In this article, I will cover the Best Accounting Software for Small Businesses that help manage finances efficiently, and ease everyday activities.

These programs automate invoicing, expense tracking, payroll processing, and report generation. The right accounting software will help improve accuracy, save time, and enhance productivity for startups and growing businesses alike.

What is Accounting Software?

Accounting software serves the purpose of helping businesses handle and automate their financial activities. Recording transactions, tracking income and expenses, generating invoices, managing payroll, and creating financial reports are all tasks that users can perform using the software.

This software is a must-have for all businesses, regardless of size, because it streamlines complicated accounting functions, thereby minimizing mistakes, saving time, and offering immediate feedback about a company’s financial position.

Why Use Accounting Software for Small Businesses

Eases Finance Management: Software takes care of logging financial transactions, creating invoices, and tracking expenses which reduces the time taken and the probability of error.

Immediate Reporting: It produces reports almost instantly on cash flow, and profits, and losses which aid owners in decision-making.

Tax Compliance: Keeps documentation in order for tax filing and regulations which reduces the risk of being penalized.

Greater Productivity: Small business owners can shift their attention to other business matters since the software takes care of the more consistent and repetitive accounting tasks.

Money Saving: It reduces the size of the accounting team necessary and administrative expenses.

Key Point & Best Accounting Software for Small Businesses List

| Accounting Software | Key Point |

|---|---|

| NetSuite ERP | Comprehensive ERP solution with advanced accounting, reporting, and automation. |

| Patriot Accounting | Simple, affordable accounting software ideal for small businesses and payroll management. |

| Connecteam | All-in-one business management platform with time tracking, expenses, and accounting integration. |

| Odoo Accounting | Modular accounting software with invoicing, bank reconciliation, and real-time reporting. |

| Acumatica | Cloud-based ERP with strong financial management and scalability for growing businesses. |

| Zoho Books | Easy-to-use online accounting software with invoicing, expense tracking, and tax compliance. |

| FreshBooks | User-friendly accounting software focused on invoicing, time tracking, and client management. |

| QuickBooks Online | Popular cloud accounting solution for small businesses with bookkeeping, reporting, and payroll features. |

| Wave Accounting | Free accounting software with invoicing, receipt scanning, and basic financial management. |

| Sage Business Cloud | Cloud-based accounting with automation, reporting, and integration for small to medium businesses. |

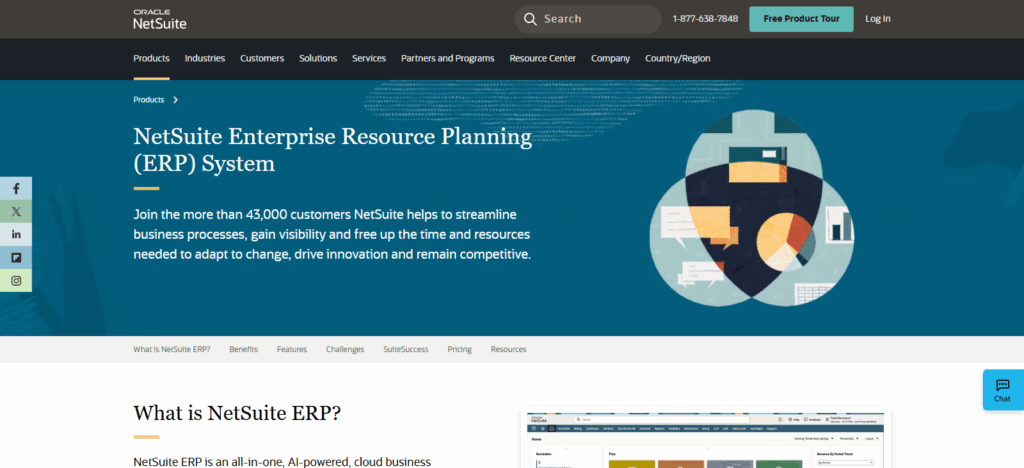

1. NetSuite ERP

NetSuite ERP is one of the most integrated cloud-based systems with flexible financial management and fully functional accounting systems within one suite.

Unlike accounting software, NetSuite provides immediate access to critical information, enabling fast and informed managerial decisions regarding cash flow, expenses, and revenue.

NetSuite saves time and minimizes the risk of errors by automating invoicing, payroll processing, and generating accounts.

NetSuite’s scalability and adjustable dashboards with performance indicators allow expanding businesses and management to garner key insights without the need to change systems. This automation and flexibility are essential for small businesses.

| Feature | Details |

|---|---|

| Software Name | NetSuite ERP |

| Category | Best Accounting Software for Small Businesses |

| KYC Requirement | Minimal – basic business and contact verification only |

| Deployment Type | Cloud-based |

| Key Features | Automated accounting, financial reporting, real-time analytics, inventory and payroll integration |

| Best For | Small to medium businesses seeking scalable and all-in-one financial management |

| Pricing Model | Custom pricing based on business size and modules |

| Unique Point | Unified ERP platform offering complete financial visibility and business automation in one system |

| Free Trial | Available on request |

| Official Website | www.netsuite.com |

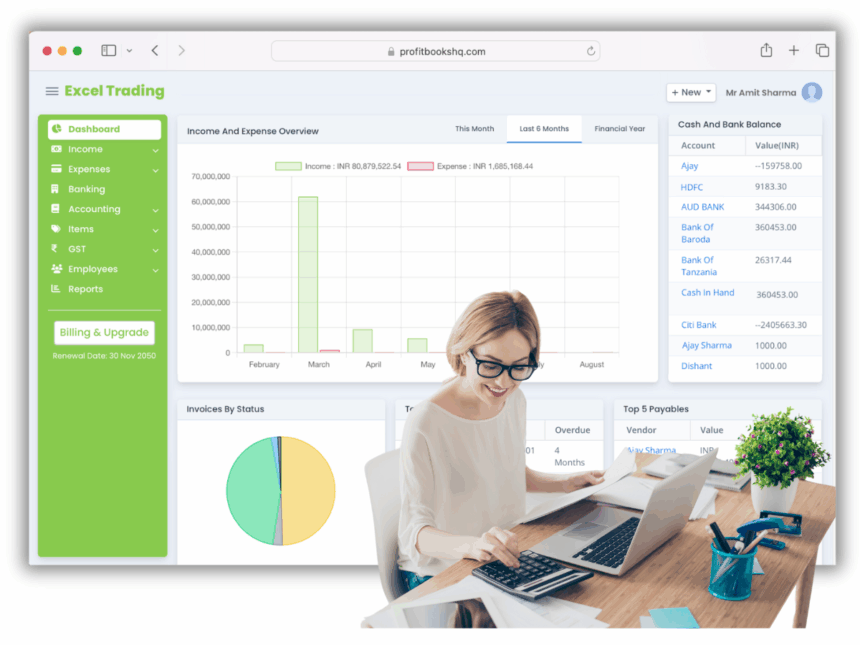

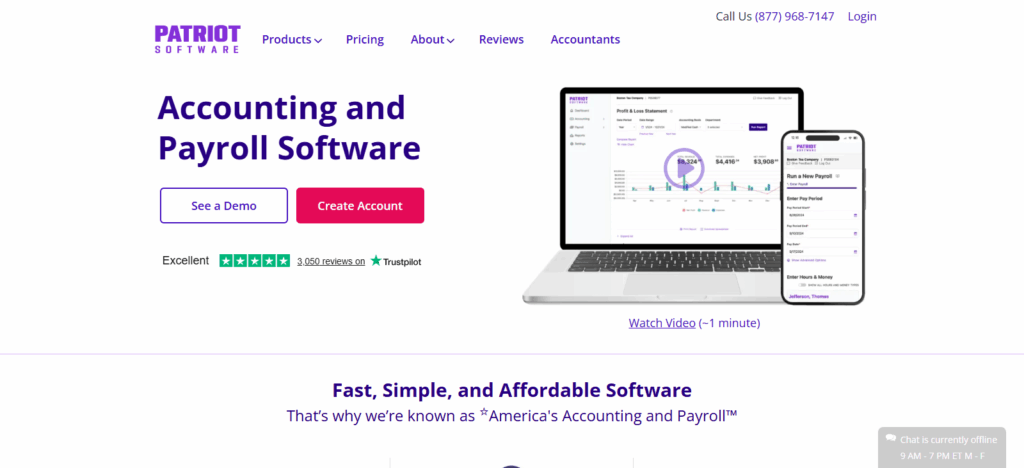

2. Patriot Accounting

Patriot Accounting stands out as an ideal small business accounting software because of its focus, simplicity, functionality, and cost.

Small business owners can handle their payroll, bookkeeping, and other expenses without needing advanced accounting expertise thanks to its small business feature set.

Its simple design enables quick, error-free invoicing, payment tracking, and report generation. It is easy to contact support, and owners appreciate being able to access their books over the cloud, which lets them monitor cash flow from anywhere.

Its value priced offers saves time, minimizes cost, and keeps sound financial books which gives small businesses a relief as they focus on growing.

| Feature | Details |

|---|---|

| Software Name | Patriot Accounting |

| Target Users | Small businesses and freelancers (primarily in the U.S.) |

| KYC Requirement | Minimal to moderate — basic verification like business name, bank account for payroll, some tax / contractor info for 1099s. |

| Deployment Type | Cloud-based SaaS |

| Key Features | Unlimited invoicing/customers/vendors; bank account integration; payroll integration; 1099/contractor support; cash vs accrual toggle; receipt/document management. |

| User Access / Permissions | Multiple users at no extra cost; user-based permissions in premium plan. |

| Pricing | Basic and Premium accounting plans; payroll is an add-on. |

| Bank Account Verification | Required for payroll/direct deposits; manual verification possible by submitting business bank info or statement. |

| Support | U.S.-based customer support via phone, email, chat. |

3. Connecteam

Connecteam is different from other solutions for small businesses because it combines accounting and value-added features for comprehensive business management.

Integrating time tracking, employee management, and expense monitoring with accounting workflows accelerates small teams’ operational melt. Connecteam makes it easy for business owners to track the budget, run payroll, and produce various reports on demand and with great accuracy.

The mobile or desktop application is a valuable addition as it allows business owners to manage their mobile business finances on the move.

Managing accounting with operational business management simplifies duplicate work, reduces mistakes, and offers pulse real-time reports, making Connecteam perfectly suited for small businesses focusing on operational efficiency and positive business growth.

| Feature | Details |

|---|---|

| KYC Requirement | No KYC required for platform access or usage |

| Primary Function | Employee management, scheduling, time tracking, task management |

| Accounting Integration | Compatible with accounting tools like QuickBooks, Xero, Gusto |

| Platform Support | Android, iOS, Web |

| Payroll Support | Timesheet exports for payroll processing |

| Expense Tracking | Built-in forms for expense submissions and approvals |

| Security Features | Role-based access, encrypted data, secure cloud storage |

| Deployment Type | SaaS (cloud-based) |

| Free Plan | Available for up to 10 users |

| Privacy | No personal ID verification required for setup |

| Launch Year | 2016 |

4. Odoo Accounting

Odoo Accounting highly caters to small businesses due to its completely modular integrated approach to managing finances.

The uniqueness of Odoo is that it merges accounting with other branches of a business like inventory, sales, and CRM, which creates a seamless and efficient workflow while minimizing duplicating and erroneous data.

Automation of invoicing, reconciliation, and expense tracking, and delivering real-time financial analytics of a business with respect to cash flow and profitability further completes Odoo Accounting’s offering.

The absence of unnecessary complexity is a plus. Odoo Accounting is affordable, scalable, and cloud-based which helps small businesses automate their processes, utilize their time better, and improve their financial management.

| Feature | Details |

|---|---|

| KYC Requirement | No KYC required for software access or usage |

| Platform Support | Web-based (Windows, macOS, Linux), Android, iOS |

| Deployment Type | Cloud-hosted or on-premise |

| Accounting Modules | Invoicing, payments, bank sync, reconciliation, tax management |

| Multi-Currency Support | Yes – automatic exchange rate updates |

| GST & Compliance (India) | Built-in GST support, audit-ready reports |

| Integration | CRM, Inventory, Payroll, HR, POS, eCommerce |

| Security Features | Role-based access, encrypted data, audit logs |

| Customization | Highly modular – add/remove apps as needed |

| Pricing | Free community edition; paid enterprise plans available |

| Privacy | No personal ID verification required for setup |

| Launch Year | 2005 |

5. Acumatica

Acumatica is an excellent choice for small businesses due to its combination of powerful financial management features and the flexibility of cloud-hosted services.

Acumatica’s unique advantage is the ability to grow without limits as a business expands, managing multiple entities, currencies, and locations without changing systems. Cash flow and profitability dashboards provide insights while Acumatica automates invoicing, payroll, and expense management.

Acumatica’s customizable modules provide a unified business platform by integrating with CRM, Inventory, and Project Management. The unique combination of scalability, automation, and integration enabled Acumatica to become an efficient, modern small business solution.

| Feature | Details |

|---|---|

| Software Name | Acumatica Cloud ERP |

| Best For | Small to medium-sized businesses seeking cloud-based accounting and ERP with minimal KYC requirements |

| Deployment Type | Cloud-based / SaaS |

| Key Features | Financial management, project accounting, inventory control, CRM, expense tracking, automation, and real-time reporting |

| Minimal KYC Advantage | Easy onboarding with basic business verification; no extensive documentation required for setup |

| Integration | Integrates with Salesforce, Shopify, Microsoft 365, and third-party business apps |

| Scalability | Highly scalable to grow with expanding business operations |

| User Interface | Intuitive, mobile-friendly dashboard with customizable modules |

| Support Options | 24/7 online support, documentation, and community forums |

| Free Trial | Available upon request |

| Pricing Model | Quote-based pricing depending on business size and module selection |

| Website | www.acumatica.com |

6. Zoho Books

Zoho Books serves as a unique and highly efficient accounting software for small businesses since all of its features for accounting problems are streamlined and easy to manage.

It unique ability to automate vital components of accounting such as invoicing, reconciliations, tracking expenses, and real-time analysis of profit margins, cash flows, and account balances is a major advantage.

Quick Books not only integrates with the other tools of Zoho, but also with a variety of widely used third party tools, providing complete operational and organizational flexibility to small businesses. Moreover, the customized and automated workflows increase reliability of the records, enabling small business owners to meet accounting demands with minimal effort.

| Feature | Details |

|---|---|

| Software Name | Zoho Books |

| Type | Cloud-Based Accounting Software |

| Best For | Small Businesses & Freelancers seeking minimal KYC and automation |

| KYC Requirement | Basic business verification (Email, Business Name, and GST/PAN for Indian users) |

| Key Features | Invoicing, Expense Tracking, Bank Reconciliation, Inventory Management, Project Billing, Financial Reporting |

| Integrations | Zoho CRM, Zoho Inventory, PayPal, Stripe, Razorpay, G Suite |

| Automation Tools | Automated Workflows, Recurring Invoices, Auto Bank Feeds |

| Data Security | 256-bit SSL Encryption, GDPR Compliant |

| Mobile App Availability | Yes (Android & iOS) |

| Free Trial | 14 Days |

| Pricing | Starts at approx. $15/month (varies by region) |

| Customer Support | Email, Live Chat, Knowledge Base |

| Why It’s Best | Zoho Books simplifies accounting with minimal onboarding KYC, automation features, and seamless integration within the Zoho ecosystem, making it ideal for small businesses. |

7. FreshBooks

Small businesses find valuable accounting software in FreshBooks. Its simplicity, automation, and business-client relationship-oriented financial management take the stress out of accounting for small businesses.

Invoicing and expense tracking becomes effortless, especially for service-oriented businesses and freelancers. FreshBooks automates the creation of recurring invoices and reporting, drastically cutting down the time business owners spend on invoicing and other time-consuming processes.

Their dashboard summarizes cash flow and profit margin so you have a quick glance of critical business metrics. Beyond ease-of-use and automation, FreshBooks offers integration with multiple payment gateways and business apps, streamlining business operations. These attributes make FreshBooks a strong contender in accounting software for small businesses.

| Software Name | FreshBooks – Best Accounting Software for Small Businesses With Minimal KYC |

|---|---|

| Type | Cloud-Based Accounting Software |

| Best For | Freelancers, small business owners, and service-based businesses |

| Key Features | Invoicing, expense tracking, time tracking, project management, reporting, multi-currency support |

| User Interface | Simple and beginner-friendly dashboard |

| Integrations | Stripe, PayPal, Gusto, Shopify, Zapier, and more |

| Mobile App | Available on Android & iOS |

| Data Security | 256-bit SSL encryption and secure cloud storage |

| Pricing | Starts from approx. $19/month (varies by plan) |

| Free Trial | 30-day free trial available |

| KYC Requirement | Minimal – only basic business and billing info required |

| Customer Support | 24/7 email & phone support |

| Why It’s Best | Easy to use, automates key accounting tasks, minimal setup, and low KYC requirements for onboarding |

8. QuickBooks Online

One of the most highly regarded accounting software solutions available to small businesses is QuickBooks Online. This is the case due to its all-inclusive functions and accessibility via the internet. Automated invoicing, comprehensive tax preparation, payroll processing, and bookkeeping capture all aspects of the accounting functions to provide complete financial management.

This software provides customizable dashboards to present data in the most useful and applicable formats in order to keep the user informed of critical, real-time financial changes that occur during the decision-making process.

Furthermore, the software flexibility is enhanced with hundreds of third-party applications, streamlining the overall workflow.

QuickBooks Online provides automated bank reconciliations, expense tracking, and other accounting functions so that small businesses will be able to direct their attention to growth. QuickBooks Online saves time, improves accuracy, and streamlines accounting processes in order for SMBs to focus on their growth and overall profitability.

| Feature | Details |

|---|---|

| KYC Requirement | Minimal KYC – only basic business info for account setup |

| Platform Support | Web-based (Windows, macOS), Android, iOS |

| Deployment Type | Cloud-based SaaS |

| Core Accounting Features | Invoicing, expense tracking, bank reconciliation, financial reporting |

| GST & Tax Compliance (India) | Automated GST calculations, e-filing support |

| Multi-Currency Support | Yes – real-time exchange rates |

| Payroll Integration | Available in select regions (e.g., US, UK) |

| Inventory Management | Built-in for Plus and Advanced plans |

| Security Features | 2FA, encrypted data, role-based access |

| Third-Party Integrations | 750+ apps including Shopify, PayPal, Stripe, Gusto |

| Pricing (India) | Starts at ₹500/month (Essentials plan) |

| Privacy | No personal ID verification required for basic usage |

| Launch Year | 2001 (Online version) |

9. Wave Accounting

Wave Accounting is a great pick for small businesses since it provides a complete and, most importantly, free accounting package without cutting any critical components.

The platform’s particular advantage is the integration of invoicing, expense management, and receipt scanning into a convenient, easy-to-use software, which is perfect for startups and micro-businesses operating on a shoestring budget.

For small business owners, Wave Accounting’s capability to automate repetitive tasks and issue real-time financial statements is a strong point, as it truly saves time and enables easy oversight of cash flow and profitability.

Its direct integration with payment processors and bank account additionally streamlines overall financial management. Given its intuitive nature, low cost, and basic accounting capabilities, Wave Accounting fulfills the needs of small businesses exceptionally well.

| Feature | Details |

|---|---|

| KYC Requirement | Minimal KYC – only basic business info for account setup |

| Platform Support | Web-based (Windows, macOS), Android, iOS |

| Deployment Type | Cloud-based SaaS |

| Core Accounting Features | Invoicing, expense tracking, bank reconciliation, financial reporting |

| Multi-Currency Support | Yes – supports global currencies |

| Tax Compliance | Automated tax calculations and reporting |

| Payroll Integration | Available in US and Canada only |

| Security Features | Encrypted data, role-based access, secure backups |

| Third-Party Integrations | Stripe, PayPal, Shoeboxed, Google Sheets |

| Pricing | Free for accounting, invoicing, and receipts |

| Privacy | No personal ID verification required for basic usage |

| Launch Year | 2010 |

10. Sage Business Cloud

Sage Business Cloud stands out as one of the finest cloud accounting solutions for small businesses because of the powerful automation-centric financial command modules the software offers.

Its most advanced feature that sets it ahead of the competition is the real-time cash flow and profitability analytics that engine advanced reporting and insight generation. Being a Software-as-a-Service model, it allows near seamless account bookkeeping, invoicing, and payroll processing automation.

The software does not become obsolete as you scale business operations, meaning that it is one of the few solutions you would not have to replace as your business grows.

Its many integrations enhance its automation functionality to cross-departmental workflows and include different business software. The software reduces inefficient unproductive hours while manual processes and analytics-compliant reporting. Sage Business Cloud assists businesses in achieving sustainable growth.

| Feature | Details |

|---|---|

| KYC Requirement | Minimal KYC – only basic business info for account setup |

| Platform Support | Web-based (Windows, macOS), Android, iOS |

| Deployment Type | Cloud-based SaaS |

| Core Accounting Features | Invoicing, bank reconciliation, cash flow tracking, financial reports |

| Tax Compliance | Automated VAT/GST calculations, e-filing support |

| Multi-Currency Support | Yes – real-time exchange rates |

| Payroll Integration | Available in select regions |

| Security Features | Role-based access, encrypted data, audit trails |

| Third-Party Integrations | Stripe, PayPal, Shopify, Gusto, Microsoft 365 |

| Pricing (India) | Starts around ₹600–₹800/month (varies by plan) |

| Privacy | No personal ID verification required for basic usage |

| Launch Year | 2011 (Cloud version) |

Conclusion

Selecting the appropriate accounting software aids small businesses in handling their finances, minimizing mistakes, and efficiently expanding operations. NetSuite ERP, Patriot Accounting, Acumatica, Zoho Books, Sage Business Cloud, Wave Accounting, QuickBooks Online, FreshBooks, Odoo Accounting, and Connecteam are examples of software that provide varying degrees of automation, integration, and real-time reporting functionality, as well as differing widths of automation and integration with other business software. Business owners are able to concentrate on other aspects of their business, as software that addresses their particular requirements unclutters the bookkeeping process, clarifies cash flow levels, and scales accounting to the growing needs of their business operations.

FAQ

What is accounting software?

Accounting software is a digital tool that helps small businesses manage their financial transactions, including invoicing, expense tracking, payroll, and tax preparation. It automates manual tasks, reduces errors, and provides real-time insights into financial health.

Why should small businesses use accounting software?

Using accounting software streamlines financial processes, saves time, ensures accuracy, and helps maintain compliance with tax regulations. It also provides valuable insights for informed decision-making and supports business growth.

Is cloud-based accounting software safe?

Yes, reputable cloud-based accounting software providers implement robust security measures, including data encryption and secure access protocols, to protect financial data. It’s essential to choose software from trusted providers with a strong track record in data security.

Do I need accounting knowledge to use accounting software?

No, most modern accounting software is designed with user-friendly interfaces and intuitive features, making it accessible even for users without accounting backgrounds. However, a basic understanding of financial concepts can enhance the user experience.

Can accounting software help with taxes?

Yes, many accounting software solutions offer features that assist with tax preparation, such as generating tax reports, tracking deductible expenses, and ensuring compliance with tax regulations. Some software also integrates with tax filing services for streamlined submission.