns using several decision trees simultaenously, and by evaluating numerous features Random Forest can identify subtle fraudulent activities that might be missed by simpler models.

This ensemble method minimizes overfitting and provides accurate predictions. Its robustness and adaptability make it particularly effective in detecting evolving and diverse fraudulent strategies in financial transactions.

Random Forest Features

2.Support Vector Machines (SVM)

Support Vector Machines (SVM) is one of the most effective AI algorithms for detecting fraud in the finance domain because it can accurately classify high-dimensional data.

SVM excels at identifying the best hyperplane that separates out fraudulent transactions from legitimate ones.

Its strength in processing linear and non-linear data makes it useful for detecting complex patterns of fraud. By concentrating on maximizing the margin of error, SVM maintains minimum error which is essential distinguishing subtle fraudulent activities within financial datasets.

Support Vector Machines (SVM) Features

3.Gradient Boosting Machines (GBM)

Gradient boosting machines is one of the most preferred algorithms in AI systems for fraud detection in the financial industry because of its focus on increasing accuracy by polishing the mistakes made by earlier models.

Explanation by transaction GBM brings together several week models into a strong predictor and thus, effectively uncovers intricate patterns in transaction data.

Its step-wise training approach enables it to respond to changing complex fraud strategies over time. Because of its accuracy with biased datasets and the ability to minimize undue influence, GBM is particularly useful in detecting financial fraud.

Gradient Boosting Machines (GBM) Features

4.XGBoost

XGBoost is one of the fastest and most accurate AI algorithms used in fraud detection in finance, making it particularly effective.

It is an enhanced version of Gradient Boosting that adds additional regularization to reduce overfitting and improve generalization. XGBoost has the ability to highly process large and complex datasets to identify very sophisticated patterns which could suggest fraudulent activities.

Additionally, avoiding bias and managing missing values makes it highly effective in detecting advanced financial fraud while ensuring reliability and operational efficiency.

XGBoost Features

5.Logistic Regression

Fraud detection is one of the primary use case of Logistic Regression when combined with AI in finance because it is easy to use. Its primary use-case is bi-class classification which works best when identifying binary outcomes – if a transaction is legit or not.

Logistic Regression makes clear distinction on event outcome boundaries of Logistic functions. It is also fast, takes less time and can work on large set of data which allows it to detect con in real life time.

This is why financial firms who require prompt and dependable analysis are able to fraud detection processes find this very useful.

Logistic Regression Features

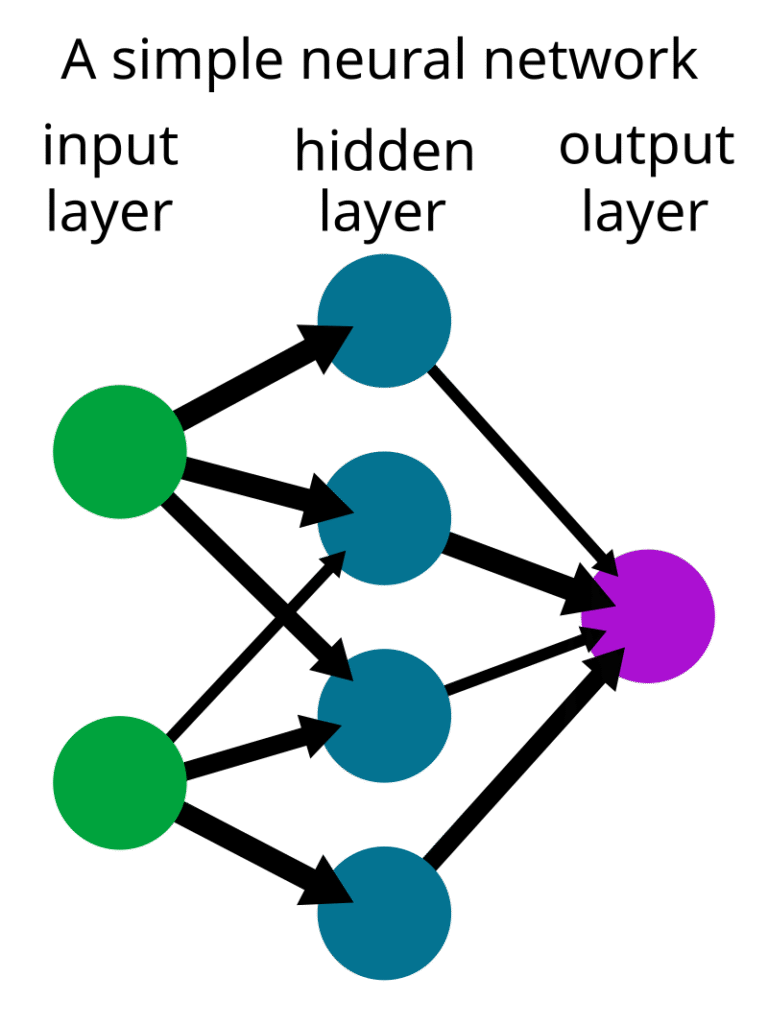

6.Neural Networks

Neural networks are some of the most competent AI algorithms applicable for learning fraud detection in finance considering their ability to learn and recognize intricate, non-linear relationships in large datasets.

They are capable of self-feature selection and thus, are very efficient in recognizing non-obvious fraudulent activities. By changing the weights of different neurons, Neural Networks becomes increasingly accurate with time, intelligently adapting to the changes in fraud attempts.

The diversity in which data can be presented gives Neural Networks the strength to unveil the complex patterns entwined in financial fraud.

Neural Networks Features

7.Autoencoders

Autoencoders are robust for the unsupervised learning based fraud detection in finance due to their capability to learn data representations.

By reconstructing compressed input data, autoencoders are able to identify anomalies like unusual transactions that differ from normal behavior. Fraudulent activities, which are outliers, are easily detected.

Such unlabeled data is common in finance where evolving fraud strategies demand adaptive solutions, thus automakers without needs—previously unseen fraud patterns can be detected and responded to.

Autoencoders Features

8.Isolation Forest

Isolation Forest is a highly effective AI algorithm for anomaly detection in large data sets such as in finance due to its ability to “isolate” anomalies effectively. Unlike traditional approaches, it isolates outliers by recursively partitioning the data.

This is useful for detecting rare, fraudulent transactions that differ significantly from the normal behavior. Its speed and scalability also enable real-time detection in enormous financial systems.

Isolation Forest has proven to be especially useful for detecting fraud in highly unbalanced datasets, where there is a severe lack of known fraudulent transactions compared to legitimate ones.

Isolation Forest Features

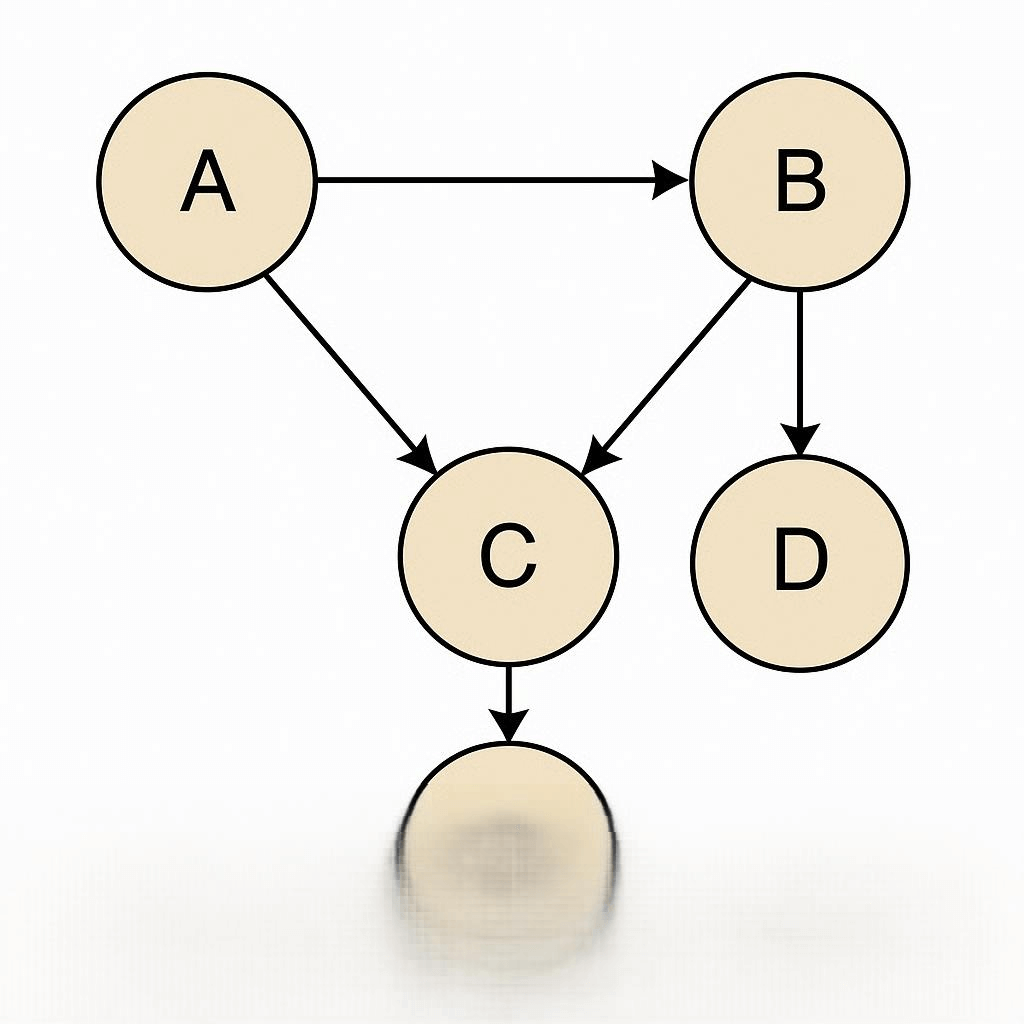

9.Bayesian Networks

Bayesian Networks are useful in finance for fraud detection because they can model sophisticated relationships containing uncertainty. Knowing the dependencies among different attributes, Bayesian Networks can estimate probabilities of fraud based on observed behaviors.

Their flexible approaches to prior knowledge and adjusting beliefs with new information make Bayesian Networks fraud detection systems adaptable to changing fraud strategies. It enables Bayesian Networks to make precise, reformable estimations that improve the decisions made in financial fraud detection systems.

Bayesian Networks Features

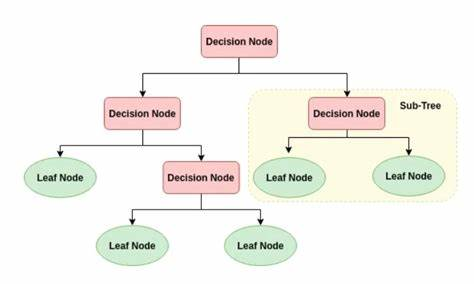

10.Decision Trees

Financial fraud detection employs a powerful AI algorithm known as Decision Trees. This algorithm is especially useful in finance for its simplicity and interpretability.

It works by recursively splitting data based on the most significant features, or “deciding factors”, which makes translation of resultant decisions easy to follow. Such clarity is important for financial bodies when assessing potentially dubious operations.

Numerical and categorical data can all be incorporated into Decision Trees making them useful across different scenarios of fraud detection. Their ability to visualize the entire path of decisions enables rapid detection of deception in intricate data.

Decision Trees Features

Conclusion

To summarize, every key AI algorithms used in fraud detection in finance uniquely specialize at some aspect of the problem of identifying fraudulent activities. Random Forests, SVM, and XGBoost are ideal for large and complicated datasets, while Logistic Regression and Decision Trees are simple and easy to interpret.

Neural Networks and Autoencoders are good at learning complex patterns and detecting anomalous data in unbalanced data sets is the forte of Isolation Forest.

Bayesian Networks are useful for providing insights through probabilities which are critical in the dynamic requirements of fraud detection. As a whole these AI techniques assist financial institutions in improving their systems for detecting fraud, accuracy, efficiency, and adaptability are enhanced.