This article will cover the Best Accounts Receivable Software. I will focus on software that allows businesses to keep track of invoices, track payments, and improve their cash flow.

Accounts Receivable Software automatically handles the billing process, minimizes human errors, and helps to see the money owed to the business in real time.

Big or small, every business can have their financial management made easier and their efficiency multiplied with the right AR software.

What is Accounts Receivable Software?

Accounts receivable software assists companies in managing money that customers owe them. It automates the invoicing system, tracks records of payments that are pending, monitoring balances that are owed by the customers.

It cuts down manual work, manual errors in recording payments computation, and enhances work management. It improves cash flow by sending reminders of payments due, monitoring receivables and generating reports of performance.

It bills and records cash collection, improves communication to customers, Customers Billing Software fast cash collection and reduces manual work. It is important for all companies.

Benefits of using Accounts Receivable Software

Better Cash Flow: Keeps track of overdue invoices, automates reminders, and helps collections happen more promptly.

Less Mistakes: Reduces the chance of manual entry errors improving the precision of billing and the finance reports.

More Time: Fast invoicing and payment receipt allows employees more time to concentrate on other aspects of the business.

Better Communication with Customers: Sends reminders and invoices, and helps maintain healthy business relationships with customers.

Real-Time Data: Tracks receivables and helps businesses make better decisions.

Easier Compliance: Keeps detailed audit and tax records and saves them for appropriate regulations, helping the business pass audits.

Key Point & Best Accounts Receivable Software List

| Software | Key Feature / Highlight |

|---|---|

| BlackLine | Automated financial close & reconciliation |

| Corcentric | End-to-end AR automation & invoice management |

| VersaPay | Cloud-based AR platform with payment processing |

| BlueSnap | Global payment solutions & invoice management |

| HighRadius | AI-driven AR automation & cash application |

| Centime | Invoice and payment management with analytics |

| EzyCollect | Payment reminders & collections automation |

| Quadient | AR automation & customer communication tools |

| Invoiced | Cloud invoicing & recurring billing management |

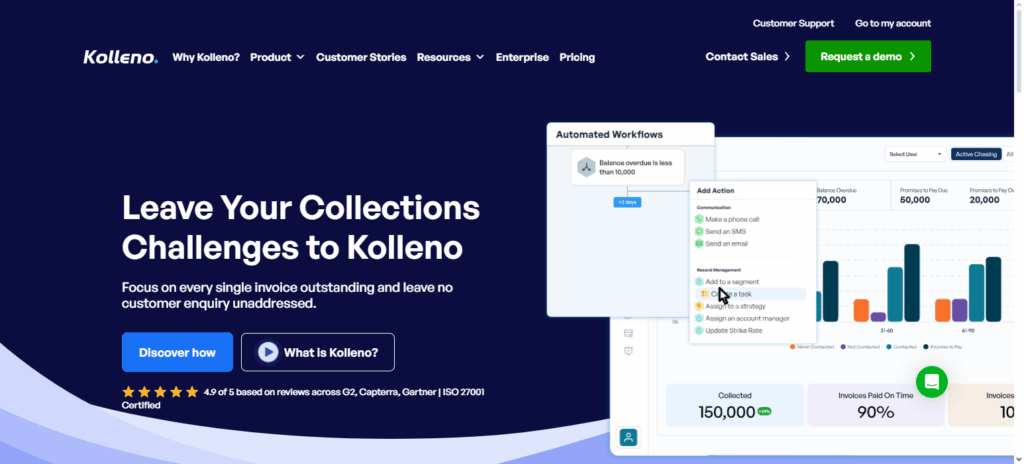

| Kolleno | AR software for workflow automation & payment tracking |

1. BlackLine

BlackLine accounts receivable software is recognized for its software Business Line is recognized for combining automation, accuracy, and real-time visibility to user automation accounts receivable.

With software is centralized automation accounts receivable dashboard offers businesses real-time visibility and invoicing and cash application to receivables. Recent enhancements increased functionality enabling users to and embedded data to BlackIncludes expansion.

Expansion includes to enable restricted to BlackLines cash and manual with. BlackLine is top automation. BlackLines unique offers top Black. BlackLine top software included Black automat realtime data software customers. accounts receivable cloud automation Black automated accounts receivable console.

| Feature / Detail | Description |

|---|---|

| Software Name | BlackLine |

| Type | Accounts Receivable Software |

| KYC Requirement | Minimal KYC required |

| Key Features | Automated invoice reconciliation, cash application, AR tracking, reporting |

| Deployment | Cloud-based |

| Ideal For | Large enterprises managing high transaction volumes |

| Payment Integration | Supports multiple payment methods and ERP integration |

| Automation | High – reduces manual errors and speeds up collections |

| Reporting & Analytics | Real-time dashboards for receivables and cash flow insights |

2. Corcentric

Corcentric is best accounts receivable software is largely because of its all-inclusive end-to-end automation and invoice management. Providing invoicing, payment processing, and cash application all on one singular integrated platform is perhaps its greatest strength, simplfying workflows and hastening the collection of cash.

Advanced analytics and insights into customer payment behavior is now a value add on receivable accounts software and clients are able to optimize collection on accounts receivable. Decision making and efficiency are invariably improved as clients are able to access and analyze all their real time data from anywhere from the platform.

Having tailored automation in addition to decision making and comprehensive reports are added features that enable all clients to eliminate inefficiencies, increase cash flow and automation to receivables management.

| Feature / Detail | Description |

|---|---|

| Software Name | Corcentric AR Automation |

| KYC Requirement | Minimal KYC required |

| Key Features | Automated invoicing, cash application, dispute management, collections automation |

| Deployment | Cloud-based SaaS |

| Ideal For | Mid to large enterprises seeking AR process optimization |

| Integration | Seamless integration with ERP and accounting systems |

| Automation Level | High – automates end-to-end AR processes |

| Reporting & Analytics | Real-time dashboards, DSO tracking, cash flow insights |

3. VersaPay

One of the best accounts receivable software is VersaPay since it best simplifies the B2B payments and customer experience. Its best selling point is the cloud platform that combines invoicing, payment collection, and account management into one user-friendly system.

VersaPay helps businesses provide several payment methods, automate and skip a few steps in the payment reminder process, and quickly reconcile to eliminate several manual processes.

Lots of companies benefit from real time cash flow and accounts receivable trend analysis to improve their decision making. VersaPay significantly improves account receivable management by laser focusing on automation seamless process, customer engagement, accuracy, and efficiency.

| Feature / Detail | Description |

|---|---|

| Software Name | VersaPay Accounts Receivable Automation |

| KYC Requirement | Minimal KYC required |

| Key Features | Automated invoicing, cash application, collections management, B2B payment services |

| Deployment | Cloud-based SaaS |

| Ideal For | Mid to large enterprises seeking AR process optimization |

| Integration | Integrates with ERP systems like NetSuite, QuickBooks, Microsoft Dynamics, Sage Intacct |

| Automation Level | High – automates end-to-end AR processes |

| Reporting & Analytics | Real-time dashboards, DSO tracking, cash flow insights |

4. BlueSnap

BlueSnap is considered one of the best accounts receivable software because it combines invoicing seamlessly and managing payments globally, which is ideal for businesses going international.

It stands out due to its ability to automate the billing and reconciliation processes while supporting multiple currencies and payment methods. Businesses can manage cash flow effectively as BlueSnap integrates receivables, giving businesses the ability to track outstanding invoices.

BlueSnap minimizes payment collection time by linking AR workflows to payment gate-ways which cuts down on collection time. By focusing on global transactions, automated AR workflows, and analytical reporting, BlueSnap increases the speed, precision, and control over the finance in the receivables processes.

| Feature | Details |

|---|---|

| Software Name | BlueSnap |

| Type | Accounts Receivable / Payment Management |

| KYC Requirement | Minimal KYC for account setup |

| Key Features | Invoice management, automated payments, subscription billing, global payment processing, multi-currency support |

| Supported Payments | Credit/Debit Cards, PayPal, ACH, Digital Wallets |

| Integrations | QuickBooks, Salesforce, Shopify, WooCommerce, Zapier |

| Customer Support | 24/7 email & chat support |

| Security | PCI DSS compliant, tokenization, fraud protection |

| Pricing | Transaction-based fees; no heavy upfront costs |

| Ideal For | Small to medium businesses seeking simple AR management with fast setup |

5. HighRadius

HighRadius is recognized as one of the best accounts receivable software because of its sophisticated AI-powered automation features that simplify the entire AR process. Its most exceptional component is the intelligent cash application that effortlessly matches payments to invoices, diminishing the manual work and mistakes.

HighRadius offers predictive analytics to point out possible late payments, allowing businesses to manage collections and cash flow more efficiently. The system’s all-in-one dashboard offers visibility into outstanding receivables, dispute resolution, and customer payment trends.

HighRadius uniquely placed automation, AI forecasting, and robust analytics to help businesses increase operational agility, streamline receivables, and achieve tight oversight of AR.

| Feature/Aspect | Details |

|---|---|

| Software Name | HighRadius |

| Type | Accounts Receivable (AR) Automation Software |

| KYC Requirement | Minimal |

| Key Features | Invoice management, cash application, collections management, credit management, AI-driven analytics |

| Deployment | Cloud-based, SaaS |

| Integrations | ERP systems like SAP, Oracle, NetSuite, Microsoft Dynamics |

| Automation | AI-powered cash forecasting, automatic invoice matching, smart reminders |

| User Interface | Intuitive dashboard with real-time AR insights |

| Target Users | Enterprises, finance teams, accounts receivable departments |

| Customer Support | 24/7 support, onboarding assistance, dedicated account managers |

| Benefits | Reduces DSO, improves cash flow, minimizes manual errors, fast deployment |

6. Centime

Centime is one of the most effective accounts receivable software due to its dedication to making invoicing and payment collection seamless across any size of business.

Centrime combines automation with nuanced analytics, enabling businesses to easily monitor overdue invoices, payment trends, and customers who pay late.

Centime’s AR workflow cloud platform is designed to minimize the time and money required to manage accounts receivable and reconcile payments towards an invoice, increasing cash flow and reducing errors caused by human intervention.

Custom alerting thresholds and various reporting options improve decision-making and financial precision. The effective blend of automation, analytics, and simplicity is Centime’s strongest AR offering.

| Feature | Details |

|---|---|

| Software Name | Centime |

| Type | Accounts Receivable (AR) Automation Software |

| KYC Requirement | Minimal; primarily for customer verification and creditworthiness assessment |

| Key Features | Invoice delivery, reminders, collections workflows, customer portal, AI-driven cash forecasting |

| Deployment | Cloud-based, integrates with NetSuite, Sage Intacct, and QuickBooks |

| Customer Payment Portal | Branded portal supporting ACH, credit card, and check payments without requiring account creation |

| Automation Capabilities | AI-powered workflows for invoice delivery, follow-ups, escalations, and collections based on customer behavior |

| Onboarding Time | Typically 7–21 days with award-winning support |

| Integration | Native integration with NetSuite, Sage Intacct, and QuickBooks for seamless data synchronization |

| Target Users | Enterprises, finance teams, accounts receivable departments |

| Benefits | Reduces Days Sales Outstanding (DSO), improves cash flow, enhances customer satisfaction, minimizes manual errors |

7. EzyCollect

EzyCollect is one of the best accounts receivable software because it values relationships with customers during the process of accelerating cash collections.

It stands out in the automation of payment reminders, dunning, and follow-up, all effortless, so businesses can get paid on time.

Moreover, EzyCollect offers an overview of outstanding invoices, payment histories, and customer behavior in real time and clearly, allowing businesses to prioritize collections. EzyCollect integrates with accounting systems.

Its friendly UI eases AR management for SMEs. EzyCollect, with the help of automation, visibility, and customer-centric tools, streamlines the receivables process, improves cash flow, minimizes overdue payments, and makes the process faster and more efficient.

| Feature | Details |

|---|---|

| Software Name | ezyCollect |

| Type | Accounts Receivable (AR) Automation Software |

| KYC Requirement | Minimal; primarily for customer verification and creditworthiness assessment |

| Key Features | Invoice reminders, online payment portal, credit risk monitoring, cash application, ERP integrations |

| Deployment | Cloud-based, integrates with Xero, MYOB, QuickBooks, NetSuite, Microsoft Dynamics, and more |

| Payment Options | ACH, direct debit, credit card, bank transfer via integrated ‘Pay Now’ portal |

| Automation Capabilities | AI-driven reminders via email, SMS, and postal mail; automated cash application; credit risk alerts |

| Onboarding Time | Typically 7–21 days with onboarding support |

| Security | Hosted on AWS with PCI-compliant payment processing; 3DS checks and bank account validation |

| Target Users | Enterprises, finance teams, accounts receivable departments |

| Benefits | Reduces Days Sales Outstanding (DSO), improves cash flow, enhances customer satisfaction, minimizes manual errors |

8. Quadient

Quadient maintains a reputation as the top accounts receivable software. It automates workflows in AR while communicating with customers.

Its distinguishing capability is the automation of complex processes—invoice delivery, payment automation, and delivery of receivable follow-ups—within one platform. Quadient eliminates delays and minimizes human error. Quadient’s cash flow analytics help businesses assess payment tendencies, outstanding receivables, and guide proactive decision-making.

Its configurable communications enable businesses to send payment reminders and correspondence. Quadient combines automation, analytics, and customer-oriented capabilities to facilitate AR management, streamline control collections, and improve the overall financial control of the company.

| Feature | Details |

|---|---|

| Software Name | Quadient Accounts Receivable |

| Best For | Businesses seeking automated AR management with minimal KYC |

| Core Functionality | Invoice automation, payment tracking, collections management |

| Integration | ERP systems, accounting software, CRM platforms |

| Payment Methods Supported | Bank transfers, credit cards, digital payments |

| Security & Compliance | Data encryption, GDPR compliance |

| User Access | Role-based access control, minimal verification required for setup |

| Customer Support | Email, phone, live chat |

| Pricing | Custom pricing based on business size and requirements |

| Key Benefit | Streamlined AR processes with minimal KYC requirements |

9. Invoiced

Invoiced is recognized among the best accounts receivable software because of the automation of billing and collections, as well as the versatility it offers to its users.

The software enables users to manage recurring invoices, one-off payments, and subscription billing all on one platform, which is best suited for companies with diverse revenue models.

The software also automates the sending of payment reminders, dunning, and reconciliation of accounts which lowers the chances of late payments and reduces the time and effort needed for these tasks.

Users gain the ability to provide finance teams with up to date cash flow information as well as insights on customer payment behavior and receivables. The combination of detailed reporting, automation, and flexibility enhances efficiency and collections. Invoiced ensures that accounts receivable management is precise.

| Feature | Details |

|---|---|

| Software Name | Invoiced |

| Best For | Businesses seeking automated accounts receivable with minimal KYC |

| Core Functionality | Invoice automation, payment reminders, recurring billing, dunning management |

| Integration | QuickBooks, NetSuite, Xero, Salesforce, Stripe |

| Payment Methods Supported | ACH, credit cards, wire transfers, digital wallets |

| Security & Compliance | PCI-DSS compliance, data encryption, GDPR-ready |

| User Access | Role-based access, minimal verification required for onboarding |

| Customer Support | Email, phone, live chat, help center |

| Pricing | Custom pricing based on usage and business needs |

| Key Benefit | Simplifies collections and cash flow management while minimizing KYC friction |

10. Kolleno

Kolleno has been identified and acclaimed as one of the top software accounts receivable programs because it centers its attention and resources on automating workflows for accounts receivables and improving tracking of payments, and customer interactions.

Streamlining the entire receivables process, invoicing, and payment reconciliation, all on one intuitive, easy to use platform, is its unique advantage.

Moreover, smart reminders, real-time dashboards and comprehensive marking reports enhance the visibility of outstanding invoices and trends in cash flow.

It trims down the manual effort to enhance collections and improve control on finances while permitting the user to streamline workflows automation and receivables transparency. It has become synonymous with user receivables automation.

| Feature | Details |

|---|---|

| Software Name | Kolleno |

| Best For | Businesses seeking automated AR management with minimal KYC |

| Core Functionality | Invoice generation, payment tracking, automated reminders, collections management |

| Integration | ERP systems, accounting software, CRM platforms |

| Payment Methods Supported | Bank transfers, credit/debit cards, digital wallets |

| Security & Compliance | Data encryption, GDPR compliance |

| User Access | Role-based access with minimal verification required |

| Customer Support | Email, live chat, phone support |

| Pricing | Custom pricing based on business size and usage |

| Key Benefit | Streamlined accounts receivable processes with reduced KYC requirements |

How Do Accounts Receivable Software work?

Invoice Generates: Producing and dispatching invoices to clients with little to no manual input is efficiently automated.

Payment Tracking: Checking and managing received payments and outstanding accounts in real time is automated.

Automated Reminders: Customers receive automated reminders and follow-up notifications.

Cash Application: Incoming payments to customer accounts are compared against the invoices for greater accuracy and reduced error.

Reporting & Analytics: Streams receivable accounts and overdue accounts to enhance the decision-making process.

Integration: Works with your payment solution, accounting, and ERP systems, providing total control over your finances.

Conclusion

For businesses seeking to optimize their billing, improve collection speeds, and keep cash flow positive, picking the right accounts receivable software is pivotal.

Leading options like BlackLine, Corcentric, VersaPay, BlueSnap, HighRadius, Centime, EzyCollect, Quadient, Invoiced, and Kolleno offer a host of time-saving and value-added capabilities like automation, real-time tracking, robust analytics, and integration with other modules of the finance stack.

These systems help businesses receivable ops with precision and actionable insights eliminating manual work, and optimizing error reduction. Best in class AR software translates to enhanced operational efficacy, and stronger customer partnership, all contributing to robust AR health.

FAQ

What is accounts receivable software?

Accounts receivable software is a digital tool that automates invoicing, tracks outstanding payments, and manages customer balances to improve cash flow and reduce manual errors.

Why do businesses need accounts receivable software?

It helps streamline billing, send automated reminders, reconcile payments quickly, and provides real-time insights into receivables, improving efficiency and cash flow.

Which is the best accounts receivable software?

Top options include BlackLine, Corcentric, VersaPay, BlueSnap, HighRadius, Centime, EzyCollect, Quadient, Invoiced, and Kolleno, each offering unique features for different business needs.

Can AR software integrate with other systems?

Yes, most AR software integrates with accounting, ERP, and payment systems for seamless financial management.

How does AR software improve cash flow?

By automating invoices, sending reminders, and tracking payments, it ensures faster collections and reduces overdue receivables.