In this article, I will discuss the best AI trading bots in 2025. As trading technology advances, AI bots have become essential tools for traders seeking to maximize profits and minimize risks.

These bots offer powerful features like automated strategy execution, real-time analytics, and seamless integration with major exchanges, making them invaluable for both new and experienced traders.

Key Points & Best Ai Trading Bots In 2025 List

| Platform | Key Points |

|---|---|

| Dash2Trade | Advanced signal generation, strategy backtesting, real-time alerts, and trading community. |

| Learn2Trade | Educational resources, trading signals, market analysis, and community support. |

| Perceptrader AI | Machine learning algorithms, real-time data analysis, and automated strategy execution. |

| Cryptohopper | Cloud-based trading bots, strategy creation, backtesting, and support for multiple exchanges. |

| Coinrule | User-friendly interface, customizable rules, and automated trading strategies. |

| 3Commas | Smart trading terminals, portfolio management, and automated bot strategies. |

| Pionex | Integrated trading bots, fee-saving features, and automatic trading setups. |

| Bitsgap | Arbitrage trading, portfolio management, strategy builder, and multi-exchange support. |

| Trade Ideas | AI-powered scanning, stock screening, real-time alerts, and advanced backtesting. |

| AlgoTrader | High-frequency trading, automated strategy development, and advanced analytics. |

| HaasOnline | Customizable bots, comprehensive backtesting, and wide range of technical indicators. |

| TradeSanta | Easy-to-use trading bots, customizable strategies, and multi-exchange support. |

| Shrimpy | Portfolio management, social trading, and automated rebalancing features. |

| Zignaly | Copy trading, automated bot strategies, and signal provider integration. |

| Covesting | Strategy mirroring, social trading platform, and real-time performance analytics. |

| Autonio | Decentralized trading, AI-powered predictions, and custom strategy creation. |

| Trality | Python-based bot creation, backtesting, and real-time trading automation. |

| Botcrypto | Customizable trading bots, easy setup, and support for various exchanges. |

| WunderTrading | User-friendly interface, strategy automation, and copy trading features. |

| NinjaTrader | Advanced charting tools, automated trading strategies, and backtesting capabilities. |

20 Best Ai Trading Bots In 2025

1.Dash2Trade

For AI trading bots, Dash2Trade tops the list of best AI trading bots for the year 2025. It came equipped with advanced features such as strategy backtesting and signal generation to make it appealing to traders.

Users can optimize any trading strategies they want with the help of real time notifications and a committed trading community.

It has plenty of tools that suit different styles of trading which means it can be utilized by both amateur traders and professional traders who need to gain an upper hand in the market.

Pros And Cons Dash2Trade

| Pros | Cons |

|---|---|

| Advanced AI-driven trading algorithms | May require learning curve for new users |

| Real-time market analysis and signals | Subscription cost could be high for some |

| User-friendly platform and interface | Limited support for some smaller exchanges |

2.Learn2Trade

In 2025, Learn2Trade is perceived as one of the leading AI trading bots Sabri that features a unique education delivery combined with advanced trading tools.

It is enjoyed by traders thanks to the credible trading signals, market analysis, and the assistance of the experts which facilitates the needs of the traders.

Since it comes with user-friendly features and an interactive community, learn2trade is apt for both novice and experienced traders with the intention of improving their tactics and increasing the returns.

Pros And Cons Learn2Trade

| Pros | Cons |

|---|---|

| Comprehensive educational resources | Limited customization for trading strategies |

| Access to real-time trading signals | Basic features may require paid subscription |

| User-friendly interface for beginners | No mobile app for on-the-go trading |

3.Perceptrader AI

Perceptrader AI appears to be one of the best AI trading robots in the year 2025 where there is deployment of state of the art machine learning algorithms to achieve real-time market prediction and automated trading.

The software has strong predictive abilities which help traders look for best opportunities as well as fine tune their strategies.

With the help of customizable settings, both beginners and experts might find Perceptrader AI useful in attaining improved market results.

Pros And Cons Perceptrader AI

| Pros | Cons |

|---|---|

| Advanced machine learning algorithms | High cost for premium features |

| Provides predictive trading insights | Limited support for certain assets |

| Customizable strategies and indicators | Steeper learning curve for beginners |

4.Cryptohopper

In 2025, Cryptohopper is a top artificial intelligence trading bot with fully automated processes and cutting-edge trading algorithms which allow for transactions on various trading platforms simultaneously.

Customizable strategies, a trading signals marketplace, and a rich historical data to test their strategies are all offered by Cryptohopper for traders of all levels.

Continuous improvements of traders’ competitive edge, thanks to the like of trailing stops as well as AI suggestions, are an engaging feature by Cryptohopper.

Pros And Cons Cryptohopper

| Pros | Cons |

|---|---|

| Supports multiple exchanges | Can be expensive for advanced plans |

| Automated trading with customizable bots | Learning curve for configuring strategies |

| Advanced backtesting and strategy builder | Limited customer support for free users |

5.Coinrule

In 2025, Coinrule is hailed as the best AI trading bot owing to its all-in-one crypto-bot for devising and implementing personalized trading strategies with no programming knowledge whatsoever.

With its intuitive design and templates prepared in advance, it is perfect for novices. At the same time, professional investors are also taken care of to a certain degree, because advanced options are also provided.

Users of Coinrule have the opportunity to take advantage of its integration with several exchanges as well as instant updates on cryptocurrency prices.

Pros And Cons Coinrule

| Pros | Cons |

|---|---|

| Simple, user-friendly interface | Limited advanced features in the free plan |

| Supports automated trading on major exchanges | May require upgrades for complex strategies |

| No coding required for strategy creation | Can be less suitable for experienced traders |

6.3Commas

According to 3Commas reviews and other stats, the crypto trading platform is one of the most popular tools for trader in 2025.

It has an excellent automated trading feature which allows you to control your positions based on DCA, Grid or Options bots, etc.

Additionally, it is well-suited for traders of all skill levels thanks to its straightforward design, rich analytics, and integration with the leading exchanges.

Pros And Cons 3Commas

| Pros | Cons |

|---|---|

| Supports a wide range of exchanges | Can be costly for premium features |

| Advanced trading bots and automation | Interface may feel overwhelming for new users |

| Smart trading tools like trailing stops | Limited customer support response times |

7.Pionex

In 2025, Pionex is one of the best AI trading bots on the market with up to 16 automated trading bots embedded within the platform making it seamless to invest in cryptocurrencies and other assets.

It has some of the good trading fees and uniquely designed innovative trading tools like Grid and DCA bots for all kinds of traders.

The Pionex supports users to manage their portfolio in a straightforward manner while increasing their strategy optimization using AI technology.

Pros And Cons Pionex

| Pros | Cons |

|---|---|

| Offers built-in trading bots for automation | Limited customization options for bots |

| Low trading fees and competitive pricing | Not as advanced as some other trading platforms |

| User-friendly interface for beginners | Limited educational resources for new users |

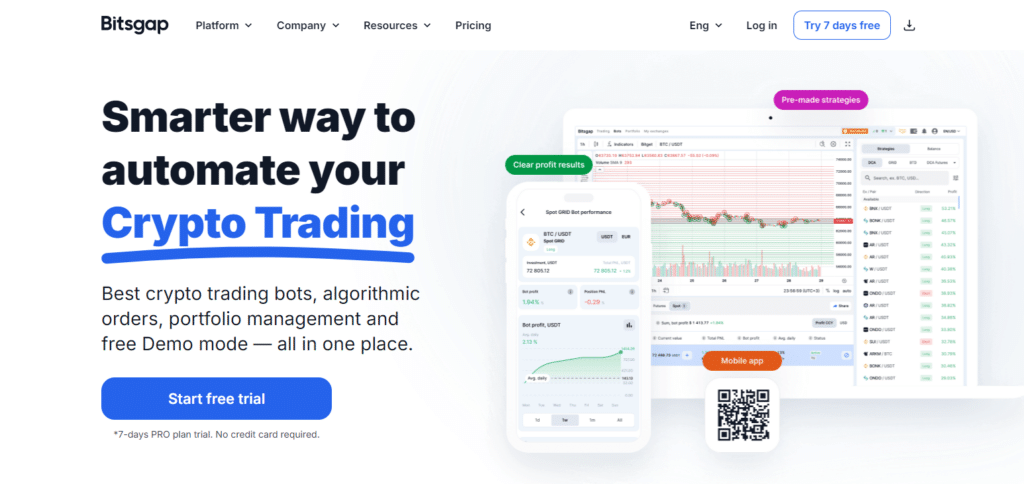

8.Bitsgap

In 2025, Bitsgap stands out as one of the best AI trading bots, boasting intuitive automation and intelligent grid methodologies.

The platform allows users to trade seamlessly across several exchanges and offers features such as backtesting, a portfolio manager, and market analysis.

Thanks to an easy-to-use interface combined with intelligent automated options tools, Bitsgap assists traders in strategically executing optimized trades for the best possible outcomes.

Pros And Cons Bitsgap

| Pros | Cons |

|---|---|

| Supports a variety of exchanges and assets | Can be expensive for full feature access |

| Offers automated trading and grid bots | Limited free plan with basic features |

| Advanced portfolio management tools | Interface can be complex for beginners |

9.Trade Ideas

Even now, in 2025, Trade Ideas is the best AI trading bot which scans markets and automates trading strategies almost instantly. It is designed for Stock traders and features useful analytics, notifications, and risk management.

Thanks to the user-friendly platform, allowing traders to search for possibilities and icognitive decision-making options for improved trading performance through “Holly AI”.

Pros And Cons Trade Ideas

| Pros | Cons |

|---|---|

| Advanced stock scanning and alerts | High cost compared to other platforms |

| Real-time data and powerful analysis tools | Steeper learning curve for beginners |

| Customizable trading strategies | Limited cryptocurrency trading support |

10.AlgoTrader

By 2025, AlgoTrader is a leading AI trading bot that has a unique approach to statistical arbitrage.

The product offers a multi-asset algorithmic trading system with multiple trading venues integration, advanced testing modules and practices and smart real-time recording and syncing of information.

Both institutions and retail traders benefit from AlgoTrader, as its AI-based instruments allow the users to develop and administer automated strategies, which ensure highest operational efficiency and trading profits.

Pros And Cons AlgoTrader

| Pros | Cons |

|---|---|

| Supports multiple asset classes and strategies | High cost, more suitable for professionals |

| Advanced backtesting and optimization tools | Steeper learning curve for new users |

| Integrates with various brokers and data providers | Limited customer support options |

11.HaasOnline

HaasOnline is one of the best AI trading bots in 2025, as it provides users with a strong tool to develop and implement more complex strategies of cryptocurrency trading.

It has an interesting visual strategy designer, good backtesting options, and works with all the main exchanges so it is popular with traders.

Automated trading with the help of HaasOnline and individual scripts allows users to maximize the potential of every trade and gain more profit.

Pros And Cons HaasOnline

| Pros | Cons |

|---|---|

| Wide range of pre-built and custom bots | High initial cost for full access |

| Advanced security features for trading | Interface may be complex for beginners |

| Supports multiple exchanges and assets | Steeper learning curve for effective use |

12.TradeSanta

In 2025, TradeSanta has established itself as the best AI trading bot and caters for the crypto market by manual grid bot as well as DCA bot strategies. TradeSanta has best in class tools, integration and adaptability for every trader.

The TradeSanta platform also offers traders the possibility to oversee the employment of multiple different bots in their portfolio, optimizing for performance with the help of AI.

Pros And Cons TradeSanta

| Pros | Cons |

|---|---|

| User-friendly interface for easy setup | Limited customization for advanced users |

| Affordable pricing plans available | Basic analytics compared to competitors |

| Supports major cryptocurrency exchanges | Fewer advanced trading features |

13.Shrimpy

As of 2025, Shrimpy is the best AI trading bot available. The bot goes beyond trading alone as it has an integrated portfolio management as well as crypto automation features. It facilitates simple rebalancing, performance tracking, and is connected with top exchanges.

Best suited for long-term investments, Shrimpy maximizes its users’ allocations and strategy execution with the help of its AI tools.

Due to its social trading component, Shrimpy users are able to discover and copy well-performing portfolios with minimal effort.

Pros And Cons Shrimpy

| Pros | Cons |

|---|---|

| Portfolio rebalancing automation | Limited advanced trading options |

| User-friendly interface and easy setup | High fees for premium features |

| Supports multiple cryptocurrency exchanges | Basic analysis tools for in-depth traders |

14.Zignaly

Zignaly is one of the best AI bots in 2025 which offers automated trading and signal copying help in making few perfect trades in cryptocurrency.

Its profit sharing feature, strategy marketplace, support for multiple exchanges enables traders to utilize strategies in every trade, as well as learning from specialists.

Zignaly’s built-in AI systems enable users to perform analytics, optimize their portfolio, and achieve the best possible trading results in an efficient manner.

Pros And Cons Zignaly

| Pros | Cons |

|---|---|

| Offers automated trading with copy trading | Limited number of supported exchanges |

| User-friendly and easy to navigate | Basic analytics and reporting tools |

| Low-cost plans for budget-conscious traders | May not be suitable for advanced strategies |

15.Covesting

Covesting can be described as one of the most advanced AI trading bots, especially in 2025 as it is a copy trading platform that allows traders to copy winning strategies.

With the unique AI verification that is able to Covesting offers users of the top performing traders to track and copy the trades made seamlessly.

This bot operates numerous assets and exchanges, thus making it possible for both novice and seasoned traders to implement their game plans and maximize profits.

Pros And Cons Covesting

| Pros | Cons |

|---|---|

| Allows users to copy top traders’ strategies | Limited educational resources for beginners |

| Simple interface for easy navigation | Fees may vary based on trader performance |

| Offers a wide range of trading options | May not support all preferred exchanges |

16.Autonio

Autonio is the latest AI trading bot to emerge and is marking itself as the best in the industry in 2025. It helps traders automate the process of crypto trading by providing them with advanced tools.

The trading strategies that Autonio provides are best suited to the market since they are based on machine learning algorithms.

The platform incorporates trade planning, strategy development, and performance evaluation into a single straightforward interface that is marketed to the general public.

Autonio is recommended for both new traders and seasoned traders because it allows its users to be fully aware and informed when making decisions as well as increasing their profit margins.

Pros And Cons Autonio

| Pros | Cons |

|---|---|

| Utilizes AI-driven trading algorithms | Steeper learning curve for new users |

| Customizable strategies for flexibility | Limited integrations with exchanges |

| Offers a comprehensive backtesting tool | May require additional fees for full features |

17.Trality

In 2025, Trality is said to be the best AI trading bot, suitable for both beginners and seasoned experts.

Its code-free strategy builder and a programming platform with the Python language allows any user to design and install complicated algorithms of their personal trading.

With Trality backtesting of the strategy and actual execution are performed in real time thus allowing for accuracy in the refinement of the strategy.

It’s connected to major exchanges for smooth trading execution along with enabling the investors to earn high returns by utilizing sophisticated AI based automation.

Pros And Cons Trality

| Pros | Cons |

|---|---|

| User-friendly platform for beginners | Limited number of supported exchanges |

| Advanced coding capabilities for custom bots | Can be costly for premium features |

| Offers robust backtesting and analytics | Some technical expertise needed for optimal use |

18.Botcrypto

A top AI trading bot in 2025 is Botcrypto, which has an automated cryptocurrency trading platform that is pretty straightforward to navigate.

Using the quite simple UI, people are able to design individual trading strategies without any programming.

It provides support for different bots like grid and DCA and connects well with all the popular exchanges.

Botcrypto also deploys AI-generated information and enables its clients to consistently boost returns and limit risks while regards to their optimal portfolio management effortlessly.

Pros And Cons Botcrypto

| Pros | Cons |

|---|---|

| Simple interface suitable for beginners | Limited to basic trading strategies |

| Supports a variety of exchanges | No advanced customization options available |

| Offers automatic trading and strategy automation | Some features require a paid subscription |

19.WunderTrading

In 2025, along with a few other AI trading bots, nobody challenged the position of WunderTrading in the industry. The platform is rich and allows to not only automate crypto trading but also manage a portfolio.

For effective working, the system links with the multiple exchanges and supports such strategies as grid and DCA. All trades are managed by artificial intelligence algorithms of WunderTrading.

Users are eager to get the maximum number of effective trades without carrying huge risks. The platform itself is designed so that every level of trading experience can find a way to utilize the system effectivel

Pros And Cons WunderTrading

| Pros | Cons |

|---|---|

| User-friendly platform for all skill levels | Limited advanced features compared to competitors |

| Supports multiple exchanges and trading pairs | Can be costly for premium subscription plans |

| Offers social trading and copy trading features | May have a learning curve for new users |

20.Ninja Trader

As of 2025, NinjaTrader can be regarded as one of the better AI trading platforms due to its advanced charting tools and robust trading automation capabilities. It has built-in capabilities for devising strategies, backtesting and current practice.

It has an emphasis on stock and cryptos, therefore the AI features of NinjaTrader assist the traders in sharpening the strategies and improving their performance to ensure maximum profitability.

Furthermore, due to the customizable features it employs, NinjaTrader is appropriate for traders of virtually every level.

Pros And Cons Ninja Trader

| Pros | Cons |

|---|---|

| Advanced charting and technical analysis tools | High initial learning curve for beginners |

| Supports custom strategy development and backtesting | Full-featured platform can be expensive |

| Integrates with various data providers and brokers | Limited mobile app functionality |

How We Choose Best Ai Trading Bots In 2025

Performance and Accuracy: The performance and the accuracy of the AI are examined with respect to real trades done in past.

User Interface: The focus is on how friendly the platform is for novice and accomplished traders alike.

Customization Options: Provision for users to modify or create their own trading systems to cater for their individual specifications.

Integration: Ability to integrate with major cryptocurrency exchanges and other trading platforms.

Backtesting and Analytics: Full-back testing as well as performance analytic to enhance the precision of the strategy execution.

Security: Security measures like effective encryption and secured connection protocols are in place to safeguard users’ information and funds.

Customer Support: Address assistance that is practically available and is quick to tackle any technical concerns or issues regarding trading.

Community and Reviews: Standing in the trading focused community and remarks of end users using the gadget.

Cost and Fees: Reasonable and clear information on prices including registration costs or subscription costs.

Advanced Features: Other useful tools including AI tools, social trading, automated portfolio management etc.

Conclusion

To summarize, the top AI trading bots in 2025 combine rich technology with user-friendliness and superior execution.

Having strategy alteration, instant implementation, and full-scale backtesting, these platforms provide armament tools for traders so that they can enhance their trades and profits obtained.

The appropriate bot is determined by personal preferences, safety and price ensuring that trading is done effectively and profitably.