For this article, I will go over the greatest artificial intelligence solutions for addressing finance questions.

These AI tools have changed the way we think about investments and give personalized financial suggestions among other things.

Learn about some of the most influential artificial intelligence technologies in finance that can make hard queries easier and faster.

Key Points & Best Ai For Finance Questions

| Tool | Key Points |

|---|---|

| ChatGPT | Versatile language model, capable of answering complex financial queries, generating reports, and providing insights based on conversational inputs. |

| Domo | Offers real-time data visualization and analytics, integrates with various data sources, and provides actionable insights for financial decision-making. |

| Stampli | Focuses on accounts payable automation, streamlining invoice management, and enhancing financial workflows with AI-driven processing. |

| Vena Insights | Combines financial planning and analysis with robust data integration, offering forecasting, budgeting, and comprehensive financial reporting capabilities. |

| Macroaxis | Provides investment research, portfolio management, and financial risk analysis tools, leveraging AI to offer predictive insights and recommendations. |

| Trullion | Specializes in automating lease accounting and compliance, using AI to manage lease agreements and financial reporting seamlessly. |

| Nanonets Flow | Automates document processing and data extraction from financial documents, enhancing accuracy and efficiency in handling financial paperwork. |

| Zoho Finance Plus | Integrated suite for finance management, including invoicing, expense tracking, and financial reporting, with AI-driven insights for improved decision-making. |

| Datarails | Focuses on consolidating financial data and enhancing FP&A processes with AI-driven analytics, simplifying budgeting, forecasting, and reporting. |

| Vic.ai | Specializes in automating accounts payable with AI, offering invoice processing, expense management, and financial analytics to improve efficiency. |

| Planful Predict | Provides AI-powered predictive analytics for financial planning, budgeting, and forecasting, helping businesses anticipate future financial performance. |

| Microsoft Copilot | Enhances financial productivity with AI-driven tools for data analysis, document generation, and decision support within Microsoft 365 applications. |

| Bill.com | Automates accounts payable and receivable, streamlines invoice management, and enhances cash flow management with AI-driven features. |

| Booke.ai | Offers AI-powered bookkeeping services, automating transaction categorization and financial reporting for small businesses. |

| ClickUp | Provides comprehensive project and financial management tools with AI features for task automation, financial tracking, and reporting within a single platform. |

15 Best Ai For Finance Questions

1.ChatGPT

The advanced natural language processing capabilities of ChatGPT make it the best AI for finance questions.

It gives right answers and provides useful insights to help users deal with difficult financial inquiries, create elaborate reports, and give recommendations that are strategic in nature.

Its adaptability and contextual comprehension enable it to be a potent instrument in managing financial uncertainty wisely.

Pros And Cons ChatGPT

| Pros | Cons |

|---|---|

| Versatile: Handles a wide range of financial queries and provides detailed responses. | Context Limitations: May struggle with highly specialized or nuanced financial topics. |

| Interactive: Engages in conversational format, making complex information more understandable. | Dependence on Inputs: Accuracy depends on the quality and specificity of user queries. |

| Real-Time Updates: Continuously improves with user interactions and data. | Generalization: May offer generalized advice not tailored to specific financial scenarios. |

| Cost-Effective: Often more affordable compared to specialized financial advisory services. | Data Security: Users must ensure sensitive information is handled securely during interactions. |

2.Domo

Domo is successful as one of the best AIs for finance queries because it provides real-time data visualization and analytics.

It can be integrated with multiple financial data sources to provide actionable insights that simplify decision-making.

The strong dashboard and reporting capabilities enable users to analyze financial trends and metrics more efficiently. which makes it a valuable asset in optimizing financial strategies and performance.

Pros And Cons Domo

| Pros | Cons |

|---|---|

| Real-Time Analytics: Provides up-to-date data visualization and insights. | Complex Setup: Can be challenging to configure and integrate with existing systems. |

| Customizable Dashboards: Offers tailored reporting and visualization options. | Cost: Can be expensive, especially for small businesses or teams. |

| Integration: Connects with various data sources for comprehensive analysis. | Learning Curve: Requires time to fully understand and utilize all features. |

| Scalability: Suitable for both small and large enterprises with expanding needs. | Performance Issues: May experience slowdowns with very large datasets. |

3.Stampli

Stampli is a top finance AI that concentrates on automating accounts payable undertakings.

It improves financial workflows through invoice management streamlining which involves AI-powered functions.

By cutting down on manual data entries and enhancing accuracy, Stampli eases invoice processing while also simplifying financial authorizations

Thus making itself necessary for effective financial operations where there is need to manage budgets better.

Pros And Cons Stampli

| Pros | Cons |

|---|---|

| Invoice Automation: Streamlines and automates invoice management processes. | Limited Functionality: Focuses primarily on accounts payable, with less support for other financial areas. |

| Enhanced Accuracy: Reduces manual data entry errors and improves invoice processing accuracy. | Integration: May require additional configuration to integrate with all financial systems. |

| Workflow Efficiency: Speeds up invoice approvals and financial workflows. | Cost: Pricing may be high for smaller businesses or those with limited needs. |

| User-Friendly Interface: Intuitive design makes it easy to use and navigate. | Customization Limits: May not offer extensive customization options for specific business needs. |

4.Vena Insights

Vena Insights is a leading AI for finance queries because it combines strong financial planning and analysis capabilities.

It stands out in forecasting, budgeting, and reporting, providing actionable information based on consolidated data.

Vena Insights enables companies to make informed decisions and drive financial performance improvement with its analytic features driven by artificial intelligence.

Pros And Cons Vena Insights

| Pros | Cons |

|---|---|

| Comprehensive Financial Planning: Integrates budgeting, forecasting, and reporting. | Complex Implementation: Can be challenging to set up and integrate with existing systems. |

| Data Integration: Consolidates data from multiple sources for a unified view. | High Cost: May be expensive for smaller organizations or limited-use scenarios. |

| Advanced Analytics: Provides in-depth insights and analytics for better decision-making. | Learning Curve: Requires time and training to fully utilize its features. |

| Customization: Offers robust customization options for reporting and planning. | Performance Issues: Can experience performance slowdowns with large datasets or complex models. |

5.Macroaxis

Macroaxis is a top AI for finance questions because it provides detailed investment research and portfolio management tools.

It has predictive insights and risk assessments driven by artificial intelligence, which contributes to strategic financial planning.

Through the analysis of market trends and giving customized suggestions, Macroaxis enables people to make decisions about investments with information and manage their money well.

Pros And Cons Macroaxis

| Pros | Cons |

|---|---|

| Investment Research: Provides detailed analysis and research tools for investments. | Complex Interface: May be challenging for new users to navigate and utilize effectively. |

| Portfolio Management: Offers comprehensive tools for managing and optimizing portfolios. | Limited Customization: May have restrictions on tailoring features to specific needs. |

| Risk Analysis: Delivers valuable insights into financial risk and market trends. | Cost: Some features may be pricey, especially for premium services. |

| Predictive Insights: Uses AI to offer predictive analytics and recommendations. | Data Accuracy: Reliance on the accuracy of the data sources and algorithms used. |

6.Trullion

When it comes to answering financial inquiries, Trullion is an AI that can automate lease accounting and compliance functions.

It applies artificial intelligence in the handling of lease contracts which guarantees correct presentation of financial reports as well as conformity with regulations.

Trullion simplifies complicated lease administration processes thus increasing precision in business records and ensures adherence with the law hence becoming an essential system for managing leases effectively from a financial point of view.

Pros And Cons Trullion

| Pros | Cons |

|---|---|

| Lease Accounting Automation: Streamlines lease management and compliance. | Niche Focus: Primarily focuses on lease accounting, which may not cover broader financial needs. |

| Regulatory Compliance: Ensures adherence to accounting standards and regulations. | Integration Challenges: May require customization to integrate with existing systems. |

| Accuracy in Reporting: Enhances precision in lease-related financial reporting. | Learning Curve: Requires training to fully understand and utilize its features. |

| Efficiency Improvement: Reduces manual effort and accelerates financial processes. | Cost: Can be expensive, particularly for smaller organizations. |

7.Nanonets Flow

Nanonets Flow is the best options for finance questions because it automates document processing and data extraction using artificial intelligence.

It achieves high accuracy in extracting key financial information from various documents such as invoices etc.

By simplifying invoice management and other financial documentations, Nanonets Flow eliminates manual work and mistakes made thus improving efficiency in carrying out financial tasks as well as reporting on them accurately.

Pros And Cons Nanonets Flow

| Pros | Cons |

|---|---|

| Automated Document Processing: Streamlines the extraction of data from financial documents. | Limited Functionality: Primarily focuses on document processing, with fewer features for broader financial management. |

| High Accuracy: Utilizes advanced AI to accurately extract and handle data. | Integration Needs: May require additional setup to integrate with existing financial systems. |

| Efficiency Gains: Reduces manual data entry and speeds up financial operations. | Cost: Pricing may be high for small businesses or limited-use cases. |

| Scalability: Adaptable to handle varying volumes of documents and data. | Customization Limits: May offer limited options for customizing extraction templates and rules. |

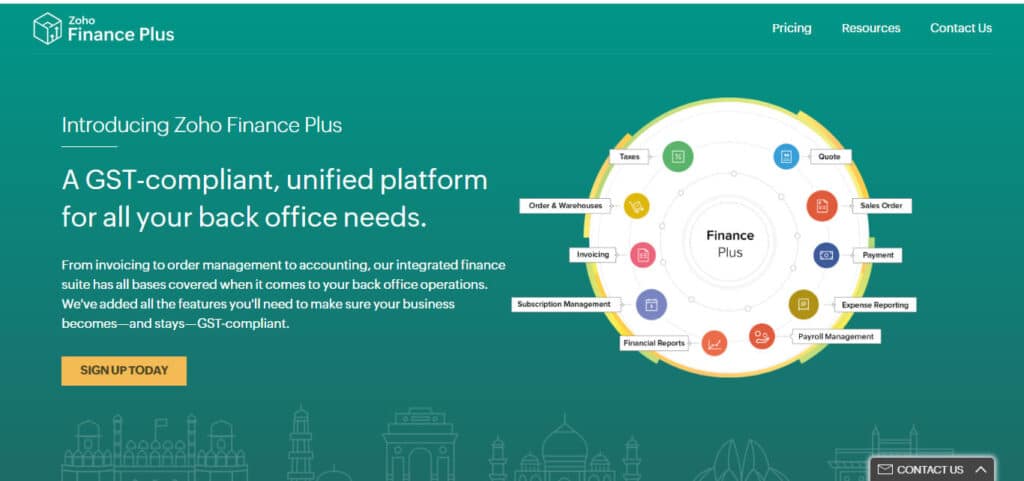

8.Zoho Finance Plus

Zoho Finance Plus is a top AI for finance questions, offering an integrated suite for financial management.

It features invoicing, expense tracking, and financial reporting with AI-driven insights. Zoho Finance Plus enhances decision-making by providing comprehensive financial data

Analysis and streamlining financial processes, making it a valuable tool for managing and optimizing financial operations effectively.

Pros And Cons Zoho Finance Plus

| Pros | Cons |

|---|---|

| Integrated Suite: Combines various financial tools like invoicing, expense tracking, and reporting. | Complex Interface: Can be overwhelming to navigate due to its wide range of features. |

| AI-Driven Insights: Provides valuable financial insights and analytics. | Cost Structure: Pricing may be higher for advanced features and additional users. |

| Customization Options: Offers customizable reports and dashboards to meet specific needs. | Integration Issues: May face challenges integrating with third-party systems and applications. |

| User-Friendly: Generally designed to be accessible and easy to use for various users. | Support: Customer support may be slow or less responsive during high-demand periods. |

9.Datarails

Datarails is great for financial questions as it combines financial data and improves FP&A processes.

Budgeting, forecasting and reporting are made easier by machine-learning analytics that the company has designed; thus providing useful suggestions.

This program can be used in conjunction with other financial systems thereby simplifying management of information.

Which leads to increased precision hence making it a necessary tool for quick decision making in finance planning and analysis.

Pros And Cons Datarails

| Pros | Cons |

|---|---|

| Data Consolidation: Integrates financial data from multiple sources for a unified view. | Implementation Complexity: Initial setup and integration can be complex and time-consuming. |

| Enhanced FP&A: Improves financial planning and analysis with advanced AI-driven tools. | Cost: May be costly, particularly for smaller organizations or those with limited budgets. |

| Budgeting and Forecasting: Provides robust tools for accurate budgeting and forecasting. | Learning Curve: Users may need significant training to fully leverage all features. |

| Automation: Streamlines financial processes and reduces manual effort. | Customization: Customization options might be limited based on specific business needs. |

10.Vic.ai

Vic.ai is one of the best AI systems for finance inquiries. This technology that relies on artificial intelligence is able to handle invoice processing, cost management as well as financial analysis effectively.

By decreasing human inputting errors while enhancing efficiency through other areas like data entry jobs or accuracy improvements.

It makes more sense why this company would be considered essential in any organization’s attempt at streamlining and optimizing their accounts payable function.

Pros And Cons Vic.ai

| Pros | Cons |

|---|---|

| Automated Invoice Processing: Streamlines accounts payable with AI-driven automation. | Limited Scope: Focuses mainly on accounts payable, lacking broader financial management features. |

| Efficiency Improvement: Reduces manual data entry and speeds up invoice approvals. | Integration: May require additional configuration to integrate seamlessly with existing systems. |

| Accuracy: Enhances accuracy in handling and categorizing invoices. | Cost: Can be expensive, especially for smaller businesses or those with limited needs. |

| User-Friendly: Designed to be intuitive and easy to use. | Customization Constraints: May offer limited options for tailoring features to specific business requirements. |

11.Planful Predict

Planful Predict is the number one finance AI that provides advanced predictive analytics for financial planning and forecasting.

It uses artificial intelligence to make forecasts about what will happen in the future of money accurately.

Planful Predict enables companies to predict changes, therefore optimizing their entire financial control through improving budgeting and strategic decision making ability.

Which allow them to anticipate trends and choose wisely where they invest their funds into so as to maximize returns.

Pros And Cons Planful Predict

| Pros | Cons |

|---|---|

| Advanced Predictive Analytics: Provides accurate forecasts and insights for financial planning. | Implementation Complexity: Can be challenging to set up and integrate with existing systems. |

| Enhanced Budgeting: Improves budgeting accuracy with AI-driven predictions. | Cost: May be pricey, particularly for smaller businesses or those with limited budgets. |

| Data Integration: Integrates data from various sources for comprehensive analysis. | Learning Curve: Requires time to master and fully utilize its advanced features. |

| Scalability: Adapts to the needs of growing businesses with evolving financial requirements. | Performance Issues: May experience slowdowns with very large datasets or complex models. |

12.Microsoft Copilot

Microsoft Copilot is good at answering financial AI questions by increasing productivity in Microsoft 365 applications.

It provides data analysis tools, document generation tools, and decision support systems all driven by artificial intelligence.

Copilot simplifies financial tasks, delivers actionable business insights, enhances efficiency thereby becoming an essential tool for handling money matters and gaining quick knowledge-based judgment ability.

Pros And Cons Microsoft Copilot

| Pros | Cons |

|---|---|

| Integration with Microsoft 365: Enhances productivity within familiar Microsoft applications. | Limited to Microsoft Ecosystem: Best suited for users within the Microsoft 365 environment. |

| AI-Driven Tools: Provides intelligent assistance for data analysis and document generation. | Dependence on Microsoft Apps: May not integrate well with non-Microsoft financial systems. |

| Improves Efficiency: Automates routine tasks and streamlines financial workflows. | Cost: Can be expensive, particularly when combined with other Microsoft 365 services. |

| Ease of Use: Leverages familiar interfaces, reducing the learning curve. | Data Security: Requires attention to ensure sensitive financial data is handled securely. |

13.Bill.com

Bill.com is one of the best AI for finance questions. It’s an AI that automates account payables and receivables.

This platform uses artificial intelligence to streamline invoice management, improve cash flow visibility and simplify financial tasks.

The program does this by cutting down on manual work and increasing accuracy so that companies can manage their payments better while optimizing overall financial operations through informed decision making.

Pros And Cons Bill.com

| Pros | Cons |

|---|---|

| Automated Invoice Management: Streamlines accounts payable and receivable processes. | Integration Limitations: May face challenges integrating with some third-party systems. |

| Improves Cash Flow: Enhances visibility and management of cash flow through automation. | Cost: Pricing may be high, especially for smaller businesses or those with limited needs. |

| User-Friendly Interface: Designed for ease of use and quick adoption. | Limited Customization: Customization options may be restricted based on specific business requirements. |

| Efficient Payment Processing: Automates payment approvals and disbursements. | Customer Support: May experience delays or challenges with customer support during peak times. |

14.Booke.ai

Booke.ai is outstanding in terms of finance question answering AI, which is achieved by automating bookkeeping tasks for small businesses.

It utilizes artificial intelligence to classify transactions, produce financial statements and guarantee preciseness in accounting.

Financial management and reporting are improved with this software because it saves time spent on manual data entry.

Thus reducing errors that may occur during calculations hence becoming an important tool for effective record keeping.

Pros And Cons Booke.ai

| Pros | Cons |

|---|---|

| Automated Bookkeeping: Handles transaction categorization and financial reporting. | Limited Scope: Primarily focuses on bookkeeping, lacking broader financial management features. |

| Efficiency Gains: Reduces manual data entry and speeds up accounting processes. | Integration Issues: May require additional configuration to integrate with other financial systems. |

| User-Friendly: Designed to be intuitive and easy for small businesses to use. | Cost: Pricing may be higher compared to traditional bookkeeping solutions. |

| Accuracy: Enhances accuracy in financial record-keeping with AI-driven automation. | Customization Constraints: Limited options for customizing features to specific business needs. |

15.ClickUp

ClickUp offers a full suite of project and financial management tools, making it the best AI for finance questions.

It has task management automation, financial tracking automation, and reporting automation through its AI capabilities.

Through the integration of project management with financial workflows, ClickUp improves efficiency and decision-making by delivering actionable intelligence.

While also optimizing financial processes thereby being an all-around solution for successful project management as well as robust financial controls.

Pros And Cons ClickUp

| Pros | Cons |

|---|---|

| Comprehensive Management: Integrates project and financial management tools in one platform. | Complexity: Can be overwhelming due to its extensive feature set and customization options. |

| Task Automation: Automates tasks and workflows, improving efficiency. | Learning Curve: Requires time to master its full range of functionalities. |

| Customizable Dashboards: Offers customizable reporting and tracking features. | Performance Issues: May experience slowdowns with large volumes of data or complex setups. |

| Integration Options: Connects with various third-party applications and tools. | Cost: Pricing can increase with additional features and higher usage levels. |

How We Pick Best Ai For Finance Questions?

Response Accuracy: Confirm that the artificial intelligence provides accurate answers to intricate finance questions which reduce mistakes and improve decision making.

Incorporation Capabilities: Determine if it can work well with current systems and data sources in order to maximize its efficiency.

Real-Time Analysis: Find tools that are capable of processing and analyzing information instantly so as to give current insights and feedbacks.

Flexibility: Can this technology be personalized according to specific financial requirements or preferences thus allowing for individualized recommendations and reporting?

User-Friendliness: Go for an interface which is easy to navigate through, has intuitive features/functions – this ensures convenience not only for finance experts but also casual users.

Safety Measures: Ensure that it follows strict security protocols meant safeguarding private financial records as well as meeting relevant legal obligations.

Conclusion

The choice of the most suitable AI for financial inquiries is dependent on individual requirements and objectives.

For example, ChatGPT provides flexible conversational capabilities while Domo or Vena Insights are better in data analysis and reporting.

You can consider accuracy, compatibility, cost etcetera when selecting a system that will improve your financial control and decision making abilitys.