Arbitrage Scanner Ai : In this article, we cover a detailed review of Arbitrage Scanner How does Arbitrage Scanner Artificial Intelligence work & Are important features?

What Is Arbitrage Scanner ?

In order to find and seize Arbitrage Scanner opportunities, traders and investors in the financial markets employ advanced tools called arbitrage scanners. The act of profitably taking advantage of pricing differences between several assets or markets is known as arbitrage. Real-time monitoring of many financial instruments, including stocks, currencies, cryptocurrencies, and commodities, is the purpose of the scanner.

It continuously examines data from many exchanges and sources to find situations in which an asset is concurrently valued differently in two or more markets. Traders can quickly execute buy and sell orders to capitalize on a price differential before it normalizes when they spot an arbitrage opportunity. These scanners are an essential part of contemporary algorithmic trading systems and are priceless for anyone looking to participate in low-risk, high-reward trading techniques.

Key Points Table

| Key | Points |

|---|---|

| Product Name | Arbitrage Scanner |

| Starting Price | Free |

| Free Versions | Yes Free Versions Available |

| Product Type | Ai |

| Free Trial | Available |

| API Options | Available |

| Email Support | Yes |

| Website Url | Click Here To Visit |

| Device | Type of Courses | Support Channel |

|---|---|---|

| On-Premise | Multi-Asset Support | 24/7 Support |

| Mac | Customizable Criteria | Email Support |

| Linux | Risk Management | |

| Chromebook | ||

| Windows | ||

| SaaS |

Arbitrage Scanner Features List

Here are some of the amazing features offered by the Arbitrage Scanner tool;

- Arbitrage Scanner Suggest™ for chat and helpdesk tickets retrieves relevant responses from a team

- User-Friendly Interface

- Quick & Easy

- Customizable

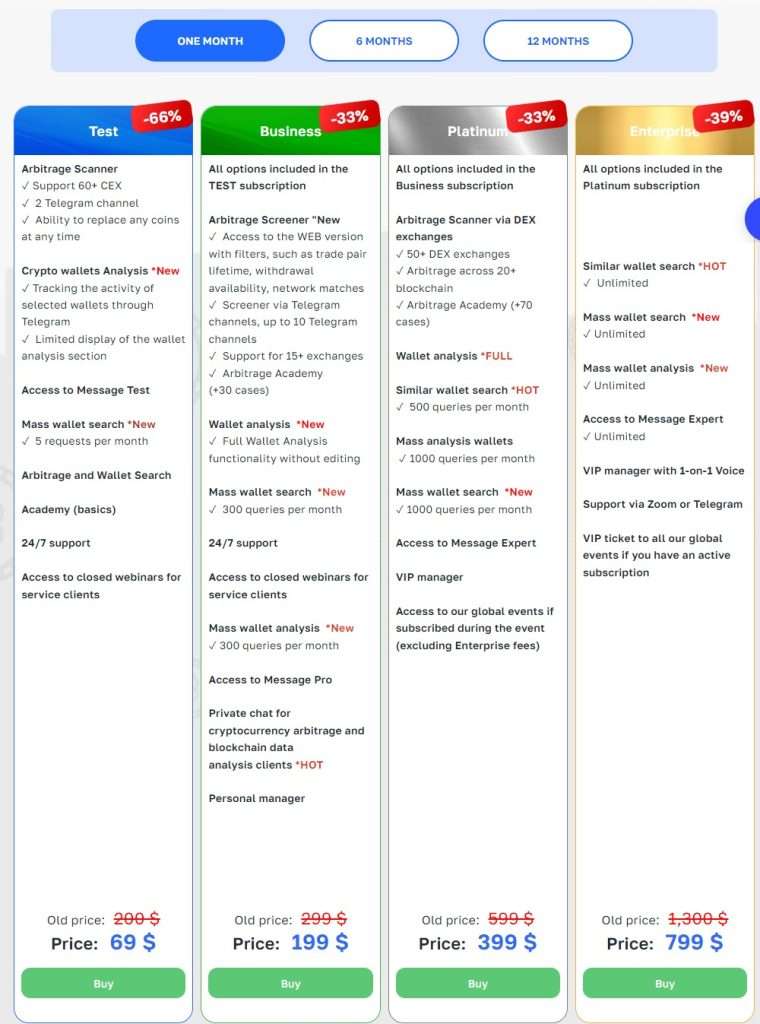

Arbitrage Scanner Price & Information

The software offers a free plan, but you don’t have access to all of its features. There are also pro and enterprise versions available.

How Does Arbitrage Scanner Work?

In order to identify price differences in real-time, an arbitrage scanner continuously scans a number of financial marketplaces, including stock exchanges, currency pairs, and cryptocurrency platforms. Finding instances where the same asset is trading at various prices across several markets is the fundamental idea. The scanner uses complex algorithms to gather and compare data from multiple sources in order to accomplish this.

An alert or warning is sent to the trader or algorithmic trading system by the scanner when it finds a pricing disparity that fits certain criteria. After then, the trader can quickly carry out a number of transactions to profit on the price difference by purchasing the item at a lower price and selling it at a higher price. This process is carried out fast—often in a matter of seconds—to make sure that the arbitrage opportunity is not missed because markets have a tendency to adjust swiftly.

In order to find and take advantage of arbitrage opportunities, traders can use technology and data analysis, which narrows price differences between various trading venues and eventually improves market efficiency. This is where arbitrage scanners come into play in today’s financial markets.

Who Uses Arbitrage Scanner ?

So who should be using Arbitrage Scanner tool?

- Bloggers who are struggling to create new content regularly

- Small business owners who want to create original product reviews

- YouTubers who want crispy and unique titles and descriptions for their videos

- Social media managers who want to quickly create excellent social media posts

- SEOs, affiliate marketers, and anyone who wants to write blog articles

Apps and Integrations

Unfortunately, Arbitrage Scanner doesn’t offer a native app for desktop or mobile devices.

You have the option to download an extension for:

- Chrome

- Firefox

- Microsoft Edge

- Opera

- Brave

You can also download add-ons for Google Docs, Word, Outloo

Some Outstanding Features Offer By Arbitrage Scanner ?

Real-time Market Monitoring

To help traders quickly spot opportunities as they present themselves, arbitrage scanners continuously keep an eye on a variety of financial markets and assets.

Arbitrage Scanner Multi-Asset Support

They enable traders to diversify their arbitrage tactics by tracking a range of asset classes, such as equities, bonds, currencies, commodities, and cryptocurrencies.

Customizable Criteria

To better match the scanner’s warnings to their trading methods, traders can establish precise criteria for price differentials, such as absolute price discrepancies or percentage thresholds.

Integration with Exchanges

When arbitrage opportunities are identified, arbitrage scanners frequently integrate with a variety of exchanges and trading platforms to facilitate the smooth execution of buy and sell orders.

Arbitrage Scanner Historical Data Analysis

By offering historical pricing data and analytics, certain scanners enable traders to backtest arbitrage techniques and perform in-depth research.

Alerting and Notifications

They make sure traders don’t miss out on possible opportunities by sending out real-time alerts via a variety of channels, including email, SMS, and push notifications.

Risk management

To assist traders in weighing the possible risks and benefits connected to certain arbitrage possibilities, several scanners provide risk assessment and management tools.

User-Friendly Interface

Traders may easily navigate the scanner and modify settings to suit their preferences thanks to intuitive and user-friendly interfaces.

Insights into Arbitrage methods

Depending on the state of the market, certain scanners offer analysis and suggestions for arbitrage methods to take into account.

Mobile Compatibility

When traders are on the go, they may stay connected and take advantage of arbitrage opportunities using mobile apps or responsive online interfaces.

Backtesting Capabilities

In order to assess the past performance of probable arbitrage techniques, advanced scanners may provide backtesting tools.

Security and Data Privacy

Reputable arbitrage scanners put strong security measures in place to ensure the security of sensitive trading data.

Arbitrage Scanner Pros Or Cons

| Pros | Cons |

|---|---|

| Profit Potential: In real time, arbitrage scanners can assist traders in spotting opportunities to capitalize on price differences, which could result in steady profits. | Cost: Smaller or solitary traders may find it prohibitive to purchase high-quality arbitrage scanners due to their high cost. |

| Efficiency: By automating the process of locating arbitrage opportunities, they help traders save a significant amount of time and effort compared to manually watching the market. | Problems with latency: In fiercely competitive marketplaces, the speed at which warnings arrive and orders are carried out can be crucial, and even a small delay can lead to lost chances. |

| Diversification: Traders can use arbitrage scanners to apply their trading methods across a variety of financial assets and markets. | Market Volatility: Quick shifts in the market may result in arbitrage scanning producing false positives or negatives, which could result in losses. |

| Risk management: Certain scanners provide instruments for assessing risk, allowing traders to determine and control the risks connected to certain arbitrage opportunities. | Complexity: For inexperienced traders in particular, comprehending and adjusting the scanner’s parameters and settings might be challenging. |

| Automation: A lot of scanners are integrated with trading platforms, which lowers the possibility of human error by enabling automated order execution when arbitrage possibilities are found. | Market limits: The efficacy of arbitrage tactics may be restricted by rules or limits on certain markets and exchanges. |

Arbitrage Scanner Alternative

Manual Research and Analysis: Trading professionals might use manual market research and analysis to find arbitrage possibilities. This strategy necessitates a thorough comprehension of the markets and an acute sense of price differences.

Algorithmic Trading methods: Instead of depending on outside scanners, traders can create their own algorithmic trading methods to automate the execution of arbitrage possibilities. More flexibility and control are available with this method.

Signal Services: Real-time notifications and suggestions for trading opportunities are provided by certain websites and financial platforms’ arbitrage signal services. For advice, traders can sign up for these services.

Market Data sources: Traders can obtain pricing details and historical data to independently assess any arbitrage possibilities by utilizing extensive market data sources, often known as APIs.

Pair Trading: In order to profit from the relative price fluctuations of two connected assets, pair traders simultaneously purchase and sell one of the assets. It is a manually executable approach that does not rely on price differences between markets.

Statistical arbitrage: Rather of concentrating only on price differences, this method takes use of statistical correlations between various assets or instruments. Using statistical models, traders can find trading opportunities.

Arbitrage Scanner Conclusion

In conclusion, Arbitrage Scanner traders looking to profit on price differences across a variety of financial markets will find an arbitrage scanner to be a useful tool. Its automation features, adjustable criteria, and real-time monitoring might provide it a competitive edge in the trading industry. Traders must, however, carefully assess the advantages and disadvantages, taking into account things like expenses, latency problems, and market volatility.

Arbitrage scanners are not a one-size-fits-all solution, and there are other effective ways to pursue arbitrage methods, including algorithmic trading, human research, and depending on signal providers. In the end, an arbitrage scanner’s efficacy is contingent upon a trader’s expertise, familiarity with the market, and flexibility. Arbitrage scanners can improve trading techniques and open doors in the financial markets whether used as a main tool or in combination with other approaches.

Arbitrage Scanner FAQ

What is an arbitrage scanner?

An arbitrage scanner is a software or tool that monitors multiple financial markets in real-time to identify and alert traders to potential opportunities for arbitrage. Arbitrage involves exploiting price differentials between the same or related assets in different markets to make a profit.

How does an arbitrage scanner work?

The work by continuously collecting and analyzing pricing data from various sources and exchanges. When they detect a significant price difference or other predefined criteria, they trigger alerts or notifications for traders to take action, typically involving buying low and selling high.

What assets or markets can arbitrage scanners monitor?

They can monitor a wide range of assets, including stocks, currencies, commodities, bonds, and cryptocurrencies. They can also focus on different markets, such as traditional stock exchanges, forex markets, or cryptocurrency exchanges.

What are the key features of an arbitrage scanner?

Key features of an arbitrage scanner typically include real-time monitoring, customizable criteria for arbitrage opportunities, integration with exchanges, risk management tools, historical data analysis, alerts and notifications, and user-friendly interfaces.

What are the benefits of using an arbitrage scanner?

The primary benefit is the potential to profit from price discrepancies in the markets. Additionally, arbitrage scanners can save time, enhance trading efficiency, and provide opportunities for diversification in trading strategies.