I’ll go over the Top Financial Education Websites in this post so you may efficiently understand, manage, and increase your finances.

These websites provide a variety of seminars, courses, research tools, and useful guidelines, ranging from simple platforms like Khan Academy and Investopedia to sophisticated resources like Morningstar and Coursera.

These sites cover everything, whether you’re looking for investment insights or personal finance expertise.

Criteria for Choosing the Best Financial Education Websites

Credibility and Authority

- Definite websites to avoid would be those created arbitrarily. These websites will provide no evidence backing up their claims. Websites such as Coursera and Morningstar would provide evidence backing up their websites. Coursera is backed by universities and Morningstar is backed by qualified investment researchers.

Range of Topics Covered

- A well-rounded financial education will include investing, personal finance, budgeting, economics, and retirement planning. A diverse range of topics can ensure that financial illiteracy will be panning out and will furnish the financial education someone would so desire.

Accessibility and Affordability

- Free options should definitely be utilized. Academy, Investopedia, and Khan are three legitimate and low-budget options. If one is more willing to invest money, Coursera is an excellent option and will provide certifications and extra premium courses, but is definitely more expensive.

Interactive Tools and Practical Application

- It is definitely important to have platforms that include tools: especially those that allow people to create portfolios, and those that provide simulators so people can apply what they have learned. There are tools for almost everything financial, and having those will greatly enhance the financial skills one will be able to obtain.

Certification and Career Support

- Some online learning platforms, such as Coursera and Udemy, offer industry-recognized and career-advancing completion certificates, which can positively impact your career prospects.

Benefits of Using Financial Education Websites

Gaining Financial Literacy

- One can learn key skills such as managing money and investing and understand the principles of the economy to be able to make sound decisions on finances.

Flexibility and Convenience

- Financial education resources can be accessed anytime and anywhere. Users can take their time to learn as the courses are self-paced and do not have deadlines.

Real World Applications

- Users of certain platforms can be able to use resources such as planners and financial calculators. There are even simulators and trackers. These resources can be used to demonstrate their knowledge and understanding of the concepts they have learned.

Professional Advancement

- Certificates and other credentials that can be obtained from certain courses on platforms like Coursera or Udemy can enrich a learner’s resume and increase their employability in finance and other related fields.

Affordable Education

- It is not necessary to have a degree to have the knowledge that is offered on financial education websites. Paying lots of money to take courses is also unnecessary. Users can find many sites that offer quality financial education for free or at a low cost.

Current and Relevant Information

- Financial education platforms offer market forecasts, updates, and commentary from their in-house experts. Some even have observed trends in the market to make it easier for learners to understand and relate to the concept.

Reduced Anxiety in Planning and Budgeting

- When users of financial education sites learn to prepare and plan their budgets, investments, and overall financial goals using acquired knowledge and facts, their worries about being wrong are eliminated.

Key Point & Best Financial Education Websites List

| Platform | Key Points |

|---|---|

| Investopedia | Comprehensive financial education hub offering in-depth articles, tutorials, investing guides, and financial term explanations. Ideal for beginners and advanced users looking to understand markets, personal finance, and investment strategies with real-world examples. |

| Khan Academy (Finance & Economics) | Free, structured learning platform featuring video lessons on economics, personal finance, and core financial concepts. Great for students and self-learners seeking step-by-step, easy-to-understand educational content. |

| Coursera (Finance Courses) | Provides professional and academic finance courses from top universities and institutions. Offers certifications, career-focused learning paths, and in-depth topics like corporate finance, financial modeling, and investment management. |

| Udemy (Finance & Investing) | Marketplace for finance and investing courses created by industry experts. Covers practical skills like stock trading, crypto investing, budgeting, and financial analysis with lifetime access to purchased courses. |

| Morningstar | Research-driven investment platform offering detailed analysis of stocks, mutual funds, and ETFs. Known for unbiased ratings, portfolio tools, and data-backed insights for long-term investors. |

| Yahoo Finance Education | Educational extension of Yahoo Finance providing market news, investing basics, and financial guides. Useful for staying updated on market trends while learning fundamental investing and personal finance concepts. |

| NerdWallet Learn | Personal finance education platform focusing on credit cards, loans, banking, and investing. Offers practical guides, calculators, and comparisons to help users make smarter financial decisions. |

| Skillshare (Finance Classes) | Creative learning platform with short, practical finance and entrepreneurship classes. Best for freelancers, creators, and small business owners looking to improve money management and financial planning skills. |

| Wealtharian | Wealth-building education platform offering insights on investing, passive income, and financial independence. Focuses on long-term financial growth strategies and smart money habits. |

| SmartAsset | Financial planning platform providing tools, calculators, and educational resources. Helps users compare financial products, find financial advisors, and plan for taxes, retirement, and major life goals. |

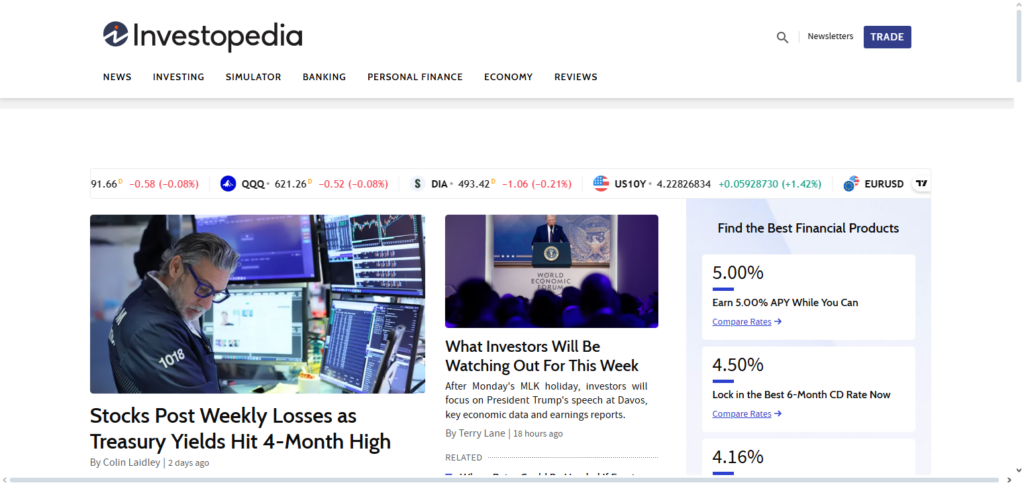

1. Investopedia

One of the most reliable and thorough resources for learning about economics, finance, and investment is Investopedia. It provides thousands of clear articles, lessons, and tips that simplify difficult financial concepts. Users can find useful examples and real-world applications ranging from complex trading tactics to the fundamentals of the stock market.

It stands out among the Best Financial Education Websites for both novices and experts in the middle of its extensive resources. The platform is a go-to resource for anyone wishing to develop solid financial knowledge and confidence because it offers market news, expert insights, and investing simulators.

Investopedia Features

- Glossary of Financial Terms – Smooths over the explanations of financial concepts, jargon, and processes.

- Free Learning Resources – Great for beginners, and more experienced learners, as the majority of content doesn’t require a subscription to access.

- Expert Analysis & Insights – Features professional commentary, and updates about the state of the markets.

- Simulators – Lets you practice for free. Trade stocks, and ETFs with pretend money, and practice how to be an investor.

- Articles and Tutorials – Covers the fundamentals of investing, personal finance, trading, and the economy.

Investopedia Benefits & Drawbacks

| Benefits | Drawbacks |

|---|---|

| Extensive library of articles and tutorials covering all finance topics. | Some content can be overwhelming for complete beginners due to volume. |

| Free access to most learning resources. | Advanced tools like simulators may require registration or paid features. |

| Investment simulators for practical learning. | Less structured courses compared to formal platforms like Coursera. |

| Glossary simplifies financial jargon for beginners. | Heavy focus on articles rather than interactive learning. |

| Expert insights and market analysis for deeper understanding. | May not offer certification or recognized credentials. |

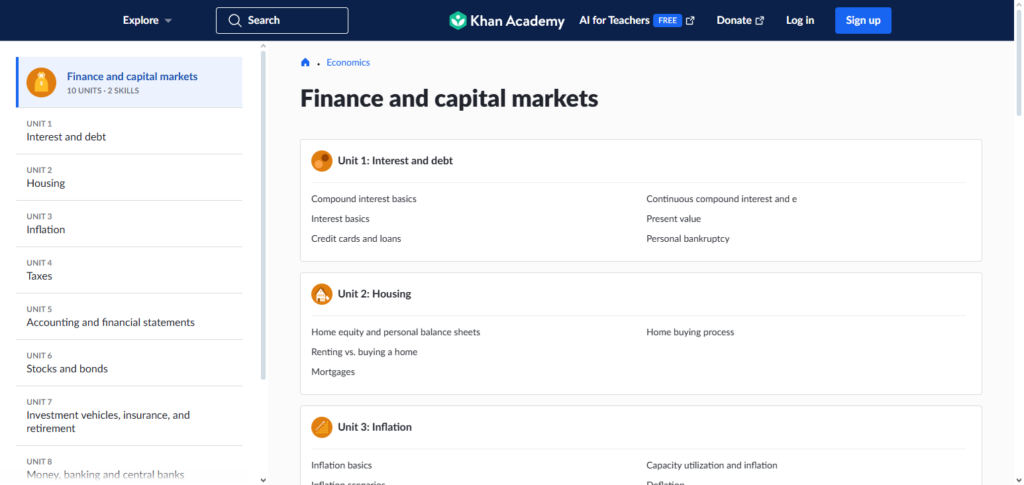

2. Khan Academy (Finance & Economics)

A free, organized, and user-friendly method for learning economics and finance is offered by Khan Academy. Its video-based courses provide step-by-step instruction on subjects including financial literacy, macroeconomics, microeconomics, and personal finance. Through quizzes, students can practice ideas and monitor their development over time.

It is particularly helpful for students, teachers, and self-learners who prefer guided and visual learning, making it one of the Best Financial Education Websites. Users may better grasp how financial institutions function and how economic concepts affect daily choices and long-term money management thanks to the platform’s straightforward explanations and practical examples.

Khan Academy (Finance & Economics) Features

- Macro and Microeconomics – Aspects of economics and finance.

- Interactive Assessments – Quizzes and practice activities contribute to learning.

- Free Courses – Course structure, and lessons offered on personal money management, finance, and economics.

- Visual Explanations – Videos, and elegant tutorials make the content easy to understand for all skill levels.

- Self-Paced Learning – Progress can be tracked to empower learners to take control of their learning.

Khan Academy (Finance & Economics) Benefits & Drawbacks

| Benefits | Drawbacks |

|---|---|

| Completely free and accessible worldwide. | Limited advanced or professional-level courses. |

| Step-by-step video lessons for easy understanding. | Fewer interactive features like forums or real-time feedback. |

| Quizzes reinforce learning. | Mostly focused on theory rather than practical investing. |

| Covers personal finance, macro, and microeconomics. | No formal certification for completed courses. |

| Self-paced learning allows flexibility. | May not be suitable for users seeking career-oriented finance credentials. |

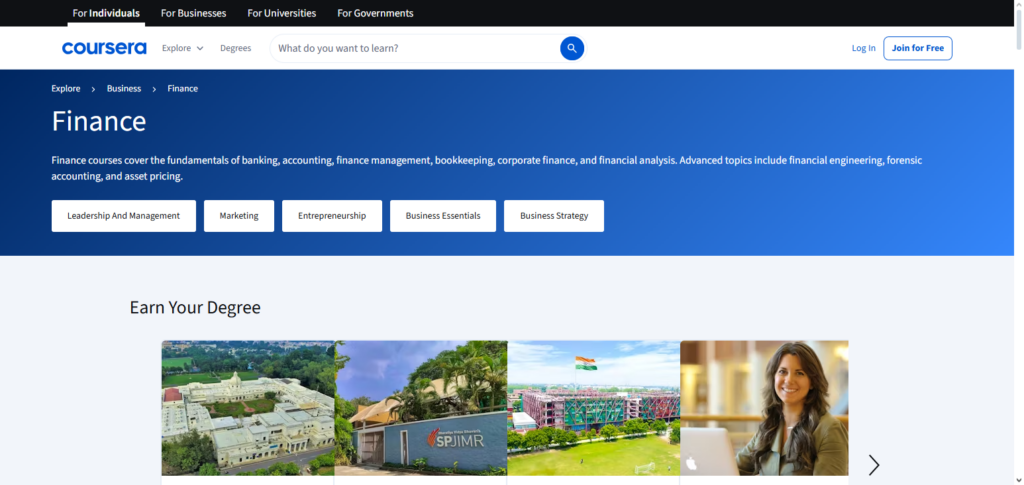

3. Coursera (Finance Courses)

Coursera collaborates with leading universities and international organizations to provide high-grade finance courses and professional certification. It includes corporate finance, investment management, financial modeling, and finance on blockchain.

Numerous courses provide certificates that could improve your job opportunities. It is recognized as one of the Best Financial Education Websites and is great for students that seek both academic rigor and practical, employable skills.

The platform allows users to learn at their convenience. It has video lectures, assignments, and peer discussions, making it a great platform for all levels, both beginners and seasoned professionals. It has a well-structured education on finance.

Coursera (Finance Courses) Features

- Recognized Qualifications – Get certifications & credentials that empower you for career growth.

- Diverse Course Offerings – Corporate finance, investing, and accounting, plus blockchain finance.

- Interactive Learning – Includes video lectures, assignments, and peer discussions.

- Flexible Study Options – Learn on your schedule with self-paced or scheduled courses.

Coursera (Finance Courses) Benefits & Drawbacks

| Benefits | Drawbacks |

|---|---|

| University-backed courses ensure credibility. | Paid courses can be expensive without financial aid. |

| Offers professional certifications recognized globally. | Some courses require structured schedules and deadlines. |

| Wide range of finance topics from beginner to advanced. | May be overwhelming for users seeking simple learning paths. |

| Includes assignments, quizzes, and peer discussions. | Requires stable internet and commitment for completion. |

| Flexible self-paced and scheduled courses. | Free content is limited; certification usually requires payment. |

4. Udemy (Finance & Investing)

As a learning marketplace, Udemy provides thousands of courses on finance and investing, which have been designed by industry professionals and seasoned educators. Courses are designed around stock trading, cryptocurrency, real estate investing, budgeting, accounting, financial analysis, and more.

You get to own the courses and their additional resources for a lifetime after your purchase. Due to the affordability and range of courses, Udemy is recognized as one of the Best Financial Education Websites. Users can take courses at their own pace, based on reviewing difficulty levels, interests, and skills, and can assess their hands-on financial skills by selecting courses based on their preferences.

Udemy (Finance & Investing) Features

- Wide Variety of Courses – Covers stock trading, cryptocurrency, budgeting, accounting, and investing.

- Expert-Led Lessons – Courses designed by industry professionals.

- Hands-On & Practical Learning – Focus on actionable skills and real-world examples.

- Lifetime Access – Once purchased, courses remain accessible forever.

- Affordable & Rated – User reviews help choose high-quality courses at reasonable prices.

Udemy (Finance & Investing) Benefits & Drawbacks

| Benefits | Drawbacks |

|---|---|

| Wide variety of practical finance and investing courses. | Quality varies depending on the instructor. |

| Lifetime access to purchased courses. | Paid courses can accumulate if not selective. |

| Hands-on approach for actionable skills. | Less academic rigor compared to university platforms. |

| Affordable pricing and frequent discounts. | No standardized certification across courses. |

| User reviews help identify high-quality content. | Some courses may lack depth for advanced learners. |

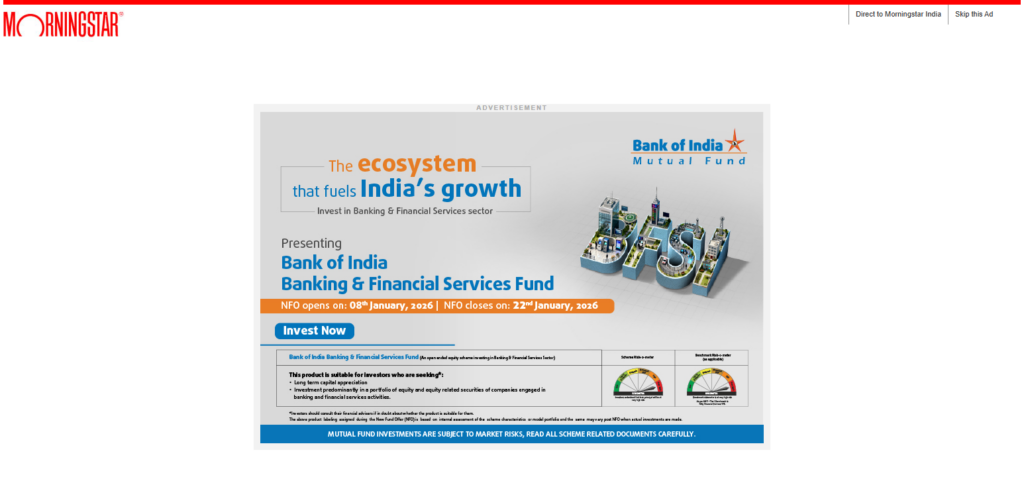

5. Morningstar

Morningstar has established itself as a highly regarded investment research service. Offering information and analysis of individual stocks, mutual funds, exchange traded funds, and pension/retirement portfolios, Morningstar provides customers information and research, as well as financial ratings, which provide a basis for customers to develop assistance in investment decisions.

Most long-term investors need insight and assistance through research, and as such being named one of the Best Financial Education Websites carries a significant level of respect and trust.

Education articles, as well as tools and updates for portfolio market analysis diversification strategies, to guides investment strategies the website provides. Providing tools for access to market updates diversification strategies guides investors in and tools for portfolio market analysis provides research and education articles.

Morningstar Features

- Investment Research – Deep analysis of stocks, mutual funds, and ETFs.

- Independent Ratings – Unbiased evaluations of investment opportunities.

- Portfolio Management Tools – Track and manage investments effectively.

- Market News & Analysis – Stay informed with timely updates and expert opinions.

- Long-Term Guidance – Helps investors make data-driven decisions for wealth growth.

Morningstar Benefits & Drawbacks

| Benefits | Drawbacks |

|---|---|

| In-depth research on stocks, ETFs, and mutual funds. | Premium features can be expensive. |

| Independent ratings provide unbiased investment advice. | Primarily focused on long-term investors, less suitable for beginners. |

| Portfolio management tools for tracking investments. | Steep learning curve for new investors. |

| Market news and analysis for informed decisions. | Limited interactive tutorials or structured learning. |

| Trusted source for professional investors. | Less coverage of personal finance topics. |

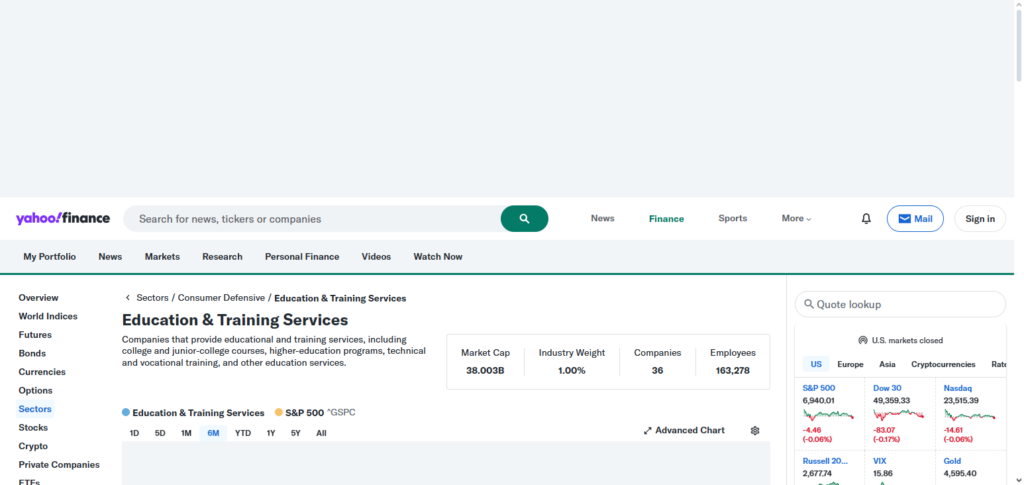

6. Yahoo Finance Education

Yahoo Finance Education provides a unique combination of financial education and market news. The service provides guides for beginners in their studies of investing, guide in personal finances, and provides a study of economics.

The Education service provides investing guides, personal finance guides, and studies in economics as well. As one of the Best Financial Education Websites, education on the fundamentals of finance, and access to their own tools for tracking stocks, portfolios, and currencies has proven to be a unique combination.

The blending of education, market analysis, and opinion provides a way to integrate the theoretical side of investment analysis with the real world. The service’s ability to provide access to the data for free, and the education of fundamentals provides a large customer base of investors, as well as an education for casual learners.

Yahoo Finance Education Features

- Market News & Updates – Real-time financial news coverage.

- Beginner-Friendly Guides – Easy-to-understand content for finance novices.

- Portfolio & Stock Tracking – Tools to monitor investments.

- Educational Articles – Covers investing, personal finance, and economic trends.

Yahoo Finance Education Benefits & Drawbacks

| Benefits | Drawbacks |

|---|---|

| Free access to market news and financial education. | Limited depth in advanced finance topics. |

| Beginner-friendly guides for investing and personal finance. | Mostly article-based; lacks interactive features. |

| Portfolio tracking tools included. | Minimal formal learning structure. |

| Real-time market updates for practical learning. | Limited certification or credentials. |

| Accessible and easy-to-navigate interface. | Focus is more on news than structured financial education. |

7. NerdWallet Learn

NerdWallet Learn covers a range of important personal finance topics including credit cards, loans, mortgages, banking, and investing.

With step-by-step guides, calculators, and comparisons, NerdWallet has users covered for any of their financial decision help needs. NerdWallet has won awards for being among the Best Financial Education Websites.

NerdWallet has a consumer-centric model and gives users easy advice. NerdWallet outlines complicated financial tools and lists all the pros and cons as well as the costs associated with each one. NerdWallet gives users actionable insights for any of their saving, investing, or debt management needs.

NerdWallet Learn Features

- Personal Finance Guides – Budgeting, saving, investing, and debt management tips.

- Product Comparisons – Credit cards, loans, mortgages, and banking products.

- Simple & Clear Advice – Simplifies tough financial decisions and options.

- Calculators & Tools – Tools to assist in planning finances.

- Consumer-Focused Education – Guides practical financial decision-making.

NerdWallet Learn Benefits & Drawbacks

| Benefits | Drawbacks |

|---|---|

| Practical personal finance guidance and tips. | Limited focus on investment strategies. |

| Comparisons of financial products help decision-making. | Not ideal for advanced investors or finance professionals. |

| Easy-to-understand advice for real-world application. | Mostly textual content with limited interactive tools. |

| Useful calculators and financial planning tools. | Lacks structured course formats. |

| Consumer-focused, beginner-friendly platform. | No certifications or academic recognition. |

8. Skillshare (Finance Classes)

For creatives, independent contractors, and small business owners, Skillshare provides brief, project-based courses in finance and entrepreneurship. Budgeting for creatives, pricing strategies, financial planning, and the fundamentals of business finance are among the subjects covered.

Skillshare, one of the Best Financial Education Websites, places a strong emphasis on experiential learning through practical projects and real-world situations. Because the classes are bite-sized, users can easily fit them into their hectic schedules.

The platform’s community-driven methodology makes financial education more participatory and suited to contemporary, independent professionals by enabling learners to share their progress and receive feedback.

Skillshare (Finance Classes) Features

- Short, Project-Based Lessons – Focus on concise practical finance skills.

- For Entrepreneurs & Freelancers – Budgeting, pricing, and small business finance.

- Hands-On Learning – Learning through actionable projects.

- Community Interaction – Peer feedback on work.

- Flexible, Bite-Sized Learning – Design your own pace and timelines for learning.

Skillshare (Finance Classes) Benefits & Drawbacks

| Benefits | Drawbacks |

|---|---|

| Short, practical lessons suitable for busy learners. | Limited in-depth courses for professional finance careers. |

| Project-based learning encourages application. | Requires a subscription for full access. |

| Focuses on freelancers, entrepreneurs, and creatives. | Less academic rigor compared to university courses. |

| Community interaction for feedback and sharing. | Some classes may lack expert credibility. |

| Flexible, self-paced learning. | Not ideal for users seeking structured finance certifications. |

9. Wealtharian

Wealtharian offers wealth-building and financial-education tools, as well as investing strategies and financial independence resources. Wealtharian also helps users learn techniques such as long-term financial planning, creating passive income, and developing smart investing habits. Wealtharian has also been recognized as one of the Best Financial Education Websites.

They assist users in financially educating themselves to fundamentally grow their wealth. Wealtharian helps users adopt sustainable money management behaviors. They encourage goal-focused money management, risk management, and diversification. Every financial investor, seasoned and novice alike, can appreciate the value of their simplified content on complex investing concepts.

Wealtharian Features

- Wealth-Building Guides – Focus on acquiring and sustaining long-term wealth.

- Investing & Passive Income Tips – Strategies to achieve financial independence.

- Goal-Oriented Planning – Plans for retirement, investments, and other financial goals.

- Easy-to-Understand Content – Breaks down investing concepts for beginners.

- Practical Tools – Actionable wealth strategies to assist in implementation.

Wealtharian Benefits & Drawbacks

| Benefits | Drawbacks |

|---|---|

| Focus on wealth-building and financial independence. | Less known, smaller community compared to bigger platforms. |

| Simplifies investing and passive income strategies. | Limited interactive tools or courses. |

| Goal-oriented financial planning guidance. | Mostly textual guides, fewer videos or practical projects. |

| Practical for beginners and intermediate learners. | No formal certifications offered. |

| Easy-to-read content for better understanding. | Limited coverage of academic finance concepts. |

10. SmartAsset

A platform for financial planning, SmartAsset provides comparative tools, guidelines, and calculators for taxes, retirement, investing, and significant financial decisions. Additionally, it assists users in locating and establishing connections with qualified financial experts.

SmartAsset’s practical, tool-driven approach to financial education makes it one of the Best Financial Education Websites. With interactive tools, users can plan tax strategies, examine mortgage possibilities, and estimate retirement savings.

It is particularly helpful for people who desire individualized insights and data-backed planning for their long-term financial goals because of its instructional material and practical financial tools.

SmartAsset Features

- Financial Calculators – These include tools essential for retirement planning, tax planning, mortgage planning, and investment planning.

- Guides for Major Financial Decisions – These provide step-by-step instructions for significant financial events, such as purchasing a house.

- Advisor Matching – This feature helps users find and connect with certified financial planners.

- Interactive Tools – Users can examine a range of financial options and create plans.

- Data-Driven Insights – SmartAsset utilizes research and analytics to support users in making financial decisions.

SmartAsset Benefits & Drawbacks

| Benefits | Drawbacks |

|---|---|

| Offers financial calculators for retirement, taxes, and investments. | Focused on tools; limited traditional learning content. |

| Guides for major life and financial decisions. | Less content for deep financial theory or investing strategies. |

| Advisor matching provides personalized professional guidance. | Some features may require registration. |

| Interactive scenario analysis tools. | Mostly geared toward practical planning rather than structured courses. |

| Data-driven insights to optimize money management. | Not ideal for users seeking academic or certification courses. |

Tips for Maximizing Learning

Combine Multiple Platforms

- Using a variety of websites in order to learn both theory and practical tools is a good idea. An example of this would be a combination of Investopedia or Khan Academy with SmartAsset or NerdWallet.

Define Personal Learning Objectives

- Personal learning objectives must be determined before focusing and structuring learning goals to be achieved. Learning goal examples include mastering investing and/or personal finance and/or economics.

Implement Real-World Applications

- Real world applications of lessons learned will increase retention. Use personal finance tools to apply your lessons to a budget, investment, or savings plan.

Complete Note Taking and Progress Tracking

- It’s important to summarize your lessons, concepts, and strategies in order to record your improvement. Keeping a digital or paper notebook will assist in tracking your improvement and keeping you motivated.

Engage With Fun Learning Features

- Many websites use learning tools like quizzes or fun contests, be sure to use these to help reinforce your knowledge and obtain learning feedback.

Implement Regular Study Habits

- Your retention and skills will improve if you have regularly scheduled study sessions instead of irregular marathon study sessions.

Conclusion

How confidently you manage, invest, and develop your money can be greatly impacted by your choice of the top financial education websites.

While Coursera and Udemy offer advanced financial skills and career-focused instruction, platforms like Investopedia and Khan Academy provide solid foundations.

Real-time market data are provided by research-driven websites like Morningstar and Yahoo Finance Education, and useful resources like NerdWallet, Wealtharian, Skillshare, and SmartAsset assist with putting information into practice.

These websites enable learners at all levels to make better decisions and attain long-term financial success by fusing teaching, research, and financial planning tools.

FAQ

What are the best websites to learn finance online?

Some of the best financial education websites include Investopedia, Khan Academy, Coursera, Udemy, Morningstar, Yahoo Finance Education, NerdWallet Learn, Skillshare, Wealtharian, and SmartAsset. These platforms offer a mix of beginner-friendly tutorials, advanced courses, research tools, and practical financial planning resources.

Are these financial education websites free?

Many sites, like Khan Academy and parts of Yahoo Finance Education, are completely free. Others, like Coursera, Udemy, Skillshare, or premium Morningstar tools, may require subscriptions or paid courses. Most platforms also offer a combination of free and paid content.

Which website is best for beginners?

Investopedia, Khan Academy, and NerdWallet Learn are excellent for beginners. They provide simple explanations of financial concepts, personal finance guidance, and step-by-step tutorials without overwhelming learners.

Which platforms are best for professional or advanced learning?

Coursera, Udemy, and Morningstar are ideal for professionals seeking advanced skills, certifications, or deep investment insights. These platforms often offer structured courses and research-driven tools for career growth.

Can these websites help with real-life financial decisions?

Yes. Platforms like SmartAsset, NerdWallet Learn, and Wealtharian provide tools, calculators, and personalized guidance to help with investing, taxes, retirement planning, and other practical financial decisions.