The Best AI Agents for Automated DeFi Strategies that are revolutionizing decentralized finance will be covered in this post.

By automating trading, portfolio management, risk assessment, and yield optimization, these intelligent agents enable both institutional and retail investors to access complicated strategies.

These platforms, which range from Credix to Fetch.ai, offer scalable, dependable, and effective solutions for the developing DeFi ecosystem.

Key Point & Best AI Agents for Automated DeFi Strategies List

| Platform | Key Features / Keypoints |

|---|---|

| Fetch.ai Agents | Autonomous software agents for real-time data processing, smart contracts, and decentralized AI workflows. |

| SingularityDAO Dynasets | AI-powered decentralized asset management, automated portfolio rebalancing, and tokenized fund structures. |

| Numerai Signals | Crowdsourced AI models for stock market predictions, leveraging encrypted data and incentivized data scientists. |

| Autonolas | Self-governing autonomous agents that automate tasks in decentralized applications and services. |

| Velas AI Agents | AI-enhanced smart contracts and agent-based automation on Velas’ high-speed blockchain. |

| Covalent AI Query Agents | AI-driven blockchain data query and analytics agents for real-time insights across multiple chains. |

| AllianceBlock Nexera | AI-based regulatory compliance agents, connecting DeFi protocols with traditional financial standards. |

| Giza Protocol | AI-powered decentralized finance management tools, including lending, staking, and risk assessment. |

| Kaiko AI Agents | Market data analysis agents providing AI-powered insights, pricing, and crypto market intelligence. |

| Credix AI Credit Agents | AI-driven credit scoring and lending automation for tokenized private credit markets. |

1. Fetch.ai Agents

Fetch.ai agents have gained popularity due to their ability to work without human supervision on blockchain technologies. They seamlessly combine artificial intelligence to automate numerous activities on the blockchain.

They can perform real-time trading, execute smart contracts, and serve as decentralized coordinators. Their ability to decentralize structures makes them the best AI agents for automated Defi strategies.

They have been integrated into numerous financial models, chain supply models, and connected smart devices where they have improved efficiency and scalability while minimizing the need for human supervision. Thus, merging artificial intelligence with automated Defi strategies.

Pros & Cons Fetch.ai Agents

Pros:

- Complete autonomy for making decisions concerning DeFi trades and operations.

- Efficient and accurate processing based on real-time data.

- Applicable on different blockchains.

Cons:

- Requires an understanding of how to set up the agents for more advanced uses.

- Limited adoption in niche segments of DeFi.

- Performance will largely depend on the quality of the input.

2. SingularityDAO Dynasets

These are AI-managed, tokenized portfolios that perform automated portfolio management on DEXes. SingularityDAO Dynasets employ machine learning to optimize portfolio management through rebalancing, risk mitigation, and capturing market inefficiencies on the go.

They democratize access to complex DeFi strategies and facilitate ‘hands-free’ participation for retail and institutional investors.

Owing to their automated strategies, SingularityDAO Dynasets are the most AI Agents for Automated DeFi Strategies as they consistently perform, mitigate human errors, and facilitate efficient asset diversification across various digital currencies at minimal operational costs for decentralized asset managers.

Pros & Cons SingularityDAO Dynasets

Pros:

- Portfolios are managed by AI and automate the rebalancing of assets.

- Less human intervention leads to fewer errors in the investments’ complex strategies.

- Both retail and institutional investors can access DeFi.

Cons:

- Limited algorithms can appear opaque to new users.

- Returns may still be affected by the market.

- Some functionalities will require platform-specific tokens.

3. Numerai Signals

Numerai Signals promotes the idea of data scientists contributing encrypted, tradeable tokens on their platform, which are tied to improving the prediction of stock market movements. The platform combines decentralized prediction market rewards with crowdsourced AI models to create a unique predictive market.

Numerai Signals is one of the best AI Agents for Automated DeFi Strategies since it creates a seamless DeFi framework from traditional market opportunities while also predicting the future of finance by efficiently utilizing AI to democratize DeFi.

Pros & Cons Numerai Signals

Pros:

- Predictive accuracy improves through crowdsourced AI models.

- Funded participation in strategy development encourages innovative approaches.

- Uses data in an encrypted format, which protects the users’ privacy.

Cons:

- Must understand how staking mechanisms work.

- Signals are not easy to use, and a learning curve exists.

- Primarily focuses on the market predictions aspect, leaving automation of the DeFi strategies out.

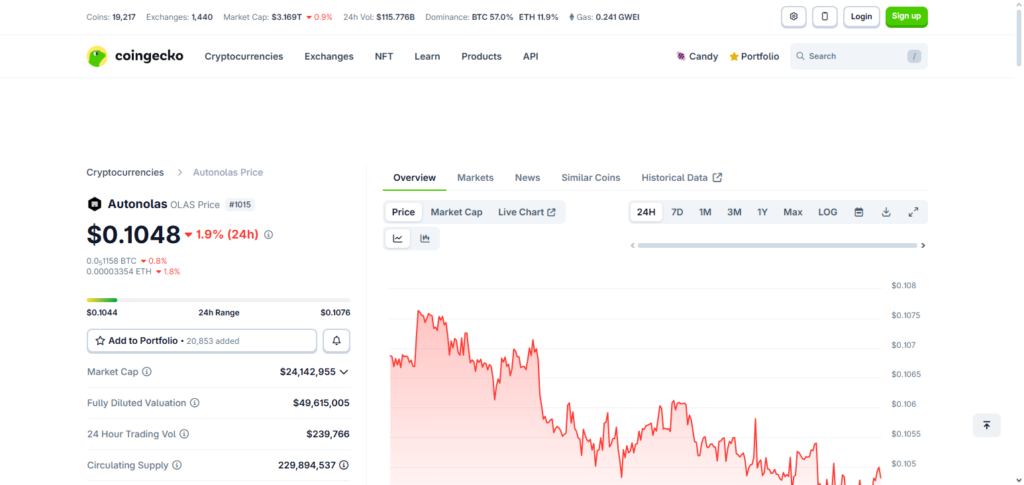

4. Autonolas

Autonolas makes self-autonomous agents that can perform decentralized processes without supervision. They interface with AI systems to learn and optimize workflows to automate dApps, DeFi protocols, and blockchain services.

With workflow automation, these agents streamline task completion, and improve operational reliability without increasing costs. Autonolas agents have been recognized as best AI Agents for Automated DeFi Strategies.

They integrate with trading bots, liquidity managers, and smart contracts to help organizations automate on-chain financial operations, and scale operational complexity tasks, seamlessly.

Pros & Cons Autonolas

Pros:

- Operational complexity is alleviated due to full autonomy of the agents.

- Can be adapted to various dApps and to different DeFi workflows.

- Performance improves over time due to the self-learning nature of the AI.

Cons:

- Some technology skills needed to implement.

- Less common use than other bigger systems.

- Complicated to set up and incorporate initially.

5. Velas AI Agents

Velas AI Agents incorporate smart contracts with automation on the blockchain to provide decentralized services on the Velas network. They perform trading, liquidity provision, and yield optimization tasks in real time while conducting on-chain data analysis. Velas AI Agents are reputed to have the best AI for Automated DeFi Strategies.

They offer advanced financial strategy execution in DeFi, real-time optimized capital allocation, and automated decision making with minimal manual intervention. Their high speed consensus mechanism and operational latency makes them the best in the market.

Pros & Cons Velas AI Agents

Pros:

- Very fast blockchain makes it possible to execute commands with a quick response time.

- Uses AI to trade and get liquidity and yield.

- Uses many chains available for DeFi.

Cons:

- Newer ecosystem than others and has fewer integrations.

- Specialized Velas software development tools may require.

- Very volatile markets.

6. Covalent AI Query Agents

These Query Agents from Covalent AI can help users efficiently retrieve and understand data from various blockchains. These Agents can perform multi-step functions and get answers to complicated trading questions. These Answers help trading and portfolio management while also assisting to assess risk and get real-time updates.

These Agents are very helpful to developers and financial analysts due to their capabilities to retrieve large amounts of data and are therefore called The Best AI for Automated DeFi Strategies because they help DeFi users execute intelligent trades, track liquidity and market changes and manage liquidty through generated AI designed insights.

Pros & Cons Covalent AI Query Agents

Pros:

- Analyzes and pulls together data on multiple blockchains.

- Portfolio and trading decisions are enhanced with realtime data.

- Simple integration for developers and analysts.

Cons:

- Automation of DeFi is not the main focus.

- More data features than the basic ones require a paid plan.

- Some queries can be complicated and require a level of technical skill.

7. AllianceBlock Nexera

Nexera AllianceBlock has focused on the automatic compliance and supervision of DeFi ecosystems. His AI supervises and completes transactions and applies compliance and supervisory rules while incorporating DeFi into Traditional Finance.

The algorithms of artificial intelligence offer operational efficiencies through risk avoidance and improved efficiency. As a result, these AI Agents are also The Best AI for Automated DeFi Strategies because they offer DeFi ecosystem participants the opportunity to automate investments with a structured and compliant framework, allowing institutional investors to access DeFi without the risks of regulatory breaches or fraud.

Pros & Cons AllianceBlock Nexera

Pros:

- AI agents enforce DeFi compliance.

- Combines traditional finance with decentralized finance.

- Automation of risk monitoring and reporting.

Cons:

- Strategy flexibility may be more limited due to the compliance focus.

- More intended for institutional clients than retail.

- Regulatory understanding may be needed for integration.

8. Giza Protocol

Giza Protocol manages a multitude of decentralized finances with a focus on loans, deposits, and risk. Giza Protocol manages and assesses risk with automation and refrains from moving assets in real time. Giza is of particular value to retail and institutional customers who value real-time on-chain data and the ability to improve their finance decisions with Giza’s agents.

Giza is reputed as the best AI agent to automate various DeFi offerings. Giza efficiently automates lending, yield management, and other general finance management protocols and improves customer satisfaction and yield in a multitude of complex cryptocurrencies dealing with large amounts of finances.

Pros & Cons Giza Protocol

Pros:

- Staking and lending are managed automatically with AI including risk assessment.

- Capital allocation and yield strategies are improved.

- Lessens manual input for supervision of an investment portfolio management.

Cons:

- Newer services; use might be limited.

- Needs confidence on AI models for judgements.

- Platform can be difficult for novices.

9. Kaiko AI Agents

Kaiko’s AI agents stream and analyze large quantities of data to capture cryptocurrency market dynamics. They identify and characterize market liquidity, price trends, and trading signals and provide predictive guidance to customers.

Kaiko AI Agents have revolutionized automated market surveillance and trading to help users identify and exploit arbitrage and other algorithm-optimized trades on inefficient markets. For this reason, Kaiko is recognized as having the best AI Agents for Automated DeFi Strategies.

Pros & Cons Kaiko AI Agents

Pros:

- Offers market prediction and pricing analysis.

- Aids in automating trading and arbitrage strategies.

- Provides institutional market insights.

Cons:

- Focused on data, not full automation.

- Higher subscription fee for smaller users.

- Must understand market signals.

10. Credix AI Credit Agents

These agents automate credit scoring, lending, and risk assessments across tokenized private credit markets. They rely on AI models to assess borrower reliability, predict default risk, and automate loan issuance.

By integrating these agents into their systems, clients are able to replace manual underwriting processes while improving their decisioning. Credix AI Credit Agents are considered the best AI Agents for Automated DeFi Strategies and allow decentralized lending marketplaces to run seamlessly, deliver safe credit, optimize capital allocation, and do on-chain credit work within operational and regulatory frictionless environments.

Pros & Cons Credix AI Credit Agents

Pros:

- Credits scoring and lending automation in DeFi.

- Decreases human risk assessment error.

- Improves entry and efficiency in tokenized private credit market.

Cons:

- Only lending and credit use cases.

- Dependent on the quality of the borrower data.

- Adoption is mostly for institutions.

Conclusion

In conclusion, the emergence of AI agents in decentralized finance is changing how assets are optimized, risks are controlled, and plans are carried out.

The power of intelligent automation is demonstrated by platforms such as Fetch.ai Agents, SingularityDAO Dynasets, Numerai Signals, Autonolas, Velas AI Agents, Covalent AI Query Agents, AllianceBlock Nexera, Giza Protocol, Kaiko AI Agents, and Credix AI Credit Agents, which enable smooth portfolio management, predictive analytics, and compliant lending in DeFi ecosystems.

These agents improve productivity, scalability, and profitability while lowering human error and operational complexity. These platforms are the best AI Agents for Automated DeFi Strategies, propelling the next wave of innovation in decentralized finance for institutions and investors looking to take use of cutting-edge technology.

FAQ

What are AI agents in DeFi?

AI agents in DeFi are autonomous software programs that use artificial intelligence to execute financial strategies, automate trading, manage portfolios, and perform predictive analytics on blockchain networks without human intervention.

Why are AI agents important for DeFi strategies?

They increase efficiency, reduce human error, optimize capital allocation, and enable real-time decision-making, making complex strategies accessible to both retail and institutional investors.

Which platforms offer the best AI agents for automated DeFi strategies?

Some of the top platforms include Fetch.ai Agents, SingularityDAO Dynasets, Numerai Signals, Autonolas, Velas AI Agents, Covalent AI Query Agents, AllianceBlock Nexera, Giza Protocol, Kaiko AI Agents, and Credix AI Credit Agents.